The Coalition for a Prosperous America (CPA) appreciates the opportunity to provide testimony to the US Department of Commerce regarding the impact of significant bilateral deficits on the US economy. CPA is a national, non-partisan organization focusing upon improving American trade performance, eliminating our persistent trade deficit, and growing domestic supply chains as a means to achieving broadly based prosperity in the US. Our members are organizations, companies and individuals involved in or representing manufacturing, agricultural and worker interests.

1. Overview

Significant bilateral trade deficits are often strong evidence of strategic mercantilist behavior by persistent surplus countries. Canada, China, Germany, India, Indonesia, Japan, South Korea, Malaysia, Mexico, Switzerland, Thailand, Taiwan, and Vietnam are the top countries with which the U.S. has significant bilateral deficits. Many of these countries have used a set of policies and practices to maintain their surpluses, including: currency intervention, consumption suppression, over-savings, massive industrial subsidies, and raising VATS while cutting domestic taxes. The combination of bilateral deficits with other mercantilist, export oriented practices distorts trade in ways that harm United States’ economic performance, job creation and prosperity.

America’s persistent multilateral trade deficit—41 years and counting–has played a major causal role the widespread stagnation and even decline in household incomes, manufacturing employment, our national security, our prosperity, and even our health and happiness. US aggregate demand leaks, on net, to foreign suppliers. Comprehensive, mercantilistic, export-oriented practices and policies by persistent surplus countries cause overproduction and underconsumption as they export their excess capacity – and unemployment – to deficit countries like the United States.

National current accounts should trend towards balance due to exchange rate fluctuation enforcing that balance. But the link between exchange rates and current account balances is broken. President Reagan acted to re-establish that link in the 1985 Plaza Accord, resulting in nearly balanced trade in 1991. But the international community has tolerated the absence of “trade balancing currency exchange rate equilibrium” from the Clinton years to today.

2. Trade Deficits, Suppressed Growth and Labor Slack

Trade deficits depress economic growth. The chart below shows the correlation between America’s worsening trade deficit and declining inflation-adjusted GDP growth per capita. Between 1960 and the mid-1970s, the US was regularly growing by 3%-4% per year. Families were gaining affluence and could confidently assume their children would grow up and live better lives than they did.

But from the late 1970s on, those figures dropped. After 2001, when China joined the World Trade Organization, growth rates declined further as American production declined. In the 16 years of this century, the United States failed to reach 3% in any year. Instead, annual growth rates hovered around 1% most years and were negative twice.

This economic stagnation is in large part to the hemorrhaging of good paying manufacturing jobs resulting from the US trade deficit. In 1999 the trade deficit surpassed negative $200 billion for the first time. It has never gone back. Last year it was negative $500 billion.

Surplus countries grew much faster as US growth deteriorated. The chart below shows export oriented China and India in relation to the US.1 Starting in 1994, when the North American Free Trade Agreement was implemented and our trade deficit again increased, China’s and India’s real GDP grew far faster than America’s as their export oriented strategy succeeded.

Trade agreements have not helped and have often harmed our economic growth. These agreements are often irrelevant to the tactics of surplus countries. Trade deals focus primarily upon reciprocal tariff cuts. However, modern mercantilist strategies overwhelm tariff cuts through currency devaluation, industrial subsidies, border adjustable consumption tax strategies, and consumption suppression. Many of these practices are too deeply embedded in other countries’ domestic policies for trade agreements to address. The result is that we opened our borders far more than other countries did. Excessive imports followed the path of least resistance, into the US consumer market.

The North American Free Trade Agreement [NAFTA] was implemented in 1994. The result transformed a prior surplus with Mexico into a deficit. Our overall trade performance suffered.

China joined the World Trade Organization [WTO] in 2001 producing the now well known

“China Shock”. Our pre-existing trade deficit with China grew from $68 billion to $347 billion in 2016.

The 1999 creation of the Eurozone gave rise to unexpected effects in that the German economy benefitted from a passive currency undervaluation in that the non-German EU countries prevent the euro from rising enough to reduce Germany’s astoundingly large trade surpluses. That fact, combined with German consumption suppression policies, has resulted in Germany boasting a trade surplus of 8.5% of GDP which is currently the world’s largest.

Trade deficits cause underutilization of American labor, or labor “slack”. The chart below shows that the US labor force participation rate grew prior to NAFTA but that growth slowed in the 1990’s as manufacturing was offshored. China and Germany began developing very strong trade surpluses, often at America’s expense, after 2000. The result was a serious decline in labor force participation. The currently low U3 unemployment rate is substantially caused by millions of workers exiting the labor market.

Trade deficits cause underutilization of capacity. Aggregate US demand is, on net, leaking to foreign suppliers. The result is capacity utilization rates which are at their lowest non-recession level in modern history, as the figure below shows.

