On Friday, March 31, the U.S. Treasury launched their latest torpedo targeting the Inflation Reduction Act’s domestic manufacturing policies. This time, it’s over what countries have a “free trade agreement” with the United States. This is actually universally understood fact: there are twenty countries. But to grow the list beyond the twenty, so as to dilute sourcing requirements, Treasury has now conjured up their own definition of “Free Trade Agreement” and USTR even signed an entirely fake agreement with Japan that may as well be a blank piece of paper. Congressional leaders, both Democrat and Republican, have blasted the move. Has Treasury finally gone too far?

Background: The Inflation Reduction Act Was The Perennial Rejection of the Global Trading System

CPA is a keen supporter of the Inflation Reduction Act’s (IRA) investments into domestic manufacturing. And from a trade policy perspective, CPA has especially embraced the IRA. As soon as the legislation passed in August, 2022, CPA detailed how it “knifed and left for dead the multilateral trading system.”

In short, the IRA limited tax credit eligibly for a number of products depending on where the product was made. This is a core ‘National Treatment’ violation, and something the U.S. Congress had never done in such an explicit and high profile manner. See “The Inflation Reduction Act Sparks Trade Disputes: What Next” in American Affairs for a deep dive into this topic.

Background: Treasury’s broader attack on IRA domestic content rules

Since passage of the IRA, the U.S. Treasury has been seeking to undermine the domestic sourcing requirements.

In February, 2023, CPA detailed the U.S. Treasury’s multifaceted thwarting of clear Congressional policy for the future of the automotive industry. Arguably the biggest vandalism to date has been to the Section 30D consumer credit for electric vehicles. At the request of foreign automakers, and against the wishes of General Motors and Tesla, Treasury declared every consumer car lease – long the domain of Sec. 30D of the Internal Revenue Code – to actually be a Section 45W commercial acquisition. Treasury did this because Section 45W had none of Section 30D’s domestic content restrictions. Because of this decision, consumers can get the full $7,500 Section 45W credit if they lease a Made-in-China Polestar 2 electric vehicle. And that’s the point.

Treasury gaslights everyone saying no one knows what “Free Trade Agreement” means

The Section 30D consumer credit, which due to the above executive abuse now only applies to purchases of electric vehicles, has been around for thirteen years. Before the IRA, consumers received a $7,500 tax credit for buying an electric vehicle regardless of where it was made. By 2022, this was directly subsidizing tens of thousands of imported Chinese EVs, mostly from Polestar.

The IRA sought to end this by limiting the credit to electric vehicles assembled in North America, but Treasury has greatly undermined the restrictions.

Having exempted all consumer leases, Treasury turns to watering down the 30D sourcing rules for car purchases.

As a baseline requirement, only vehicles with final assembly in North America are eligible for 30D. That part is holding (for now). The IRA’s revised 30D took the $7,500, and broke it into two $3,750 credits: First, a car is eligible for a $3,750 credit if 50% of the vehicle’s battery is assembled within North America. This required percentage goes up by 10% every year until it reaches 100% in 2029.

Second, an additional $3,750 is offered (so $7,500 in total) if a minimum threshold of the battery’s critical minerals are extracted or processed domestically, or from a “country with which the United States has a free trade agreement in effect“. (In 2023, the critical minerals percentage is 40%, and then it peaks at 80% in 2027, where it stays until 2032.)

This second leg, “countries with which the U.S. has a free trade agreement”, is what this article is about.

As stated up front, this was not a controversial topic prior to Treasury’s lawless guidance. Since at least October, 2009, USTR has helpfully included a list of countries with whom the United States had a “Free Trade Agreement”. That same web page persists today: https://ustr.gov/trade-agreements/free-trade-agreements

Nonetheless, despite this universal understanding, Treasury’s guidance from Friday declared that because “Free Trade Agreement” wasn’t defined in either the IRA or the Internal Revenue Code, they would ignore the plain meaning and propose a definition that “takes into account the term’s meaning, use and context” in the IRA, to the exclusion of the real world.

