By Jeff Ferry, CPA Research Director

The Trump Administration’s views on some issues (think health care) has evolved over recent months. But on foreign trade, the Administration has consistently stuck to Donald Trump’s pre-election view that past trade deals have been a lousy deal for the U.S. worker and they need to be fixed.

Secretary of Commerce Wilbur Ross has been tough and outspoken on the need to fix the trade deficit, singling out Mexico, China, and others as nations where our trade relations can and must be improved.

Last week, the Senate approved the appointment of Bob Lighthizer as US Trade Representative, completing the triumvirate (White House advisor Peter Navarro is the third figure) that will lead the Administration’s trade policies. And later this week, Department of Commerce public hearings on “significant trade deficits” look set to shine a bright light on the causes and consequences of America’s huge and persistent trade deficits.

So far, 155 public comments have been published containing summaries of planned testimony by everybody from the semiconductor industry to the association of U.S. catfish farmers, so it’s possible to get a good advance view of what the government officials will be hearing. And for anybody interested in the state of the U.S. economy and its relationship to world trade, those submissions make pretty grim reading.

The United Auto Workers’ testimony spells out the severe consequences that unfair trade have had on the American automotive industry. According to the testimony, from 2006 to 2016 our trade deficit in the automotive sector (vehicles and auto parts) rose 28% to $129.8 billion. That’s more than one quarter of our total trade deficit of $501 billion last year. In auto parts alone, the deficit doubled from $25.9 billion to $59.9 billion. The parts sector has been particularly hard hit by foreign competition, with employment tumbling 36% between 2000 and 2014. The UAW singles out Mexico as the most damaging trading relationship for the auto industry.

Between 2006 and 2016, our automotive deficit with Mexico rose by 249% to $37.5 billion. According to the UAW, the NAFTA agreement has led many auto companies to move production to Mexico, but some of the impact was concealed before 2006 because many foreign car producers were also opening new facilities in the U.S. Since 2006, Mexican competition has hit hard. Between 2005 and 2016, the US lost 13 final assembly facilities, to reach a current total of 49. Mexico gained 6 new facilities to reach a total of 17. Today Mexico produces 3.2 million vehicles a year, and the UAW says it is expected to produce 5 million vehicles by 2018.

Labor costs are a key factor in the corporate decision to shift production to Mexico. The UAW cites a figure of $3.95 an hour as the pay of an average Mexican autoworker. We think this may be too high, as a recent well-researched Bloomberg News investigation concluded the real figure is just $2.04. Even worse than the low level of the wage is the fact that Mexican auto worker wages scarcely rise at all, despite all the new jobs and investments south of the border. That’s partly because Mexico’s so-called labor unions are carefully controlled by the Mexican government. They don’t give employees a vote, and don’t engage in wage bargaining. Since U.S. automotive workers compete with Mexican workers, if Mexican wages don’t rise, then the laws of competition tell us U.S. wages must fall. And that’s precisely what has happened. According to the UAW, “adjusted for inflation, auto parts production workers’ average hourly wages declined by 23% in the past decade.”

