It is time to include Vietnam, Malaysia and Thailand sourced solar panels as part of the original International Trade Commission’s anti-dumping/countervailing duties (AD/CVD) judgment against Chinese manufacturers back in 2015. Chinese producers found an end-around those high tariffs, putting American manufacturers at risk.

An unnamed group of American solar producers has come together to ask the ITC to extend the anti-dumping tariffs to those three countries because those locations were explicitly chosen by the Chinese companies to circumvent the U.S. anti-dumping tariffs. Circumvention is not allowed under U.S. anti-dumping laws.

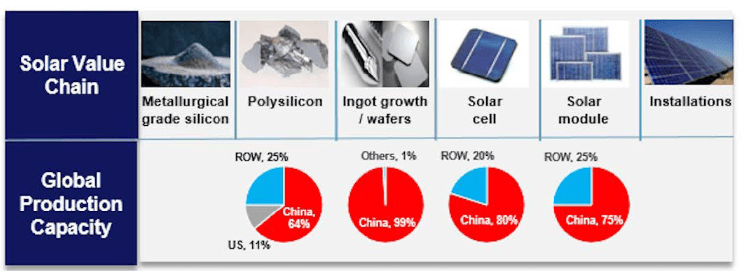

China dominates much of the global supply chain for solar, as the CPA has pointed out in research published on March 10.

ROW stands for “Rest of World”.

Multinationals like JA Solar and others have been setting up shop throughout the three aforementioned nations since 2015. While much of this move was to avoid US anti-dumping duties specific to China and Taiwan, they also capitalize on cheaper labor costs and lackluster environmental rules. Southeast Asia has been turned into alternatives to mainland China solar cells and solar panels – destined for the U.S.

Nearly all of the major Chinese global solar firms are manufacturing solar cells and/or solar panels in these countries. There still face the worldwide Section 201 tariffs on solar panels, imposed by the Trump administration. Those tariffs are currently 20%. But the much higher 2015 anti-dumping and countervailing duties imposed by the ITC is only for Chinese companies in China and Taiwan. Tariffs from the ITC decision range are company-specific and range from as low as 11.45% for Taiwanese firm Motech Industries to as high as 165% for JinkoSolar. This is likely the main reason why Jinko set up a factory in Florida in 2018.

For the Asian-based solar supply chain, Chinese-origin components such as ingots and wafers go through southeast Asian factories to be turned into solar cells and solar panels that are exported to the U.S. in order to avoid the hefty AD/CVD duties.

China: The GreenOPEC?

China’s dominance in the global supply chain for solar products has grown over the last 20 years. After spending much of that time listening to leaders from Europe and the U.S. bemoan the use of fossil fuels, China stepped in and invested heavily in the fossil fuel alternatives market.

Since the imposition of the ITC ruling on China dumping, their biggest producers began building solar cell and module assembly plants in neighboring countries in Southeast Asia. Solar cells are placed into modules, better known as solar panels.

Despite being made in Vietnam, Malaysia, and Thailand, they still rely heavily on Chinese labor and mainland supply chains. No way is China going to allow its strategic energy multinationals to shift the bulk of their labor overseas. China’s CCP wants its youth to work in manufacturing, not as delivery boys and nail stylists.

Chinese producers are circumventing the ITC’s ruling while maintaining much of the subsidized supply chain and labor as possible in China.

Chinese-owned Boviet Solar has admitted that it has “strategically headquartered its solar panel manufacturing operations in Vietnam” because “Vietnam is not a U.S. listed Anti-dumping and Countervailing region,” the company said on its website in 2017.

Undermining the ITC

Some have argued that climate change is so urgent, that importing Asian-made solar panels is more important than building up our own domestic supply and manufacturing base. Such an argument, if it were the winning one, would decimate a U.S. solar industry that has come back to life thanks almost exclusively to tariffs.

Solar manufacturing was a European and American industry. But in 2005, China mounted its assault, seeing a promising market within its top two export markets. Europe’s solar industry is now ruined. By 2012, lower-priced China solar products took what was left of the U.S. manufacturers in this space out of the running. Two companies filed a lawsuit in November 2011, arguing that their problems were mainly due to China selling below production costs.

