The Senate Banking Committee heard from two Senators and four separate witnesses in a difficult debate centered on whether Washington should create more hurdles for American companies to invest in adversarial nations. China, of course, was front and center. The Committee met at a time when the White House is considering more restrictions on what U.S. tech companies can sell to China defense contractors.

Chairman Sherrod Brown (D-OH) summed up the nature of the hearing, titled “Examining Outbound Investments”, held last Thursday.

“U.S. investments, venture capitalists or pension funds, could wittingly or unwittingly support foreign technological investments…we cannot let that happen. We need to better understand whether U.S. investments abroad pose national security risks in a global economy where capital flows freely. We need to make sure we are not investing in technologies that harm that national security,” Sen. Brown said, often using economic security and domestic labor markets in the same breath.

He mentioned the Committee on Foreign Investment in the United States (CFIUS), commonly pronounced “Cifius”), an inter-agency committee that has existed since 1975 to review foreign investment in the U.S. The first panel featured two Senators that testified about their work on legislation that would create a “reverse CFIUS” to examine outbound investment of U.S. companies into China, primarily.

“Times have changed,” Sen. Brown said about the early days of CFIUS. “So have the threats we face. We must consider outbound investment now and how our investments abroad help our adversaries achieve its foreign policy goals.”

A reverse CFIUS will not go down easily.

While everyone agreed something should be done, especially in critical sectors of the economy (think high tech, rather than apparel or home goods), there is no agreement on how it should be done. Or if another bureaucracy telling companies whether they can or cannot invest sets the table for government control of capital flow and business strategy.

Ranking member Pat Toomey (R-PA) is against it, saying that the Commerce Department’s Bureau of Industry and Security (BIS) currently restricts what tech companies like Intel are allowed to sell to Chinese tech companies like Huawei. Intel has to get permission from the government to sell certain computer hardware to the Chinese.

Ranking member Pat Toomey (R-PA) is against it, saying that the Commerce Department’s Bureau of Industry and Security (BIS) currently restricts what tech companies like Intel are allowed to sell to Chinese tech companies like Huawei. Intel has to get permission from the government to sell certain computer hardware to the Chinese.

But with a “reverse CFIUS”, Intel would have to get permission to invest in China at all. Intel has well over half a billion dollars invested in Chinese semiconductor businesses and is expanding its China footprint. Concerned members of Congress and the White House are trying to get them to think twice about those investments.

Intel is against such moves by Washington to restrict investment in China. They are not alone.

“BIS already has the authority to block investments going to China,” said Sen. Toomey. “What is the need for an outbound investment regime?”

Sens. Casey, Cornyn Speak: More Restrictions Needed

Senators Bob Casey (D-PA) and John Cornyn (R-TX) spoke separately about the National Critical Capabilities Defense Act. (S. 1854) This is the so-called “reversed CFIUS” that Sen. Toomey was against in his opening remarks, but a bill that CPA strongly supports.

Casey and Cornyn appealed to the Senate Banking Committee to pass this legislation in some form, instead of forcing the White House to do an Executive Order. Toomey said that maybe something like this could be included in the National Defense Authorization Act (NDAA), a bill that sets the top-line spending totals and priorities for the Defense Department. But with the Senate out for recess until after the midterm elections in November – and not having yet passed their version of the annual NDAA bill – it seems unlikely that something like this can get in that bill and pass Congress by Christmas.

“For decades, the U.S. has ceded its manufacturing power to other countries, particularly foreign adversaries like China,” Sen. Casey said. “Outsourcing our manufacturing and supply chains has put our economy and national security at risk. Our goal for this bill is to safeguard critical industries and avoid any action that aids or abets our adversaries. Manufacturing is the foundation of our economic competitiveness.”

Read Sen. Casey’s testimony here.

In his remarks to the Senate Banking Committee on September 29, Sen. Bob Casey noted that the U.S. has “ceded up to 60% in telecommunications technology equipment (ICT) to Chinese imports. As of 2020, U.S. investments in China have totaled $152 billion in partnerships with state owned enterprises like Apple and semiconductor manufacturer YMTC; with another $54 billion actually going to Chinese defense contractors. “We don’t know what kind of projects that money is supporting,” Sen. Casey told his peers. “Venture capital firms are pouring billions into Chinese companies that are developing sensitive technology that will be weaponized against us. The U.S. is an active party in the decline of our own economic might,” Sen. Casey said, adding that China violates international laws, such as laws on patents, and is not interested in free market principals espoused by the free traders of Washington and Wall Street. China’s government ambitions are entwined with its commercial interests, too. The two are often inseparable. For this reason, “It’s going to be up to U.S. policy makers and not international markets to be vigilant of our national security and protection of our workers. We have gaps (in existing investment rules). We should review our outbound investment program and match it with what South Korea and even Taiwan have done, which is to take steps to protect its own manufacturing security,” Sen. Casey said.

If Sen. Casey played the role of “bad cop” in promoting outbound investment oversight, Senator Cornyn played the role of “good cop”. He was more inclined to lean towards what Sen. Toomey had warned about – using CFIUS as a new form of trade protectionism while building a huge bureaucracy to police American business.

“We must not overreach, of course. Trade and investment with China must continue and it will continue and for this reason, it must be targeted. We need the scalpel, not the sword,” Sen. Cornyn said.

