The Senate Intelligence Committee heard from three witnesses Wednesday on what Washington needed to do to counter China’s plans for economic and technological dominance. The answer was to “run faster and slow them down.”

“Be it genome editing or quantum tech, if China led on that it would …have an impact on global security,” said Dr. Dewey Murdick one of the witnesses from Georgetown University’s Center for Security and Emerging Technology. The notion was China would use advanced technologies not only for leverage against countries weaker than their own but to spy and steal innovations from the U.S., let alone beat Western countries in new drug treatments and supercomputers. Sunway Taihu Light and Tianhe-2A are two of the top 5 supercomputers in the world, only trailing computers in the U.S. and Japan.

Beyond China’s own smarts, IP theft has helped China’s tech ecosystem innovate faster than any other emerging economy. It has put China on par with other tech powers in the region.

“The U.S. risks being surprised and falling behind because we don’t have a clear picture of what China is doing. You can slow competitors down and coordination with allies is essential on that,” Murdick said. “China’s rapid rise in science and technology comes from massive state support. No part of the U.S. government has this scalable countermeasure. You will need to run faster and slow them down.”

Slowing them down can come from export controls.

Currently, we have Entity List restrictions for computer hardware. But it seems these are porous and weak.

“In 2018-19, 99% of the export licenses were either granted or there was no action taken,” said Nazak Nikakhtar, a trade lawyer and partner at Wiley Rein. “So of the items that are controlled, almost all are allowed.”

See Nazak’s written testimony here.

China was taken to task for its year-long supply chain crisis, caused by lockdowns. Senator Marco Rubio (R-FL), the ranking member of the Intelligence Committee, imagined aloud if such disruptions at the world’s biggest port in Shanghai were being done on purpose. It was the first time a high-ranking member of the Senate had ever said such things.

“If we think having supply chain disruptions as a result of a pandemic, shutting down some factories, has been bad for our economy, imagine it being shut down deliberately as leverage against us in a time of future conflict,” Rubio said. “Because that’s what we can expect to see, and it leaves us vulnerable and it’s something we need to begin to address.”

“I think this matters…. If the most powerful and influential nation on Earth is a dictatorship that is willing to enslave its own people in death camps and commit genocide against its population — if that’s how they treat their own people, and that’s the most powerful country in the world — that’s not going to be a good world. And that is unfortunately what we’re headed towards if we don’t deal with that. And if anyone has any illusions about the nature of the Communist Party of China, ask the people of China, and people living in places like Tibet and Hong Kong and Xinjiang, and they’ll tell you what this government is capable of doing.” – Senator Marco Rubio, Senate Intelligence Committee hearing, “Countering China’s Economic and Technological Plan for Dominance,” for March 11, 2022

Wednesday’s hearing revealed a heightened awareness that not only is the U.S. falling behind China on many fronts – from economic soft power in Asia to new technologies like 5G – but that China’s stellar growth is also thanks to Wall Street and American multinationals. Apple was called out on the carpet numerous times.

Here are some comments in the context of Wednesday’s discussion.

Nazak Nikakhtar, former Assistant Secretary for Industry and Analysis, Department of Commerce, in the Trump administration, on supply chains:

Nazak Nikakhtar, former Assistant Secretary for Industry and Analysis, Department of Commerce, in the Trump administration, on supply chains:

“China’s goal is to weaken our supply chains, so we are helpless. We need outbound investment reviews. You have companies investing in China’s growth. You have the unregulated move of medicine and critical medical equipment being outsourced to China… You have overcapacity in fiber optic cables…the infrastructure of 5G…all because of China. So what you need is more Section 301 tariffs on these products. Use the 301s to create a fund; use that tariff revenue to build out our own critical supply chains instead. Because the more we invest in China’s non-market economy and outsource to China, the more we buy China goods, the more we allow distorted non-market forces to become a greater share of the economy and we accelerate the demise of the global market system.”

