A House Financial Services Committee hearing on Wednesday revealed what could easily be seen as a stalemate when it comes to questions about China’s investments in the U.S. Should it be restricted? Should it be banned? Lots of opinions, but not any answers other than if something looks bad, the government’s Committee on Foreign Investment in the United States (CFIUS) – may or may not – do something about it.

The hearing on CFIUS coincides with the one-year anniversary of President Biden’s Executive Order that requires CFIUS to consider the national security implications of foreign direct investment (FDI) into the United States. The EO did not mention China, but China was the focal point of the Sept. 13th hearing.

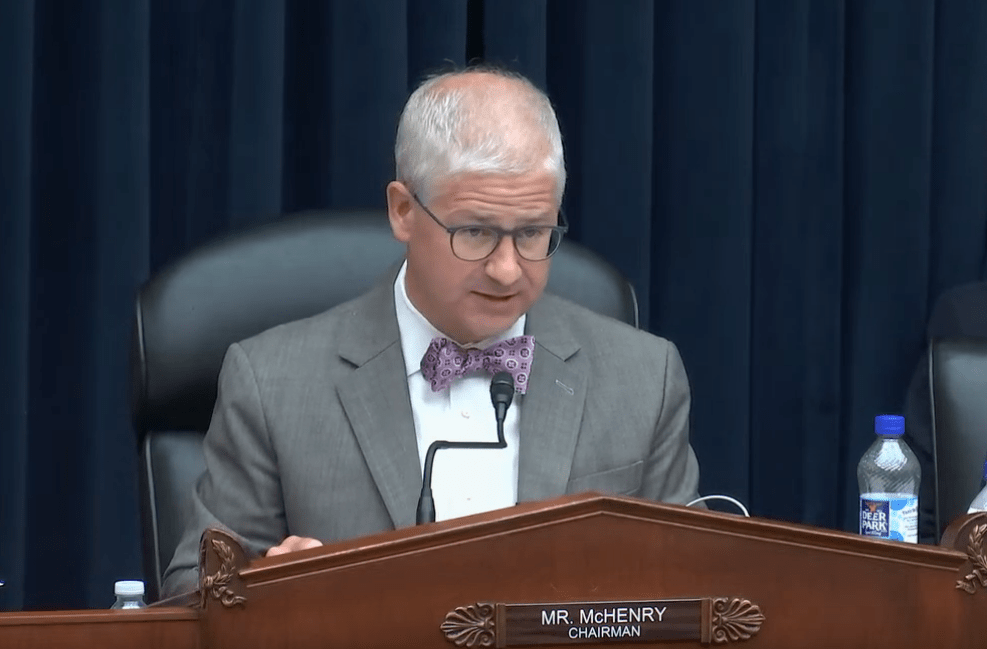

“The Biden Administration is proposing to use CFIUS to regulate Americans’ investments into China. That’s nonsense. Congress has repeatedly dismissed this idea, and for good reason,” said Committee Chairman Patrick McHenry (R-NC) who came down squarely on the side of not closing the door to China FDI. His counter points were unrealistic. “If you oppose Beijing’s state-owned enterprises, you want more Western investment in China—not less,” he said. The U.S. is only marginally invited to invest in China and when doing so has had to partner with Chinese firms in a deal that often led to stolen trade secrets.

“If you are concerned about Chinese technology companies, you want more Americans in control of them—not fewer,” he said. U.S. tech companies are largely closed to China. As much as they want in, AWS cloud service is only allowed in two cities in China. The CCP is not going to allow a Western company to rule the local market. AWS is barely a player in China. Alibaba, Huawei, Tencent, and Baidu are the top five cloud service providers, according to market research firm Canalys.

“And if you want to expand the reach of U.S. sanctions and export control laws, you want Americans in Chinese boardrooms,” McHenry said. Alibaba has one American on its board – J. Michael Evans, a former Goldman Sachs executive and a trustee of the Asia Society, a group of old China hands within the Washington intelligentsia that seek deep engagement with China.

Maxine Waters of California questioned the wisdom of Wall Street “investing in our adversaries”.

What Chairman McHenry fails to grasp with his comments is that there is no such thing as a private company in China. As such, every business is firmly within Beijing’s control. In CPA’s view, the Biden administration and Congress should be doing much more to restrict U.S. investment in Chinese industries, especially ones that are directly involved in the modernization and buildup of China’s People’s Liberation Army, in the genocide and human rights abuses that remain ongoing in Xinjiang, and that pose a threat to U.S. national security.

Tech giants Tencent and Sina Corp. do not have any Americans on their boards. Tencent owns Los Angeles-based gaming company Riot Games. Chinese automaker Geely, makers of the Polestar EV, also has no Americans on its board (but neither does GM have any foreign nationals on its board).

The hearing was divided into two panels. Panel one, reviewed here, had only one witness, Assistant Treasury Secretary Paul Rosen. Rosen addressed concerns over inbound and outbound investment into China.

Rep. Maxine Waters (D-CA) – who spent most of her time bemoaning the threats of a “government shutdown” by Republicans who want to cut spending, including military spending for Ukraine — said outbound screening would address supply chain security and how workers are treated overseas.

