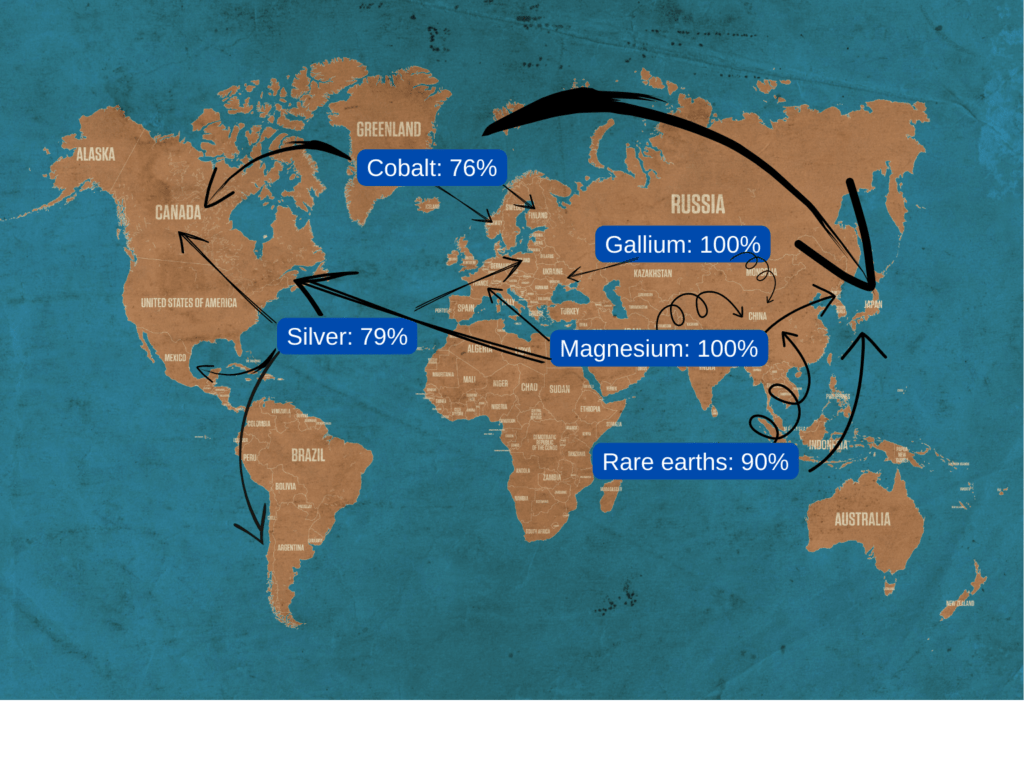

It’s not easy getting a permit to mine in the United States. That has forced the country to source critical minerals like cobalt used in EV batteries and gallium, a silicon replacement, from around the world.

The numbers are ridiculous. The U.S. depends on 50% or more of its mineral needs for 26 of the 32 critical minerals that the 2022 U.S. Geological Survey publishes data on. That means 81% of the critical minerals the U.S. consumes are mostly found abroad. Worse yet, of those 26, China is the main source for 11 of them.

No domestic gallium has been recovered since 1987, notes industrial policy news and information website, Force Distance Times. This is becoming an important mineral as it is being used to replace silicon for advanced computer chips. The U.S. depends on imports for all of its gallium supply at the moment, which comes from China, the UK, Germany, and war-torn Ukraine. China accounts for 53% of those imports. China controls 96% of the global gallium market.

Chinese government subsidies, both direct and indirect, for gallium mining and processing, have allowed China to under-price competitors, as usual. They have a near monopoly now, right when demand for gallium from the U.S. is growing. Demand for that mineral alone is expected to grow at a compound annual growth rate of 24% over the next 10 years.

Under the Biden administration, the U.S. has become more active on shoring up domestic supply for clean energy technologies. At least on the policy front.

Under the Biden administration, the U.S. has become more active on shoring up domestic supply for clean energy technologies. At least on the policy front.

The recently passed Inflation Reduction Act only favors and funds the battery-powered vehicle supply chain and solar. Section 13502 of the IRA gives product credits for numerous products — like solar and EV batteries — and lists precise critical minerals, of which gallium is included. Next up will be getting miners to drill for it now that at least some incentives are there.