Treasury’s new definition for “Free Trade Agreement” is at odds with reality, and their criteria requires extension to all WTO countries

Here’s the down and dirty from Treasury’s guidance (see page 24 of 61 page PDF), where they create their own reality (emphasis added):

The IRA’s amendments to section 30D expand the incentives for taxpayers to purchase new clean vehicles and for vehicle manufacturers to increase their reliance on supply chains in the United States and in countries with which the United States has reliable and trusted economic relationships. The Treasury Department and the IRS recognize that more secure and resilient supply chains are essential for our national security, our economic security, and our technological leadership. The Treasury Department and the IRS propose to identify the countries with which the United States has free trade agreements in effect for purposes of section 30D consistent with the statute’s purposes of promoting reliance on such supply chains and of providing eligible consumers with access to tax credits for the purchase of new clean vehicles.

Bolded above is Treasury flipping the bird to Congress. Instead of adopting USTR’s list of FTA countries which was everyone’s understanding, Treasury ignores the plain words of the law and decides it will make up its own list of “countries with which the United States has reliable and trusted economic relationships.”

What that new definition of free trade agreement, Treasury adopts four criteria to make up its own list:

Based on these considerations, the Treasury Department and the IRS propose criteria the Secretary would consider in identifying these countries. As set forth in proposed §1.30D-3(c)(7)(i), those criteria would include whether an agreement between the United States and another country, as to the critical minerals contained in electric vehicle batteries or more generally, and in the context of the overall commercial and economic relationship between that country and the United States: (A) reduces or eliminates trade barriers on a preferential basis, (B) commits the parties to refrain from imposing new trade barriers, (C) establishes high-standard disciplines in key areas affecting trade (such as core labor and environmental protections), and/or (D) reduces or eliminates restrictions on exports or commits the parties to refrain from imposing such restrictions on exports.

Heavy emphasis on the “and/or” which is the same as just saying “or”. Hit any one of those four criteria and bam: you’ve got a “free trade agreement” with the United States according to Treasury.

So far, no one seems to be talking about the elephant in the room, i.e. the one agreement that easily hits all four criteria, and that’s the GATT. Under the GATT, we’ve been (A) reducing and eliminating trade barriers on a preferential basis for 75 years, through eight successive multilateral negotiating rounds; (B) promising not to impose new trade barriers, although the IRA itself blew that up big time; (C) establishing “high-standard disciplines” in areas from customs to agriculture, and (D) promising not to impose export restrictions.

Long before the IRA, CPA has been elevating the profile of the GATT to policy makers as our sleeper free trade agreement with the world. Under our GATT Schedule of Concessions, we still maintain some negligible tariffs on a minority of goods, but that’s also true under are 20 “Free Trade Agreements” as well. The difference is only a matter of degree. And even the GATT is a preferential tariff agreement, as we have always declined to extend our GATT tariff concessions to North Korea. Cuba was excluded after the revolution, and more recently Congress expelled Belarus and Russia from GATT tariff treatment.

