In most administrations, lower-ranking officials make the incendiary comments, while the president rises above to offer the calmer, more soothing explanations of his policies.

[Gerald F. Seib] June 19th, 2017 [The Wall Street Journal]

In the Trump administration, the opposite is true. That’s especially the case on foreign affairs—and in particular on trade policy.

President Donald Trump sounds as if he wants to take a wrecking ball to the international trade system; people fear trade wars because his commentary often has a martial air about it. “I don’t mind trade wars” when the U.S. is running big trade deficits, he said at one point. His talk of new tariffs should be read as a “threat,” he said during the presidential campaign. He once referred to China as “our enemy” because of its trade practices, while Germany is “bad, very bad.”

By contrast, his most influential trade adviser, Commerce Secretary Wilbur Ross, gives a more reasoned explanation of Trump policies. He also uses the “trade war” phraseology, but he offers a philosophical context to explain why he thinks that’s already the state of affairs. Perhaps most important, he puts the administration’s quest for change in the international trade architecture into a historical context—one with which many Democrats would agree.

When Mr. Ross appeared last week at the Journal’s CFO Network, he described the international trade regime as a kind of anachronism—one that was founded with the best of intentions amid postwar rubble but that now has fallen out of sync with modern economic realities.

“After World War II, there was a deliberate matter of our public policy to try to help the war-ravaged nations rebuild themselves,” Mr. Ross said. At that point, obviously, the U.S. was the world’s dominant economic power by far, and its self-interest lay in helping its European allies and Japan pull themselves up economically to ward off the spread of communism. America not only could afford to be generous in trade relations but had a profound self-interest in doing so.

That attitude, Mr. Ross argued, “morphed” into the alphabet-soup structures that constitute today’s international trade architecture—first the Organization for Economic Cooperation and Development, then the General Agreement on Tariffs and Trade, and the World Trade Organization.

Along the way, the world evolved and the allies caught up with the dominant U.S., but, Mr. Ross argued, “our policies didn’t really change. And so we now have a terrible structural problem that I think is really inhibiting free trade.”

That history, he said, has produced some “oxymoronic” outcomes. For example, the tariff on a European automobile sent into the U.S. is 2.5%, while the tariff on an American automobile sent into Europe is 10%, despite the fact that the two markets now are roughly the same size.

