Two weeks ago, the first-ever hearing of the bipartisan House Select Committee on the CCP, the Chinese Communist Party, was held on Capitol Hill. It was a home run. It revealed how worried members of that new committee are when it comes to China.

“We are investing in China…and that is feeding a lion that is going to one day eat us if we are not careful,” said Rep. Blaine Luetkemeyer (R-MO).

The hearing focused on ways in which the U.S. is trying to cope with China’s rise, with some warning the government against spending too much to “be like China”.

“As we consider policy responses, we shouldn’t try to counter China by becoming more like China,” said Rep. Andy Barr (R-KY).

Chairman Mike Gallagher (R-WI) led a hearing that was hard to ignore or tune out as background noise. Gallagher’s first show for the House Select Committee on China was a hit.

In the opener, Gallagher played a video of China beginning with Chairman Mao’s rule. The documentary-style clip talked about Mao’s culture war. Then delves into the Tiananmen Square student protest in 1989. In 1997, the Brits handed over Hong Kong to China with a 40-year deal for “two systems”, meaning Hong Kong would not be ruled by the CCP for a generation. That changed about four years ago with the merging of a security law that would allow for political opposition figures to be tried by a Beijing court. It also talked about Uyghur prisons in Xinjiang and showed video camera footage of those inside – men sitting in rows on the floor dressed in blue prison suits and people talking about how China’s societal full spectrum dominance techniques were beta tested in Xinjiang. That 24/7 surveillance system was later used in major cities to keep people in line with Xi Jinping’s paranoid Zero Covid policies, policies that ended last year after thousands protested. All the while, not one human rights institution, nor the World Health Organization, addressed these wanton human rights violations in the name of public health. It could only mean that China is that influential.

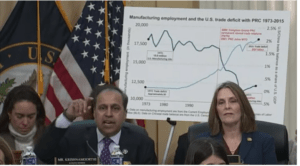

Ranking Member Raja Krishna Moorthi during his opening remarks at the first House Select Committee on the CCP on Feb. 28. Here, a chart showing how manufacturing fled the coop once China opened up to the West and joined the World Trade Organization in 2001. Rep. Kathy Castor of Florida is pictured beside him on the right.

Ranking member Raja Krishna Moorthi said the U.S. needed to fix weaknesses in its supply chains and that Congress “must be bipartisan and avoid anti-China bias at all costs because China wants us to be prejudiced and anti-Asian as if it is a bug in our operating system,” he said.

Two protesters interrupted the opening remarks of the witnesses after Moorthi spoke. One held a sign that read “Stop Asian Hate”. Gallagher told the activist that his sign was being held upside down. Both were escorted out of the room.

On the commercial front, “We wrongly assumed that trade and investment would lead to democracy in China,” Moorthi said in his opening remarks. “The opposite has happened. Their economy has gained 10-fold thanks to access to U.S. markets and the CCP has strengthened its authority at home. It has pursued economic trade policies that undermine our economy. The goal is to displace the U.S. in strategic industries. As Xi says, the East is rising and the West is declining. We must boost U.S. manufacturing to counter that,” he said, touting the bipartisan infrastructure law and the CHIPS and Sciences Act.