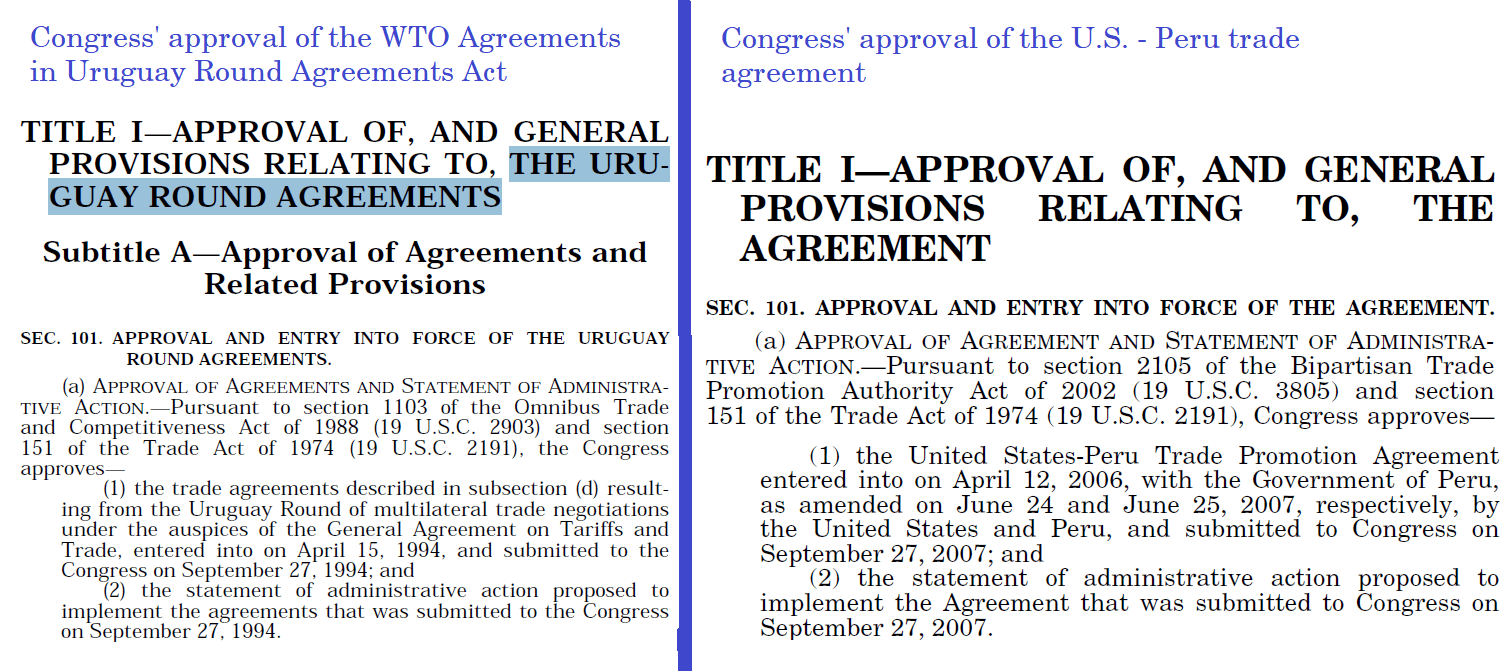

In 1994, the GATT was married with more agreements under an umbrella WTO Agreement, and it was approved and implemented by Congress in the precise manner as our twenty FTAs. See here comparing the implementing language for the GATT in 1994 at the end of the Uruguay Negotiating Round, next to the implementing language for the U.S.-Peru FTA of 2006.

There’s no substantive difference between the GATT and our FTAs from a legal perspective. All are executive agreements that required implementing legislation from Congress.

Treasury actually goes on in its guidance to refer to the twenty FTAs as “Comprehensive” Free Trade Agreements, and that’s a fair way to distinguish them from the GATT as FTA tariff elimination typically covers north of 95% of all goods. (A correct taxonomy would lump the GATT and FTAs together as “Preferential Tariff Agreements”.) Treasury should have stuck with that aspect when it defined FTA in the IRA, and Congress would have been pleased.

But Treasury didn’t want to limit themselves to Comprehensive FTAs like Congress clearly intended, so here we are.

The new fake Free Trade Agreement with Japan may as well be a blank sheet of paper

USTR has now updated its FTA webpage with a new category, apart from the Free Trade Agreement list. This list is titled agreements “focusing on free trade in critical minerals“. As of April 3, 2023, only a new fake agreement with Japan, signed on March 28, 2023, is listed, but one with Europe is anticipated shortly.