A year later, the Commerce Department published its final decision on the matter and said Chinese-made solar panels were “being sold, or likely to be sold, at less than fair value.” Countervailable subsidies were then provided to U.S. producers and exporters of solar panels.

The ITC also said that the domestic industry was materially injured by China dumping and the Commerce Department, two months later, imposed AD/CVD orders on December 7, 2012.

In 2019, after the AD/CVD duties expired, both Commerce and the ITC extended them for another four years.

One of the 23 companies listed for duties in 2019 included Risen Energy, a Shenzhen listed company that as of April 2021 counted Vanguard mutual funds and a State Street exchange-traded fund, the SPDR Emerging Markets fund, as an investor. These funds are therefore putting U.S. investment capital into companies that are displacing American manufacturing and labor and were charged high port duties because of it.

Worth noting, Commerce said at the time that solar cells manufactured in China, solar panels manufactured in China with Chinese cells, and solar panels manufactured in third countries from Chinese solar cells were all subject to the ITC anti-dumping charges. This is a problem for China’s solar vassal states to the south.

If it Looks Like China, it is China

From 2011, the year the petitions were filed against China solar companies, up to 2020, the value of Chinese imports has decreased 86%, from $2.8 billion to $392 million. The sharp decline has continued into 2021, with less than $7.5 million of imports from China from January through May of this year.

With less being spent on China manufactured goods, more has gone to U.S. manufactured goods — a plus for high-skilled labor, and blue-collar workers, too.

But a lot of the business is going back to China, via operations in Vietnam, Malaysia, and Thailand.

In 2011, the U.S. imported a mere $336,806 of solar cells and modules from Thailand. Since then, imports from Thailand have increased to over $1.4 billion in 2020. This trend has continued into 2021, with more than $532 million of imports in just the first five months of the year. Thai import value share of solar cells and modules went from a .01% in 2010 to nearly 20% in the first five months of 2021.

In 2011, Vietnam solar cell and module imports were valued at $1.3 million, based on official export statistics of the U.S. government. In 2020, Vietnamese imports rose to $1.6 billion in 2020. This year, they are already at $681 million.

Vietnam was always bigger than the Thai solar market, but it only was around 1% of the value of total U.S. solar imports in 2010. So far this year, it’s 25%.

Then there is Malaysia. Thanks to big investments from China giants like JA Solar, U.S. imports of solar cells and modules from there have surged even with the 20% higher price tag. In 2011, the United States imported a mere $576 million of solar cells and modules from Malaysia but it hit $2.3 billion in 2020. So far this year, Malaysian-made solar products worth roughly $900 million have landed in the U.S. Malaysian import value share of solar cells and modules went from 5.5% of total U.S. imports in 2010 to nearly 34.8% in the first five months of 2021.

The Trump administration went after these players with tariffs on imported solar cells and panels under Section 201 of the 1974 Trade Act. Those tariffs are scheduled to expire if not renewed in 2022. They have not been enough to slow imports, or make the price of Asian-made solar less interesting. With the currencies of those countries worth pennies on the dollar, a 20% tariff on them is not enough. These countries will flood the U.S. with solar cells, and eventually, solar panels. That risks putting a lid on U.S. solar investment should that trend continue.

CPA highly doubts that Vietnam, Malaysia, and Thailand suddenly grew their own national solar industry on such short notice. This is China money. These are China companies. Imports from there are circumventing the ITC’s anti-dumping decision. They need to be considered just another offshoot of mainland China manufacturing and AD/CVD duties should be imposed. If not, Washington runs the real risk of watching the U.S. solar industry tap out at a time when leadership is pushing hard for alternatives to fossil fuels in the power grid. The worst possible situation for U.S. energy policy would be to ease up on domestically sourced oil, natural gas and coal, and give demand over to solar panels largely made in what the Director of National Intelligence considers the single biggest threat to U.S. national security – the People’s Republic of China.

