Summary

- Global supply-chain crises, over-dependence on foreign production and government stimulus best explain the current inflation problem. Policy makers should learn from current crises and enact policies to reduce our strong dependence on unreliable foreign suppliers.

- Tariffs can cause a one-time rise in prices, but they don’t cause persistent month-after-month high rates of inflation such as what we are seeing today.

- Tariffs can have real beneficial effects on the economy, including helping grow the domestic supply chain and create jobs. Increased domestic production could have helped moderate recent inflationary shocks and supply chain shortages.

- This article outlines eight major ways our dependence on foreign production has contributed to the global supply-chain crises and high inflation.

- The underlying reasons for inflation reflect a systemic U.S. ambivalence over fostering domestic supply chains for consistency of domestic supplies and to moderate price hikes.

Since the onset of the COVID pandemic in 2020, U.S. policy makers have been concerned with the impact that the deep economic slowdown would have on inflation. These fears came to fruition as COVID led to a series of economic events that drove up inflation. Inflationary pressures came from supply chain shortages, changing demand for services vs. goods, COVID protocols that kept people at home, government stimulus, and a slow recovery/vaccine adoption rate. The ongoing crisis in Ukraine then spiked oil prices globally. Yet despite these tremendously difficult events, the political conversation has turned towards Donald Trump’s tariff policies, enacted years ago in 2017-2019. This should outrage voters; this mindset demonstrates an avoidance of the true cause of the current inflation problem and ultimately the impact that inflation has on households and firms. Effectively, the conversation is trading the chance to address the real issues for cheap political points against tariffs.

This ambivalence is not new, however, in fact it’s part of the reason we are suffering in these current crises. Decades of policies that favor multinational corporations and cheap prices have hollowed out U.S. manufacturing capabilities (not to mention high paying jobs with it). These policies not only shut down a main source for real wealth for many Americans but are also myopic and unrealistically optimistic: low prices rely on the good behavior of countries like Russia and China (whom we have no reason to trust). But now, the proverbial chickens have come home to roost. Recent events have demonstrated that we cannot rely so heavily on foreign production. We are paying the price now for the low prices we once enjoyed and sold-out millions of good jobs for. Policy makers should learn from these events and enact industrial policies including tariffs that will strengthen the U.S.’s ability to produce here at home.

Why tariffs don’t explain the current inflation spike

The political debate right now is whether removing the section 301 (Trump tariffs), which occurred 2017-2019, will reduce inflation. For this to be possible, one must accept that the tariffs enacted years ago are responsible for current inflation. The problem is that tariffs are not a monetary policy tool, they are an industrial policy tool that has real output effects on U.S. firms, workers, and investment.

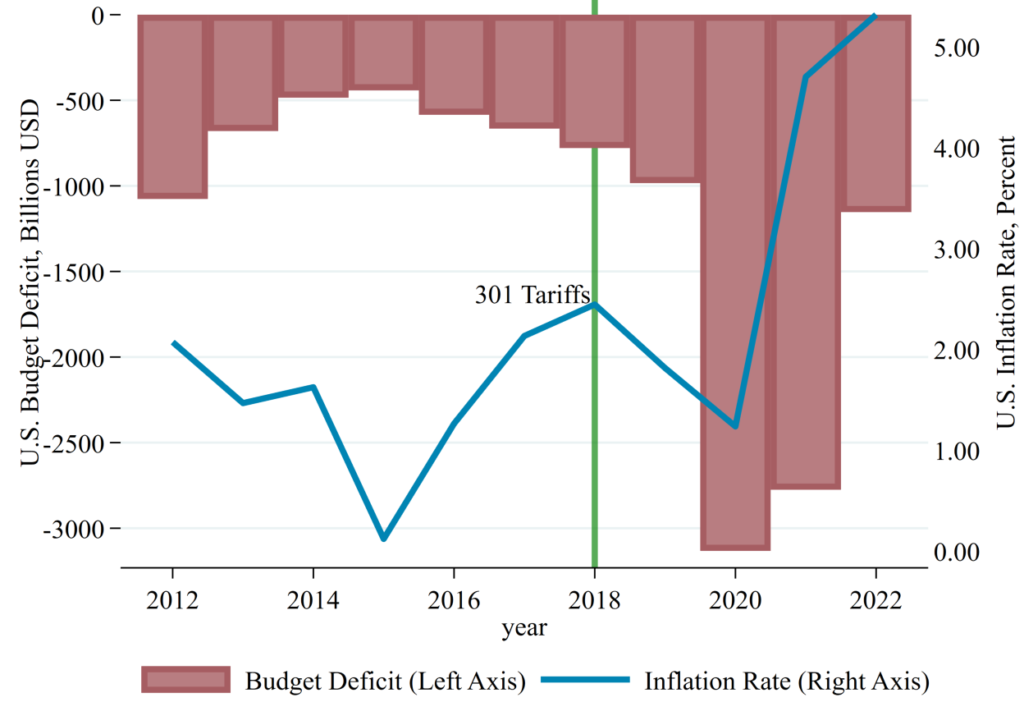

A tariff is a one-time price increase (tax) on imports. A tax on importers would raise prices, forcing importers and exporters to adjust to the price change. Some of this tax would be spread between foreign exporters and some by U.S. importers who then decide how much of the price increase to pass onto consumers if any. Broadly speaking the latter is what anti-tariff pundits mean whey they say tariffs cause inflation. However, this mechanism doesn’t explain current and dramatic high rates of inflation. Inflation is a change in the price level over a given period of time, typically reported in months or one year. We would not be easily concerned about inflation today over a one-time tariff/price increase years ago under a different administration. Figure 1 is consistent with this line of thought. The inflation that we are concerned with only started in March of 2021, long-after the trump tariffs were in place.