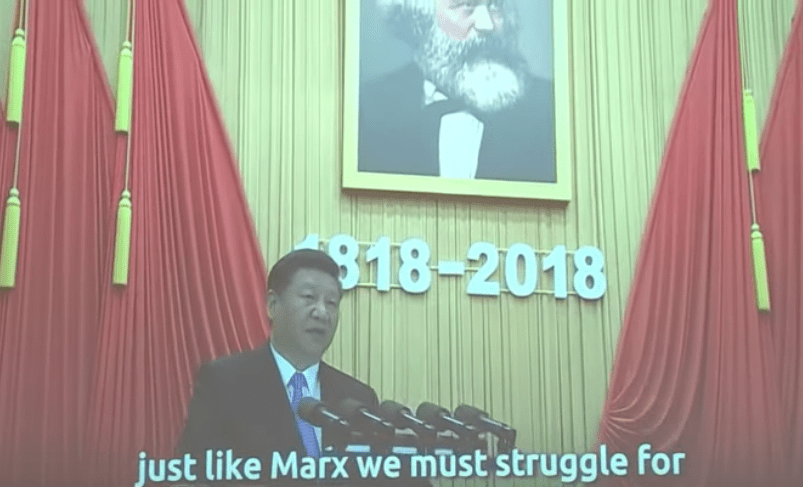

The first 10 minutes of the hearing included video montages, complete with Xi leading about 100 men in raising their right hand in a pledge to communism. Even, which seemed odd, a celebration of Karl Marx where Xi appears to say in translation, “Just like Marx, we must struggle for communism our entire lives.”

Few Americans have seen such footage or heard such things from a leader most in the business community assumed since the Obama years was all about business, and economic growth.

Most in Washington believed so too, until the Trump presidency. The China relationship has changed since, and President Biden continues where Trump left off.

Due to its length and varied topics of conversation, here are some key comments and exchanges among Committee members and the four witnesses.

The witnesses were national security adviser and retired General H.R. McMaster; former deputy national security adviser Matthew Pottinger; Tong Yi, a Chinese human rights advocate, and Tiananmen Square activist in the 1980s; and Scott Paul, president of the Alliance for American Manufacturing (AAM). All of them complimented what was a fast-paced three hours.

* * *

Scott Paul (from opening remarks): “The economic policies of the CCP represent a clear and present danger to the American worker, our innovation base, and our national security. For decades, the CCP has telegraphed its intentions with its five-year plans…its goals are to dominate key industries, set global standards, and weaken competitors, and they have attracted American investors to do so. Big company investment in China grew to $1.3 trillion in 20 years. The cost: tens of thousands of factory closures in America and an estimated $600 billion in IP losses. The incredibly cheap ‘China price’ masks the true cost of production. It’s made China the world’s factory thanks to trillions in subsidies, currency manipulation, exploiting workers and the environment, and lax safety standards that harm our consumers. The overproduction at state-owned factories goes on. Big Tech, retail legends, sports leagues, all bend the knee for the CCP.”

AAM’s Scott Paul also said the U.S. needs to “reform the de minimis policy that gives Chinese shopping apps such as Temu and SHEIN as well as Amazon, a way to evade inspections and tariffs.” And said in his opening remarks that Congress should “suspend Most Favored Nation trading status with China, which gives it nearly duty-free access to the U.S. for the products not facing existing Section 301 tariffs imposed by the previous government. “The CCP does not deserve the same trade status as our allies,” Paul said.

H.R. McMaster (responding to Rep. Dan Newhouse’s question on China and U.S. agribusiness): China has co-opted the U.S. agriculture market so that once you’re in their market and dependent on them, then China’s government can use you for coercive purposes. All of this is simply concealed as just normal business practices.

[See notes from the Feb. 28 Senate Banking Committee hearing on the topic of agriculture and China buying arable land and agribusiness near military installations.]

* * *

Rep. Andre Carson (D-IN): Is there anything we should be focusing on to make sure the Uyghur Forced Labor law is working?

Paul: Importers are fighting this law. But we have seen results: 2,300 seizures of goods and Customs needs to scale up. It is an overwhelming volume for them to handle. Right now it is mostly polysilicon, cotton, and tomatoes. Some automotive parts have supply chains (in Xinjiang), too. Importers who are complaining need a different business model and shouldn’t be dependent on Xinjiang labor. There is no transparency about what is happening there.

Rep. Carson: How do we bolster American production in critical sectors of the economy?

Paul: It takes intent. We never had the intent. There is no single policy that will change it. It will take an all-of-government approach, like being smarter about trade enforcement actions. We tried to invest in our manufacturing, namely with solar and EV batteries and of course semiconductors, but it will take an effort similar to that. Then you need to make sure you have a skilled workforce here if you are going to reshore.

