By Jeff Ferry, CPA Research Director

It’s just six months since the first of the Trump administration’s tariffs went into effect and the job gains are already visible.

Our CPA Tariff Job Creation Tracker (TJCT) shows over 11,000 jobs have been created or announced since February 1st and that includes only cases where companies announced specific job counts. Other companies have also said they intend to add jobs, but we will wait for numbers before adding them to the TJCT.

In general, these are good, well-paying jobs, in strong, stable industries. The addition of high-paying jobs to any locality creates upward pressure on wages in the entire region.

The process is just beginning. More tariffs, which were previously announced, are being finalized and implemented. The so-called “second tranche” of section 301 tariffs recently announced on 279 lines amounting to about $16 billion of Chinese imports will go into effect on August 23. Hearings will be held on August 20 by the US Trade Representative’s office relating to the proposal of 10% to 25% tariffs on an additional $200 billion of Chinese imports. As a result, we should expect to see more future job creation by domestic companies that make or can make products associated with those tariff lines.

A good example of the job creation now underway is the expansion by Magnitude 7 Metals, in New Madrid, Missouri. Privately-owned American company Magnitude 7 bought the aluminum smelting facilities out of bankruptcy after previous owner Noranda failed, due largely to international competition which forced some 90% of US aluminum smelters out of business. In March, Missouri Governor Eric Greitens spoke at an event at Magnitude 7, praising the company for relaunching the smelter and creating jobs offering average annual pay of $64,000. “These jobs will improve the whole economy in the region. It means more money for the schools. It means more customers for the restaurants,” Governor Greitens told the crowd. n total, our tracker shows 2,899 jobs have been announced or created in the aluminum industry since February.

In the steel sector, industry leaders Nucor and US Steel have announced expansions and re-openings of previously shuttered facilities. Nucor has also announced plans to build a new greenfield steel mill in Frostburg, Florida, creating 250 jobs at an average pay of $66,000 a year. Less well known is that smaller steel companies are expanding too. Big River Steel, a steel startup, is investing in its Arkansas mill to double production capacity to 3.3 million tons a year. Big River is also planning to open a second mill in Brownsville, Texas, which will employ 500 steelworkers. Our tracker shows a total of 4,960 new jobs planned in the steel industry.

