KEY POINTS

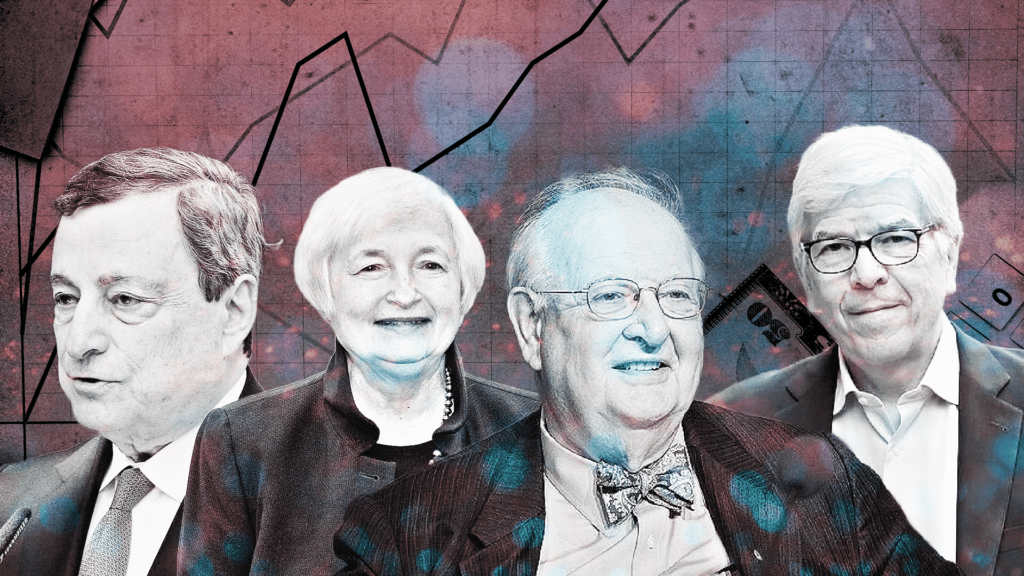

- Respected economists including Janet Yellen, Mario Draghi, Paul Romer and Angus Deaton have been critical of free trade and globalization in recent weeks.

- Criticism focuses on the millions in the U.S. and other advanced countries “left behind” by increased imports from low-wage nations.

- Critics praise and expect a new growing focus on “secure supply” which means increased production within national borders or close to home.

Economists have enjoyed significant influence over U.S. economic policy since the Great Depression. In Bill Clinton’s presidency (1993-2000), economist influence may have reached a peak. With Larry Summers and Bob Rubin at Treasury, Robert Reich at Labor, and Martin Baily at the Council of Economic Advisers, economists were seemingly everywhere in Washington. Bill Clinton even created a new agency, the National Economic Council, to combine and coordinate the advice of his multitude of economic advisers.

One result of all these policy-making economists was that free trade became the dominant economic philosophy of Clinton’s and subsequent administrations. Free trade, they argued, would make the U.S. economy more competitive, lift poor nations out of poverty, reduce the cost of imports, and increase U.S. influence in the world. NAFTA was ratified and adopted, and China joined the WTO and the world trading system. Globalization became a sort of house religion for academic economists, with polls of professors showing 99% support for free trade.

But the tide has turned. Several of America’s best-known economists have openly criticized free trade and globalization. Economic theory is finally beginning to recognize reality.

Treasury Secretary Janet Yellen’s recent trip to China was notable for her warnings to Chinese officials that the U.S. government is considering taking action (such as tariffs) against the massive overproduction in China of products in important sectors including electric vehicles (EVs) and solar power equipment.

Janet Yellen: Cheap Imports No Longer Worth It

In China and in U.S. press interviews, Yellen cited two standard complaints about China: China ignores all the rules of the world trading system, like not to subsidize and dump Chinese production in foreign markets, and that China produces far more than it consumes, putting the burden on countries like the U.S. to buy up their products, shutting down U.S. industries.

From these comments, Yellen had apparently moved from the free-trade wing of the Biden administration to the activist anti-China wing. But Yellen went even further. In a Wall Street Journal interview, she made a point of repudiating standard economic theory, saying:

“People like me grew up with the view: If people send you cheap goods, you should send a thank-you note. That’s what standard economics basically says,” she said. “I would never ever again say, ‘Send a thank-you note.’ ”[1]

This is a direct repudiation of the trade policies followed by the Clinton administration and supported by Yellen herself, when she was chair of Clinton’s Council of Economic Advisers.

