Trade Deficit Reduction Could be Frustrated

Washington ~ The Coalition for a Prosperous America (CPA) sent a letter to President Trump urging that he ensures that any Federal Reserve nominee favors a competitively priced dollar rather than a “strong” dollar.

“Past federal government support for a ‘strong’ US dollar has made our exports too expensive and foreign imports too cheap,” said Michael Stumo, CEO of CPA. “President Trump rightfully aims to reduce or eliminate the US trade deficit. We want to alert him to the fact that a pro-‘strong’ dollar stance by the Federal Reserve is unwarranted and will frustrate the administration’s trade deficit reduction efforts.”

The full text of the letter is below.

——

October 20, 2017

President Donald J. Trump

The White House

1600 Pennsylvania Ave.

Washington D.C. 20500

Re: Federal Reserve nominees, trade deficits and the “strong” dollar

Dear President Trump,

The Coalition for a Prosperous America (CPA) appreciates your administration’s focus upon the US trade deficit. However, we fear that a “strong” dollar monetary policy can and will overwhelm any positive efforts in trade policy. For that reason, we respectfully request that you ensure that any nominee to fill a Federal Reserve vacancy favor a competitively priced dollar, not a “strong” dollar.

Our organization, the Coalition for a Prosperous America, unites manufacturers, labor unions, farmers, ranchers, and members of the public who are concerned about the need to restore US industrial strength and eliminate the trade deficit. We represent the interests of 4.1 million households through our association and company membership. Like you, we favor balanced trade, increasing US production to create good paying jobs and protecting our sovereignty.

All other things equal, strong currency economies stagnate, weak currency economies grow.

A “strong” dollar is priced above the equilibrium price required to bring US trade into balance. This increases the price of US exports and and makes foreign imports excessively cheap. As a result, American goods, services and labor find it far harder to compete, through no fault of our businesses and workers.

A “strong” dollar thus frustrates the Fed’s efforts to achieve and maintain full employment with high quality jobs. Conversely, countries with undervalued currencies are export powerhouses with persistent trade surpluses. This worldwide misalignment of currencies – deficit countries with overvalued currencies and surplus countries with undervalued currencies – threatens the US and the world economy. We believe the Fed incorrectly views the US as a closed economy when, in fact, a more open economy mindset should be considered because the strategic mercantilism of surplus countries has spillover effects as we import excessive amounts of capital, goods and services.

Our CPA researchers estimated that the US dollar was 25% overvalued as of May 2017. The dollar’s overvaluation has persisted for years even in the absence of foreign government intervention or “manipulation.” While Wall Street can sell more US Treasury bonds when the dollar is strong, US goods and services producers lose domestic and international orders to China, Germany, Japan and Korea – all of which have currencies that are between five and twenty five percent undervalued. On commonly accepted estimates, wiping out our trade deficit could add at least three million jobs to the US economy, largely in industrial states.

The goal of the Federal Reserve is to manage US monetary policy so as to deliver full employment, low inflation and strong economic growth. Those goals are best achieved with a competitively dollar that is priced to bring US trade into balance. The best candidates for Fed vacancies would show an appreciation for the huge challenge of restoring US employment, competitiveness, and growth rates. The “strong currency” fetish of past administrations gave rise to a disproportionately large financial sector but a declining industrial and employment base. “Weak” currency nations, in contrast, are gaining global market share, global leadership, full employment and strong industrial sectors. The US needs to learn from those nations and restore the prosperity of its non-financial economic base with a competitive US dollar.

We hope you will keep these thoughts in mind as you consider candidates for this vitally important position. While the US economy has grown significantly in the past year, the quality of jobs has not improved. A competitively priced dollar will help raise living standards for the majority of Americans and substantially reduce or eliminate the trade deficit. Thank you for your consideration.