Senator Susan Collins (R-ME) expressed concern over pharmaceuticals and export controls:

“We are very vulnerable in that area of pharmaceutical goods. I am told of the billions of dollars in exports to China in 2019, that almost all but $500 million were exempt from export controls or did not require an export license in the first place. I think that’s absolutely stunning. That seems to be potentially harmful to our national security.”

Dew Murdick as a witness during the May 11 Senate Select Intelligence Committee hearing on China.

Senator Roy Blunt (R-MO): “What is the best way to compete with a country that subsidizes and moves quickly in technologies without regulations or without having to have outside financing? Is it reasonable with areas like microchips where you make a taxpayer-funded commitment to bring that industry back here?

Dr. Dewey Murdick, Georgetown University, responding to Senator. Blunt: “The U.S. strength is our highly distributed system. We don’t have a command economy. We have a lot of innovators moving. But sometimes you need the government to move in to correct subsidies in China. We have lost a core competency here (in semiconductor manufacturing). But it needs to be done in a way that allows for that distribution system to flourish and not have the government control too much of how it happens. We can bring back our manufacturing capacity and that will enable us to be more competitive. This is a very fast-moving space. It moves faster than law-making.

Sen. Blunt said the U.S. was running behind.

James Mulvenon, Director of SOSi’s Center for Intelligence Research and Analysis, responded in relation to the CHIPS Act as a possible solution to the tech supply chain gap:

“We need a ‘coalition of the wiling.’ Bring together countries that have similar systems and their telecommunications giants. We were all aware that Huawei was the only company that had an end-to-end offering for 5G from handsets to servers to base stations. But if Nokia or Cisco tried that alone, they would have fallen afoul of anti-trust regulations while trying to compete head-to-head with Huawei.”

Senator Angus King (D-ME) on the need for a national strategy:

“In facing a rival like China, we have to get over our aversion to industrial policy.”

Senator John Cornyn (R-TX) called out U.S. investors in Silicon Valley stoked on new China tech:

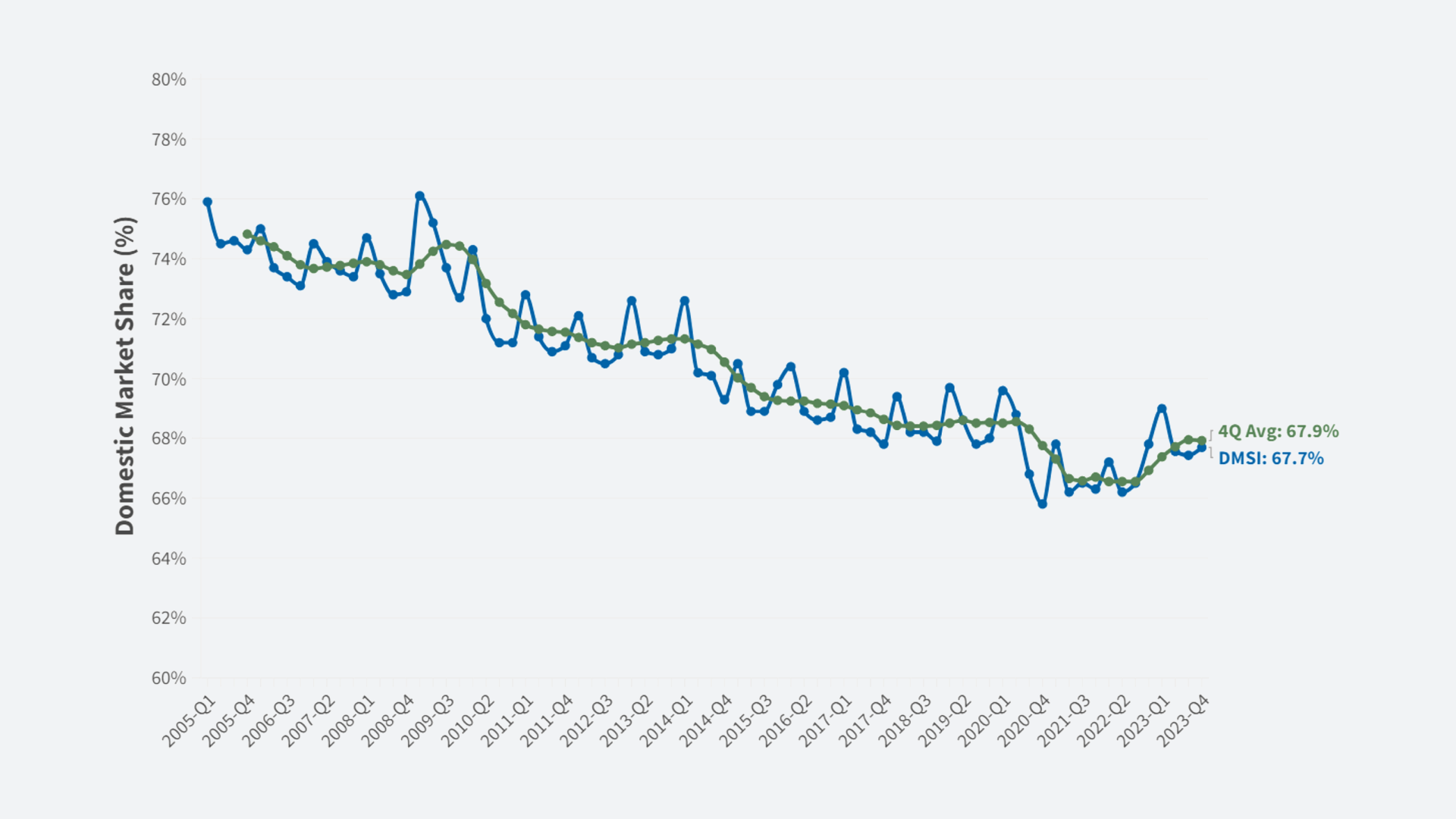

“Looks to me like U.S. venture capitalists have funded the rise of China’s high tech economy. You’ve got over two trillion dollars of U.S. financial market holdings in China in 2020.”

On that comment by Sen. Cornyn, Nazak returned to the CHIPS Act issue, with a warning:

“If you did the CHIPS Act, there has to be guard rails,” she said. “You have to make sure you’re not giving these chip makers taxpayer subsidies to later invest in China. Semiconductor capabilities…high-capacity batteries…we have moved it all overseas. Many chemicals…people don’t understand how much of that is reliant on sourcing from China. I can go on for hours listing chemicals alone. Businesses will not protect national security,” she said. “That’s not their job. That’s the government’s job.”

“Our policy of making things cheaper in China has been a catastrophic failure. We need to have an industrial policy that is done in a way that harnesses the capitalist system and where we can know we are succeeding at it, rather than having Beijing eat our lunch.” – Senator Bob Casey (D-PA)

Senator Mark Warner (D-VA), Chairman of the Senate Intelligence Committee, with a new take on the work with allies rhetoric:

“We need allies; we need them in the private sector. We need American companies to understand the CCPs goal to overtake their market share and we need them to realize what that would mean to the United States.”

Mulvenon, responding in regard to allies like Europe:

“We can’t wait for allies. We have to move unilaterally and allow them to catch up to us.”

There were some awkward moments at the hearing. Comments by Senator Diane Feinstein (D-CA) to be more friendly to China and not just think in terms of economics and technology were rebutted by the witnesses who said this is not your 1990s China. And that the U.S. needed to understand who they were dealing with now.

Senator Ben Sasse (R-NE) spun off from Feinstein’s comment, where she mentioned trade was a remedy to animosities. He said the U.S. needed a sort-of Trans-Pacific Partnership for Technology to confront China.

Running faster and slowing down China will not be easy, panelists agreed.

The U.S. system of governance is different from the top-down managerial control model of communism. But more importantly, the U.S. is weighed down by private interests enmeshed in China.

“Every time you try to slow them down,” warned Nikakhtar, “U.S. companies end up lobbying for the CCP and doing Beijing’s bidding. We’ve got companies here with exquisite IP in clean rare earths processing, for example, but they don’t have the market. Why? These companies are reluctant to invest here because they think they are going to be displaced by China. They are freaked out by it.”