KEY POINTS

- Solar panel imports from Southeast Asia continue to surge in the first half of 2024.

- U.S. Department of Commerce has initiated antidumping investigations into Southeast Asian producers dumping solar products into the U.S. market.

- Imports from Vietnam rapidly rise even after the antidumping investigation is initiated, prompting additional concerns of duty avoidance.

- Total 2024 solar imports outpacing total U.S. domestic solar demand.

- Chinese-owned and heavily subsidized solar manufacturers driving SE Asian import surge to avoid U.S. tariffs.

Surging Solar Imports Prompts Critical Circumstances Filing

Over the past few months, solar imports from Vietnam have been surging. As shown in Figure 1, imports from Vietnam have doubled since January 2024, reaching an all-time monthly high of 2.55 GW in June 2024.

FIGURE 1:

These surging imports have prompted the American Alliance for Solar Manufacturing Trade Committee to file critical circumstances allegations against Vietnam, as well as Thailand, in August 2024. These allegations accuse Vietnam and Thailand of rapidly increasing solar imports amid an active antidumping investigation, to avoid the antidumping duties before they are enacted.

In May this year, the U.S. Department of Commerce initiated the antidumping and countervailing duty investigations into solar cells and panels from Vietnam, Thailand, Malaysia, and Cambodia. Commerce found sufficient evidence that solar manufacturers in these countries are engaging in high levels of solar product dumping into the U.S. at below-market rates.

According to Department of Energy data, solar panels are now priced in the U.S. at between 30 and 35 cents per watt. U.S. producers tell us they cannot make money and may not be able to stay in business at these prices brought down by dumping.

As shown in Figure 2, solar manufacturers in these countries may be dumping solar products into the U.S. market at 70-270% below market value, based on the allegations from the American Alliance for Solar Manufacturing Trade Committee which initiated Commerce’s solar anti-dumping investigation. Vietnam appears to be one of the worst offenders with alleged dumping rates at around 270%, and Vietnam has also seen the largest increase in total imports into the U.S.

Figure 2: Commerce Antidumping Investigation into SE Asian Solar Manufacturers (Alleged Dumping Rates)

Country | Dumping Margin |

Vietnam | 271.28% |

Cambodia | 125.37% |

Malaysia | 81.22% |

Thailand | 70.36% |

Benefits of U.S. Solar Boom Largely Going to Foreign Firms

U.S. government policies such as the 2022 Inflation Reduction Act (IRA), which provided substantial tax credits for solar energy, have greatly increased demand and deployment of solar panels in the United States. According to the U.S. Energy Information Administration, Jan-May 2024 electricity generation from solar is up 40% compared to 2022 levels during the same time period.

However, much of the benefits of this solar growth have gone to foreign solar producers. As shown in Figure 3, imports of solar cells have seen substantial growth since the IRA was passed in 2022. Solar panel imports jumped 85% in 2023. Imports in 2024 are increasing yet again, up 21% in the first half of 2024. Imports are measured in gigawatts (GW) of power capacity.

According to Wood Mackenzie market analysis, the U.S. is now installing about 47 GW a year in 2024. The official U.S. import data below shows that the U.S. is likely to import 52 GW this year, more than the total U.S. demand for solar. This trend indicates that domestic U.S. solar manufacturers are in serious danger of getting crowded out of the market amid large and surging imports.

FIGURE 3:

The key countries behind the solar import surge are Southeast Asian countries. Vietnam is the largest total exporter, holding 42% of total U.S. solar panel imports so far in 2024. The next highest exporters of solar panels are Thailand (at 27% of imports), Malaysia (at 9%), and Cambodia (at 9%).

These top countries by total volume are also the fastest growing for imports. As shown in Figure 4, Vietnam and Thailand have seen the largest increases, with annual solar imports rising by over 13 GW and 9 GW since 2022 respectively. India saw the largest percent increase in imports (up over 1,000 %), but India’s total volume is still relatively small compared to Southeast Asia producers.

FIGURE 4:

Within this solar import surge, the below-market prices and potential subsidy support (as alleged by the countervailing duty investigation) do not come entirely from within Southeast Asia. Chinese solar manufacturers are increasingly using Southeast Asia as a hub for solar manufacturing to avoid current and future U.S. duties on Chinese imports.

China Fueling Southeast Asia Surge

The surge of solar panel imports from Southeast Asia is directly fueled by production and investment by Chinese companies. Many Chinese solar companies have invested in major manufacturing locations across Southeast Asia in recent years. There is evidence that the solar panels assembled in Southeast Asia are using solar cells and possibly other parts imported from China.

China’s Longi Green Energy Technology has already launched solar manufacturing locations in Vietnam and launched a new solar module plant in Malaysia in late 2023. Similarly, China’s Trina Solar has invested heavily in solar manufacturing in Thailand, and more recently in Vietnam. These Chinese solar companies have invested heavily in Southeast Asia to avoid duties owed on U.S. imports, and consequently directly target the U.S. market.