The new Japan agreement may as well be a blank piece of paper. Formally titled an “Agreement Between the Government of Japan and the Government of the United States of America on Strengthening Critical Minerals Supply Chains“, it’s nothing [full text]:

- Article 1: states an objective, nothing actionable;

- Article 2: definitions (even the definition of “labor rights” fails to cite any actual International Labor Organization (ILO) conventions, and opts instead for a non-actionable ILO declaration document);

- Article 3: merely affirms existing GATT obligations, specifically GATT Article III (National Treatment) and GATT Article XI (Elimination of Quantitative Restrictions);

- Article 4: “Facilitating Sustainable Supply Chains for Critical Minerals”: non-actionable fluff about “recognizing the importance”;

- Article 5: “Building Equitable Supply Chains for Critical Minerals”, non-actionable fluff about “confirming intentions” and “recognizing the importance”;

- Article 6: “Inclusive Trade Policy”, one sentence long, meaningless.

- Article 7: “Cooperation on Critical Minerals”, each party “shall endeavor” (meaningless);

- Article 8: Security Exception (why bother?);

- Article 9: Implementation, adds a qualifier out (why bother?);

- Article 10: states “Nothing in this Agreement modifies any international obligation” nor “shall be construed to affect the authorities of the relevant state institutions” (confirmation that this may as well be a blank piece of paper)

Suffice it to say, it is dishonest and professional malpractice for USTR to list an agreement like this Japan one under a heading “free trade in critical minerals”.

“Free trade” has been understood since the dawn of the industrial revolution to mean tariff-free trade. An agreement that fails to repeal tariffs in a sector cannot be called a “free trade” agreement in that sector.

Japan gets to keep its tariffs on critical minerals from the United States while we impose none

Outside of agriculture, Japan, like the United States, is a very low tariff nation. And in 2019, the U.S. and Japan actually entered into a tariff cutting trade agreement, wherein Japan agreed to cut many of its agricultural tariffs for the U.S., and the U.S. agreed to eliminate some agricultural tariffs as well as tariffs on certain machine tools, fasteners, steam turbines, bicycles, bicycle parts, and musical instruments. (Because the tariff elimination was more limited, it was not included among USTR’s list of “Free Trade Agreements”.)/

As it happens, despite being a low tariff country with preferential tariffs for the U.S., Japan does maintain tariffs on certain critical minerals. A cursory search of Japan’s tariff code reveals the following tariffs applicable to American critical minerals:

- 2820.10 – Manganese oxides – 3.9%

- 2825.40 – Nickel oxides and hydroxides – 4.8%

- 2825.50 – Copper oxides and hydroxides – 4.8%

There may be more. This is quite the humiliation for the Biden Administration.

Do you want to guess what tariff the U.S. charges on those same tariff lines for the respective imports from Japan? If you said zero, congrats.

(Incidentally, Japan exports to us about 1.4 – 1.7 million new passenger vehicles annually, and we typically export to them less than 20,000 per year. International “free trade” is and always has been a scam, never forget.)

Ah well, this indignity, like most in international trade, pales in comparison to our GATT humiliation, wherein we gave away the most of all 164 member nations.

Fake Japan Trade Agreement draws total condemnation from the Hill

The Biden Administration was condemned by both Democrat and Republican trade leaders on the Hill.

Top trade Democrats: U.S. House Ways and Means Committee Ranking Member Richard E. Neal (D-MA) and Senate Finance Committee Chair Ron Wyden (D-OR) released a statement saying “It’s clear this agreement is one of convenience. As we warned Ambassador Tai last week, the Administration does not have the authority to unilaterally enter into free trade agreements.”

Top trade Republicans: U.S. House Ways and Means Committee Chairman Jason Smith (R-MO) released a statement saying in part: “This so-called ‘free trade agreement’ with Japan does nothing to shift critical mineral supply chains away from China. Equally shameful is the fact that the Biden Administration is distorting the plain text of U.S. law”. Senate Finance Committee Ranking Member Mike Crapo’s (R-ID) statement said “The Administration is also attempting to side-step a statutory requirement for the clean vehicle tax credit in the Inflation Reduction Act (IRA) by negotiating the United States – Japan Critical Minerals Agreement, which lacks any binding or enforceable commitments, bypassing Congress and the American people.”

