Chairman Michael Gallagher (R-WI) of the House Select Committee on the CCP said in a hearing Wednesday night that the U.S. needed to “stop funding our own destruction”, “reinforce our economic sovereignty” and “reshore pharmaceuticals”. To get that done, one of the tools is to impose more tariffs on China, Robert Lighthizer, formerUSTR, told him.

“I don’t espouse cutting off economic relations, but strategic decoupling is necessary,” he said after being sworn in along with two other witnesses – Roger Robinson, Jr., former National Security Council (NSC) Senior Director of International Economic Affairs for President Ronald Reagan and former Chairman of the Congressional U.S.-China Economic and Security Review Commission, and former Google Chairman Eric Schmidt. “We need to raise tariffs and balance trade so we buy as much from them as we sell to them.This is an aggressive recommendation, but this is not the time for half measures. It is the time to be bold and Congress must write the rules to make this happen.”

In the third hearing of the House Select Committee on the CCP, titled “Leveling the Playing Field to Counter China’s Economic Aggression”, both Chairman Gallagher and Ranking Member Raja Krishnamoorthi (D-IL) set the tone for what continues to be a hawkish view on China and trade. While a small handful of Committee members, led by Rep. Dusty Johnson (R-SD) and Rep. Haley Stevens (D-MI), talked about opening markets for agriculture in poor Southeast Asian nations, or were not supportive of tariffs, the bulk of Wednesday’s conversation went directionally in favor of what CPA members would want to see.

The House Select Committee on the CCP fully understands the China threat. Even Schmidt, who focused more on improving the American STEM education and labor ecosystem, said the U.S. is lagging behind, or neck-and-neck with China on important global tech platforms. He singled out 5G telecommunications systems, where China is the world leader; commercial drones; critical minerals used for new, so-called clean technologies; and of course artificial intelligence platforms and quantum computing where the U.S. maintains a slight edge at this time.

There is a sense of urgency at these hearings, with the takeaway always being that the U.S. might be one step behind.

Krishnamoorthi opened up with some numbers to showcase China’s trajectory enroute to overtaking the world’s No. 1 economy.

“We used to produce four times more steel than China, now China produces 12 times more. We produced more cars, now China produces three times more than we do. In 1978, we had the world’s leading GDP and China was number 10. We are number one still, but China is number two now and aiming to be number one. Let me give you one more stat: China leads in 37 of 44 advanced technologies, including 5G, nanoscale manufacturing, and drones, among others. If we want to be the global economic leader, we need to protect ourselves from unfair trade practices by the CCP while at the same time, upping our game domestically.”

Krishnamoorthi said the U.S. needed to invest in people, but in this he included bringing in more high skilled workers from around the world. He also advocated for producing more goods in the United States, and called for more private and public partnerships. “These matters need to be priorities for our entire country. China’s rise (in key economic areas) is not science fiction and not in the distant future. The moment is not next year or five years. It’s now.”

Other than tariffs, export controls on advanced technological components going to China was considered. Schmidt said it was slowing China down in the AI field, but also warned that China was maybe one to two years behind the United States only. Moreover, previous House hearings on this subject of export controls suggested the majority of U.S. companies facing restrictions on exports to China were getting around those restrictions.

In speaking to Gallagher’s early comment on funding our adversaries, Roger Robinson, Jr. said Wall Street, venture capitalists from Silicon Valley, and New York private equity firms should not be allowed to invest in companies on blacklists held by Treasury, State and Commerce departments. But they are anyway.

“The U.S. has allowed a cavalcade of thousands of Chinese companies to enter American investment portfolios without any screening as to who these companies are…including companies that are sanctioned,” Robinson said. “None of these roughly 5,000 Chinese securities traded in the markets are compliant with U.S. securities laws and do not follow any corporate transparency laws and requirements,” he said in relation to the Shanghai and Shenzhen listed stocks that dominate numerous mutual funds and ETFs sold to retail investors here. “Americans trust that our pension managers and other fiduciaries are protecting our investment interests, but no, that is not the case. These funds are loaded with Chinese companies that are sanctioned and other bad actor companies are part of indexes. We need to remove CCP-controlled companies from our exchanges and give Americans worldwide 180 days from dislodging these stocks from their portfolios. There are millions of Americans holding sanctioned Chinese companies, unwittingly,” he said, warning that geopolitical risks could eventually translate to trillions in capital losses in these funds. He imagined outloud a situation where the U.S. was being asked to bailout U.S. bond funds that have lost their shirts in Chinese debt. “We must act now. Or scores of people face billions of dollars in losses,” he told the Committee. We cannot wait another day to decouple financially. We have to defund the CCP and make that the 21st Century equivalent of our finest hour.”

