Democrats and Republicans on the House Ways & Means Committee clashed over the Inflation Reduction Act (IRA) in a hearing on Wednesday, with one of the key tenets of the dispute being whether IRA benefits should go to Chinese companies.

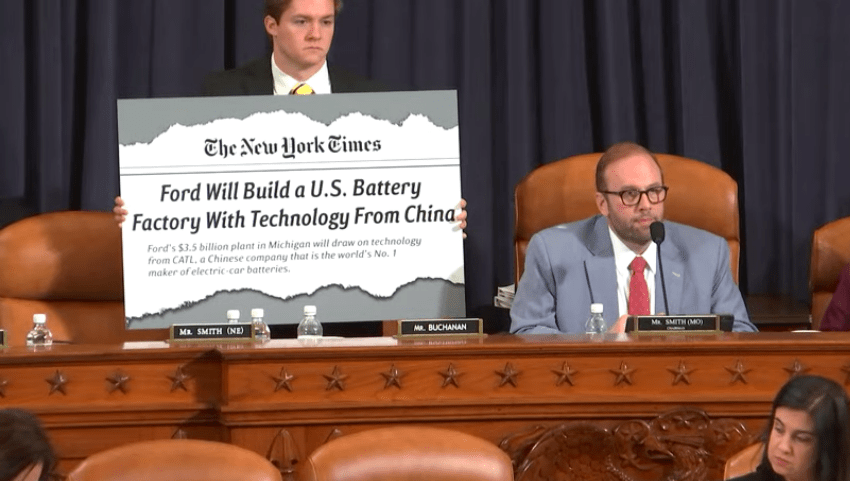

The IRA offers a plethora of tax credits for domestic manufacturing, most notably the Section 45X Advanced Manufacturing Production Tax Credit. This credit is available to any business undertaking domestic manufacturing, and that includes Chinese enterprises. This is now being looked at more closely. Rep. Jason Smith (R-MO) put out a press release on this issue on April 17. He is Chairman of House Ways & Means.

The massive Section 45X tax credit does not have the same limitation as the Section 30D consumer tax credit for electric vehicles, which beginning in 2024 will exclude from eligibility vehicles with battery components that are manufactured by a foreign entity of concern. (Treasury, however, neutered the Section 30D restriction by deciding that all consumer vehicle leases could escape the restriction.)

The massive Section 45X tax credit does not have the same limitation as the Section 30D consumer tax credit for electric vehicles, which beginning in 2024 will exclude from eligibility vehicles with battery components that are manufactured by a foreign entity of concern. (Treasury, however, neutered the Section 30D restriction by deciding that all consumer vehicle leases could escape the restriction.)

There is also the issue of the Section 48 Investment Tax Credit, which gives homeowners, businesses, and utility companies credits for purchasing and installing renewable energy-generating equipment. Under the IRA, all renewable energy-generating equipment is eligible for credit, but there is an additional bonus for installing domestically produced equipment.

“President Biden may succeed in strengthening manufacturing…but more so in China,” argued Chairman Smith on Wednesday. “Solar cells manufactured in China and assembled into panels in the U.S. will qualify for special tax breaks even if the company was implicated in human rights abuses. Some of those companies will be investing in OH to take advantage of those tax credits. To develop EV batteries for EV cars, American companies are partnering with China state-controlled companies to make batteries.”

Republicans were largely against the IRA credits helping China, while Democrats were quiet on that particular issue, only noting that the investment capital was being deployed in the U.S., with U.S. labor. This is the case with the Ford-CATL deal, for example. But large utility projects qualifying for the so-called Section 48 ITC tax credit can still benefit even if they buy solar products made overseas. Thanks to the IRA, however, the credit is bigger if the equipment was made domestically.

At least one witness said that allowing China access to IRA benefits was a “Trojan horse”.

“The CCP engages in commercial practices that make them dangerous to partner with, certainly for the U.S.,” said Drew Horn, CEO of GreenMet, a consulting group working to reshore rare earth minerals production. Horn, a former Green Beret and Army Special Operations officer, was one of four witnesses at Wednesday’s hearing about the IRA and China.

“When you look at what the CCP is doing, they serve as a threat to our interests relatively everywhere. You don’t want to invite a Trojan Horse to come in against us,” Horn told the House Ways & Means Committee. “The CCP is an expert at this. If we allow loopholes, we enable them to dominate U.S. industries.” He said that there were a few domestic companies in the rare earths space that are trying to come online, but China is dominant in that industry and can flood the market to lower prices, making it harder for these companies to attract financing.

Rep. Darin LaHood (R-IL) said that his main concern with the IRA was a lack of safeguards to make it easy for foreign adversaries to enjoy U.S. tax breaks and industrial policy. He did not name China in particular. So far, at least two China solar projects have been announced – the Longii project in Ohio mentioned by Chairman Smith, and the JA Solar project in Arizona, announced earlier this year.

