Should Silicon Valley and private equity firms be allowed to invest in Chinese advanced technology companies and start-ups? As the China debate heats up – and will likely get hotter in the 2024 presidential election season – even the Business Roundtable has suggested more scrutiny for outbound investment into what is America’s most worrisome rival.

“The Business Roundtable says there is a good case to be made to restrict investments in venture capital into China if those investments come with management and technical expertise being transferred to companies,” said Christopher Padilla, former Under Secretary for International Trade at the U.S. Department of Commerce. “I think this is where the Treasury Department is headed. This would stop the most egregious cases from getting venture capital funding, and stop money flowing into sectors we are most concerned about,” Padilla told the House Select Committee on the CCP on Wednesday, July 19.

Nazak Nikakhtar, former Undersecretary for Industry and Security at the U.S. Department of Commerce during the Trump years and now a trade lawyer, told the Committee yesterday that Congress needed to scrutinize outbound investment from Silicon Valley into China.

“As of January 2023, there were 253 China companies listed on US exchanges with a total market cap of over $1 trillion. We have prohibitions on 68 military industrial companies but that only bans stock purchases, not other capital flow. We have sanctions on 253 entities, but have no financial restrictions on them,” she said. “We need outbound restrictions on venture capital and private equity and other investments.”

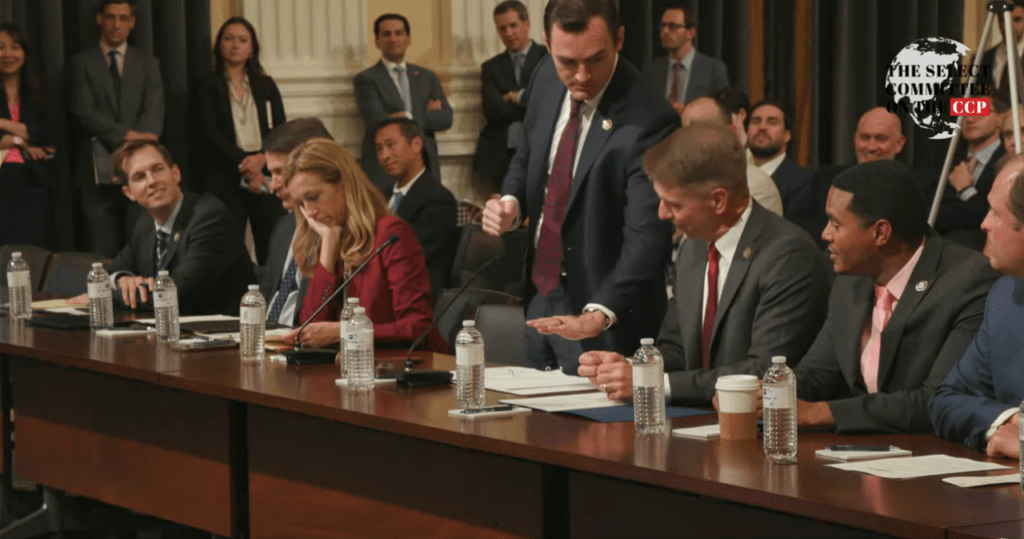

Wednesday marked the second of three hearings at the seven-month-old Committee. Another one is scheduled for Thursday. This one was different from any of the previous sessions and was set up as a debate between two teams with Nikakhtar and Padilla on opposing sides. Only a handful of Committee members asked questions.

Welcome to the “Thunderdome”. The House Select Committee on the CCP held its second of three hearings in less than a week. There is a differing of opinion on how to target tech sanctions against China. The debate, dubbed “Thunderdome”, also pitted two teams against each other that made the case for or against removing Most Favored Nation trading status for China.

Nikakhtar’s debate partner, international trade attorney Elizabeth Drake, said the U.S. was funding Beijing’s Made in China 2025 strategy through both Silicon Valley, and Wall Street.

“China has already listed the types of business they want to dominate by 2025 and I take them at their word. They are going to dominate those industries if we keep funding those sectors of the Made in China 2025 plan,” she said, calling for restricting outbound investment to China.

Mary Lovely, Senior Fellow at the Peterson Institute for International Economics, which is mostly funded by Wall Street asset managers, and old money foundations, said, “China doesn’t need our capital. They need our know-how.” Lovely was Padilla’s debate partner.

Rep. Andy Barr (R-KY) responded by saying Americans have some $1.2 trillion invested in Chinese securities. “China does need our capital? I think they do.”

Both debate teams seem to agree that outbound investment controls were warranted but disagreed on how they should be implemented. This suggests such controls may be in the works for Silicon Valley, which has long partnered with Chinese venture capital to tap into new tech companies and startups like JD.com, Shein, Temu and many more.

The same day as the hearing, dubbed the “Thunderdome debate”, the House Select Committee on the CCP announced investigations into venture capital firms invested in China. GGV Capital, GSR Ventures, Qualcomm Ventures, and Walden International were sent letters by the Committee expressing concern

about the firms’ investments in Chinese artificial intelligence, semiconductor, and quantum companies in China. Sequoia Capital of Silicon Valley, which has Zoom as its portfolio company and had its own China arm, Sequoia Capital China, severed this month likely due to fears that it would be hounded by Washington. Sequoia Capital China is loaded with China start ups, though its website only highlights the biotech and consumer facing products, noting that the portfolio companies listed on line are “not an exhausted list of portfolio companies of Sequioa China.”

“This is the beginning of a broader investigation,” Chairman Gallagher said in a press release on Wednesday.

The debate was divided into three rounds. The venture capital round was the last. The second round was on how export controls on advanced technologies should work, and the first round centered on revoking China’s Most Favored Nation (MFN) trading status. This status is granted to all members of the World Trade Organization, but seeing how China has not kept its promises after joining, Drake argued that it was high time for Congress to place tariffs on all of China’s goods and remove them from MFN. The other side said it would be too blunt a hammer and would put the United States alone as other allies – namely industrial powers Japan, Korea, and Germany, would not follow suit and therefore have access to low-cost China components. The opposition also argued that China’s retaliation would require Congress to throw more money at farmers as they often face the brunt of Beijing’s ire. Washington did that in 2018-19 when Section 301 tariffs on nearly $300 billion worth of China imports went into effect and China vacated the U.S. soy market. China has since returned to that market and has broken import records, suggesting that even with tariffs untouched, China has found the U.S. soy market too important to punish for long

“China retaliation has had less of an impact on us because the trade relationship is so lopsided,” Drake said. “They are more dependent on our consumer market than we are on theirs. But our economy is negatively impacted by their trade surpluses. China could cut down on overcapacity. China could pay its workers more so they can consume more at home, which is good for China’s economy. They do none of those things,” she said. “To pretend that they’re just another WTO member is not realistic.”

CPA Supports Rep. Banks Bill to End Normal Trade Relations with China