Trade deficits cause the job mix to shift to low quality jobs. As high quality production jobs have moved overseas, the service sector has taken up some of the labor slack. However, because most service sector jobs are “low-wage, low-hour” jobs paying between $25,000 and $35,000 per year. Americans’ wage income has been compromised. In other words, the goods trade deficit has shifted the mix of jobs from high wage, full time jobs to low wage, low hour jobs.

The figures below show that job creation since December 2007 has shifted the labor market mix from high quality to low quality jobs.

The increase in low quality jobs hampers the ability of Americans to consume, thus reducing demand for US products.

The administration must aggressively eliminate US trade deficits to achieve our growth potential and put Americans back to work in jobs that can support a family.

3. Global Oversupply and Consumption Suppression: Excessive Reliance on Foreign Consumers for Growth

Several of the countries identified by the Department of Commerce as having significant bilateral surpluses with the U.S. are also excessive savers. They have comprehensive policies to overproduce, underconsume, and export the difference to other countries. The most problematic countries are Germany, China, Japan, South Korea, and India. Tactics can include currency devaluation and/or capital controls, industrial subsidies, de facto wage reduction regimes, and increased consumption taxes.

Additionally, the addition of high population Asian countries into the world trading system has resulted in billions of low income workers joining the global labor market. They become highly productive producers but ineffective consumers. An economic shock resulted when those high population nations increasingly overproduced and underconsumed. They relied upon the smaller but wealthier developed countries’ consumers to fund their income gains.

In the 1960s, Japan developed a successful export-oriented economic growth model, now called the “Asian development model”. It involves focusing on selected export sectors, building up a large home market position via protectionism, and then leveraging that into a worldwide export position with large economies of scale, a trade surplus, and a rapid GDP growth rate. As exports grow, protection is maintained for the home market, to ensure rapid growth. After Japan’s success, the model was adopted by a series of other nations. The key elements of this strategy include a high rate of investment in industry at home and repressed consumption to enable the investment and the focus on production and exports. In effect, these nations are “free-riding” on the large consumer markets of other nations in general, and the United States in particular.

In 1989, as many of us remember, global Communist governments began to collapse, a process that unfurled over the next ten years or so. Simultaneously, throughout the 1990s, “globalization” changed from what some saw as an exciting concept into a reality, as hundreds of million of new producers and potential consumers joined the world economy. Many of these new producers came from ex-Communist nations like China, Russia, and Poland. Others came from non-Communist nations like India, Thailand, or Morocco. Unfortunately for the U.S. and other advanced economies, many of these nations were more focused on producing than consuming. The result was an upsurge in competition in production from very low-cost nations, with a lesser increase in global consumption.

Excessive saving countries are problematic global oversuppliers. “National Savings”, in this context, is not a moral virtue, but simply the mathematical difference between national production and national consumption. Government policies can suppress consumption or supercharge production causing excessive savings rates in their reliance upon foreign consumers to grow. Another result is an export of unemployment to deficit countries. In sum, excessive savings means those countries are not consuming their share of production. They are freeriding on U.S. consumption demand and weakening the value of U.S. labor.

The table below shows the 2016 gross savings rates – and the proportionate bilateral trade surpluses with the US – of the major nations of the world from the IMF database. Our national savings rate is about 19%. Excessive national savings rate countries include Germany at 28%, South Korea 36%, and China an unheard of 49%. In many of these countries, a diverse mix of policies is used to repress household consumption, channel funds into industrial investment, and support exports. They export to the U.S., and the world, far more than they import.

If we assume that excessive savings rates are those 25% or greater than the US, then every country on the list above, with the exception of Canada and Mexico, can be determined to be excessive savers that cause imbalances through their oversupply. They free ride on the US consumer market to grow while not taking up their fair share of consumption.

In the developing economies, the promotion of domestic consumption is generally a matter of (i) increasing labor’s and, particularly, household disposable income’s share of GDP by reducing the savings and investment levels of firms and their owners; and (ii) increasing the government’s (and/or employers’) commitment to social welfare programs so as to increase to tendency for households to consume rather than save.

China does the opposite. Though Chinese household disposable income in China, for example, has increased slightly over recent years, it declined steadily during the 2000s and savings and investment, particularly at the level of state owned enterprises, remains massive.

Why does China avoid increasing consumption? Because the central party prioritizes employment and social stability as necessary to remain in power. China particularly, and the emerging markets generally, all have populations bifurcated between an already urbanized cohort (about half the population in China, but only 30% in India, for example) and a vast, mostly agrarian, peasantry. This creates the potential for substantial conflict between the have and have-nots in such countries and threatens the stability of those in power.

Their solution lies in continuous urbanization efforts (in China, to the tune of 10 to 12 million people per annum), which requires that employment be found for the newly urbanized. This is accomplished through continuous investment in domestic infrastructure and tapping foreign demand through exports. As they integrate large numbers of people into the urban economies, wages remain low, creation of new productive capacity needs to be sustained (through subsidy, if necessary), and firm profitability is therefore subordinated to internally and globally competitive factory-gate prices. China’s savings rate actually grew after 2005, despite years of central government pledges to rebalance domestic consumption and production.