Some Q&A Exchanges

Some Q&A Exchanges

Gallagher asked Robinson about including portfolio investments as the definition of “outbound investments”, which is usually reserved for private investment in companies, such as corporate foreign direct investment.

“Investment in portfolio money is outbound investment to me,” Robinson said. “Some five thousand Chinese companies are in American portfolios, sending billions of dollars of investment capital into China to help them gain a competitive advantage. Money is essential. Portfolio money is outbound investment. How is that so few are aware of this capital market saga? There are literally trillions of dollars moving from American investment portfolios into the coffers of CCP-owned companies. This is an acute problem. Capital markets have to be included in outbound investment,” he said.

Gallagher asked Lighthizer about the de minimis trade provision, which allows for duty free shipments into the U.S. if priced under $800.

“This was a mistake,” Lighthizer said about a rule change to increase the de minimis provision from $200 duty free to $800 and under duty free. “No one dreamt this would ever get carried away like this. Now we have two million packages a day, almost all from China, and we don’t know the true value of those packages.”

Lighthizer mentioned a study by CPA chief economist Jeff Ferry on de minimis. You can read the report here.

“We need to go back to what de minimis was meant to be, say $50 to $100 max. But even there, I fear that won’t work. You have companies today that exist solely because of this loophole. SHEIN and Temu would not exist here without de minimis,” Lighthizer said of China’s two new entrants into the online clothing mall biz. Wait until Temu tests Amazon’s market by offering home goods, too. “These companies are putting people out of work in retail, and will take them out in manufacturing next. At the very least, you have to take de minimis away from China and then from any country that transships from China, like Mexico and Canada.”

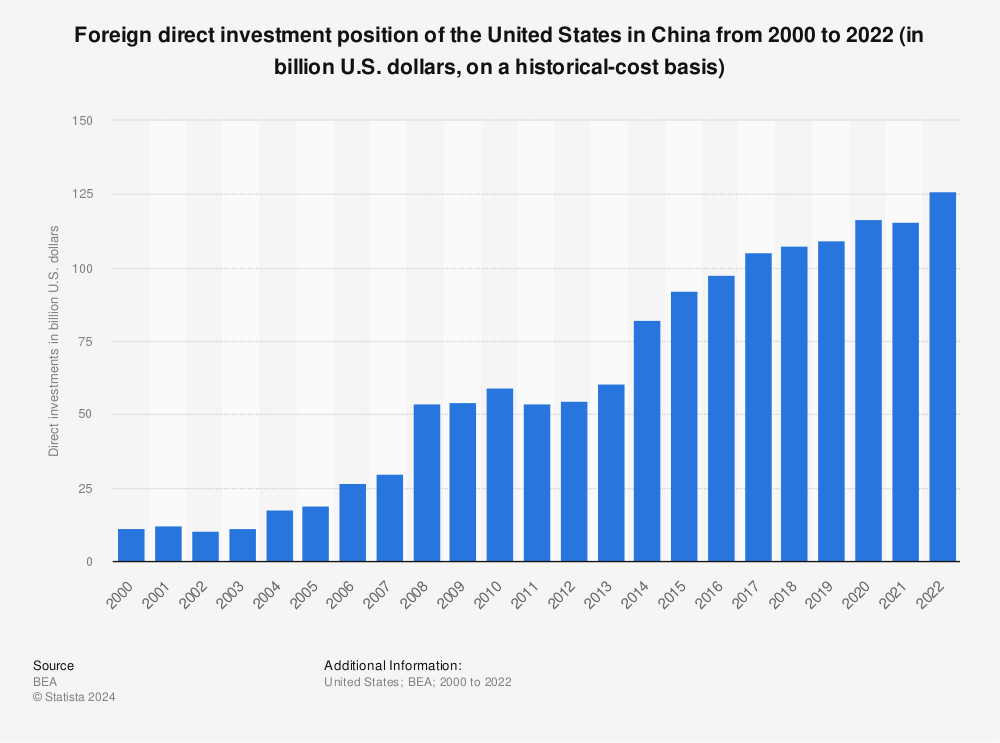

Rep. Blaine Luetkmeyer (R-MO) asked Robinson how much U.S. foreign direct investment (FDI) is flowing to China. Robinson didn’t try to guess because he wanted to consider portfolio flow, too. But here is a chart showing how much corporate FDI has gone to China. The trajectory is positive, for Beijing.