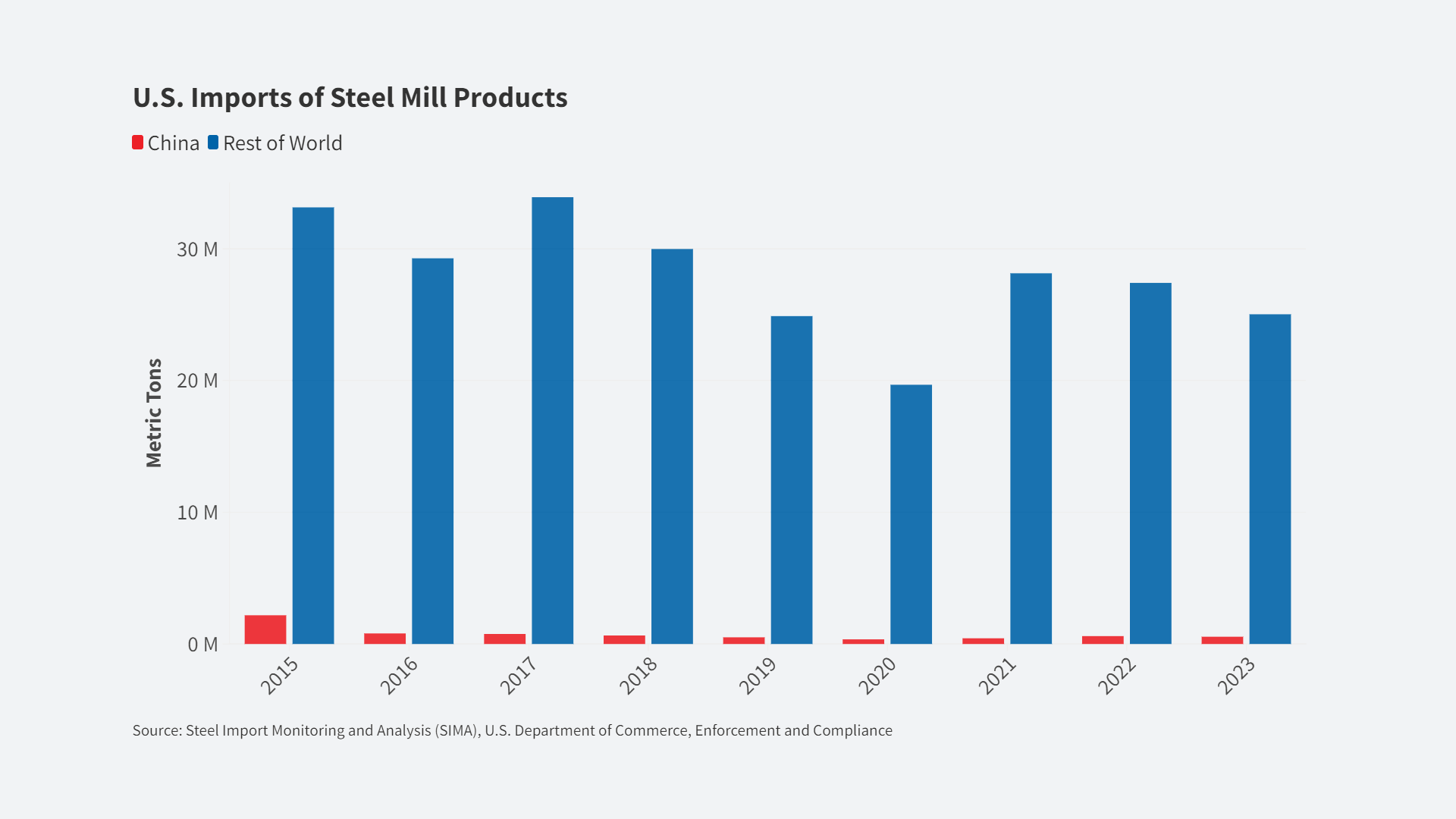

The American Iron and Steel Institute’s (AISI) testimony focuses primarily on China. Last year, China, with output of 800 million tonnes (metric tons), produced half the world’s steel. According to the AISI, on top of that production total, China has excess capacity of 425 million tonnes. Taking into account other countries, total world excess capacity is estimated at 700 million tonnes. That huge overhang depresses world steel prices and makes it hard for American steel companies to make a profit.

The AISI says that since the beginning of 2015, the U.S. industry has seen a number of plant closures and a net loss of 14,000 jobs. That’s on top of hundreds of thousands of job losses in earlier years. And with Korea, India and Vietnam investing in their steel industries, there’s little sign things will get better. The core of the problem is that China’s steel industry is largely owned by the Chinese government and supported with billions of dollars of subsidies in the form of direct grants, loans, export credit, and other creative ways of channeling funds to steelmakers.

Other Asian nations are following the Chinese model. For example, AISI reports that Korea has a subsidy plan for Korean steelmakers worth some $100 million. And while the U.S. government and U.S. steelmakers have won some anti-dumping cases against subsidized and dumped foreign steel, according to the AISI, “the level of relief granted in many of the cases has been too small to have a significant effect.”

Metalcasting is the process of casting shaped and hardened steel into specialty products with higher performance than ordinary steel. Roddy Dowd, CEO of Charlotte Pipe and Foundry, a family-owned North Carolina business with seven plants in the U.S. and a member of the Coalition for a Prosperous America (CPA), has provided some valuable testimony to the Department of Commerce. Dowd points out that this sector, which has revenue of $30 billion today and some 200,000 employees, has shrunk by some 30% since the year 2000, largely due to foreign competition.

He offers the Commerce Department a list of no less than 20 metalcasting product segments essential for our military and national security needs. They include segments like Small Arms Manufacturing, Special Die and Tool Manufacturing, Aircraft Manufacturing, and Military Armored Vehicle, Tank, and Tank Component Manufacturing. Dowd also points out that contrary to President Clinton’s 1993 confident prediction that NAFTA would create one million jobs, NAFTA has in fact cost the U.S. 700,000 jobs, according to one think tank study. He closes by asking the government to invoke Section 232 to give our trade laws real teeth. Section 232 allows the government to use future expectations of industrial loss that would endanger our national security as a reason to take aggressive trade actions.

In addition to Roddy Dowd’s eye-opening testimony, the Coalition for a Prosperous America, will be represented on Thursday with some powerful testimony from our chairman Dan DiMicco, and CPA board member Marc Fasteau.

So where will all this detailed testimony of the harm suffered by our manufacturing and agricultural industries lead? The details have yet to be worked out, but it seems very possible that a new and much tougher form of NAFTA could be negotiated with Mexico and Canada. We expect to see a series of much tougher enforcements of trade actions, particularly against Asian nations. And since Wilbur Ross has raised questions over the inability of the World Trade Organization to enforce its own rules, we would not be surprised to see the U.S. take a good hard look at how and whether it continues to work with the WTO.