Germany has a different consumption suppression model. It has pursued a conscious and deliberate array of policies to maintain global price competitiveness to ensure its access to exogenous demand. Germany saw domestic unemployment rise to 13.2% in 2002 after the introduction of the Euro (as lower-wage Euro-zone countries initially benefited). It overhauled its labor laws and social welfare system to effectively bring down the cost of domestic labor and limit future payroll growth. These so-called Hartz Reforms lowered household income and consumption, in relation to other Eurozone member trends, even as production remained high.

This was partially successful but did not provide the growth necessary to maintain domestic political stability. Germany then set about encouraging its banking sector to engage in aggressive “vendor-financing” of governments, real estate developers, and households in Euro-zone nations that could and did provide a fertile market for its exports. This led to high levels of over-indebtedness in the Euro-zone periphery, the Eurocrisis, the collapse of European demand and, ultimately, the decline of the Euro versus global currencies. Since the Euro’s devaluation, Germany has been successfully exploiting a cheap currency, linked to the poor fortunes of the Euro-zone at large and substantially undervalued relative to the strength of Germany’s economy, to develop a trade surplus with nations outside of the Euro-zone.

As a result of underinvestment and limitations on household disposable income, Germany is under-consuming and chalked up a national savings rate exceeding 27% in 2016, enormously high for a developed country.

These two examples show that surplus country oversupply is often deeply embedded in domestic policy in ways trade agreements don’t reach. Our solution should be unilateral efforts to prevent those countries from free-riding on the backs of American consumers and devaluing American labor.

4. Uniquely Low U.S. Taxes and Tariffs: Attracting Imports

The oversupply of export oriented economies tends to flow into the more open economies like the U.S., rather than into less open economies with higher tariff and border tax rates. U.S. tariffs are much lower than other major countries, thus assisting the continuance of trade deficits.

The U.S. does not have border adjustable taxes. But more than 150 nations in the world do, in the form of value added taxes (VATs) or goods and services taxes (GSTs). A VAT is a consumption tax that is applied to companies at every stage of the production process, instead of just at the final sale like an American state sales tax. The big advantage of a VAT is that it is imposed on all imports and rebated on exports. Other non-refundable domestic taxes must be reduced to gain the trade advantage, as the tax regime shifts towards more border adjustability.

Most European Union nations have VAT rates between 17% and 22%. Every American exporter into an EU nation must pay those VAT rates to sell their product there. The U.S. does not have a VAT.

When Mexico agreed to the NAFTA and abolished most tariffs charged on U.S. goods, it raised the Mexican VAT rate to 15% while reducing non-refundable taxes, thus erecting a new tax

“wall” so to speak against American goods. Under the leadership of prime minister Narendra Modi, India is now in the process of adopting a nationwide GST tax.

A country can mimic a currency devaluation by increasing its VAT and using the proceeds to reduce other domestic taxes. Domestic producers and consumers receive no net tax increase. Exports are cheaper due to the VAT rebate and domestic tax cut. Imports are more expensive because the VAT is applied with no offsetting domestic tax reduction for foreign suppliers. The practice is called Fiscal Devaluation.

Some of our bilateral trade imbalances are partially caused by higher foreign tariffs. China is a good example. We charge low tariffs on Chinese goods entering the U.S market, typically around 3.5%. China’s tariffs on American goods average around 10%, but are much higher in some sectors. The tariff on automobiles is typically 25%, although for luxury vehicles, importers to China tell us that fees and tariffs can total as much as 100%.

The table below illustrates the disproportionate openness of the US market because taxes and tariffs are far less than other major economies.

High Chinese tariffs have helped cause major U.S. auto manufacturers including GM and Ford to open production facilities in China, manufacturing in China and exporting to America. Yet if we look at last year’s auto production figures, we see that the U.S. has now lost its position as the world’s number one auto producer to China. Last year, China produced 28 million vehicles, compared to our total of 12.2 million. They have 30% worldwide market share, while our share has fallen steadily to just under 13% last year.

The U.S. government should strongly consider remedying this nonreciprocal border tax regime. Creating a U.S. goods and services tax at perhaps 12% while using the proceeds and using the proceeds as a full credit against the payroll tax would be revenue neutral domestically but would cause a tremendous boost to our trade competitiveness. American exports would be cheaper and imports would be more expensive, just like in other countries.

Tariffs should also be on the table to remedy continuing trade imbalances or neutralize foreign government practices that result in oversupply. Excessive saving/oversupply countries should be put on notice that the U.S. will no longer agree to soak up their glut of supply while devaluing American labor.

5. Currency Manipulation and Misalignment: Exchange Rates Disconnected from Trade Balancing Equilibrium

Persistent global exchange rate misalignment is a major cause of global imbalances.

