By Michael Stumo, CEO of CPA

Last Friday, Commerce Secretary Wilbur Ross announced that the US and China have agreed to establish a 100 day plan on trade. The big news is that both the President of the United States and the President of China agree that trade imbalances are a big problem. But will this 100 day plan be effective or just more talk?

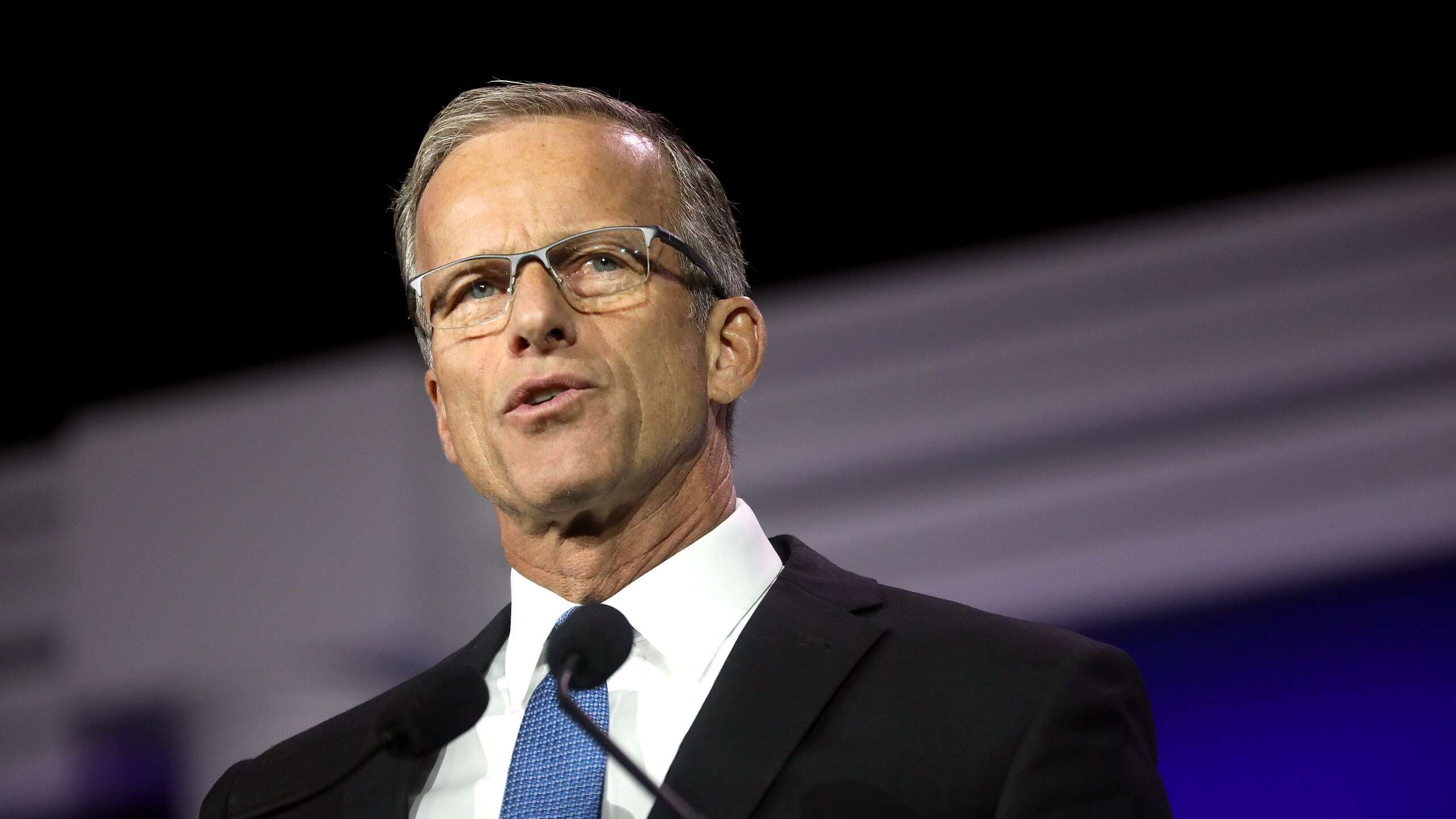

Ross was quoted in Inside US Trade (subscription required) as saying:

“Normally, trade discussions, especially between China and ourselves, are denominated in multiple years,” he said. “This was denominated in the first instance in 100 days with hopefully way stations of accomplishment along the way. Given the range of issues and the magnitude, that may be ambitious, but it’s a very big sea change in the pace of discussions. And I think that’s a very very important symbolization of the growing rapport between the two countries.”

