Japan is the third largest economy in the world. But one Japanese yen is worth $0.007 cents. That’s less than a penny. Its currency has been losing value against the dollar since its five-year peak of $0.009 on March 8, 2020.

The European Union is one of the most powerful economies in the world. But one euro used to get you $1.24 back in September 2017. The euro, once sold to all as an alternative to the dollar, is now at its weakest level in five years.

Global companies repatriating profits are bringing home fewer dollars, as some recent earnings have shown. This, coupled with a weaker global economy and a pending recession, means less money to invest and is likely to lead to more layoffs in the months ahead.

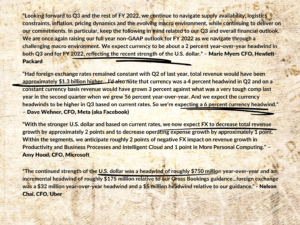

Here is what some senior executives said about the dollar in recent earnings reports:

See footnotes for links to earnings.

Other companies also faced dollar-based losses. Norwegian Cruise Lines lost over $12 million in forex adjustments. And while this seems tiny, it is four times that of the same period lost last year.

Amazon said there was a $3.6 billion “unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter”. They told investors that the dollar is causing them to lower third-quarter guidance.

Gilead Sciences said the dollar impacted first half total product sales by approximately $185 million compared to the same period last year.

The stronger dollar is the talk of the town these days:

On July 28, WSJ op-ed columnist Joseph C. Sternberg said the dollar is becoming a problem for the U.S.

“How, then, is a business or an individual to get ahead? This is the key question for any political economy, and the West’s capitalist answer should be “through patient hard work, investment and entrepreneurship.” Instead, as the currency crisis illustrates, the answer increasingly is “through a lucky choice of location and a deft deployment of complex financial derivatives.” This is no way to run a market economy, or to maintain political support for one. The flexible-exchange regime central banks now are pushing to the limit was billed as a way to facilitate the efficient functioning of the global market economy. It’s instead becoming another threat to that economy, practically and philosophically.” – The Dollar Emergency Is Worse Than You Think, Joseph C. Sternberg, WSJ, July 28, 2022.

A better-managed dollar can be one solution to this. Heavy dollar inflows from foreign countries keep the dollar strong thanks to higher demand for U.S. securities. This is also a nice way for the big sovereign wealth funds of other nations, and multi-billion dollar asset managers, to keep the dollar strong by investing heavily in U.S. stocks and bonds. This keeps imports priced attractively and makes American exports expensive.

Moreover, higher U.S. interest rates mean higher bond yields and so rich countries with lots of money to send around the globe – like Japan and countries in the EU – will borrow in their lower-cost, lower-yielding currencies, and put that money into U.S. Treasury bonds. All of this makes the dollar stronger.

A Market Access Charge (MAC) on foreign investment into U.S. securities, part of the Competitive Dollar for Jobs and Prosperity Act that was introduced in the Senate in the previous session, would assure that the world’s international currency markets would keep the dollar close to an exchange rate that would allow Americans to earn as much producing exports as they spend on imports.

“Paired with other trade and domestic industrial policies such as tariffs and sectoral development initiatives, the MAC would encourage the domestic production of goods needed to attain America’s key national goals,” said John R. Hansen, a former economic advisor to the World Bank, in an article posted on the CPA website on Aug. 2. “The MAC would help our country achieve the American Dream – the dream of steady, sustainable economic growth with benefits shared widely by all.”

Companies have lost revenues due to an overvalued dollar before. None of this is new. These global firms often operate like financial firms themselves, hedging their foreign currency in-house or through banks they work with. Sometimes they win on the currency. Sometimes they lose. They are used to this, even if they complain about it when the currency works against them.

Of note, one of the 20 companies whose earnings CPA reviewed included an IT outsourcer called TaskUs. They provide a good example of why an overvalued dollar is often liked by publicly traded firms.

Belaji Sekar, TaskUs CFO said in their earnings report that the ongoing transition of IT work from onshore to offshore was impacted somewhat by wage inflation across geographies, but “the majority of this impact was offset by the currency benefit of the strong U.S. dollar.”

A strong U.S. dollar makes offshoring more financially rewarding. It is sometimes a headwind to global corporations. It is almost always a headwind to the U.S. manufacturing base that must compete with lower financial costs elsewhere, in addition to a host of other issues – from taxation to environmental regulations and labor.

“The costs of a bloated dollar are very high,” said Hansen.

And not just for the U.S. It also has an impact on emerging market countries that have corporate and sovereign debt in dollars.

The WSJ noted this on July 29.

The U.S. dollar’s continued strength will hurt countries whose currency is depreciating. The Hungarian forint, Philippine peso, and Polish zloty have hit new lows against the dollar, making financing foreign debts more difficult.

Their weaker currencies are an example of how an over-bloated dollar doesn’t just cause a few multinationals to lose revenue, but pressures central banks in poorer countries to raise interest rates often to attract capital, even if that means risking a recession, the WSJ article said.

“The volatility and unpredictability of the dollar is also a problem as well as the high and rising level of the dollar,” said Jeff Ferry, CPA’s chief economist. “As for emerging market countries, if they borrowed in dollars, then a rising dollar could plunge them into a financial crisis.”

Mighty Dollar – Mighty Wrong

Global Corporate Earnings Putting Overvalued Dollar in Spotlight

Japan is the third largest economy in the world. But one Japanese yen is worth $0.007 cents. That’s less than a penny. Its currency has been losing value against the dollar since its five-year peak of $0.009 on March 8, 2020.