“Misalignment” includes “manipulation” caused by countries’ FOREX intervention as well as undervaluation caused by other factors. “Misalignment” also includes overvaluation.

“Aggregate misalignment” is the combination of overvaluation and undervaluation which can severely hamper the overvalued countries’ trade competitiveness. Exchange rates should trend towards a trade balancing equilibrium, but that connection has been fully broken.

Currency intervention or manipulation is important to combat. However, policy responses should counter both manipulation and misalignment to be economically meaningful and comprehensive.

If a nation’s exchange rate is too low, then its exports will be cheaper than fair market value. Its imports will be more expensive and it will tend to run a trade surplus. Conversely, if a nation’s exchange rate is too high, its exports will be priced higher than fair market value. Imports will be cheap and it will run a trade surplus.

Combining overvaluation and undervaluation: The U.S. dollar was overvalued by a range of 10% to 20% as of 2015, according to an IMF 2016 study. If we choose the midpoint of that range, 15%, and recognize that the dollar has risen about 5% further since then, we end up with

an estimate of a 20% overvaluation of the dollar today. Others estimate that the US dollar may be 26.5% overvalued compared to its trade balancing equilibrium.6 (Bergsten 2016, Table 14.4).

Germany benefits immensely from undervaluation of the Euro in relation to its trade balance. Germany runs one of the largest current account surpluses in the world, at about 8.5% of its GDP. The IMF found, last year, that the euro was undervalued by between 10% and 21%

(midpoint 15.5%) as compared to the productivity of the German economy. The total exchange rate misalignment between the US and Germany is between 35.5% and 42%.

The IMF also found that the Japanese yen was undervalued by 11% as compared to the productivity of its economy. Japan has a multilateral trade surplus and a large bilateral surplus with the U.S. The total exchange rate misalignment, using these numbers, between the U.S. and Japan is 37.5%.

In the case of China, the IMF found that the Chinese yuan is fairly valued today. However, others have found that the renminbi is 10% undervalued in relation to its trade balancing equilibrium.7 Total exchange misalignment with the United States is thus between 20% and 36.5%.

How do countries maintain undervalued exchange rates that defy economic gravity?

China

China aggressively manipulated the dollar/renminbi rate from 1994 through 2014. These were the years of China’s aggressive growth in industrial production, exports and trade surplus. These were also the years in which China built up foreign exchange reserves of some $3 trillion. By holding those dollars, instead of allowing its exporters to trade them for renminbi in the open market, China enabled its trade surplus to persist and global imbalances to continue. This was effectively a social and economic policy, of creating industrial jobs for hundreds of millions of Chinese workers, growing its economy and military to rival ours. The growth was and is financed and supported by American consumers. An undervalued yuan played a key role in the process.

China still maintains aggressive capital controls preventing the renminbi from being fully tradable. Assuming China’s currency manipulation per se is dormant, American continues suffering from “zombie currency manipulation”. The industrial effects of two decades of currency misalignments live on. Homegrown Chinese industries are overproducing, killing U.S. companies, factories and jobs as the trade imbalance continues.

Germany

Germany benefits from passive undervaluation due to its participation in the EU currency union. As a eurozone member, Germany has no autonomous control over the exchange rate for the euro. Nevertheless, it has managed to manipulate the system, thereby maintaining an average current account surplus of 7 percent of GDP for the period 2010-2016 – the highest among the eurozone countries. Its surplus averages more than three times the average two percent surplus for the zone as a whole, and is in sharp contrast to the experience of Europe’s southern tier countries –Greece, France and Spain – which have had trade deficits of 4.2%, 0.9% and 0.2% respectively over the period.

Germany has managed these exceptional surpluses in a common currency area by manipulating domestic prices and wages so that they grow more slowly than those in the other EU countries. Since 2010, prices in Germany have been in line with average inflation in the eurozone, but the secret to Germany’s success lies earlier, in the period from 2000-2010.

Germany was still integrating its Eastern and Western zones at the time. Unemployment was high and growth was slow. Wage demands in the East did not match the productivity of the workers there. To put the economy back on track, Germany began the “Hartz reforms” discussed above.

Among other effects, this comprehensive labor market overhaul made it easier to fire workers, facilitated temporary work, and reduced unemployment benefits. These and parallel reforms held total German inflation over the first decade of the century to only 17 percent, the lowest in the current eurozone countries, save for Finland at 16%. Seventeen percent, which was about half the 30 percent average inflation for the eurozone countries during this first and very critical decade of the eurozone’s operation, gave Germany a price advantage of nearly 15 percent over the average eurozone country – and a far greater advantage over Greece and the new countries of from the Soviet Bloc countries such as Slovenia, Estonia, and the Slovak Republic where inflation drove prices up by 40-50 percent over the decade.