The good news is that trade deficits are the guiding metric.

Asked for details on the “way stations” established as part of the plan, Ross said they are “a matter of negotiation itself. But, directionally, the objective is to increase our exports to China and to reduce the trade deficit that we have with them.”

Ross added that the two sides discussed a “very wide range of products,” adding, “the most interesting thing to me was they expressed an interest in reducing their net trade balance because of the impact it’s having on money supply and inflation. That’s the first time I’ve heard them say that in a bilateral context.”

This agreement is important because the establishment keeps rejecting the fact that trade deficits cost jobs and growth. The fact that both US and the Chinese government are in agreement on trade imbalances further marginalizes the “know nothing” establishment.

The US-China bilateral deficit was nearly 75% of the overall US trade deficit last year. China’s disparity of overproduction vs. underconsumption is destructive to the US economy and also to their own economy. The country’s national savings rate is an almost never-before-seen 46% caused by intentional central government policies that prevent Chinese consumers from consuming more of what they produce in the country. Their excessive reliance on the US consumer market to grow amounts to exporting their un/under-employment to our country. This is the “China Shock” many have written about even as Bush 43 and Obama did nothing.

There is a reasonable danger that this will be all talk. Bush 43 established a Strategic Economic Dialogue with China to solve the economic problems. It was a big nothing-burger. Greg Mankiw, Bush’s Director of the Council of Economic Advisors, did not believe that China’s trade surplus mattered. And still doesn’t.

Obama established a similar U.S.–China Strategic and Economic Dialogue (S&ED). Again, nothing happened. Jason Furman, Obama’s Director of the Council of Economic Advisors, did not believe that China’s trade surplus mattered. And still doesn’t.

Will the Trump-Xi 100 Day Plan be more of the same? Gary Cohn, Trump’s Director of the Council of Economic Advisors, does not believe that China’s trade surplus matters. But Wilbur Ross and Peter Navarro (Director, National Trade Council) do. The Cohn/Ross/Navarro differences are a crucial subpart of the Kushner/Bannon rivalry. The ending of that story has not yet been written. The Cohn faction could undercut any attempt at meaningful action. The Chinese could also play the game they are so good at – publicly state important measures to reduce the imbalance but ultimately do nothing.

In 2005, China’s President Wen Jiabao admitted that there are structural problems in China’s economy which cause unsteady, unabalanced, uncoordinated and unsustainable development. The headlines abounded that the country admitted its growth model was seriously lopsided with too much production, insufficient consumption and excessive reliance upon exports. Wen stated that the plan was to continue to expand domestic demand, especially consumption.

They didn’t do it.

In 2012, Vice Premier Li Kequiang, reiterated that China’s development created an “irrational economic structure” and was “uncoordinated and unsustainable”.

Nothing happened.

In 2015, US Treasury Secretary Jack Lew spoke of the need for China to rebalance towards a more sustainable economic model including more reliance upon domestic consumption.

Nothing happened.

So the risk is real that the Trump-Xi 100 Day Plan could end up producing little. Trump needs to start on a course of “constructive unilateralism” to scale down China’s reliance on the US market. This could entail action on tariffs, currency, controls on incoming capital flows or other means. The best action would be all of them in concert, because China could subvert tariffs by devaluing its currency, for example.

If the Trump administration takes action, they should publicly announce what they are doing, and the measures of success. There should be a timeline that gives the market notice and time to act.

The 100 Day Plan could be a good thing or it could be nothing. The President needs to deliver on his campaign promises to get tough on China and to eliminate the US trade deficit or he will not be seen as credible to the voters. The “trade deficits don’t matter” crowd is out of touch with the electorate and with basic economics. The public wants good jobs and industries here.

We at CPA will be supporting any effective measures from Trump, the GOP or the Democrats to eliminate the trade deficit.