* * *

Rep. Rho Khanna (D-CA): We basically deindustrialized the nation, manufacturing didn’t matter; you could just have MIT people design things and win Nobel prizes but production of it wasn’t relevant. We used to make 20% of the world’s steel, now we make 4%. China makes 57% of all steel produced. We used to make 37% of the world’s aluminum, now we are down to 2% and China is at 57%. We used to have 36% of the paper and pulp market and are down to 17%. China took it over and is now at 30%. You can go industry by industry and it’s like this. The rise of China resembles that of the U.S. a century ago using (Alexander) Hamilton’s formula. They copied what we invented with the American system. China spends 1.4% of its GDP on industrial financing. We are at 0.39%. If we industrialize, doesn’t the government have to be a partner in rebuilding American industry?

Paul: No doubt the government has to be a partner. In a perfect world, the market would settle this out, but we are not in that world with China. We are in a market failure and we are starting from behind.

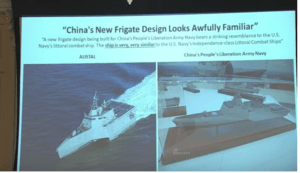

A screenshot of one of the presentations during the Feb. 28 House China hearing. Looks eerily familiar…

* * *

Rep. Andy Kim (D-NJ): We keep hearing that we cannot take on the CCP alone. Is that true and are alliances essential?

Mike Pottinger: They are important. But our national interests have been deeply undermined over the last quarter century and it is we who have to take the initiative.

* * *

Rep. Mikie Sherrill (D-NJ): Outsourcing American jobs has hurt us. How have American manufacturers suffered because of China?

Paul: We are competing against firms owned by the state. More than half of the world’s biggest steel companies are owned by the Chinese government. China has ignored most of the WTO rules it agreed to when it joined. You have dumping and subsidies and lax labor and environmental standards. From time to time there has been a misalignment with the dollar, which gives China goods an enormous advantage in our market. Over 90 thousand factories closed over the years. It has been a staggering loss for American manufacturing.

Rep. Sherrill: Yes, we have certainly seen that in New Jersey.

[See CPA’s Domestic Market Share Index for a look at where our imports are coming from, and what sectors are most dependent on imports.]

* * *

Rep. Haley Stevens (D-MI): From a national security standpoint, is it okay that 98% of the microchips the DoD purchases are manufactured in Asia?

McMaster: No, it is not okay. Our supply chains need to become much more resilient.

Rep. Stevens: An estimated 85% of refining capacity for rare earth minerals is controlled by China, is that acceptable?

McMaster: No,it is not, and it is going to take a lot of work by this Committee to rectify permitting (for local mines) and deregulation reform.

“We know we have a big trade deficit. We are reacting to supply chain deficiencies when we should be acting instead. How do we revitalize industrial policy in this nation?” Rep. Stevens asked Scott Paul. He said the U.S. government needs to assess the problem and is doing just that.

“We have a lot of material. Biden has a 1,400-page supply chain review. Not only is this about (reshoring) car batteries and critical minerals, but we also need to look at imported medicines, too,” Scott told her. She agreed in principle, saying the country needs to “get critical manufacturers back.”

* * *

Rep. Andy Barr (R-KY): I want you to consider Western capital flows into companies that contribute to national security issues. Thoughts on those investments, please?

Pottinger: It is a huge amount of money. Roger Robinson has tracked this data. I think most Americans invested in China don’t know where their money is going. If they knew, they’d say “I’m out.” I think there has been poor stewardship from money managers as to where that money is being invested.

Rep. Andy Barr of Kentucky during the House Select Committee on the CCP’s first hearing. “Let’s not be like China,” he said, which is often seen as a warning against too much spending. The government will have to devise a new bag of tricks, however, to go after China. Many in the Committee say the U.S. is “playing from behind.”

