The U.S. ended 2022 with its largest ever goods deficit, reaching $1.19 trillion, which is more than the $1.09 trillion goods deficit in 2021 at the height of the pandemic, the Bureau of Economic Analysis said Tuesday.

Talk of supply chain disruptions, tariffs supposedly hurting the demand side, plus rising inflation and rumors of recession were no match for U.S. import demand. Last year marked the second time the goods trade breached a trillion-dollar gap. There is no end in sight to this trend.

To put that number in perspective, the difference between what the U.S. exports to the world and what it imports from the world is equal to the entire output of Spain’s economy, which has a GDP of around $1.2 trillion.

“The huge deficit in goods last year represents over a trillion dollars in lost demand for U.S. goods, which would have created millions of jobs in this country if those dollars were spent on U.S. goods,” said CPA chief economist Jeff Ferry. “The U.S. needs a full arsenal of measures and tools to rebuild our manufacturing sector and the good-paying jobs that come with it.”

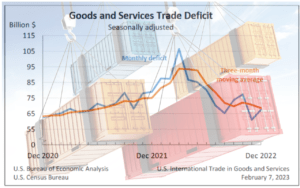

The combined goods and services deficit for the month of December rose 10.5% to $67.4 billion.

The combined goods and services deficit for the month of December rose 10.5% to $67.4 billion.

December imports were $317.6 billion, $4.2 billion more than November imports, owing much to the holiday season and restocking for the first quarter 2023. Exports for the month were $250.2 billion, $2.2 billion less than November exports.

All told, the 2022 goods and services deficit increased $103.0 billion, or 12.2% to reach a record $948.06 billion. The services surplus, led by Wall Street and intellectual property fees, is the only reason why the full trade deficit is not over $1 trillion yet. It will get there next year, however. Services won’t change that trend.

Moreover, growing U.S. petroleum exports are almost entirely offset by growing petroleum imports. This means that oil exports have not really made much of a dent in the overall trade equation. The non-petroleum deficit is $1.195 trillion, virtually the same as the total goods deficit.

***See CPA’s monthly trade database to compare with previous months and years.***

2022’s Biggest Deficits

Deficits were recorded, in billions of dollars, with China ($382.9), the European Union

($203.9), Mexico ($130.6), Vietnam broke another record ($116.1), Canada ($81.6), Germany ($73.7) and Japan ($68.0), pharma and IP offshore tax haven Ireland

($66.1), semiconductor maker Taiwan ($48.1), South Korea ($43.9), Thailand ($43.1), Italy ($41.7), India ($38.3), solar panel maker Malaysia ($36.6), Indonesia ($24.6), Switzerland ($22.6), Austria ($13.1), and even Russia ($12.7).

Some notable deficit increases:

- The deficit with China increased $29.4 billion to $382.9 billion in 2022. Exports increased $2.4 billion to $153.8 billion and imports increased $31.8 billion to $536.8 billion. This is the second-highest trade deficit ever recorded with China. The record was set at 2018, the year the Section 301 tariffs were set. That year, the trade deficit with China was $418.2 billion. This year marked the second biggest deficit. At this rate, without substantial shifts of behavior from American companies, the trade deficit record will be breached within the next two to three years despite all of Washington’s talk about changing the U.S.-China trade relationship.

- The deficit with Canada increased $31.6 billion to a record-smashing $81.6 billion in 2022. Exports increased $48.4 billion to $356.1 billion and imports increased $79.9 billion to $437.7 billion. The previous record was $78.4 billion set in 2004.

- The deficit with Mexico broke a record and hit $130.5 billion, up from $108.1 billion in 2021. The previous record was set in 2020 at $112 billion. In ten years’ time, our deficit with Mexico has more than doubled.

- The deficit with Vietnam keeps rising. The country has become an outpost for Chinese and other multinationals looking to escape anti-dumping duties and the Section 301 and Section 201 tariffs. The 2022 deficit of $116.1 billion beats the 2021 record of $90.8 billion. In 2017, before the Section 301 tariffs began, the deficit with Vietnam was $38.3 billion. The number looks glaring simply because Vietnam buys almost nothing from the U.S.

2022’s Top Traded Goods

Last year was no different than any other year in terms of the top five goods exported and imported. They remain relatively stable month after month and year after year.

One standout here is industrial machinery and semiconductors. The U.S. is much more of an exporter of those items than an importer. Whereas other important manufacturing sectors, such as automotive and pharma, the U.S. is increasingly outsourcing those jobs to Mexico, Europe, and Asia.

Despite cell phones being a near-peer in import value to auto parts, the U.S. has no cell phone manufacturers.