“We had an open hearing with the intel community recently, where we learned that the market value of U.S. investments in China is like $2.3 trillion. American businesses have funded the rise of the CCP. We don’t need to decouple entirely, but we need to look at this with our eyes wide open. If a company is invested in critical industries on a foreign adversary’s soil, we should know about it. There is no fire wall between private Chinese industry and the Peoples Liberation Army. We need new thinking. This is not the China of Richard Nixon’s time. We can’t risk playing politics with important topics such as outbound investments on questions of free trade versus protectionism. I know that the administration, and in my conversations with (Commerce Secretary Gina) Raimondo, they would welcome congressional action. That is what we (Casey) have been trying to do for some time now. Legislation is better than an Executive Order from the White House.” – Sen. John Cornyn, Senate Banking Committee hearing, September 29, 2022

Read Sen. Cornyn’s testimony here.

Witnesses Say Reverse CFIUS Good Idea, But…

The four witnesses at the hearing had similar thoughts – examining outbound investments is a good idea, mainly for critical supply chains related to new technologies and energy, but the concept needs work.

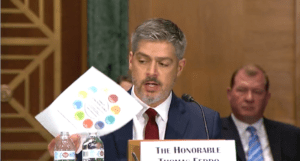

Thomas Feddo, former Assistant Secretary for Investment Security at the Department of the Treasury [Download Testimony] agreed legislation would be longer lasting than a Biden EO.

“I think this is the prerogative of Congress,” Feddo said. “But there are so many questions that I think need to be answered, such as how many transactions do you expect to capture; who is in charge; where is the accountability; who is in charge of the oversight. As far as I am aware, that sort of dialogue is not happening.”

Thomas Feddo of the Treasury Department holds up what the FBI refers to as the “wheel of doom” — all the ways China infiltrates and captures U.S. trade secrets and intellectual property.

Feddo said that there were red flags already related to inbound investment, spying, and hacking from abroad. “Damage to our IP is profound. It brings home the point that we need more information. We don’t fully understand the problem,” he said. “Another problem might be the risk of outbound investment, but how does that compare to hacking and other issues we face?”

Sen. Jon Tester (R-MT) brought up China’s inbound investment into farmland and agribusiness to change the subject a bit. “You can screw the food supply up pretty easily. Whose job is it to look at that? I’m talking about foreigners buying arable land in the U.S.”

China has been buying up farmland in the U.S., and is also investing in agribusiness assets. A Chinese company owns Smithfield Foods, for example.

Richard Ashooh, former Assistant Secretary for Export Administration at the U.S. Department of Commerce [Download Testimony] said that is the purvey of existing CFIUS rules.

“CFIUS has that scope. The real estate scope has grown substantially,” Ashooh said, including farmland not just luxury high rises in Manhattan. “Food security is really an infrastructure issue and that has grown to become an economic security issue,” he said.

“CPA strongly supports a multi-pronged approach to addressing outbound investment – to address outgoing foreign direct investment in technology, AI, weapons, biotech, and more on the side of supply chains, fabrication, etc. You have to look at actual outbound financing and capital flows to address the financial components of the problems we are seeing with China these days. While safeguarding IP and building our technology outside of China matters to U.S. competiveness against the CCP, so also does where our money goes. Wall Street and retirees investing in the very capabilities the U.S. is trying to compete against undermines American economic prosperity and security. Any legislation or White House action on this matter must tackle both the hard infrastructure and the capital markets angles of outbound investment.” – Robby Smith Saunders, CPA’s National Security Advisor.

Sen. Chris Van Hollen (D-MD) brought up the “work with allies” angle. He said existing legislation like the CHIPS Act, which provides funding incentives and guidelines designed to get Intel, others, to build semiconductor fabrication factories in the U.S. instead of their preferred countries in Asia. He said policies like that were another way to make it more enticing for U.S. companies to invest here rather than invest abroad, where the dollar obviously goes much farther, and markets are growing faster.

“It’s important for the U.S. to remain its competitive edge in parts of the economy that are critically important. CHIPS Act is one piece; another piece is to make sure foreign companies are not stealing IP. But I think the other piece is outbound investment,” Sen. Van Hollen said. “Without some government oversight, U.S. outbound investment could strengthen the capabilities of China in areas that are strategically important to us. I think there are disagreements on how you define the scope of this and what the mechanism will be, but we also have to make sure our allied partners adopt similar mechanisms.”

Sarah Bauerle Danzman, Associate Professor of International Studies at Indiana University Washington will “need multilateral engagement on this issue.” Otherwise, countries like Japan or Europe will be able to invest in high-tech growth markets in China, while their American counterparts cannot.

This was one of many sticking points.

“You are going to have to be very precise on this,” said Robert Strayer, Executive Vice President of Policy at the Information Technology Industry Council. “Just because a company is on the Entity List doesn’t mean it’s banned. There are precise product lines that are restricted,” he told the Senate.

“Precision is imperative,” said Feddo about the potential for a reverse CFIUS being formed. “Compliance cost for the private sector will be expensive if this happens. They will need to consult with advisors and lawyers to make sure they are on the right side of the law.”

“Precision is imperative,” said Feddo about the potential for a reverse CFIUS being formed. “Compliance cost for the private sector will be expensive if this happens. They will need to consult with advisors and lawyers to make sure they are on the right side of the law.”

Sherrod Brown blamed Wall Street and global corporations for the predicament Washington legislators like himself find the country in today:

“Over the last 30 years, global corporations searched the world for cheap labor. First, they went to anti-union states – shutting down production in Pennsylvania and Ohio and moving to Mississippi or Alabama. Then those same corporations lobbied for tax breaks and trade deals to help move those jobs overseas, always in search of lower wages. It started with manufacturing jobs, but it didn’t stop there. Corporations, in some cases, moved R&D jobs abroad, too. Wall Street rewarded them. In some cases, investments abroad outpaced investments here, undermining labor and national security and hallowed out our middle class all over the country. Investing in R&D and manufacturing and U.S. workers is what will help shore up supply chains. …This is a crucial issue for our economy.”