Rep. Claudia Tenney (R-NY) called the IRA a partisan bill.

Rep. Claudia Tenney (R-NY) called the IRA a partisan bill.

“Real industrial policy would be bipartisan, but this is partisan. That is why we are trying to fix it today. We would have to make sure our adversaries do not benefit,” she said. “China companies will reap significant rewards from the IRA, including companies controlled by the China state that will get tax breaks. This will come at the expense of workers here in America. I think we would all support an industrial policy that puts American industry and American workers first. I am in an area of the country that was the beginning of everything manufacturing and it has left; it’s gone to Asia. And these people are on the bad end of bad policies. Once again, they are helping Chinese companies with their tax dollars. Will the IRA further cement China’s power in this green tech space,” she asked the witnesses.

Daniel Turner Executive Director of Power the Future said yes.

“This will increase our dependency on China’s companies for a lot of that supply,” said Kenny Stein, Policy Director for the Institute for Energy Research, a donor-funded research institution looking at energy policy based in Washington.

“Allowing China to own parts of the U.S. EV supply chain, especially crucial parts like battery production, merely helps China extend its global dominance of the industry,” said Jeff Ferry, chief economist for CPA. “To do the job properly, the IRA should have insisted on U.S.-owned battery R&D and manufacturing, with the aim of getting new companies into the business, in addition to the majors like Ford. It’s relatively easy for Congress to throw money at mining of critical minerals or at final assembly of complete vehicles, but the tricky parts of the supply chain, the parts that make us dependent on China, are those parts where we have few companies and little presence,” he said, adding that there are sectors of this new so-called green energy economy where the U.S. is “missing in action”, such as minerals processing.

Much of the hearing was a tit-for-tat partisan display of either fanfare or total disdain for the Inflation Reduction Act, with little in between. Three of the four panelists were highly critical of the policy. But the biggest takeaway from them was the combined belief that more polluting sectors of the economy would be moved to Asia and simply imported to the U.S. This included the production of solar cells and even solar panels being sold to utility companies and others building solar plants in the U.S. for investment tax credits. China, and Southeast Asia, is mostly powered by coal. And of course China’s solar supply chain has been accused of using forced labor. Polysilicon from Xinjiang is banned in the U.S. as a result. Polysilicon is a core ingredient in making solar cells.

Rep. Kevin Hern (R-OK) called the IRA an ‘oversubsidization’ of a market that cannot stand independently. “To think the Chinese Communist Party would not benefit from this is naïve and foolish,” he said.

China has used much of the last 20 years listening to Washington and Brussels bemoan climate change to invest in solar, wind, and battery-powered cars. Chinese corporates are leaders in solar now, gaining on Europe’s leadership in wind turbine production, and gaining on Japan and South Korea in the production of long-life batteries for cars. Chinese automaker Geely makes a Tesla look-a-like sedan known as the Polestar. This car will undoubtedly underprice Tesla throughout Latin America.

Rep. Greg Murphy (R-NC) ran through a list of why China is not really the clean and green manufacturer of the world.

Rep. Greg Murphy (R-NC) ran through a list of why China is not really the clean and green manufacturer of the world.

“We all want a clean environment. We are all against forced labor. We want to cut Co2 emissions. We can all agree on that. Let’s think of the clean environment for a second: we can’t manufacture something here because it’s too dirty, so instead we can do it in poorer countries where it is much dirtier. Slave labor: so you can have more EVs, we are sourcing cobalt from child labor in the Congo. To make EV batteries, wind, and solar, you have China building coal power plants to power their factories to build the West’s clean tech. But we are cleaner here as they get dirtier there. It doesn’t make sense,” he said, adding that the IRA was “funding companies run by the CCP.”

Ben Beachy, vice president of manufacturing and industrial policy for BlueGreen Alliance, was asked by Murphy what the Sierra Club – a well-known environmental activist organization –would think about China’s build-out of coal.

“They would definitely not be happy with China’s building of coal plants,” he said. Beachy was the only one aligned with Democrats that touted the growth of investment in solar and other EV-related projects because of the IRA. The IRA has also benefited numerous American solar projects, including by American-owned companies.

“Honestly, China is not worried about climate change,” Murphy said. “We are giving our competitive advantage away to China.”

Horn from GreenMet summed up the problem some have with the IRA and China.

“The problem we have with the IRA is that it plays to the CCP’s ability to use our policies against us,” Horn said. “They can use these loopholes to take over our industries.”

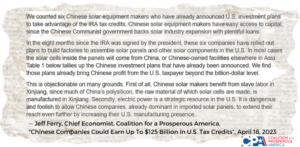

Chinese Manufacturers Could Earn Up To $125 Billion in U.S. Renewable Energy Tax Credits