On capital market risks and new sanctions…

Rep. Luetkmeyer: How do we control people’s ability to invest there, so we can cut off the flow of American capital into the CCP?

Robinson: We have to enforce the rules. After all these fund managers are fiduciaries, and they are supposed to be invested in companies that are compliant with SEC laws and these Chinese companies are not compliant. You have one abuse after the other in the area of investor protection. This is very unusual for only one country to get away with this. China has had a free ride for way too long.

Rep. Dan Newhouse (R-WA): What would the capital markets risk look like if one day China made a move on Taiwan?

Robinson: Business as usual would be over as soon as shots are fired. We would look at the multi-trillion dollar free lunch program in a whole new way and it will not be pretty for American investors holding the bag. Despite this risk, Blackrock has tripled their exposure in China and recommended it a few years ago and have not rescinded that recommendation. There are a lot of fees these companies are making in China because they are now allowed to sell financial services in mainland China. They don’t want to lose that market. These trinkets are dangled in front of our Wall Street friends and they buy them every time.”

Robinson: Business as usual would be over as soon as shots are fired. We would look at the multi-trillion dollar free lunch program in a whole new way and it will not be pretty for American investors holding the bag. Despite this risk, Blackrock has tripled their exposure in China and recommended it a few years ago and have not rescinded that recommendation. There are a lot of fees these companies are making in China because they are now allowed to sell financial services in mainland China. They don’t want to lose that market. These trinkets are dangled in front of our Wall Street friends and they buy them every time.”

Rep. Andy Barr (R-KY): Capital market sanctions are the Chinese government’s biggest, non-military related fear. Without them, they have unfettered access to trillions of assets under management looking for investable securities.

Robinson: Wall Street firms have made their position very plain, and have done so publicly. And that position is that if it is not illegal, they are going to do it. Human rights abuse is someone else’s job to deal with. Our job is financial returns, they’ll say. So I say fine, let’s give them the clarity they need on what’s legal and illegal. They are not going to lead on this issue, they are going to follow.

Rep. Barr: I have a bill that does this. It goes after private equity too. It puts a red light on those Chinese companies on entity lists. Is that the clarity U.S. investors need – knowing what securities are off limits to trade?

Robinson: Yes. This is low hanging fruit. How do you radically lower American risk exposure to the bad actors in China’s corporate world. Here we have a list of companies and you shouldn’t be invested in them. That’s a good place to start.

On export restrictions for technology…

Rep. Andy Kim (D-NJ): What’s another way to go after China without relying on just tariffs?

Rep. Andy Kim (D-NJ): What’s another way to go after China without relying on just tariffs?

Schmidt: If you invest and innovate ahead of everyone else, you are winning. China is dependent on things in the West and in making those restrictions well targeted, they will thwart China’s strategy and we should keep going with those export restrictions.

On new trade agreements to counter China…

Rep. Darin Lahood (R-IL): The Trump tariffs are still in place under Biden, however, myself and many others are concerned that stagnant trade policies are inadequate and not proactive. Can you comment on the Biden administration’s approach to China and what would you recommend as additional trade tools?

Lighthizer: With respect to the tariffs we put in place, it is a compliment to the Biden administration that they kept them in place. Like every administration, there are people who understand this issue and others who do not and they have the same mix of people as anybody else. I believe that China is not in compliance with the (Phase One) agreement made with Trump so I would use that to raise tariffs. We started the decoupling under the Section 301s. So if I were in the government, I would have tariffs across the board. That’s what I would recommend. We have to have a positive trade agenda, but I don’t think we need additional free trade agreements (FTA) nor do we need to help our allies gain American market share at the expense of American jobs.

Rep. Mikie Sherrill (D-NJ): We have seen a renaissance in manufacturing because of the CHIPS Act and Inflation Reduction Act, but we need a diplomatic strategy across Europe and in the Indo Pacific. We have seen China take advantage of markets through the Belt and Road Initiative and joining the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership.) We have a desire to reshore a lot of business, but we need our allies in this fight to present the best possible counter to China. How do we balance doing what we have to do, and doing things with our allies that are not related to FTAs?