The European Union is one of the most powerful economies in the world. But one euro used to get you $1.24 back in September 2017. The euro, once sold to all as an alternative to the dollar, is now at its weakest level in five years.

Global companies repatriating profits are bringing home fewer dollars, as some recent earnings have shown. This, coupled with a weaker global economy and a pending recession, means less money to invest and is likely to lead to more layoffs in the months ahead.

Here is what some senior executives said about the dollar in recent earnings reports:

See footnotes for links to earnings.

Other companies also faced dollar-based losses. Norwegian Cruise Lines lost over $12 million in forex adjustments. And while this seems tiny, it is four times that of the same period lost last year.

Amazon said there was a $3.6 billion “unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter”. They told investors that the dollar is causing them to lower third-quarter guidance.

Gilead Sciences said the dollar impacted first half total product sales by approximately $185 million compared to the same period last year.

The stronger dollar is the talk of the town these days:

On July 28, WSJ op-ed columnist Joseph C. Sternberg said the dollar is becoming a problem for the U.S.

A better-managed dollar can be one solution to this. Heavy dollar inflows from foreign countries keep the dollar strong thanks to higher demand for U.S. securities. This is also a nice way for the big sovereign wealth funds of other nations, and multi-billion dollar asset managers, to keep the dollar strong by investing heavily in U.S. stocks and bonds. This keeps imports priced attractively and makes American exports expensive.

Moreover, higher U.S. interest rates mean higher bond yields and so rich countries with lots of money to send around the globe – like Japan and countries in the EU – will borrow in their lower-cost, lower-yielding currencies, and put that money into U.S. Treasury bonds. All of this makes the dollar stronger.

A Market Access Charge (MAC) on foreign investment into U.S. securities, part of the Competitive Dollar for Jobs and Prosperity Act that was introduced in the Senate in the previous session, would assure that the world’s international currency markets would keep the dollar close to an exchange rate that would allow Americans to earn as much producing exports as they spend on imports.

Companies have lost revenues due to an overvalued dollar before. None of this is new. These global firms often operate like financial firms themselves, hedging their foreign currency in-house or through banks they work with. Sometimes they win on the currency. Sometimes they lose. They are used to this, even if they complain about it when the currency works against them.

Of note, one of the 20 companies whose earnings CPA reviewed included an IT outsourcer called TaskUs. They provide a good example of why an overvalued dollar is often liked by publicly traded firms.

Belaji Sekar, TaskUs CFO said in their earnings report that the ongoing transition of IT work from onshore to offshore was impacted somewhat by wage inflation across geographies, but “the majority of this impact was offset by the currency benefit of the strong U.S. dollar.”

A strong U.S. dollar makes offshoring more financially rewarding. It is sometimes a headwind to global corporations. It is almost always a headwind to the U.S. manufacturing base that must compete with lower financial costs elsewhere, in addition to a host of other issues – from taxation to environmental regulations and labor.

“The costs of a bloated dollar are very high,” said Hansen.

And not just for the U.S. It also has an impact on emerging market countries that have corporate and sovereign debt in dollars.

The WSJ noted this on July 29.

The U.S. dollar’s continued strength will hurt countries whose currency is depreciating. The Hungarian forint, Philippine peso, and Polish zloty have hit new lows against the dollar, making financing foreign debts more difficult.

Their weaker currencies are an example of how an over-bloated dollar doesn’t just cause a few multinationals to lose revenue, but pressures central banks in poorer countries to raise interest rates often to attract capital, even if that means risking a recession, the WSJ article said.

“The volatility and unpredictability of the dollar is also a problem as well as the high and rising level of the dollar,” said Jeff Ferry, CPA’s chief economist. “As for emerging market countries, if they borrowed in dollars, then a rising dollar could plunge them into a financial crisis.”

1. Hewlett Packard, https://s2.q4cdn.com/602190090/files/doc_financials/2022/q2/HPQ-Q2’22-Earnings-Transcript.pdf

2. Meta, https://s21.q4cdn.com/399680738/files/doc_financials/2022/q2/Meta-Q2’22-Follow-Up-Call-Transcript.pdf Meta COO Sheryl Sandberg said: “Foreign exchange trends had a significant impact in Q2, in particular the depreciation of the Euro relative to the Dollar. On a constant currency basis, we would have seen 3% revenue growth year-over-year.”

3. Microsoft, https://view.officeapps.live.com/op/view.aspx?src=https://c.s-microsoft.com/en-us/CMSFiles/TranscriptFY22Q2.docx?version=9b096353-1d5b-fdfb-f5ba-5e79031d3433

4. Uber, https://s23.q4cdn.com/407969754/files/doc_financials/2022/q2/Q2-2022-Prepared-Remarks.pdf

MADE IN AMERICA.

CPA is the leading national, bipartisan organization exclusively representing domestic producers and workers across many industries and sectors of the U.S. economy.

TRENDING

CPA Sends Letter To Senate Leaders Schumer and McConnell Opposing Advancement of Recent USITC Nominations

CPA: Liberty Steel Closures Highlight Urgent Need to Address Mexico’s Violations and Steel Import Surge

CPA Applauds Chairman Jason Smith’s Reappointment to Lead House Ways and Means Committee

Senator Blackburn and Ossoff’s De Minimis Bill is Seriously Flawed

JQI Dips Due to Declining Wages in Several Sectors as November Jobs Total Bounces Back from Low October Level

The latest CPA news and updates, delivered every Friday.

WATCH: WE ARE CPA

Get the latest in CPA news, industry analysis, opinion, and updates from Team CPA.

CHECK OUT THE NEWSROOM ➔