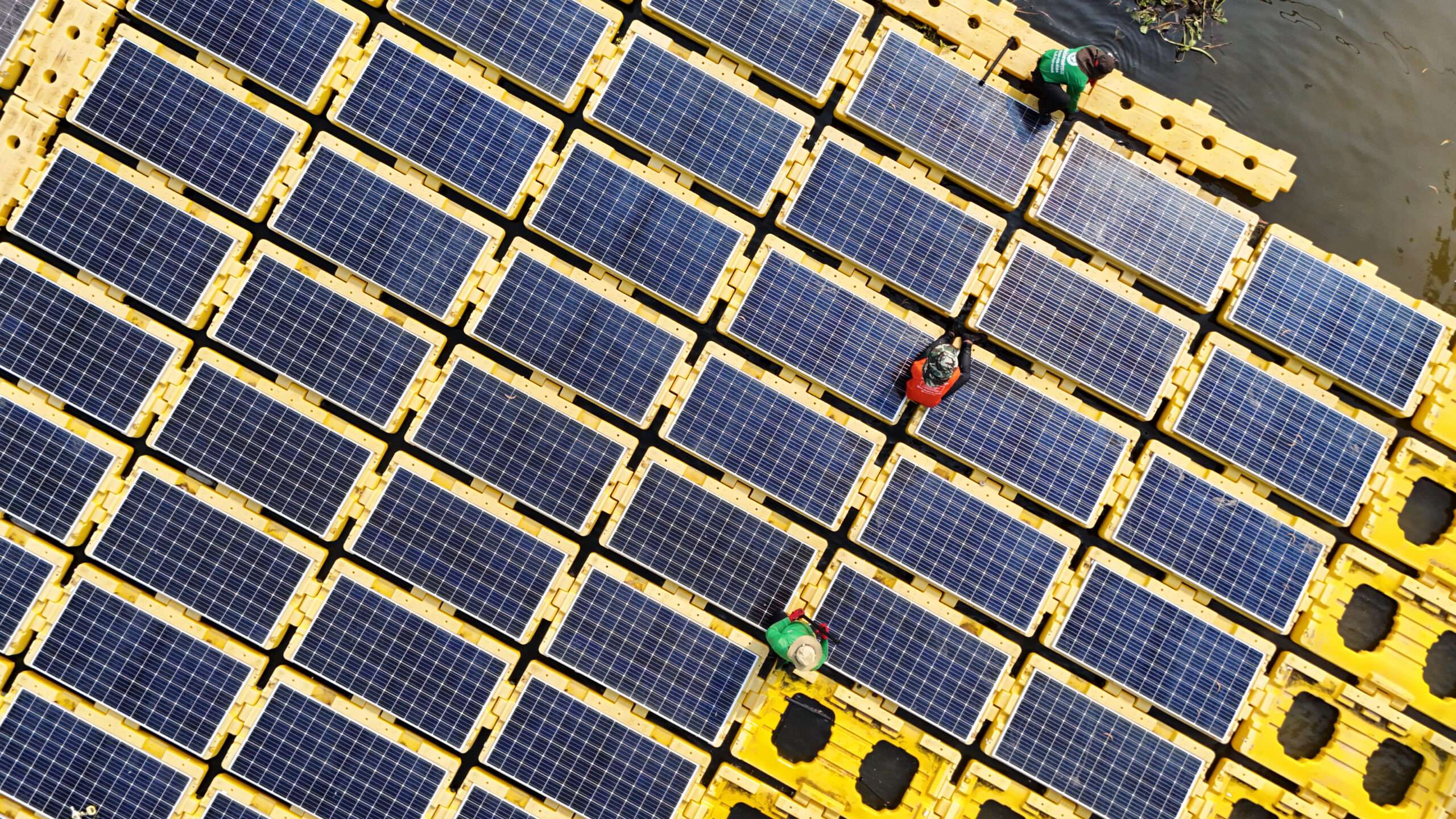

The solar panel industry was the first industry where the administration announced tariffs, back in January. Some doom-mongers predicted disaster for the industry. Instead, the solar industry is booming. Around 10 solar manufacturing companies have announced investment and job creation in solar manufacturing facilities, from Oregon to Florida. In April, First Solar Corp. announced a $400 million expansion at its Ohio plant, which will create 500 new jobs. First Solar’s innovative thin-film solar cells are not directly affected by the solar tariffs, but its ability to build a strong manufacturing capability depends on the existence of a robust solar supply chain and the required skills here in the US. The solar tariffs are designed to achieve exactly that. According to jobs website Glassdoor, a manufacturing operator at First Solar earns about $37,000 a year while a development engineer earns $97,000.

Our tracker shows new solar jobs at 1,150 so far, and new jobs in the washing machine industry at 2,100. Add up those four categories and you get 11,100 new jobs. And that’s without counting jobs that will be created in the diverse industries and sectors where the administration is levying tariffs on Chinese imports worth $50 billion a year.

It’s the Supply Chain

The United States made a huge mistake in the 1990s and early 2000s when it allowed entire manufacturing supply chains to move to Asia. Manufacturing is too important for employment, wealth, and income creation to allow so much of it to move overseas. Further, manufacturing success is not about individual products or stages of production dispersed over different countries thousands of miles apart. Skills and knowledge tend to cluster together, and they grow and develop best in close proximity. So it’s especially good news to see growth in broader supply chains. A good example is the recent announcement by iron ore miner Cleveland Cliffs of a new facility to process ore in Toledo, Ohio. That facility is targeted to create 1,200 new jobs.

Across the industrial world, there is growing awareness that local and in-country production is coming back into fashion. Another way to put it is that the corporate strategy of saving a few cents on every input by disaggregating production and siting it all over the world is going out of fashion. The change is not just the result of President Trump’s tariffs, or of China’s blatantly offensive IP theft, (such as the latest case of a Chinese Apple employee arrested by the FBI at San Jose Airport on July 7th, after allegedly walking out of an Apple lab with stolen circuit boards and heading for a job at a Chinese autonomous vehicle competitor).

For example, inverters transform the voltage generated by solar cells into domestic AC current and are an essential part of every solar system. Inverter maker Chint Power Systems recently announced plans to increase inverter production at its Texas facility and said it’s actively seeking a second location for US manufacturing. Chint is partly motivated by the likely third round of Chinese tariffs under consideration, but the US manager of Chint has also said he also is seeking to work closely with “customers that plan projects closely with us.” Similarly, Giant, the Taiwan-based bicycle market leader that made 4.4 million bikes last year, mainly in China, recently told the Financial Times that it is investing in production in eastern Europe as there is a global trend to reduce dependence on Chinese production. The European Union recently enacted anti-dumping tariffs on Chinese electric bikes. Supported by tariffs on both sides of the Atlantic, the business community is actively seeking to diversify out of China and find new locations in Asia, the US, and Europe. It’s the beginnings of a new world manufacturing order.

US Public Companies Need to Wake Up and Diversify Their Manufacturing

But there is one group of companies dragging their feet: American companies, and particularly publicly quoted American companies. In solar inverters, there are three large players, two Chinese and one American. Chint, one of the Chinese manufacturers, is seeking to expand US production. The sole American producer, Enphase, still produces all its inverters in China. Like many tech companies, it has a contentious relationship with its Wall Street investors. The stock is under attack from a hedge fund. Enphase CEO Badri Kothandaraman recently said: “We are laser focused on our number one priority: improve profitability quarter on quarter and creating further shareholder value.” It is this short-term obsession that prevents US tech companies from seeing the bigger picture and seeking to build a business for the long term, which would include global manufacturing. There is also a herd mentality in which tech company executives believe investors will only support manufacturing in the cheapest markets. That’s part of the reason Apple has not lived up to vague suggestions by Tim Cook that it would build US manufacturing—while its Taiwan-based supplier, Foxconn, is going ahead with a large Wisconsin manufacturing facility. US government action is needed to change this dynamic.

Downstream Industry Impact

While many companies are benefiting from the tariffs, there are also some companies that pay higher prices for the tariffed products. Those companies either pass the price increase along, reduce their profit, or lay off workers depending upon the nature of their market. The administration should follow up the existing tariffs with tariffs to protect downstream industries. More generalized tariff coverage causes fewer distortions than targeted tariffs. It is already doing so, with its “second tranche” of tariffs against $16 billion of Chinese imports and the upcoming third tranche. But more may need to be done.

Free traders wrongly focus only upon alleged “efficiency gains” of trade. But they incorrectly assume that displaced workers quickly find jobs of equal quality. That assumption has now been proven untrue. Large numbers of those who lose their jobs due to import competition either leave the workforce or find jobs at significantly lower pay. Their current and future earnings are severely reduced. Marginal efficiency gains are dwarfed by the aggregate wage reduction. It is also important to note that future innovation and productive capacity from lost industries, often high tech industries, are forfeited forever.

Tariffs present a strong initial solution to the job and industry losses caused by foreign subsidies, dumping, and China’s acts, policies and practices of commercial espionage, technology theft, and weaponized incoming investment.