Rep. Barr: What would be the right policy response? We have all these different lists — the 1260H list at Defense; the OFAC list at Treasury – what about simply telling American investors that these are red-light companies. If you can’t sell American technology to a company, you should not be able to invest in that company where there is perceived tech risk.

Pottinger: Yes, we need to coordinate (these lists) and at least study why Commerce has hundreds of companies on its export control list but Treasury has maybe 68 companies that Wall Street is banned from investing in due to Chinese defense contracts or being involved in human rights abuses. That should be hundreds of companies. Treasury has lots of explaining to do.

* * *

Rep. Blaine Luetkemeyer (R-MO): I think we have about 250 companies from China listed here but it used to be about a thousand and they left because they didn’t want to be audited. But we have BlackRock making a recommendation to investors that the best place to put their money in the next 20 years is in China. Meanwhile, we here are saying that we need to counter China as the largest asset manager in the world says that is where we are going to put your money.

Pottinger: Companies will follow guidelines if they are painted brightly and that is the work of this Committee: to make clear what the limits are to investing.

“We are working at the Hoover Institute on case studies that will illuminate how private equity and Silicon Valley venture capital firms have enabled the People’s Liberation Army in some circumstances with their investments,” said McMaster in response to a question by Rep. Luetkemeyer. “Our investors have enabled the Chinese to double down on state support for businesses like car batteries, wind turbines, solar panels, and those investments can drive Americans out of business. So many fund managers, maybe because of soft-headed cosmopolitanism, believe China is just like us when it comes to business strategy.”

Rep. Luetkemeyer: We are paying for all of this by our trade deficit with China, which the Chinese government can use that money to build its military, and put its people under constant surveillance… Is our trade deficit with them funding this; is that a fair statement?

Pottinger: I think it is.

Rep. Luetkemeyer: Americans understand that they need to look someplace else besides China.

* * *

In 1992, China’s GDP was less than 10% of U.S. GDP. In 2022, it was 62% of U.S. GDP. Over the last three decades, Silicon Valley, Wall Street, and businesses large and small have all turned China into a geopolitical threat by making it the indispensable nation to American industry and to the American consumer for which this economy is dependent.

Perhaps China-born and raised Tong Yi had the most relevant, and simplistic summation of the China-U.S. quagmire. For sure, the U.S. helped build a Frankenstein monster.

“U.S. policymakers should regret much of this,” she said. “Sacrificing American values for short-term profit will never benefit America’s overall well-being.”

* * *

Matthew Pottinger was one of four witnesses in the House Select Committee on the CCP’s first meeting.

“The exchange between Pottinger and Rep. Barr over malign investment activities and economic warfare was powerful and necessary – as well as a great boon to the work of CPA’s China Project and capital markets work with our partner, Roger Robinson, Jr. who himself got a hearing shoutout for his persistent and reliable financial data work to illuminate and quantify the economic statecraft of the CCP that exploits America’s voluminous capital markets,” said Robby Smith Saunders, vice president of national security at CPA. “Congress has an opportunity to pass laws that protect American investors from bankrolling the malign activities, threats, and atrocities of the CCP. It just has to have the political will to do so – even if it means changing some of the rules for Wall Street to play by, or finding clever ways to close gaps in U.S. policy such that we protect our free market while limiting free market-free riding by the CCP.”

The House Financial Services Committee is currently struggling to pass legislation that would apply greater punitive measures to Chinese Military Companies. The bill, drafted by Rep. Barr, has languished in its committee of jurisdiction under Republican leadership because they cannot agree on the contours of the sanctions regime against the CCP and fear negative impacts on Wall Street.

“My hope is that these hearings and the great work of the new Select Committee will provide the platform to discuss, vet, and perfect policy solutions to the China challenge from a cross-jurisdictional perspective and then send them to other Committees to rapidly proceed for votes on the House floor,” said Saunders.

The best outcome here is that the Select Committee does the hard work of sorting out the right solutions which help get these bills un-stuck in committee.

“I think people are tired of Congress pointing fingers, talking tough, and taking no action,” Saunders said.