China Solar Moves to SE Asia to Beat Anti-Dumping/Countervailing Duties

It is time to include Vietnam, Malaysia and Thailand sourced solar panels as part of the original International Trade Commission’s anti-dumping/countervailing duties (AD/CVD) judgment against Chinese manufacturers back in 2015. Chinese producers found an end-around those high tariffs, putting American manufacturers at risk.

An unnamed group of American solar producers has come together to ask the ITC to extend the anti-dumping tariffs to those three countries because those locations were explicitly chosen by the Chinese companies to circumvent the U.S. anti-dumping tariffs. Circumvention is not allowed under U.S. anti-dumping laws.

China dominates much of the global supply chain for solar, as the CPA has pointed out in research published on March 10.

ROW stands for “Rest of World”.

Multinationals like JA Solar and others have been setting up shop throughout the three aforementioned nations since 2015. While much of this move was to avoid US anti-dumping duties specific to China and Taiwan, they also capitalize on cheaper labor costs and lackluster environmental rules. Southeast Asia has been turned into alternatives to mainland China solar cells and solar panels – destined for the U.S.

Nearly all of the major Chinese global solar firms are manufacturing solar cells and/or solar panels in these countries. There still face the worldwide Section 201 tariffs on solar panels, imposed by the Trump administration. Those tariffs are currently 20%. But the much higher 2015 anti-dumping and countervailing duties imposed by the ITC is only for Chinese companies in China and Taiwan. Tariffs from the ITC decision range are company-specific and range from as low as 11.45% for Taiwanese firm Motech Industries to as high as 165% for JinkoSolar. This is likely the main reason why Jinko set up a factory in Florida in 2018.

For the Asian-based solar supply chain, Chinese-origin components such as ingots and wafers go through southeast Asian factories to be turned into solar cells and solar panels that are exported to the U.S. in order to avoid the hefty AD/CVD duties.

China: The GreenOPEC?

China’s dominance in the global supply chain for solar products has grown over the last 20 years. After spending much of that time listening to leaders from Europe and the U.S. bemoan the use of fossil fuels, China stepped in and invested heavily in the fossil fuel alternatives market.

Since the imposition of the ITC ruling on China dumping, their biggest producers began building solar cell and module assembly plants in neighboring countries in Southeast Asia. Solar cells are placed into modules, better known as solar panels.

Despite being made in Vietnam, Malaysia, and Thailand, they still rely heavily on Chinese labor and mainland supply chains. No way is China going to allow its strategic energy multinationals to shift the bulk of their labor overseas. China’s CCP wants its youth to work in manufacturing, not as delivery boys and nail stylists.

Chinese producers are circumventing the ITC’s ruling while maintaining much of the subsidized supply chain and labor as possible in China.

Chinese-owned Boviet Solar has admitted that it has “strategically headquartered its solar panel manufacturing operations in Vietnam” because “Vietnam is not a U.S. listed Anti-dumping and Countervailing region,” the company said on its website in 2017.

Undermining the ITC

Some have argued that climate change is so urgent, that importing Asian-made solar panels is more important than building up our own domestic supply and manufacturing base. Such an argument, if it were the winning one, would decimate a U.S. solar industry that has come back to life thanks almost exclusively to tariffs.

Solar manufacturing was a European and American industry. But in 2005, China mounted its assault, seeing a promising market within its top two export markets. Europe’s solar industry is now ruined. By 2012, lower-priced China solar products took what was left of the U.S. manufacturers in this space out of the running. Two companies filed a lawsuit in November 2011, arguing that their problems were mainly due to China selling below production costs.

A year later, the Commerce Department published its final decision on the matter and said Chinese-made solar panels were “being sold, or likely to be sold, at less than fair value.” Countervailable subsidies were then provided to U.S. producers and exporters of solar panels.

The ITC also said that the domestic industry was materially injured by China dumping and the Commerce Department, two months later, imposed AD/CVD orders on December 7, 2012.

In 2019, after the AD/CVD duties expired, both Commerce and the ITC extended them for another four years.

One of the 23 companies listed for duties in 2019 included Risen Energy, a Shenzhen listed company that as of April 2021 counted Vanguard mutual funds and a State Street exchange-traded fund, the SPDR Emerging Markets fund, as an investor. These funds are therefore putting U.S. investment capital into companies that are displacing American manufacturing and labor and were charged high port duties because of it.