Germany exploited this price advantage effectively, using profitable exports and protection from imports to invest in and enlarge a strong industrial sector that maintains very high standards for product quality, investment, innovation, and worker training. Today the impact of these measures is seen not only in Germany’s high current account surpluses, but also in its low unit labor cost increases. This indicator for Germany reflects not only moderate wage increases, but also strong labor productivity growth. Between 2000 and 2016, unit labor costs only went up by 18 percent, the lowest in the eurozone along with Ireland and Portugal. In contrast, some of the other eurozone countries saw unit labor costs rising by 35 to 55 percent – and by 123 percent in Estonia.

These indicators show how, by keeping productivity high and inflation low, Germany has been able to “manipulate” the real effective exchange rate for German products in a totally legal and

highly effective manner – even though it cannot change the nominal rate for the euro. Conversely, this analysis helps explain why some of the other eurozone countries have suffered greatly.

Japan, Korea, and Taiwan

These countries can be treated together because they have followed similar export-oriented trade policies. The rapid economic growth that most countries following these policies enjoyed indicates that they worked quite well. Japan enjoyed strong growth based on an export-oriented strategy during the years following the Second World War, but has seen very slow and even negative growth during the two-plus decades since its asset price bubble collapsed in 1991. However, Korea, Taiwan, and other “Asian Tigers” like Thailand enjoyed excellent growth based on an export strategy supported by an undervalued currency. For example, between 1990 and 2016, Korean growth averaged 5.3 percent per year, and Thailand’s averaged 4.5 percent.

Japan, Taiwan, and Korea are all known to have engaged in substantial “asymmetric” foreign exchange interventions—aka currency manipulation. They sold local currencies and bought foreign exchange, making only limited transactions in the opposite direction.

Recently, Japan has used another approach with effectively the same result. It has undertaken a massive expansion of the domestic currency supply. Although the Japan claims that this expansion was designed strictly to stimulate domestic growth and to fight the well-known deflationary tendencies of the Japanese economy, the result looks very much like currency manipulation. Japan is also known to “jawbone” the markets by stating that it will intervene to prevent the yen from devaluing beyond a particular level.

Switzerland

Switzerland is in a class of its own. Unlike China, Korea, Taiwan, and Thailand, it is a highly-developed country. And unlike Germany, it is not part of a currency union. However, it acts very much like a classic currency manipulator. For example, after the Crash of 2008, a “flight to safety” in European markets began driving up the Swiss franc’s value, so the Swiss National Bank began selling Swiss francs and buying euros to hold its value down. As reported by the World Bank, “By the end of June 2010, when the SNB suspended intervention, it had purchased the equivalent of US$ 179 billion, amounting to 33 percent of Swiss GDP.” Appreciation of the franc began again in mid-2011, and in September the Swiss again began manipulating currency rates. The Swiss managed to maintain of minimum exchange rate of SwF 1.20 per euro, but in the process, “SNB’s FX reserves ballooned from about SwF 200 billion prior to September 2011 to SwF 424 billion in October 2012, turning Switzerland into one of the biggest FX reserve holders in the world.”

Swiss foreign exchange policies strike outsiders as quixotic because Switzerland is not a poor country trying to escape from poverty or to avoid a balance of payments crisis. Measured in current U.S. dollars, Switzerland has the second highest per capita income in the world after Luxembourg. At $80,000 per person, its per capita income exceeds that of the United States by 44 percent.

A Swiss balance of payments crisis is unimaginable. In addition to holding one of the biggest FX reserves in the world, Switzerland has consistently maintained one of the highest current account surpluses in the world, averaging nearly 11.0 percent so far in this century, and peaking at over 15 percent in 2004.

Fortunately, Switzerland is such a small economy that, despite a current account balance nearly four times larger than China’s as a share of GDP and a seriously undervalued exchange rate, it has only accounted for 1 percent of America’s merchandise trade deficit since 2010.

United States

U.S. dollar overvaluation persists for two main reasons. First, because the dollar is the reserve currency, foreign governments buy dollars to pay off debt obligations and to purchase imports. Second, private capital flows to the U.S. as a safe haven, to store wealth or for speculative reasons. This combination of foreign public and private money inflows persistently increases the value of the dollar, further distancing its value from any trade balancing equilibrium.

Solutions

The U.S. should develop a comprehensive approach to currency manipulation and misalignment. First, the Commerce Department should treat currency manipulation as a countervailable subsidy in trade enforcement cases. Second, the Treasury or the Federal Reserve should engage in counter currency manipulation by intervening in FOREX markets to offset intervention by other countries when it occurs. Third, since dollar overvaluation is a massive and persistent multilateral trade problem, the Treasury Department or the Federal Reserve should explore a market access charge (MAC) on foreign capital which is automatically adjusted to push the dollar towards a trade balancing equilibrium.

6. Subsidies and Overcapacity

Basic economic theory tells us that if each nation focuses on the industries in which it has

“comparative advantage,” then global production will be maximized, and all nations should be better off. However this theory, rests upon two core, but false, assumptions.