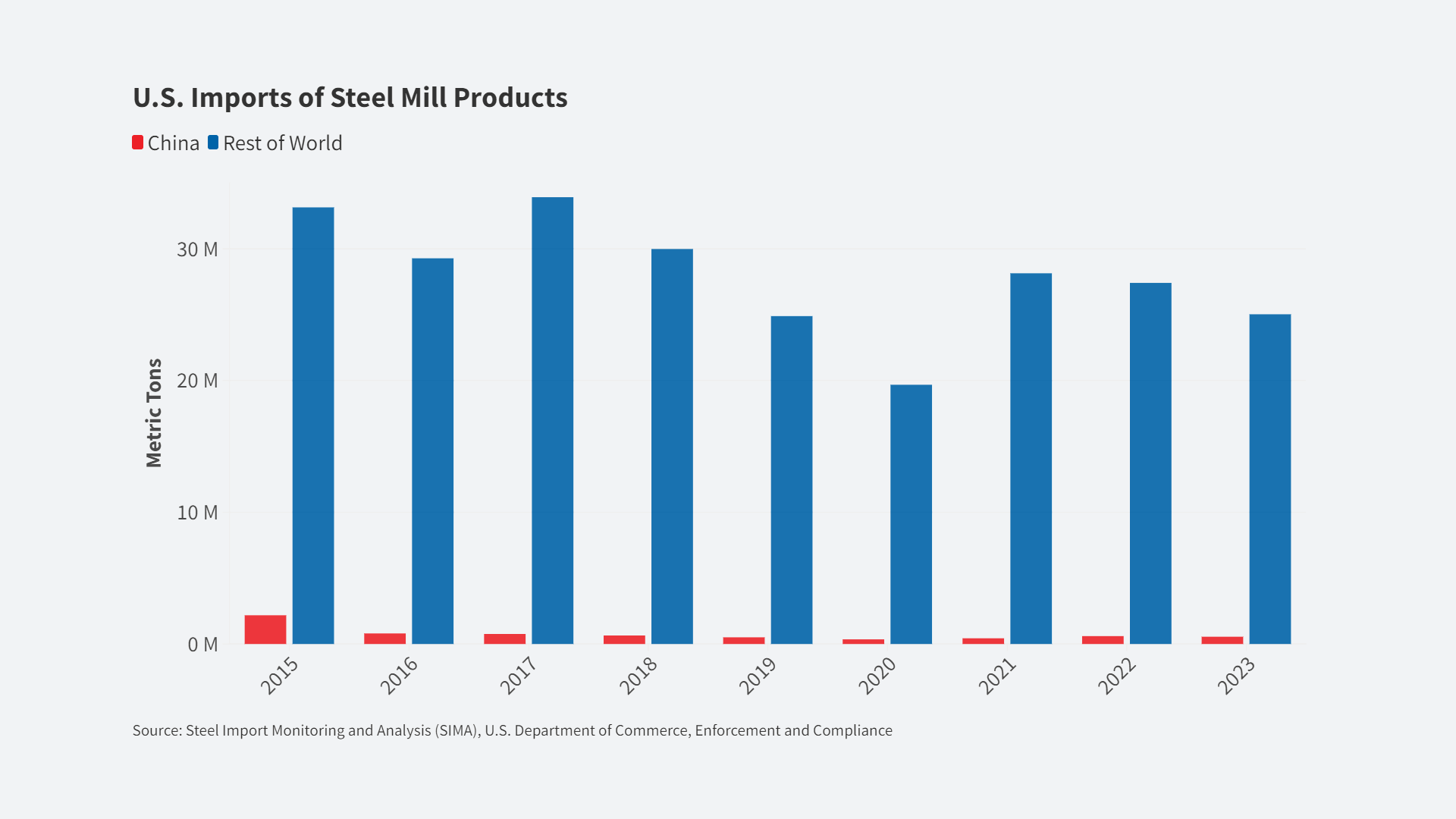

Perhaps most important, the international trade structure didn’t anticipate the rise of a command-economy giant in China as a trade juggernaut, with the imbalances that has created. Nor, given that the structure was created in an era of fixed exchange rates, did it anticipate the ability of countries to manipulate currency values to give their exports an advantage.

A few caveats are in order. On auto trade with Europe, for example, the European Union doesn’t dispute the tariff imbalance. But it also notes that the same is true in reverse on, for example, passenger-train cars, on which the U.S. imposes a 14% duty on European imports, while the EU charges 1.7% on those bought from the U.S. “The EU wants to remove these duties and other barriers to trade, such as lengthy administrative checks, that increase the cost of trade in goods,” the EU says in an online explanation of its view.

Still, the broader Ross argument is one that many on the Democratic side in the U.S. would accept. “I think Ross is right,” says Jared Bernstein, senior fellow at the Center on Budget and Policy Priorities and onetime chief economic adviser to former Vice President Joe Biden. The trade “macro infrastructure” is “problematic,” he says. “There are countries that manage trade in such a way as to boost their trade surpluses and essentially import jobs from other countries.”

Mr. Bernstein suggests changing international trade agreements to allow a country to offset currency manipulation by a trading partner by buying that partner’s currency. More broadly, he advocates establishing a high-level, bipartisan commission to find a consensus approach to such issues—ideally led by investor Warren Buffett.

Ultimately, though, even the hardline Trump view argues for, not against, negotiated solutions. Douglas Irwin, an economist and trade historian at Dartmouth College, notes that, unlike the U.S., Mexico “doesn’t face any tariffs when they export their autos to Europe.” Why? “Because they have a free-trade agreement.…If we want to get rid of that tariff, we have to have a free trade agreement with the EU.”