Worth noting, Commerce said at the time that solar cells manufactured in China, solar panels manufactured in China with Chinese cells, and solar panels manufactured in third countries from Chinese solar cells were all subject to the ITC anti-dumping charges. This is a problem for China’s solar vassal states to the south.

If it Looks Like China, it is China

From 2011, the year the petitions were filed against China solar companies, up to 2020, the value of Chinese imports has decreased 86%, from $2.8 billion to $392 million. The sharp decline has continued into 2021, with less than $7.5 million of imports from China from January through May of this year.

With less being spent on China manufactured goods, more has gone to U.S. manufactured goods — a plus for high-skilled labor, and blue-collar workers, too.

But a lot of the business is going back to China, via operations in Vietnam, Malaysia, and Thailand.

In 2011, the U.S. imported a mere $336,806 of solar cells and modules from Thailand. Since then, imports from Thailand have increased to over $1.4 billion in 2020. This trend has continued into 2021, with more than $532 million of imports in just the first five months of the year. Thai import value share of solar cells and modules went from a .01% in 2010 to nearly 20% in the first five months of 2021.

In 2011, Vietnam solar cell and module imports were valued at $1.3 million, based on official export statistics of the U.S. government. In 2020, Vietnamese imports rose to $1.6 billion in 2020. This year, they are already at $681 million.

Vietnam was always bigger than the Thai solar market, but it only was around 1% of the value of total U.S. solar imports in 2010. So far this year, it’s 25%.

Then there is Malaysia. Thanks to big investments from China giants like JA Solar, U.S. imports of solar cells and modules from there have surged even with the 20% higher price tag. In 2011, the United States imported a mere $576 million of solar cells and modules from Malaysia but it hit $2.3 billion in 2020. So far this year, Malaysian-made solar products worth roughly $900 million have landed in the U.S. Malaysian import value share of solar cells and modules went from 5.5% of total U.S. imports in 2010 to nearly 34.8% in the first five months of 2021.

The Trump administration went after these players with tariffs on imported solar cells and panels under Section 201 of the 1974 Trade Act. Those tariffs are scheduled to expire if not renewed in 2022. They have not been enough to slow imports, or make the price of Asian-made solar less interesting. With the currencies of those countries worth pennies on the dollar, a 20% tariff on them is not enough. These countries will flood the U.S. with solar cells, and eventually, solar panels. That risks putting a lid on U.S. solar investment should that trend continue.

CPA highly doubts that Vietnam, Malaysia, and Thailand suddenly grew their own national solar industry on such short notice. This is China money. These are China companies. Imports from there are circumventing the ITC’s anti-dumping decision. They need to be considered just another offshoot of mainland China manufacturing and AD/CVD duties should be imposed. If not, Washington runs the real risk of watching the U.S. solar industry tap out at a time when leadership is pushing hard for alternatives to fossil fuels in the power grid. The worst possible situation for U.S. energy policy would be to ease up on domestically sourced oil, natural gas and coal, and give demand over to solar panels largely made in what the Director of National Intelligence considers the single biggest threat to U.S. national security – the People’s Republic of China.

MADE IN AMERICA.

CPA is the leading national, bipartisan organization exclusively representing domestic producers and workers across many industries and sectors of the U.S. economy.

TRENDING

CPA Sends Letter To Senate Leaders Schumer and McConnell Opposing Advancement of Recent USITC Nominations

CPA: Liberty Steel Closures Highlight Urgent Need to Address Mexico’s Violations and Steel Import Surge

CPA Applauds Chairman Jason Smith’s Reappointment to Lead House Ways and Means Committee

Senator Blackburn and Ossoff’s De Minimis Bill is Seriously Flawed

JQI Dips Due to Declining Wages in Several Sectors as November Jobs Total Bounces Back from Low October Level

The latest CPA news and updates, delivered every Friday.

WATCH: WE ARE CPA

Get the latest in CPA news, industry analysis, opinion, and updates from Team CPA.

CHECK OUT THE NEWSROOM ➔