Those assumptions are: first, that industries do not have large scale economies, in other words that large-scale production doesn’t lead to lower costs. If there ARE scale economies, then the largest producers can force the smaller producers out of business and end up dominating the most important industries, whether we define an “important” industry as one which delivers good

wages and healthy profits, one important to our national security, or one with good future growth prospects.

Secondly, classical free trade theory assumes that nations do not subsidize their industries with the aim of driving competitor nations out of the business. If that were to happen, then there would be massive inefficiency as well as large-scale dislocation as nations around the world would have to react to policy decisions made by the subsidizing nation.

Yet there is growing evidence that one nation is disturbing the world’s economic equilibrium in exactly that way, and that nation is China. This section of our testimony relies largely on the groundbreaking research of two academics, Usha and George Haley. China now leads the world in most of the key infrastructure industries.

China’s state capitalism model is, in many respects, a subsidized full employment program. It is also a geopolitical strategy aimed at becoming a military and economic superpower. The scale of Chinese production and overproduction is mind-boggling. To give you one example, in the two years 2011 and 2012, it is estimated that China produced as much cement as the U.S. did in the entire 20th century!

Gathering together the data from the Haleys’ work shows that in recent years annual direct subsidies to key Chinese industries totals around $59 billion a year, although this is just a partial estimate. That is a massive sum of money. But it’s just the tip of the iceberg. “Direct national government subsidies” do not include many other subsidies such as free or low-interest loans from state-owned banks, cheap use of land, or support from provincial or municipal governments. There is a significant added privilege in that China’s state-owned enterprises need not deliver a profit.

As our table above shows, China is now the world’s leading producer of steel, paper, aluminum, cement, glass, solar panels, and many other industries.

China’s massive overcapacity extends to many other sectors. The U.S. solar panel industry was pretty much wiped out by Chinese subsidies to their own producers. According to a study by the Economic Progress Institute, the U.S. lost 3.4 million jobs, most of them in manufacturing, from Chinese competition between 2001 and 2015.

So when President Xi goes to Davos and talks about Chinese support for “free trade”, what he is really saying is support for a system where the Chinese identify the industries that are most important for them, and those are the ones they intend to dominate, and the rest of the world will be free to employ their people in the remaining industries. For most other nations, this is a recipe for second-class status. And for a rich nation like the U.S., this is a recipe for a declining standard of living.

7. Bilateral Trade Deficits: Strong Evidence of a Trade Problem

The Commerce Department and USTR asked for views on bilateral trade deficits and the extent to which they can be seen as causes of the global U.S. trade deficit. It is clear to us that large bilateral trade deficits provide strong evidence of a trade problem. Excessive savings rates and multilateral surpluses are further evidence of a problem as well as currency devaluation and industrial subsidies.

One nation, China, accounts for roughly half of last year’s global goods deficit of $750 billion. We have already described some of the most egregious mercantilist practices employed by China to support its exports to the U.S. and restrain U.S. exports to China. All of our top five bilateral deficits, with China, Mexico, Japan, Germany, and Canada, are due in large part to mercantilist practices by those partners. Figure 5 shows our 2016 bilateral deficits with these five trading partners and the industry segments that account for the largest parts of those deficits.

The U.S. should set a goal to achieve an overall balance of trade. The U.S. should not aim to have a bilateral surplus with every one of its trading partners. However, if the U.S. were to fix its trading relationships with the leading mercantilist nations, it would eliminate most and very possibly all of its $750 billion annual deficit, and give new life to U.S. goods-producing industries.

We base this view on the familiar old concept of comparative advantage. Nations have a comparative advantage in certain products due to their endowments of natural resources or to skills built up in certain fields of activity over years and decades. A couple of examples might be the nation of Bolivia, which has a comparative advantage in the production of precious metals and tin, due to natural resource endowments. Another example is Saudi Arabia, which has a comparative advantage in oil production. We have run deficits with both of these nations for most of this century and one could call these deficits structural, because they are determined in large part by the structure of resource endowments. Both of these countries buy a limited volume of imports from the U.S. because of the limitations of population and in the case of Bolivia, low income levels of the population.

There are also deficits that could be termed cyclical. These deficits are strongly influenced by the business cycle in the trading partners. Our trade with the United Kingdom and France exhibit cyclical characteristics. When our economy is strong and growing rapidly, the U.S. buys more imports, and when their economies are growing strongly, they buy more imports. There are also structural elements to our trade with these countries. For example, we import whisky from the UK and luxury goods from France because those countries have developed expertise in those fields over the centuries. And they import aerospace and other advanced technology products from the U.S. because of our “structural” advantages in those fields.

Finally, there are bilateral deficits due to mercantilist practices. Our deficits with three nations, China, Mexico, and Korea, have risen consistently through this century. In fact, these deficits have a cyclical element too, which explains why our deficits fell from their 2007 peaks, as the Great Recession of 2008 depressed our imports. In addition to mercantilist practices, defective trade agreements have played a large role in accelerating our bilateral deficits.