Rep. Waters mentioned outbound investment review – which was not part of the Biden EO. “If we want to confront our adversaries, we have to make sure that trillions of dollars of American capital markets are not funding those adversaries.”

Rep. Brad Sherman (D-CA) challenged McHenry’s response on allowing for greater interaction between U.S. and China investors when his turn came in the Q&A period.

On adding Americans to Chinese boards, Rep. Sherman said, “The CCP is not going to listen to business lobbyists.”

Sherman also gave the best definition of the trade relationship with China in the hearing.

“Since we granted Most Favored Nation status to China, we were told that if we share our economy with them, they will share our values; that has not been

the case. We have this enormous trade deficit with China and we have that because we do not have adequate tariffs and we have that because Walmart imports from there and makes a lot of money, etcetera. Every year we import from $300 to $500 billion and over a decade that’s trillions of dollars to China. That money is for them to grow with. Then you add our investments into China securities. Half of the foreign initial public offerings on Wall Street are from China. We invest our capital in China. We provide our investors with tax incentives, and those incentives also help Americans invest in China and in China jobs,” Rep. Sherman said.

Still, despite his criticism of McHenry, Sherman too was not keen on the CFIUS restrictions. Rosen told the Committee that the CFIUS review workload has gone from around 200 case filings in 2017 to more than double that last year due to changes in what CFIUS has to look at now to allow for FDI, per Congress.

For Congressman Sherman, bans on China here just means they will take that investment someplace else.

“You can tell China not to buy farmland here. So what? They can go buy it in Russia,” he said. “They can buy influence in Europe. Perhaps the least we can do is let them invest here because if there was ever a fight with China we can at least seize those properties.”

CFIUS: Hard Work, Soft Hands

CFIUS has more work cut out for it in Biden’s EO and judging by its caseload. What’s getting done? Rosen mostly stayed in his swim lane and talked up the EO with great reverence. There were no stand-out examples of deals that CFIUS shut down. FDI is flowing.

Rep. Bill Posey (R-FL) said that the last time he met with a CFIUS staffer in a Committee hearing he was told that they would produce a report about how much land China owns in the U.S. This has become a favorite talking point of China hawks in Washington.

“They said they’d get back to me but they have not. Do you know?” Posey asked Rosen.

Rosen did not know.

While Rosen didn’t give much in the way of blocked deals since the Biden EO, at least two Committee members rolled back the clock to look at some deals that really turned into winners for China and losers for the U.S.

Committee member Bill Huizenga of Michigan recalled how one upstart EV battery maker, funded by tax dollars, eventually went bust and was sold to a Chinese company. China has gone on to become an EV battery powerhouse, soon to rival South Korea and Japan, and far far ahead of anything Tesla produces.

Rep. Blaine Luektmeyer (R-MO) mentioned a recent Dupont deal to sell to a Chinese company that was frowned upon by the Department of Defense, but CFIUS allowed for it to proceed. The deal, which allowed for the technological know-how of a special nylon material that could theoretically be used in weapons manufacturing to be sent to China. That happened, of course. Biden’s solution was to devise the new EO laying out more points for CFIUS to consider before greenlighting FDI.

Rep. Bill Huizenga (R-MI) recalled back in 2013 when a Chinese auto parts maker named Wanxiang bought upstart EV battery producer A123 Systems. The company had run into some production problems and went bust. Wanxiang effectively came in to bail them out and take them over. EVs were a nascent industry then.

A123 was subsidized by Washington at the time, keeping it in business almost like it was a Capitol Hill venture capital portfolio company.

“The A123 approval was probably not the best decision that CFIUS made,” he recalled. Wanxiang turned that company around, but more importantly, learned the EV battery business and now is on its way to becoming a market leader in EV batteries just as this market begins to expand in the West.

“American taxpayers went to fund companies whose technology gets acquired by China, and is now going to beat up on American companies,” Huizenga said.

He mentioned another China EV battery maker, Gotion, that got approved to buy 270 acres in Michigan. Huizenga alluded to this land possibly being near sensitive areas off limits based on the Biden EO last September, but Rosen said he only read about it in news articles and knew nothing more about its approval. Rosen deflected again and again on questions such as these, staying within the talking points of what was in the EO.

The hawkish views on restricting investment abroad from Waters, and restricting farm land buys by the Chinese were equally met by Committee members who revealed an uneasy peace about China’s FDI here.

At least one Congressman questioned the wisdom of reshoring.

“Friendshoring is the right direction,” said Rep. Bill Foster (D-IL) in addressing the supply chain component of the Biden EO. “I challenge any American company to make a microwave oven for $42 that has high-paying labor.”

The Biden EO about CFIUS addresses the reshoring issue but only as FDI related to manufactured goods deemed critical The EO states that CFIUS must consider a foreign transaction’s effect on supply chain resilience and security, both within and outside of the defense industrial base, in manufacturing capabilities, critical mineral resources, or technologies that are fundamental to national security. This included deals related to food security issues. It did not mention EV batteries, but did mention “advanced clean energy” technologies which could include EV batteries, wind and solar. As a single, national source of investments, China has led the pack of FDI into the U.S. solar industry following the passing of the Inflation Reduction Act.