And also last week, Senator Joe Manchin (D-WV), whose vote was key to passage of the Inflation Reduction Act, penned an op-ed in the Wall Street Journal titled “Biden’s Inflation Reduction Act Betrayal“.

The saga will continue

Treasury is not done reigning fire down on Congressional intent. Treasury has more opportunities to promote the importation of made-in-China electric vehicles coming up. Notably, expect their interpretation of the IRA’s “countries of concern” language later this year. Yikes!

U.S. Treasury Continues Undoing of Inflation Reduction Act

On Friday, March 31, the U.S. Treasury launched their latest torpedo targeting the Inflation Reduction Act’s domestic manufacturing policies. This time, it’s over what countries have a “free trade agreement” with the United States. This is actually universally understood fact: there are twenty countries. But to grow the list beyond the twenty, so as to dilute sourcing requirements, Treasury has now conjured up their own definition of “Free Trade Agreement” and USTR even signed an entirely fake agreement with Japan that may as well be a blank piece of paper. Congressional leaders, both Democrat and Republican, have blasted the move. Has Treasury finally gone too far?

Background: The Inflation Reduction Act Was The Perennial Rejection of the Global Trading System

CPA is a keen supporter of the Inflation Reduction Act’s (IRA) investments into domestic manufacturing. And from a trade policy perspective, CPA has especially embraced the IRA. As soon as the legislation passed in August, 2022, CPA detailed how it “knifed and left for dead the multilateral trading system.”

In short, the IRA limited tax credit eligibly for a number of products depending on where the product was made. This is a core ‘National Treatment’ violation, and something the U.S. Congress had never done in such an explicit and high profile manner. See “The Inflation Reduction Act Sparks Trade Disputes: What Next” in American Affairs for a deep dive into this topic.

Background: Treasury’s broader attack on IRA domestic content rules

Since passage of the IRA, the U.S. Treasury has been seeking to undermine the domestic sourcing requirements.

In February, 2023, CPA detailed the U.S. Treasury’s multifaceted thwarting of clear Congressional policy for the future of the automotive industry. Arguably the biggest vandalism to date has been to the Section 30D consumer credit for electric vehicles. At the request of foreign automakers, and against the wishes of General Motors and Tesla, Treasury declared every consumer car lease – long the domain of Sec. 30D of the Internal Revenue Code – to actually be a Section 45W commercial acquisition. Treasury did this because Section 45W had none of Section 30D’s domestic content restrictions. Because of this decision, consumers can get the full $7,500 Section 45W credit if they lease a Made-in-China Polestar 2 electric vehicle. And that’s the point.

Treasury gaslights everyone saying no one knows what “Free Trade Agreement” means

The Section 30D consumer credit, which due to the above executive abuse now only applies to purchases of electric vehicles, has been around for thirteen years. Before the IRA, consumers received a $7,500 tax credit for buying an electric vehicle regardless of where it was made. By 2022, this was directly subsidizing tens of thousands of imported Chinese EVs, mostly from Polestar.

The IRA sought to end this by limiting the credit to electric vehicles assembled in North America, but Treasury has greatly undermined the restrictions.

Having exempted all consumer leases, Treasury turns to watering down the 30D sourcing rules for car purchases.

As a baseline requirement, only vehicles with final assembly in North America are eligible for 30D. That part is holding (for now). The IRA’s revised 30D took the $7,500, and broke it into two $3,750 credits: First, a car is eligible for a $3,750 credit if 50% of the vehicle’s battery is assembled within North America. This required percentage goes up by 10% every year until it reaches 100% in 2029.

Second, an additional $3,750 is offered (so $7,500 in total) if a minimum threshold of the battery’s critical minerals are extracted or processed domestically, or from a “country with which the United States has a free trade agreement in effect“. (In 2023, the critical minerals percentage is 40%, and then it peaks at 80% in 2027, where it stays until 2032.)

This second leg, “countries with which the U.S. has a free trade agreement”, is what this article is about.