The NAFTA agreement, ratified in 1994, transformed our surplus with Mexico into a deficit. The South Korea trade agreement, ratified in 2011, accelerated our deficit with Korea. If you examine the nature of these economies, it’s clear that their persistent and growing surpluses with the U.S. cannot be explained by true comparative advantage. For example, in the steel industry, neither China nor Korea have any comparative advantage. Both countries import coking coal and iron ore, the major ingredients for making steel. Energy in both countries is cheap only through government subsidy. Yet both export steel to the U.S. and many other nations.

Labor costs, which noneconomists often identify as the reason for China’s success, are minimal in the case of steel. Today, it takes about one hour of labor to make a ton of steel, less than 5% of its cost in the U.S. It costs more than that to transport steel across the Pacific. Yet China produces just over 50% of the world’s steel. This is mercantilism, pure and simple. It derives from a conscious decision by the Chinese government that self-sufficiency and dominance in steel production is essential for economic growth and national security. The converse is also true: America’s weakness and decline in steel production stems from a decision, or perhaps an acceptance, that strength in steel production will not affect our economic growth nor our national security. We think time will show that decision is wrong.

8. National security demands a smarter trade policy

The effects of bad trade are just as serious for our national security and defense capability. The following comments rely heavily on contributions from our advisory board member Greg Autry, an economist and co-author of the book Death By China.

Since the 19th century, the primary factor determining victory on the battlefield has been technology superiority and the primary factor in winning wars has been sustained production capacity. The shorter the conflict, more important technology and the more protracted the conflict, the more significant is production capability. Military skills, strategy and tenacity still matter, but in modern wars technology and production matter more.

Our victories in the Gulf Wars were perfect examples of the technological advantage while the Second World War clearly illustrated the supremacy of production in sustained conflicts. The lesson is clear, to avoid costly conflicts and even potential loss of sovereignty a nation must maintain technological and production superiority. Consequently, the worst possible national strategy would be to transfer that technology and productive capacity to a potential opponent. For the last two decades America’s trade policy has undermined our military strategic advantage by allowing and encouraging exactly that.

Beginning in the 1990s, U.S. technology companies found that under the current rules the highest profits are to be found by moving the manufacture of and allowing the transfer of electronic, computing and aerospace technology to China. The old illusion that we would somehow outsource messy production and retain the U.S. advantage in R&D and product development has been shattered in recent years as Chinese companies simply steal and then leapfrog their American tutors.

Let us also be clear that this is a nation that shows an open ideological distaste for American values of democracy and civil rights, is clearly determined to overcome U.S. military superiority, openly opposes American geopolitical interests around the world and even challenges U.S. forces when it can get away with it. Ignoring Chinese rhetoric, there is absolutely nothing in Chinese action to suggest that China ever intends to be an ally of the U.S. Yet American banks have been encouraged to finance the transfer of American productive capacity to China and to underwrite the sale of U.S. and global manufacturing companies, factories and resource assets to Chinese state owned enterprises. It’s long past time we stopped feeding that monster with the seed corn of our own prosperity.

The key trade practices that are impacting the national security of the U.S. are:

1. The open accommodation of one-way technology transfer requirements from potential adversary nations.

2. The capitalization by U.S. banks of the transfer of U.S. firms and productive capacity to potential adversary nations.

3. The accommodation of the purchase of U.S. intellectual property and productive capacity by the agents of potential adversary nations.

It is important to realize that in the case of China, all of these activities are non-reciprocal. The Chinese may insist U.S. firms engage in joint partnerships (i.e. all nominally American auto plants in China re joint holdings usually majority owned by a Chinese SOE) where their technology is transferred either by agreement or theft. No attempt is made to force Chinese firms operating in the U.S. into such a disadvantageous relationship. Chinese firms, including organs of the Communist Party openly purchase U.S. manufacturing plants in “strategic industries” that the Chinese government would never allow a foreign competitor to enter. Chinese firms are able to lease and purchase natural resources in the U.S. that are entirely off-limits to foreign ownership in their own country. Simply adopting a reciprocal investment policy that treats Chinese firms exactly the way China treats American ones, would be a step in the right direction.

9. Conclusion and Recommendations

A comprehensive set of solutions is needed to solve the comprehensive mercantilist problem.

First, the U.S. should set a national goal to eliminate the trade deficit and undertake macroeconomic solutions to do so. Macro-economic solutions include:

1. shifting to a border adjustable tax regime with a goods and services tax to fund the elimination of the payroll tax burden. The result would be a fiscal devaluation and the creation of millions of jobs.