Yellen’s comments are a repudiation of the standard view of trade taught every day in colleges across America. Economics as it is taught to undergraduates and repeated endlessly by the free-trade evangelists in Washington insists that cheap imports increase a nation’s prosperity. Yellen is now (apparently) aligning herself with the group that argues that industries matter and the economic consequences of losing an industry like EVs are far more serious than the small value of gains from cheap imports.

Yellen is not the only convert now looking at the world as it is instead of the world as it appears on a college blackboard.

Paul Romer: Life is getting worse

Economist and Nobel laureate Paul Romer attacked free trade theory in February, when he told Bloomberg News that the driver of economic growth is the spread of ideas such as technological innovations. Cheap imports, said Romer, are much less significant for long-term growth, especially when the adjustment costs of people losing their jobs in traditional industries are large and socially divisive:

“High school educated [i.e. workers without college degrees] are dying younger, they are dying from deaths of despair,” said Romer, who won the Nobel Prize in 2018. “These are underlying indicators that tell us life is not getting better, it is getting worse for a large fraction of people here in the US.”[1]

Mario Draghi: A Huge Shift from Capital to Labor

On Thursday, Feb. 15th, economist Mario Draghi gave a speech at the National Association of Business Economists’ Annual Conference in Washington which must have shocked the mostly financial economists who attend the event. Draghi is one of the world’s most eminent economists: he has served as Governor of the Bank of Italy (2006-2011) and prime minister of Italy (2021-2022). He was recognized as a world-class economic and financial leader during his time as president of the European Central Bank (2011-2019). On July 26, 2012, with the euro under severe financial pressure as Greece, Spain and Italy struggled with financial crises and those three countries were close to leaving the euro monetary system, Draghi announced in London that the ECB would do “whatever it takes” to support the euro. Those three words have become almost a magical mantra for how a central bank can save a currency. Within days of that speech, borrowing costs fell to manageable levels and the euro was saved[1].

In his early days at the World Bank and Goldman Sachs, through to his years at the ECB and in Italian government, Draghi has always been an advocate and an implementer of globalization. That makes his comments in February all the more striking.

In his NABE speech, Draghi said globalization had not worked out as expected and it was time to move past what he called the “globalized world trade order.” It led to large imbalances as China, the European Union and others ran large surpluses to increase employment at the expense of other nations. He argued that the current world order suffers from the lack of a powerful enforcer to stop trade cheating by nations like China. He blamed globalization for the economic harm suffered by millions of workers in the west and the turn to populist “inward-looking” politicians:

“In G7 economies, total exports and imports of goods increased by around 9 percentage points from the early 1980s to the great financial crisis, while the labor share of income dropped around 6 percentage points in that time, the steepest drop since data for these economies began in 1950…large segments of the public in Western countries justifiably felt they had been `left behind’ by globalization….The perception in the public in the West became that ordinary citizens were playing in a flawed game, one that had displaced millions of jobs, while government and corporate sector remained indifferent.”[2]

That 6 point decline in the labor share of income, a shift of real income from workers to investors, worth some $3 trillion today, was in fact the goal of many in the business and financial community back in the 1980s and 1990s. They wanted to enable global competition to drive down real wages in the U.S. and other countries. In other words, this was a feature, not a bug, of globalization.

Some political leaders understood that. Many did not. Economists should have understood that but did not. They blinded themselves with religious devotion to a free-trade, perfect-competition model that looks nice on the blackboard, but has always been far removed from how national economies work.[3] Draghi’s critique, accompanied by his endorsement of the idea that nations should now look to focus on secure supply of goods and resources closer to home, is another sign of a major turning point in economic thinking.

Angus Deaton: Globalization hurt rich countries and didn’t help poor countries much

In March, economist Angus Deaton offered a thoughtful essay on his changing views on globalization. Deaton who won the Nobel Prize for Economics in 2015, was a professor at Princeton for over 30 years until his recent retirement. Deaton’s book, Deaths of Despair, chronicled the rising morbidity among white, non-college-educated Americans in the 21st century, which Deaton and co-author Anne Case showed was linked to job loss due to imports, rising opioid use, and other social ills.