As stated up front, this was not a controversial topic prior to Treasury’s lawless guidance. Since at least October, 2009, USTR has helpfully included a list of countries with whom the United States had a “Free Trade Agreement”. That same web page persists today: https://ustr.gov/trade-agreements/free-trade-agreements

Nonetheless, despite this universal understanding, Treasury’s guidance from Friday declared that because “Free Trade Agreement” wasn’t defined in either the IRA or the Internal Revenue Code, they would ignore the plain meaning and propose a definition that “takes into account the term’s meaning, use and context” in the IRA, to the exclusion of the real world.

Treasury’s new definition for “Free Trade Agreement” is at odds with reality, and their criteria requires extension to all WTO countries

Here’s the down and dirty from Treasury’s guidance (see page 24 of 61 page PDF), where they create their own reality (emphasis added):

Bolded above is Treasury flipping the bird to Congress. Instead of adopting USTR’s list of FTA countries which was everyone’s understanding, Treasury ignores the plain words of the law and decides it will make up its own list of “countries with which the United States has reliable and trusted economic relationships.”

What that new definition of free trade agreement, Treasury adopts four criteria to make up its own list:

Heavy emphasis on the “and/or” which is the same as just saying “or”. Hit any one of those four criteria and bam: you’ve got a “free trade agreement” with the United States according to Treasury.

So far, no one seems to be talking about the elephant in the room, i.e. the one agreement that easily hits all four criteria, and that’s the GATT. Under the GATT, we’ve been (A) reducing and eliminating trade barriers on a preferential basis for 75 years, through eight successive multilateral negotiating rounds; (B) promising not to impose new trade barriers, although the IRA itself blew that up big time; (C) establishing “high-standard disciplines” in areas from customs to agriculture, and (D) promising not to impose export restrictions.

Long before the IRA, CPA has been elevating the profile of the GATT to policy makers as our sleeper free trade agreement with the world. Under our GATT Schedule of Concessions, we still maintain some negligible tariffs on a minority of goods, but that’s also true under are 20 “Free Trade Agreements” as well. The difference is only a matter of degree. And even the GATT is a preferential tariff agreement, as we have always declined to extend our GATT tariff concessions to North Korea. Cuba was excluded after the revolution, and more recently Congress expelled Belarus and Russia from GATT tariff treatment.

In 1994, the GATT was married with more agreements under an umbrella WTO Agreement, and it was approved and implemented by Congress in the precise manner as our twenty FTAs. See here comparing the implementing language for the GATT in 1994 at the end of the Uruguay Negotiating Round, next to the implementing language for the U.S.-Peru FTA of 2006.

There’s no substantive difference between the GATT and our FTAs from a legal perspective. All are executive agreements that required implementing legislation from Congress.

Treasury actually goes on in its guidance to refer to the twenty FTAs as “Comprehensive” Free Trade Agreements, and that’s a fair way to distinguish them from the GATT as FTA tariff elimination typically covers north of 95% of all goods. (A correct taxonomy would lump the GATT and FTAs together as “Preferential Tariff Agreements”.) Treasury should have stuck with that aspect when it defined FTA in the IRA, and Congress would have been pleased.

But Treasury didn’t want to limit themselves to Comprehensive FTAs like Congress clearly intended, so here we are.

The new fake Free Trade Agreement with Japan may as well be a blank sheet of paper

USTR has now updated its FTA webpage with a new category, apart from the Free Trade Agreement list. This list is titled agreements “focusing on free trade in critical minerals“. As of April 3, 2023, only a new fake agreement with Japan, signed on March 28, 2023, is listed, but one with Europe is anticipated shortly.

The new Japan agreement may as well be a blank piece of paper. Formally titled an “Agreement Between the Government of Japan and the Government of the United States of America on Strengthening Critical Minerals Supply Chains“, it’s nothing [full text]:

Suffice it to say, it is dishonest and professional malpractice for USTR to list an agreement like this Japan one under a heading “free trade in critical minerals”.

