No more than a month ago, the Solar Energy Industries Association (SEIA) and its lobby firm Akin Gump were telling the USTR that if the U.S. was going to meet the President’s climate goals, it needed imports. Lots and lots of imports, and most of them from Chinese multinationals.

The Washington Post editorial board advocated for their position on Wednesday. Pressure is building to convince President Biden to weaken the Section 201 solar safeguard tariffs imposed by the previous government. He has to decide on this by Friday.

Here is SEIA last month in a USTR hearing on the subject.

“Domestic modules cannot meet any of Biden’s climate change goals,” SEIA President Abigail Hopper told the USTR’s Trade Policy Staff Committee in the first week of January. The Biden administration wants to make solar the lead source of electricity by 2035. It is currently around 4% of the electric power matrix. Hopper said that large utility projects – where there are acres upon acres of double-sided solar panels plugged into the local power grid — can’t be made in the U.S. and therefore must rely on China. “No domestic supplier that is currently able to build 150MW of capacity to make bifacial solar panels would even be allowed to bid on a utility project,” she said, telling the Committee that it would be too risky for utility companies to put in an order at a U.S. solar factory that would be maxed out to capacity if they were the supplier. China companies are just much bigger.

But on Wednesday, import-friendly SEIA seemed to take a different stance during the House Select Committee on the Climate Crisis.

Hopper was one of four panelists and the only one representing the solar industry. Her opening testimony came after Chair Kathy Castor (D-FL-11) called for “strong policies for manufacturing in America, with that all-important Made in the USA tag with an eye on creating good jobs.”

SEIA’s Hopper largely told members of the Committee what its co-chairs wanted to here on local manufacturing and human rights in the supply chain, despite their core business being advocating for more Asian imports and eliminating tariffs. Committee members do not want to be subsidizing the industry, are worried about energy security, and agree with the majority of the registered voters that solar that relies on polysilicon produced in the coal-fired regions of Xinjiang, where prison labor is rampant, should not be part of the American power grid. SEIA also represents Chinese solar companies who want to dominate this market — making them the Saudi Arabia of solar. SEIA’s domestic members are primarily the construction companies installing solar. They prefer cheaper solar panels to improve their thin profit margins. Almost all of them told the USTR this last month.

Castor touted the importance of the Build Back Better Act and the House version of the Senate’s “China bill” – the U.S. Competition and Innovation Act – known in the House as the COMPETES Act. These were seen as an answer to building solar capacity in the U.S.

Castor’s opening commentary warned, “We are in a hyper-competitive race with China and other countries to build these industries, to attract capital and create jobs.”

So with Castor’s focus on domestic manufacturing, SEIA highlighted the importance of American-sourced supply chains – from the quartz mines that create the polysilicon that goes into solar wafer making, all the way up to solar panels plugged into the local power grid.

“We have quartz mining, polysilicon production in Alabama, Washington, Tennessee. We have the resources to lead with the right policies in place,” Hopper said. “We need two million tons of steel to build this and it’s going to come from the U.S. We are on the precipice of an American manufacturing renaissance. The (U.S.) poly industry has been treated very unfairly by China, and that led to China putting steep tariffs on poly and made it impossible to sell into that market. We have idle capacity here ready to ramp up if we put the right policies in place. So now is the time to invest here. We have the technology. We have the know-how,” she told co-chairs Castor and Rep. Garret Graves (R-LA-6).

SEIA is correct. We have the know-how. The U.S. invented solar arrays. But that innovation later led to a mass-market product that has gone almost entirely to China. It is now spreading throughout Southeast Asia, mostly by Chinese multinationals trying to escape a barrage of tariffs, and the higher cost of doing business at home.

Any increased demand for American steel for more American-made solar panels that SEIA mentioned to the Committee sounds exciting, but Committee members need to realize that only happens if American companies are actually making solar panels.

China shutting the door on U.S. polysilicon exporters is another example of Asian dependence. If we are going to make solar electricity a major part of the energy grid, having all the polysilicon in the world won’t matter if it is going to China to make the ingots and solar wafers that go into the solar cells that get placed into the double-sided solar panels that all get shipped on a boat to American ports.

SEIA is more focused on subsidies and tax incentives. CPA believes the U.S. will never be able to outsubsidize Chinese multinationals. Those companies, even the publicly traded ones, are more concerned about market share than they are profit. And the CCP is more concerned about jobs in mainland China than profit, too. So the Chinese government will do whatever it takes to keep its solar companies afloat, regardless of market conditions. That includes things like tax breaks and incentives to match anything the U.S. throws at its industry to help take back some of that market share.

In a note to investors this week, equity analysts from the Bank of America told clients that the solar safeguards will likely be weakened on Friday, calling them “toothless”. Weaker Section 201 solar safeguards is better for importers than it is for domestic manufacturers. This is the approach for which SEIA advocated last month. Taking the SEIA approach would decimate the U.S. solar industry.

When pressed, Hopper seems to understand clearly the importance of local solar supply chains.

Rep. Suzanne Bonamici (D-OR-1): On onshoring the solar supply chain…what in the BBB Act would increase manufacturing here and what kinds of job growth would we see?

Abigail Hopper, SEIA: There is a great interest in onshoring a lot of the processes, but it all depends on the policies. Companies want certainty to deploy capital. Long-term extension of investment tax credits provide certainty. Then a production tax credit for manufacturing also gives companies certainty. Those are critical to deploy capital.