2. utilizing tariffs to offset economy wide, not merely industry specific, subsidies in other countries where problematic bilateral deficits are determined to exist; and

3. fixing currency manipulation and undervaluation with countervailing duties, and countervailing currency intervention

4. fixing dollar overvaluation with consideration of a market access charge to predictably and transparently push the dollar’s value towards its trade balancing equilibrium.

Second, American should systematically increase its trade law enforcement efforts to address trade distorting and mercantilistic practices targeting particular industries and supply chains.

Third, we need to undertake very specific initiatives to safeguard and rebuild our defense capabilities in basic industries as well as advanced technology industries. These policies MUST include safeguards protecting our proprietary technology from theft and forced transfer. They also must include protections against foreign acquisition of vital U.S. corporate assets.

Fourth, we must increase our Buy American preferences for goods and food in federal an state government procurement. America leaks too much demand overseas and must fully utilize our labor, plant and agricultural capacity.

Thank you very much for the opportunity to share our views with you.

Respectfully submitted,

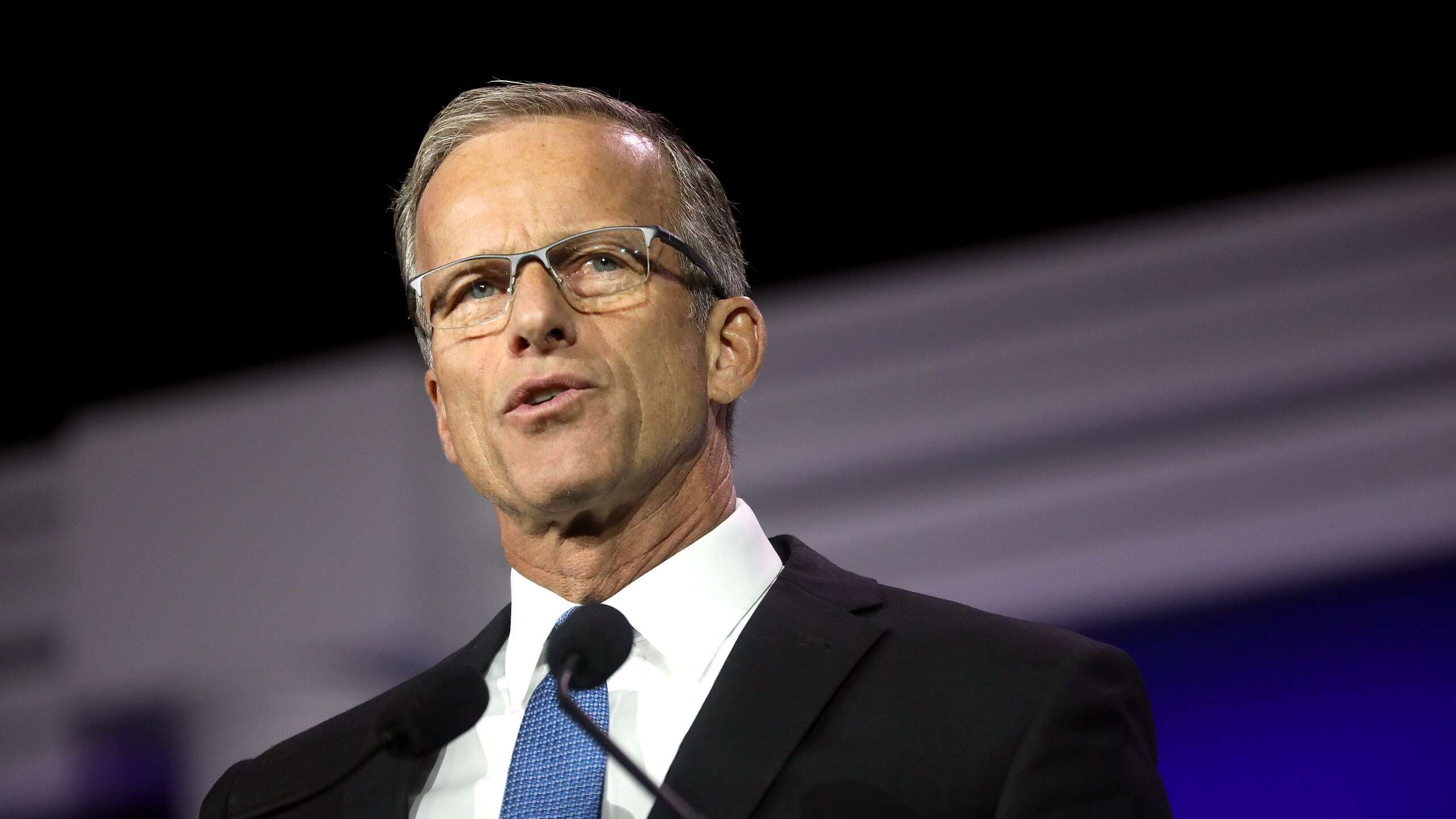

Daniel DiMicco, Chairman

Brian O’Shaughnessy, Vice Chairman

Michael Stumo, CEO