Editors note: The markets are increasingly expecting dollar realignment efforts by the US. Very good.

Washington’s FX policy has oscillated between heavy interventions and benign neglect

[Eva Szalay | July 16, 2019 | Financial Times]

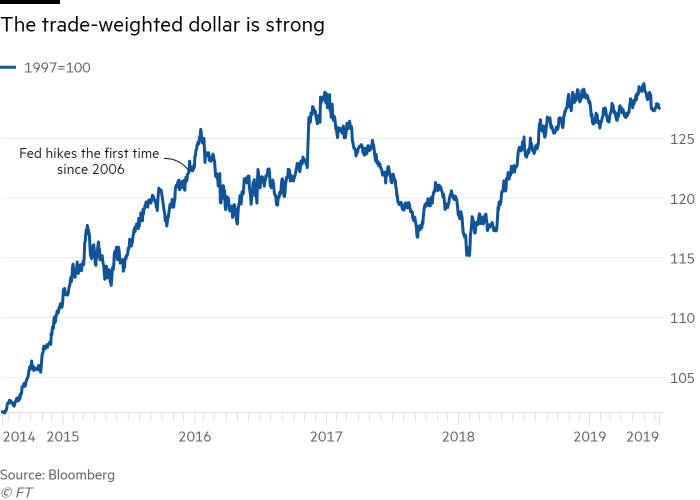

The US dollar is near a multi-decade high, on a trade-weighted basis, and President Donald Trump is not happy about it. His increasingly blustery rhetoric, accusing other countries of manipulating their currencies lower to boost exports, could mean that the US Treasury Department intervenes in FX markets for the first time in years.

Since 1995, the US has stepped in three times — but on each occasion acted in concert with other big central banks to smooth excessive exchange rate fluctuations.

Could the US intervene on its own?

The short answer is yes.

America’s exchange-rate policy has oscillated from periods of large and frequent interventions to benign neglect under different administrations. In some cases, the view about exchange rates changed significantly under the same administration, flipping from viewing a strong dollar as a threat to making it an official policy — as in Bill Clinton’s two terms as president.

“What is remarkable about these fashions is how abruptly [policies] changed at times,” said Robin Winkler, a strategist at Deutsche Bank.

Following the breakdown in 1973 of the Bretton Woods exchange-rate system — in which the currencies of 44 countries were pegged to the value of the dollar, which, in turn, was pegged to the price of gold — big central banks regularly intervened to influence their currencies. In the US, President Richard Nixon had hoped that the end of the system would stabilise the dollar’s value but it did not, forcing the Treasury to step in frequently to buy dollars. Jimmy Carter’s administration also deployed significant resources to support the dollar in 1978 before interventionist policies briefly fell out of favour under Ronald Reagan.

The dollar appreciated more than 50 per cent under Reagan, with a 90 per cent rise against the Deutschemark in the five years to 1985. This led to a change of stance during Reagan’s second term, which ultimately led to the Plaza Accord of 1985, under which big central banks co-ordinated to weaken the greenback.

In the lead-up to the 1987 October stock market crash, the dollar gained ground again despite heavy intervention from the US. In late 1988 the currency saw another spurt, against the Japanese yen in particular, as the Federal Reserve raised interest rates. That led to the US intervening on an unprecedented scale in the first half of 1989, which caused clashes between the Treasury and the Fed’s rate-setting committee.

From that point, the Treasury “largely gave up on interventions, conceding that they had failed to have the desired impact”, said Mr Winkler.

How would intervention work this time?

Since 1934, the US Treasury has held responsibility for managing exchange rates, through the official vehicle for currency interventions — the Exchange Stabilisation Fund. The New York Fed acts as the official agent for the Treasury during interventions but the central bank also holds additional firepower to influence prices.

Historically, the Treasury and the Fed have acted together, shouldering intervention amounts equally, even when the central bank had reservations about the Treasury’s goals. If the Fed agreed to participate now, the administration’s war chest to buy other currencies would total about $200bn.

The Fed’s recent dovish turn has made it easier for Mr Trump to push for interventions, as the expected rate-cutting path aligns with the administration’s desire for a weaker dollar. But sensitivities around protecting the central bank’s independence will be more difficult to overcome and the Fed could resist calls to deploy its own firepower to help. If the Treasury decides to go it alone, the move could risk what Deutsche Bank calls an “institutional crisis”.

“Our interpretation is that the Fed would probably defer to the Treasury and go along even if it does not agree,” said Michael Cahill, an FX strategist at Goldman Sachs.

Does the US have broad support?

No, and without it, the results of an intervention could be mixed at best. While central banks have combined in the past to try to stabilise currencies — as in the aftermath of Japan’s biggest ever earthquake in 2011 — there is little evidence that peers such as the European Central Bank or the Bank of Japan would support the Treasury’s efforts.

Citigroup economists highlight that at the time of the Plaza Accord, every member of the G5 bloc was concerned about the strength of the dollar, but today only the US is complaining. “This is a one-sided Plaza at best,” said Citi.

That raises the prospect of tit-for-tat competitive devaluations. A unilateral US move “could harm severely the international monetary system”, said Mark Sobel, ex-Treasury official and US chairman of think-tank OMFIF.

Such a move would also make it hard for the Trump administration to label other countries as “manipulators”. Mr Cahill noted that the US would find it difficult to respond if China aggressively weakened the renminbi, for example.

And whatever shape intervention might take, intervening in the dollar may not be enough to offset factors that are pushing it higher. The US economy, for example, continues to outperform its peers. On that basis, Nomura strategist Craig Chan says the dollar could make gains in the second half — even if intervention causes some “short-term volatility and potentially a sharp fall”.

Read the original article here.