Sincerely,

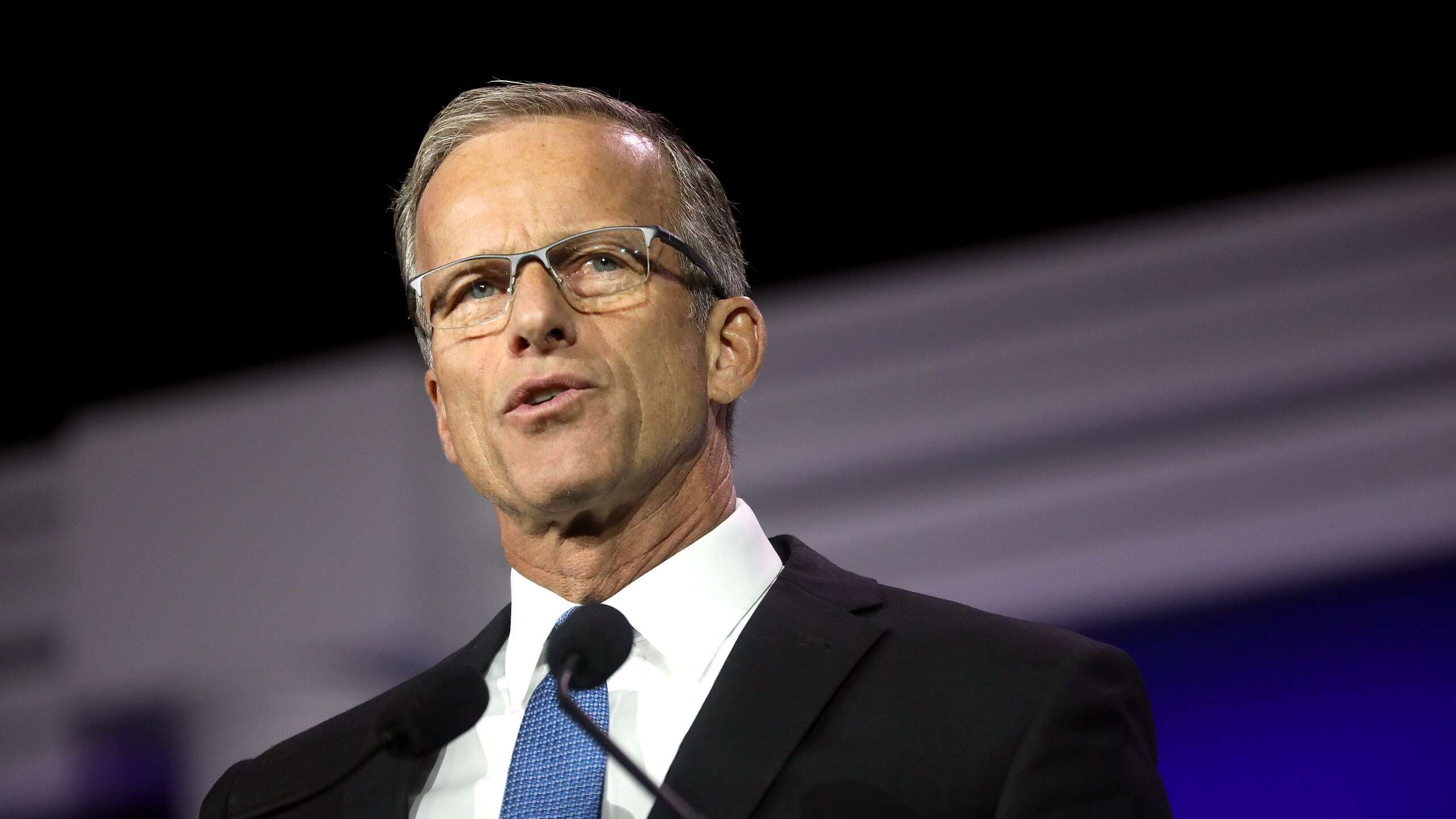

Daniel DiMicco, Chairman

Brian O’Shaughnessy, Vice Chairman

Michael Stumo, CEO

cc: Secretary Steven Mnuchin

Director Gary Cohn

Secretary Wilbur Ross

Trade Ambassador Robert Lighthizer