“Free trade” has been understood since the dawn of the industrial revolution to mean tariff-free trade. An agreement that fails to repeal tariffs in a sector cannot be called a “free trade” agreement in that sector.

Japan gets to keep its tariffs on critical minerals from the United States while we impose none

Outside of agriculture, Japan, like the United States, is a very low tariff nation. And in 2019, the U.S. and Japan actually entered into a tariff cutting trade agreement, wherein Japan agreed to cut many of its agricultural tariffs for the U.S., and the U.S. agreed to eliminate some agricultural tariffs as well as tariffs on certain machine tools, fasteners, steam turbines, bicycles, bicycle parts, and musical instruments. (Because the tariff elimination was more limited, it was not included among USTR’s list of “Free Trade Agreements”.)/

As it happens, despite being a low tariff country with preferential tariffs for the U.S., Japan does maintain tariffs on certain critical minerals. A cursory search of Japan’s tariff code reveals the following tariffs applicable to American critical minerals:

There may be more. This is quite the humiliation for the Biden Administration.

Do you want to guess what tariff the U.S. charges on those same tariff lines for the respective imports from Japan? If you said zero, congrats.

(Incidentally, Japan exports to us about 1.4 – 1.7 million new passenger vehicles annually, and we typically export to them less than 20,000 per year. International “free trade” is and always has been a scam, never forget.)

Ah well, this indignity, like most in international trade, pales in comparison to our GATT humiliation, wherein we gave away the most of all 164 member nations.

Fake Japan Trade Agreement draws total condemnation from the Hill

The Biden Administration was condemned by both Democrat and Republican trade leaders on the Hill.

Top trade Democrats: U.S. House Ways and Means Committee Ranking Member Richard E. Neal (D-MA) and Senate Finance Committee Chair Ron Wyden (D-OR) released a statement saying “It’s clear this agreement is one of convenience. As we warned Ambassador Tai last week, the Administration does not have the authority to unilaterally enter into free trade agreements.”

Top trade Republicans: U.S. House Ways and Means Committee Chairman Jason Smith (R-MO) released a statement saying in part: “This so-called ‘free trade agreement’ with Japan does nothing to shift critical mineral supply chains away from China. Equally shameful is the fact that the Biden Administration is distorting the plain text of U.S. law”. Senate Finance Committee Ranking Member Mike Crapo’s (R-ID) statement said “The Administration is also attempting to side-step a statutory requirement for the clean vehicle tax credit in the Inflation Reduction Act (IRA) by negotiating the United States – Japan Critical Minerals Agreement, which lacks any binding or enforceable commitments, bypassing Congress and the American people.”

And also last week, Senator Joe Manchin (D-WV), whose vote was key to passage of the Inflation Reduction Act, penned an op-ed in the Wall Street Journal titled “Biden’s Inflation Reduction Act Betrayal“.

The saga will continue

Treasury is not done reigning fire down on Congressional intent. Treasury has more opportunities to promote the importation of made-in-China electric vehicles coming up. Notably, expect their interpretation of the IRA’s “countries of concern” language later this year. Yikes!

MADE IN AMERICA.

CPA is the leading national, bipartisan organization exclusively representing domestic producers and workers across many industries and sectors of the U.S. economy.

TRENDING

CPA: Liberty Steel Closures Highlight Urgent Need to Address Mexico’s Violations and Steel Import Surge

CPA Applauds Chairman Jason Smith’s Reappointment to Lead House Ways and Means Committee

Senator Blackburn and Ossoff’s De Minimis Bill is Seriously Flawed

JQI Dips Due to Declining Wages in Several Sectors as November Jobs Total Bounces Back from Low October Level

What Are Trump’s Plans For Solar in the Inflation Reduction Act?

The latest CPA news and updates, delivered every Friday.

WATCH: WE ARE CPA

Get the latest in CPA news, industry analysis, opinion, and updates from Team CPA.

CHECK OUT THE NEWSROOM ➔