Lighthizer: When you talk about manufacturing coming back, which is true, keep in mind that a lot of this is because of the tariffs. We put 25% tariffs on all this stuff. Do I think we should work with allies? Yes. Should we give up access to the U.S. market to bribe them to do it? No. And do we act unilaterally if we need to? Yes.

Rep. Dusty Johnson: I am surprised you are so skeptical of free trade agreements.

Lighthizer: So creating allegiances by transferring more of our wealth to them is not going to happen.

Lighthizer: So creating allegiances by transferring more of our wealth to them is not going to happen.

Rep. Johnson: What about mutual wealth? Voluntary transactions can enrich both parties. Can’t we be stronger by transacting with our allies?

Lighthizer: Which allies then?

Rep. Johnson: Japan. We can do deals like that throughout the Indo Pacific to counter China.

Lighthizer: If you’re talking about the TPP countries, like Malaysia, and Vietnam…they send like 33% of their production to the U.S. as it is and have a trade surplus with us of about a hundred billion dollars. I don’t see how buying more Vietnamese goods or trading more (soybeans) to them helps us overall. I don’t want to give up manufacturing jobs here.

Rep. Neal Dunn (R-FL): Right now China just ships goods to Mexico and Canada to avoid duties. There are lots of bad actors in Mexico. This has to stop. It’s a shell game. What can we do to end that game?

Lighthizer: You just have to put tariffs on everything. Look, you can’t just keep transferring hundreds of billions of dollars a year to China (in the form of a trade deficit). I think it is fair to say that their economic miracle is our economic stupidity. You either continue to go into deficit and debt or put higher tariffs. At some point you will have to change this. You cannot keep going into debt to buy Chinese goods. Eventually you’re all going to say ‘we have to change’.

On repealing Most Favored Nation and Permanent Normal Trade Relations…

Rep. Ashley Hinson (R-IA): Why should we give China sweetheart deals like Most Favored Nation status?

Lighthizer: We should take back Permanent Normal Trade Relations (PNTR). I think you would have a majority of people in the House who would vote for that removal.

Rep. Jim Banks (R-IN): If we remove PNTR for China, what would it do to American manufacturing jobs?

Lighthizer: In my opinion, it would be one of the greatest things you could do for American manufacturing. All these small companies would be in a better position. It would also generate a fair amount of tariff revenue that you can use to put into all of these science and vocational education programs that Dr. Schmidt is talking about.

Rep. Banks: Why wasn’t it repealed in the Trump administration?

Lighthizer: This is an evolution.. Where we are now is not where we were then. Should we have done it? I’d say we began the process as radically as we could, but it had to be incremental and we can now move on to the next step.

* * *

CPA senior economist Andrew Heritage published a report on this question from Rep. Banks on repealing China’s Most Favored Nation trade status.

Heritage found that:

- Removal of permanent normal trade relations with China would apply Column 2 tariff rates to imports from China. At 2022 import values, this would generate an additional $198.7 billion in revenue for the U.S. government.

- Most goods imported from China have currently zero or a very low tariff levied on them. The weighted average of last year’s imports was 2.5% under MFN. The Column 2 tariff rate under MFN removal would result in a 39.9% weighted tariff rate.

The report suggests that removing MFN status would generate upwards of $198 billion in tariff revenue. Normal Trade Relations, also known as Most Favored Nation (MFN) status under World Trade Organization rules, means that imports from the beneficiary country are eligible for all trade advantages that any other country receives. Typically, this is a zero-tariff rate, or a very low tariff if one exists. Currently, based on the total value of 2022 imports, imports from China to the U.S. receive a weighted average tariff rate of 2.5%.

In his opening remarks on Wednesday, Lighthizer called China “the most dangerous threat” facing the U.S.

“China is the number one source of industrial espionage; they reduce cost of manufacturing by taking advantage of very low environmental standards we do not face, and are taking over new climate-related businesses by taking over critical mineral supply chains. If this is not an economic war, I don’t know what is. It has led to the loss of millions of jobs and led to the destruction of many towns across America. While waging this war, since granting them Most Favored Nation status, China went from a trillion dollar economy to a $17 trillion one and their tech sector now rivals our own. The kicker is that their success has largely been accomplished with our money.” – Robert Lighthizer, former U.S. trade ambassador, oral testimony, House Select Committee on the CCP, May 17, 2023.

China MFN Repeal Would Generate $198 Billion for U.S. Taxpayers