Chinese solar manufacturers have moved production to Southeast Asian countries to avoid the Section 301 tariffs as well as various antidumping duties on Chinese-made products. The Biden Administration plans to increase Section 301 tariffs on Chinese solar cells and modules from 25% to 50%, providing further incentive for Chinese companies to set up Southeast Asian operations.

This use of Southeast Asia to circumvent duties is not new, however. The U.S. Department of Commerce previously determined that China has already been using these Southeast Asian countries to circumvent antidumping and countervailing duties owed on Chinese-produced solar cells and modules. Direct production and investment in third-party countries are yet another tool for China to maintain dominance over the solar market and hold back the domestic U.S. industry.

Chinese Solar Manufacturing Subsidies Tower over the Rest of the World

China’s dominance in the solar industry and ability to keep prices so low are bolstered by substantial government subsidies. These subsidies have allowed Chinese companies to produce solar cells at lower costs than any other country, undermining global competition. Chinese solar manufacturers are able to keep prices extremely low and capture the global solar market despite poor financial performance because of massive Chinese government subsidies and investments.

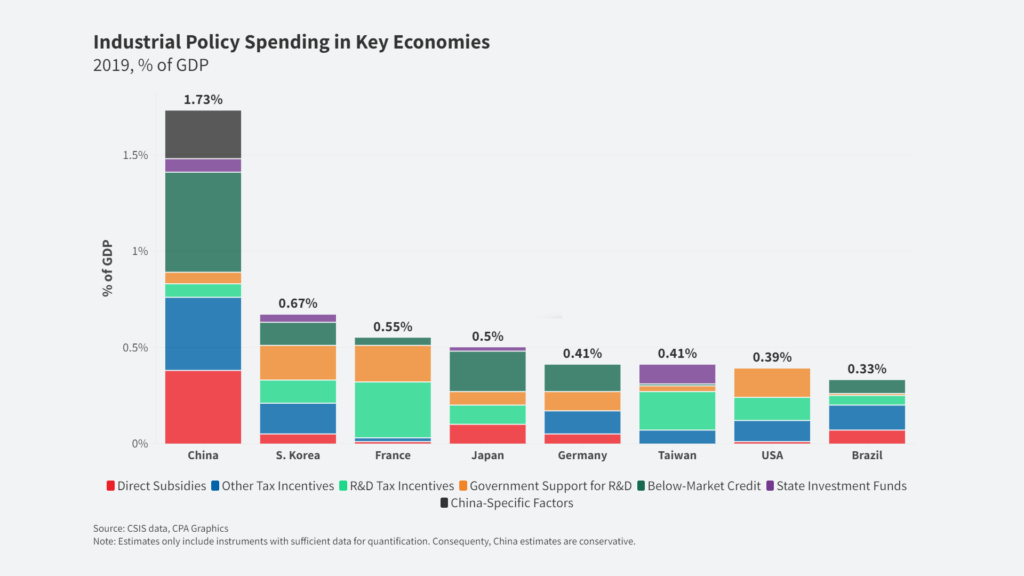

China generally has extremely high state subsidies for industry, far above the support levels in all other major industrialized economies. According to a study by the Center for Strategic and International Studies, the Chinese government subsidies, tax incentives, and other direct support for industry far exceeds that of any other country. As shown in Figure 5, this Chinese state support for industry amounted to 1.73% of GDP in 2019 (about 4.4 times the level of support the United States gives to its industry and more than double the support any other major country gives to its industry).

FIGURE 5:

For renewable energy (and especially solar) manufacturing, Chinese state subsidies for manufacturing are even more extreme. The International Energy Agency’s (IEA) World Energy Investment 2024 Report found that of the $735 billion in total global renewable spending, $220 billion was from Chinese solar PV spending alone (about half the total global solar investment for 2023). Furthermore, because of falling solar module prices (fueled by Chinese overproduction), the report found that this increasing Chinese solar investment will result in Chinese capacity increasing by a factor of 2.5 in 2024.

In total, China’s current share in all manufacturing of solar modules (including polysilicon, ingots, wafers, cells, and panels) is over 80%, more than double China’s share of global solar demand.

Conclusion

As the demand for solar energy deployment in the United States continues to grow, foreign firms are reaping nearly all the benefits. Solar imports in 2024 are outpacing total demand and crowding out domestic solar manufacturers. Low prices brought down by alleged dumping and state subsidies are keeping the United States from developing proper solar sufficiency and energy independence. Massive Chinese subsidies for its solar industry and the increasing use of Southeast Asia countries to avoid U.S. tariffs further undermine the U.S. industry’s position in the market. Further steps are needed to promote a robust U.S. solar industry, increase U.S. energy independence, and further the U.S.’s position in key industries of the future.

[1] DiPippo, Gerard, Ilaria Mazzocco, and Scott Kennedy. “Red Ink: Estimating Chinese Industrial Policy Spending in Comparative Perspective.” Center for Strategic and International Studies. CSIS, May 2022. https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/220523_DiPippo_Red_Ink.pdf?VersionId=LH8ILLKWz4o.bjrwNS7csuX_C04FyEre.