Top U.S. Exports

|

Dec 2022 |

Nov 2022 |

All 2022 |

All 2021 |

| Pharmaceuticals |

$7.99 b |

$8.21 b |

$90.23 b |

$80.20 b |

| Industrial machinery |

$5.76 b |

$6.34 b |

$73.91 b |

$68.44 b |

| Passenger cars |

$5.41 b |

$4.62 b |

$56.50 b |

$53.92 b |

| Semiconductors |

$5.20 b |

$5.58 b |

$66.45 b |

$66.31 b |

| Auto parts |

$4.73 b |

$4.60 b |

$54.38 b |

$47.35 b |

Top U.S. Imports

|

Dec 2022 |

Nov 2022 |

All 2022 |

All 2021 |

| Pharmaceuticals |

$16.30 b |

$16.23 b |

$190.07 b |

$171.22 b |

| Passenger cars |

$14.90 b |

$13.27 b |

$162.40 b |

$143.36 b |

| Auto parts |

$11.44 b |

$10.78 b |

$134.59 b |

$116.32 b |

| Cell phones |

$10.43 b |

$6.92 b |

$132.21 b |

$121.16 b |

| Electronic apparatus |

$8.03 b |

$7.84 b |

$88.86 b |

$69.13 b |

“The pace of import growth slowed at the end of last year, with December imports up only 2% on previous December imports,” said Ferry. “Consumers have rotated into services spending and away from goods spending for the time being. But the structural forces that support imports and undermine U.S. production, things like an overvalued dollar and large subsidies paid to Chinese industry remain and will continue to undermine the U.S. economy until decisive action is taken.”

U.S. Beats Trade Deficit Record, Ends 2022 With $1.19 Trillion Goods Gap

The U.S. ended 2022 with its largest ever goods deficit, reaching $1.19 trillion, which is more than the $1.09 trillion goods deficit in 2021 at the height of the pandemic, the Bureau of Economic Analysis said Tuesday.

Talk of supply chain disruptions, tariffs supposedly hurting the demand side, plus rising inflation and rumors of recession were no match for U.S. import demand. Last year marked the second time the goods trade breached a trillion-dollar gap. There is no end in sight to this trend.

To put that number in perspective, the difference between what the U.S. exports to the world and what it imports from the world is equal to the entire output of Spain’s economy, which has a GDP of around $1.2 trillion.

“The huge deficit in goods last year represents over a trillion dollars in lost demand for U.S. goods, which would have created millions of jobs in this country if those dollars were spent on U.S. goods,” said CPA chief economist Jeff Ferry. “The U.S. needs a full arsenal of measures and tools to rebuild our manufacturing sector and the good-paying jobs that come with it.”

December imports were $317.6 billion, $4.2 billion more than November imports, owing much to the holiday season and restocking for the first quarter 2023. Exports for the month were $250.2 billion, $2.2 billion less than November exports.

Moreover, growing U.S. petroleum exports are almost entirely offset by growing petroleum imports. This means that oil exports have not really made much of a dent in the overall trade equation. The non-petroleum deficit is $1.195 trillion, virtually the same as the total goods deficit.

***See CPA’s monthly trade database to compare with previous months and years.***

2022’s Biggest Deficits

Deficits were recorded, in billions of dollars, with China ($382.9), the European Union

($203.9), Mexico ($130.6), Vietnam broke another record ($116.1), Canada ($81.6), Germany ($73.7) and Japan ($68.0), pharma and IP offshore tax haven Ireland

($66.1), semiconductor maker Taiwan ($48.1), South Korea ($43.9), Thailand ($43.1), Italy ($41.7), India ($38.3), solar panel maker Malaysia ($36.6), Indonesia ($24.6), Switzerland ($22.6), Austria ($13.1), and even Russia ($12.7).

Some notable deficit increases:

2022’s Top Traded Goods

Last year was no different than any other year in terms of the top five goods exported and imported. They remain relatively stable month after month and year after year.

One standout here is industrial machinery and semiconductors. The U.S. is much more of an exporter of those items than an importer. Whereas other important manufacturing sectors, such as automotive and pharma, the U.S. is increasingly outsourcing those jobs to Mexico, Europe, and Asia.

Despite cell phones being a near-peer in import value to auto parts, the U.S. has no cell phone manufacturers.

Top U.S. Exports

Top U.S. Imports

“The pace of import growth slowed at the end of last year, with December imports up only 2% on previous December imports,” said Ferry. “Consumers have rotated into services spending and away from goods spending for the time being. But the structural forces that support imports and undermine U.S. production, things like an overvalued dollar and large subsidies paid to Chinese industry remain and will continue to undermine the U.S. economy until decisive action is taken.”

MADE IN AMERICA.

CPA is the leading national, bipartisan organization exclusively representing domestic producers and workers across many industries and sectors of the U.S. economy.

TRENDING

CPA Sends Letter To Senate Leaders Schumer and McConnell Opposing Advancement of Recent USITC Nominations

CPA: Liberty Steel Closures Highlight Urgent Need to Address Mexico’s Violations and Steel Import Surge

CPA Applauds Chairman Jason Smith’s Reappointment to Lead House Ways and Means Committee

Senator Blackburn and Ossoff’s De Minimis Bill is Seriously Flawed

JQI Dips Due to Declining Wages in Several Sectors as November Jobs Total Bounces Back from Low October Level

The latest CPA news and updates, delivered every Friday.

WATCH: WE ARE CPA

Get the latest in CPA news, industry analysis, opinion, and updates from Team CPA.

CHECK OUT THE NEWSROOM ➔