“China’s growing dominance of the world’s renewable energy supply chain is weaponizing U.S. dependence on Beijing — in the same way that Europe is now energy-reliant on Russia. The U.S. possesses an estimated $6.2 trillion worth of untapped mineral reserves, including rare earth elements and lithium, nickel and cobalt. In fact, earlier this month, the U.S. opened its largest cobalt operation to date — an Idaho mining project expected to produce enough cobalt for several million electric vehicles. Clearly, the United States possesses the resources. It’s time for the U.S. to again achieve energy security and independence by mining and manufacturing safely and responsibly at home.” — Michael Stumo, writing in The Washington Times, on October 25, 2002

If rocks are the new energy source, then the U.S. is at high risk of being wholly dependent on foreign sources of minerals used in creating advanced microchips and building a charging grid for a fleet of battery-powered vehicles. Moreover, some metals are becoming harder to find.

For example, clean-energy sources use large amounts of copper. Global copper demand is forecast to double between now and 2035, as a result. Copper supply may not keep up. If that happens, it throws doubt over the ability of many companies, U.S. and international, to execute on their current plans to build a new battery power auto fleet from scratch. The U.S. is badly placed compared to many competitors when it comes to access to copper supplies. China is notorious for gobbling up copper scraps, the main source of new copper production in the U.S. This past summer, S&P Global copper analysts forecast a shortage of as much as 10 million tons of copper by 2035.

Washington: Aware of the Sector’s Shortfalls

Rolled coils of copper at the Revere Copper facility in Rome, NY. Copper shortages expected over next 13 years, S&P Global says.

An Executive Order (E.O. 14017) in February 2021 ultimately led to a $35 million defense contract for a mining company called MP Materials to process rare earth minerals in Mountain Pass, California; a Department of Energy (DoE) plan to invest $2.9 billion in processing EV battery materials like lithium, nickel, and cobalt; and new loans for battery recycling companies like Redwood Materials.

The U.S. is fully dependent on foreign sources for manganese, despite there being a manganese mine in Arizona. South African company South32 owns rights to the Hermosa mine there, but it is not operational yet. Feasibility studies are ongoing.

Demand for manganese from the EV battery sector is set to surge ninefold by 2030, the fastest growth rate of any of the EV sector’s key metals, according to BloombergNEF.

EVs and semiconductor technologies are top of mind in Washington. Not only did Biden sign the EV-friendly Inflation Reduction Act into law this year, he also signed the CHIPS Act, which provides incentives to computer chip makers. The goal is to entice multinationals like Intel to manufacture chips and chip-making equipment in the United States. The trend had this entire industry, minus design, heading to China.

The U.S. solar industry is in the same boat. Nearly all of the solar cells that get plugged into solar panels come from Asia. The U.S. does not currently have robust domestic production, though tax credits in the Inflation Reduction Act have spurred investment to establish those facilities. We will have to see how that unfolds over time.

Sourcing clean fuel supply chain materials from countries that do not have similar environmental standards, means the U.S. is buying clean tech from dirty countries. The U.S. can maintain and sustain its own clean energy economy and be largely independent of foreign adversaries, like China. Domesticating the supply of critical minerals is better for environmental risk management and is surely better for economic security.

Another problem on the mining side is the difficulty of launching new mines in the U.S. Even if new rare earth sources are identified, there is uncertainty about the ability of the private sector to bring them up profitably. Securing permits in the U.S. can take between seven to 15 years. Still, for the first time in decades, there does seem to be a new determination to rebuild American mining and manufacturing industry. — from “U.S. Rare Earths Industry Making Inroads Into China’s Dominance,” by Kaelen Jungmeyer and Jeff Ferry, Coalition for a Prosperous America, October 6m 2022.

“The U.S. has made good progress in developing a rare earth mine and processing capability at Mountain Pass, California. We need to pursue similar policies and objectives for other critical minerals,” said Jeff Ferry, chief economist for CPA. “We also need to be aware that with many minerals, there is a chicken and egg situation. You cannot have profitable mines unless you have profitable downstream manufacturing capabilities and the two need to be coordinated. The Inflation Reduction Act is a good step in the right direction. A lot depends first, on the execution of that act and secondly on broadening that approach to other minerals and industries.”

Time is of the essence here.

From a national security perspective, the U.S. faces the real risk of quickly going from fossil fuels independence to alternative energy dependence. The critical minerals used to make advanced microchips risks being held hostage in geopolitical showdowns with China. The U.S. is cracking down on what tech companies can sell to China. But when China retaliates by cracking down on what Chinese state-controlled mining companies can sell to the United States, which country will suffer a worse fate?

US Rare Earths Industry Making Inroads Into China’s Global Dominance