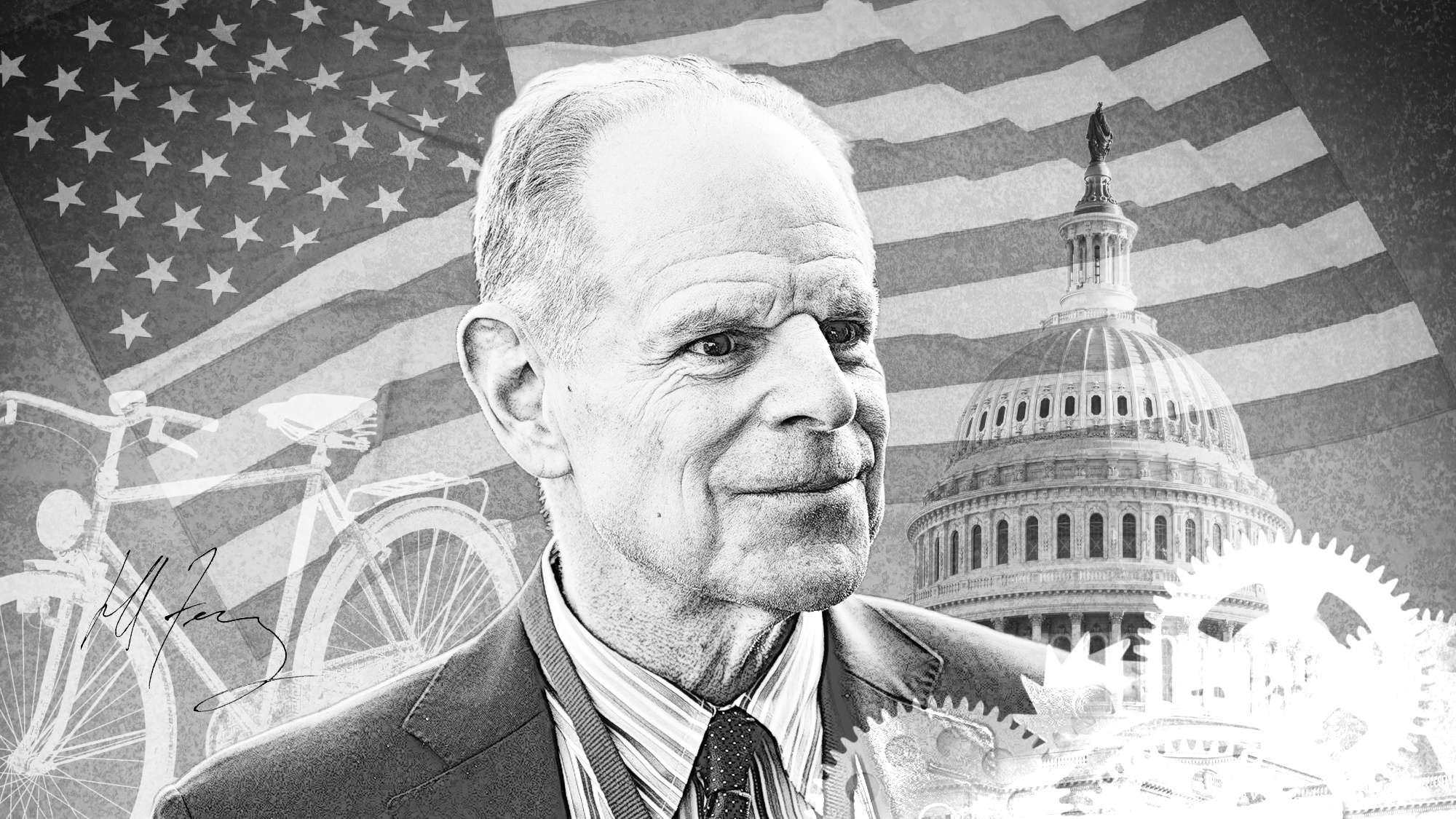

By Jeff Ferry, CPA Research Director

Since January, the Trump administration has implemented five major tariff policies, on the solar panel, washing machine, steel, and aluminum industries, as well as the so-called Section 301 tariffs affecting $250 billion worth of Chinese imports, chiefly in intermediate manufactured goods.

And so far, the evidence is that the tariffs are working. Economic growth is up, inflation is under control, many of the tariffed industries are enjoying strong recoveries in output, profits, and employment. And as optimism spreads across manufacturing, other manufacturing sectors are also enjoying better growth than they’ve seen in years.