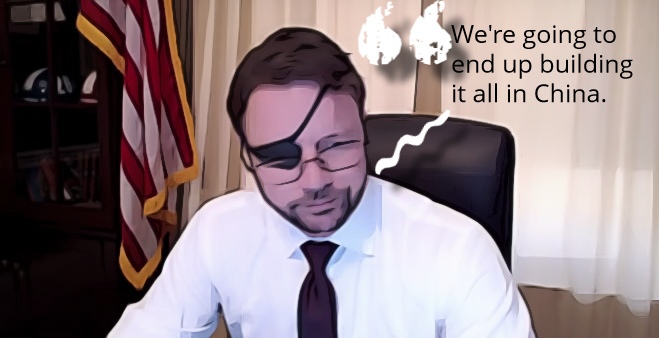

Rep. Dan Crenshaw (R-TX-2) said he wondered if the U.S. was going to try and over-subsidize in order to compete. He sounded convinced that China was going to control the market going forward.

Rep. Buddy Carter (R-GA-1): I’ve got serious concerns about aspects of the supply chain. One of the things that we talk about in particular with solar panels is that we depend on China for the critical minerals that are necessary to manufacture solar panels even here in the U.S. China is the OPEC of critical minerals.

This is true. But the main supply item that China controls is the manufacture of solar wafers. We lost that industry to Chinese subsidies. polysilicon. China controls more than 90% of that market. For strategic reasons, they would like to see our polysilicon industry die. Even if U.S. polysilicon was cheaper, the Chinese Communist Party would insist that Chinese makers of solar wafers buy Chinese.

See CPA’s CEO Michael Stumo’s op-ed in The Trentonian newspaper on the need for more critical mineral production in the U.S. if we are to truly be a green tech power.

Rep. Carter: How do we address critical minerals sourced from China?

Hopper: If we can bring back some of those elements – like quartz for polysilicon. We have mothballed polysilicon facilities in the U.S., but if we can create the policies to open those facilities then we don’t have to worry about China.

Domestic polysilicon manufacturing will only supply the U.S. if there is a solar cell manufacturing base here. If the solar cells are all being made in Asia, any ramp-up of poly production will go into the semiconductor industry, not the solar industry. We desperately need a holistic approach to this industry. To have U.S. solar panels, we need U.S. makers of solar cells, solar wafers, and polysilicon.

Congressman Carter also said China’s solar is cheap because of coal. Hopper disagreed, though the polysilicon and ingots that go into solar cells are mostly done in coal regions.

Hopper: I wouldn’t agree that it’s cheaper in China because of coal. There are a number of different provinces in China making solar, and some of it is powered by hydroelectric. The main reason for price decline is innovation. They are thinking of ways to drive down cost. That is the main reason why prices have declined.

Hopper’s comment on innovation driving down solar prices is important. Many inside the White House, including Biden’s chief climate advisor John Kerry, have argued that tariffs drive up solar prices. SEIA’s president is saying innovation is driving down prices. Tariffs are not a major price concern, as the solar import lobby has argued many times before.

Carter also wondered about energy security if tariffs on solar are removed. Here, Hopper is working at cross-purposes to SEIA’s stated position in favor of importing more bi-facial solar panels for the utility sector – the big players who generate electricity.

Rep Carter: Can we be energy independent if we depend on China to build this capacity?

Hopper: We need to bring back those opportunities to the U.S. and be energy independent

When confronted by Carter about reshoring, Hopper instead focused on human rights issues in the China supply chain.

Hopper: Our number one priority is that the solar supply chain needs to be ethical, that there is no child labor, no forced labor, nothing like that in our supply chain.

Rep Carter: But if you’re getting product out of a country that is obviously doing this, then aren’t you complicit in this by supporting the CCP?

Hopper: I don’t think so.

Many Democrats on the panel spoke about the need to pass the COMPETES Act to help solar. Others mentioned BBB.

Rep. Anthony Gonzalez (R-OH-16) warned that if Congress is pinning the future of American-made solar and electric powered cars on Biden’s signature Build Back Better Act, they are in for a rude awakening.

Without trade remedies to level the playing field for U.S. solar manufacturers that are competing against heavily subsidized Chinese companies, it won’t matter if Congress passes a domestic tax credit for American producers. If President Biden weakens the solar safeguard tariffs by excluding bifacials and ensuring a tsunami of cheap Chinese imports comes in, factories will likely close, capital investment will be reduced and the climate change jobs Biden spoke about early in his presidency will be lost. An esteimated 10 GW of planned manufacturing capacity risks being canceled if the White House turns American solar energy into an Asian jobs program.

“I’m hearing a lot of references to BBB as if that’s the answer to our problems,” Congressman Gonzalez said. “BBB as far as I know is dead. So if you’re waiting for BBB…I don’t know how long it’s going take, but it’s going take a heck of a long time.”

The same day as the hearing, Biden said the Federal Government shouldn’t be in the business of just “providing lip service to buying American, but actually takes action.”

Let’s see how that works out, as pressure mounts on gutting the solar safeguards, as well as the Section 301 China tariffs, including from those within the President’s inner circle.

To build a truly strong economy, we need a future that's made in America.pic.twitter.com/IFDZ05pw0R

— Joe Biden (@JoeBiden) February 3, 2022

“Manufacturing employs one in 11 U.S. workers today. We lost millions of jobs since 1997 due to decades of offshoring and bad policy that has weakened our supply chains and cost jobs. The current supply chain crisis underscores the importance of local manufacturing to our economy and (national) security. Worldwide, our competitors are trying to capture the job gains of the rapidly emerging green economy. Decisions we make now will determine whether the future investments are made in the U.S.” — Jessica Eckdish, Vice President, Legislation & Federal Affairs, BlueGreen Alliance, House Select Committee on Climate Change hearing, February 2, 2022