In a new essay for the IMF entitled Rethinking My Economics, Deaton questions not only the impact of globalization on affluent western nations, but also its importance for poverty reduction in poor countries:

“I am much more skeptical of the benefits of free trade to American workers and am even skeptical of the claim, which I and others have made in the past, that globalization was responsible for the vast reduction in global poverty over the past 30 years. I also no longer defend the idea that the harm done to working Americans by globalization was a reasonable price to pay for global poverty reduction because workers in America are so much better off than the global poor. I believe that the reduction in poverty in India had little to do with world trade. And poverty reduction in China could have happened with less damage to workers in rich countries if Chinese policies caused it to save less of its national income, allowing more of its manufacturing growth to be absorbed at home. I had also seriously underthought my ethical judgments about trade-offs between domestic and foreign workers. We certainly have a duty to aid those in distress, but we have additional obligations to our fellow citizens that we do not have to others.”[1]

National, Not International, Prosperity

Like the other commentators, Deaton is pointing out that at the philosophical or ethical level our obligations to our own citizens outweigh our obligations to foreign citizens and not only that, but economic doctrine grossly exaggerated the benefits of globalization for citizens of poor countries. Deaton goes further in the essay, arguing that immigration has been a negative factor for the U.S. economy:

“I used to subscribe to the near consensus among economists that immigration to the US was a good thing, with great benefits to the migrants and little or no cost to domestic low-skilled workers. I no longer think so…Inequality was high when America was open, was much lower when the borders were closed, and rose again post Hart-Celler (the Immigration and Nationality Act of 1965) as the fraction of foreign-born people rose back to its levels in the Gilded Age. It has also been plausibly argued that the Great Migration of millions of African Americans from the rural South to the factories in the North would not have happened if factory owners had been able to hire the European migrants they preferred.”[1]

This is an iconoclastic view, almost heresy in the economics community. Economists on the left support immigration out of what they see as compassion for the oppressed citizens of poor countries. Economists on the right support it because they support the free play of markets.

I agree with Deaton that the prosperity of the U.S. throughout its history is in part a function of the relatively restricted supply of labor compared with the abundance of land and growing abundance of capital in the 19th century. “Laborers [in America] are rich compared with individuals in the same class in Europe,” wrote Scottish intellectual George Combe after a U.S. tour in 1840[2]. Supply and demand matter. Worker incomes depend on supply AND demand.

A policy focused on restoring broadly-based prosperity in the U.S. would emphasize abundant capital investment in industries that can employ millions and pay high wages, chiefly manufacturing, coupled with restraint on immigration. Investment at home would need to be made more profitable than investment abroad by policy such as import restraint, and the U.S. birth rate would need to rise to accommodate the increased demand for labor.

The economics profession will not quickly follow the views of these thought leaders. It is too easy to teach the simple free-market model to students and carry on with statistical exercises that purport to verify the prejudices of the researcher. The U.S. university establishment is a vast machine honed to turn out professors who can train more students to avoid fundamental questions and focus instead on the fancy statistical techniques that win publication in career-enhancing academic journals.

Over time, economics will gradually move back to reality. Economist Paul Samuelson once said that economics progresses funeral by funeral. These comments by recognized authorities, all critical of globalization and with a large dose of “mea culpa” included, are steps in the right direction.

[1] Andrew Duehren, “Janet Yellen Missed the First China Shock, Can She Stop the Second?” Wall Street Journal, April 3, 2024.

[2] Enda Curran, Nobel Laureate Paul Romer Says Free Trade Hurts the Vulnerable, Bloomberg News, Feb. 22, 2024.

[3] See Dr. Sebastian Wanke, Five years of `whatever it takes’: three words that saved the euro, KfW Research, 26 July 2017.

[4] Mario Draghi, Economic policy in a changing world, speech at NABE Conference, Washington DC, Feb. 15, 2024.

[5] See my 2022 article, Deglobalization, An Idea Whose Time Has Come for more on the failures of economists to understand globalization and free trade.

[6] Angus Deaton, Rethinking My Economics, IMF Finance and Development, March 2024.

[7] Ibid.

[8] George Combe, Notes on the United States of North America during a Phrenological Visit, (1840). Quoted in Thomas Weiss, U.S. Labor Force Estimates and Economic Growth 1800-1860, NBER paper, 1992, pg. 19.