There is such constant onslaught of criticism of tariffs, and “warnings” about how they will damage the US and world economy that I can’t blame anybody for believing tariffs are bad. But the truth is that if you look at the evidence, tariffs are contributing to the growth of our economy this year.

In the July to September quarter, growth in inflation-adjusted GDP (the broadest measure of US economic activity) came in at 3.5 percent. That’s far better than most economists expected a year ago. Last Thursday, the Commerce Department said consumer spending was up a strong 0.6 percent in October. That’s good, but even more stunning was the data from web software firm Adobe, which said that online consumer sales were up 26.4 percent in the Black Friday kickoff to the holiday season. Economists and retailers expect a strong holiday selling season this year. That’s closely related to the low unemployment rate and the fact that wages have now begun to rise slightly faster than inflation.

But more important than the US consumer is the US business sector, because the business sector is the source of the wages and profits that pay for everything else in the economy. The Trump tariffs, combined with other policies, have triggered an economic boom in the manufacturing sector. Manufacturing jobs are up 296,000 compared with a year ago, as we explain in detail in this article. CPA members who run manufacturing companies tell us that demand for their products are up in a broad range of industries, everything from heavy construction machinery to tiny medical devices. The closely-watched PMIs (Purchasing Managers Indexes) show broad optimism right across manufacturing.

The tariffs have contributed to this growth directly and indirectly. Directly, we’ve catalogued some 11,000 US jobs that are being created by companies in the four tariffed industries, and that’s not including any of the Section 301 industries. Since that 11,000 tally in August, more investments and jobs have been announced, like the massive $1.5 billion steel plant to be built by Steel Dynamics, which will create some 600 new jobs in the southwest. Solar Power World lists a dozen solar companies now investing in US production of solar modules.

But more important than the direct effects are the indirect effects on confidence, on the “animal spirits” in the business community. The Trump tariffs seem to have ignited a feeling in the manufacturing sector that US manufacturing can come back, that finally somebody cares about manufacturing. One of our CPA members, a maker of consumer tools sold in Home Depot, complained to me back in April that steel tariffs would make his key raw material more expensive and enable the Chinese to steal what remains of his market. A few months later, the Section 301 action slapped a 10 percent tariff on Chinese hand tools, scheduled to rise to 25 percent on January 1st. Now my toolmaker friend is a happy camper. His last message to me was that it’s important to keep those tariffs on for at least a year or two, so retailers, consumers, and Chinese exporters all understand that the US no longer expects to leave its door open for state-subsidized foreign competition to take all the business.

But how can tariffs be good, I can hear you wondering, when every economist says they are bad? An economist myself, I can tell you there are two fundamental truths about economists: one, they rarely agree about anything, and two, when all of them do agree about something, it is inevitably wrong.

The Dog That Didn’t Bark

Economists have three main critiques of tariffs. They argue that tariffs shut out foreign producers who can makes goods more cheaply and that’s bad for efficiency. But we’ve learned in the last twenty years that when we throw Americans out of work and shut down whole industries, those unemployed Americans don’t move into more efficient or productive jobs. They languish in low quality jobs, or leave the workforce.

But, economists claim, tariffs will raise prices and that will hurt economic growth. Well the tariffs have been in place for almost a year now and inflation is so low you have to squint to see it. We published some research looking in detail at the price effects of tariffs and we found that most product prices are not rising, and even when they are, it’s not hurting economic growth. Published public company reports show it. As for broad consumer inflation, last week’s core consumer price deflator for October came in at just 1.8 percent. Even I was surprised at how low that was. Inflation, to quote Sherlock Holmes, is the dog that hasn’t barked.

Finally, economists put on their save-the-world hat and say the US must show political leadership to the rest of the world by running down our own industries and running a huge trade deficit as we buy their goods. This is to dance around the Golden Calf of Free Trade. Or as Canadian psychologist Jordan Peterson said in a comment aimed at teenagers but applies equally well to American economists: “If you can’t clean up your own room, who the hell are you to give advice to the rest of the world?”

At CPA, we built an economic model looking at the effects of the tariffs on the US economy from 2018 through 2021. We found that the tariffs boosted US economic growth, adding $9 billion to GDP this year. Further, our growing economy leads to growing US imports each year. In other words, by boosting our own economic growth, we buy more goods from our trading partners, not less.

The truth is that the US economy has always been a domestically-driven economy. Exports account for only some 12 percent of our GDP. The great century of American economic growth, 1870 to 1970, was based entirely on making our own workers well off enough to buy our own production. That is the secret of US economic growth.

In short, the tariffs are working. And for the American economy, the best way to help others is to help ourselves.