Moreover, it is worth pointing out that tariffs are really only directly passed onto U.S. consumers when applied to final rather than intermediate goods and in markets where the buyers have little market power (the U.S. has one of the most dominant consumer markets in the world). The assertion that tariffs are passed fully onto consumers is very unlikely, especially for products with complex supply chains such as steel.[1]

Figure 1 shows the inflation rate since 2012. There are a few very clear observations: (1) there was no obvious jump in prices in the years following the trump tariffs, (3) the inflation rate increased dramatically after the U.S. government provided 5 trillion dollars in stimulus spending (one contributor to inflation, discussed next), and most importantly (4) the high rate of inflation only happens after the COVID-19 shock, implying that COVID is the best explanation for the current inflation.

Figure 1: U.S. Deficit and Inflation Rate, 2012-2022

Source: U.S. Bureau of Labor Statistics, Federal Reserve Economic Data, and Congressional Budget Office for 2022 deficit forecast

There are several compelling reasons to explain the current inflation problem, all of which surround economic impact of COVID and our level of global dependence

Several unprecedented economic events contributed to the current level of inflation. Most of the effects are secondary effects caused by COVID-19.

(1) Chinese Supply Chain-The U.S. relies on imports from China for a large share of its goods, including critical goods such as pharmaceuticals and batteries. COVID-19 slowed down production in China and the U.S.-China supply chain. Even now, China’s new zero-tolerance COVID policy has shut down many factories, resulting in global shortages and higher prices.

(2) Shipping Shortages-As a result of COVID, shipping companies have reduced their shipping frequency to save costs. Facing changes in demand for global merchandise trade and supply disruptions, sailing schedules were consolidated to lower costs. However, as demand for global merchandise picked up, shipping companies were not at capacity to meet this demand, resulting in further supply shortages and higher prices.[2]

(3) Largest Stimulus in U.S. History-To help reduce the negative effects of COVID, the government has spent $5 trillion on COVID recovery aid. Nearly $2 trillion of this went directly to individuals to cover unemployment benefits and direct payments up to $600 per week to pay for food, rent, and other necessities.[3] Figure 1 shows how the inflation rate picked up notably after the major COVID stimulus began in 2020.

(4) Shift in Demand: COVID resulted in widespread changes in demand for different types of goods and services, leading to shortages and inflation in many sectors. While demand for services such as restaurants declined with COVID protocols, demand for other goods such as toilet paper, medical products (masks, wipes, sanitizers), lumber, automobiles, bicycles[4], some types of real estate, increased.[5] Overall, rising demand coupled with a reduction in global supply contributed to high prices for many goods. The greater was our dependence on foreign sources of supply for these goods, the greater the shortage and the higher the inflationary impact.

(5) Restricted Workforce-COVID had a profound effect on the supply and utilization of labor. First, sickness and COVID health protocols (such as social distancing and testing) reduced the productivity of workers, which contributed to higher prices. Second, workers with families were forced to stay home while young children were not allowed to attend school. Workers that were fortunate enough to work from home struggled to maintain the same level of productivity. Overall, COVID-19 put pressure on the work force that contributed to reduced supply and higher prices.

(6) Great Resignation-An unexpected outcome of COVID was a re-bargaining of the labor market. COVID caused many job losses and individuals were able to sustain their livelihoods with the help of unemployment benefits and or stimulus checks. As demand recovered, workers were still reluctant to return to work and demanded higher wages.[6] As a result of the slow return and higher wages, prices increased by 1.1 percentage points, according to the Chicago Fed.[7]

(7) COVID Recovery Fell Short-Despite the release of several safe COVID-19 vaccines, many Americans chose not to vaccinate. A smaller than expected adoption rate has exacerbated inflationary pressures by keeping COVID protocols in place, maintaining high sickness and death rates, and limiting production.

(8) Russian War in Ukraine-The most recent crisis in Ukraine has also contributed to higher prices. Russia is a major exporter of oil globally. Uncertainty with the war and economic sanctions have helped push up prices, where oil have increased by 23% since the beginning of 2022.[8] Russia is also a large exporter of nickel, contributing to the now soaring Nickel prices since the invasion.[9]

The underlying reasons for inflation are in part due to a systemic U.S. reluctance to opt for a domestic supply chain in basic and essential goods

The supply side effect of global disruptions could have been mitigated with forward looking industrial and trade policies. For several decades U.S. trade policy has favored the profits of MNC’s, effectively working against-U.S. producing firms and workers. The free trade policies adopted by the U.S. in the past 25 years alone have resulted in the shutdown of 70,000 factories, a loss of over five million manufacturing jobs[10], and positioned the U.S. to hold less than 70% of its own domestic market share for manufactured goods. [11] While policies trade U.S. jobs and ownership for cheaper prices, the U.S. International Trade Commission found the benefit of these policies to be very small, with GDP increasing by only 0.5% over the past few decades.[12]

Other countries adopt a wide range of industrial policies to protect their industries, forcing firms compete with the anti-competitive practices and resources of countries rather than firms. Legal remedies for firms against these practices are expensive, time consuming (many close down before), and result in retaliatory and extortionary practices foreign competitors.

The goal of tariffs and other industrial policies is to create real positive impacts on the economy including helping the domestic supply chain grow—a process that would reduce inflation by creating more sources of supply close by and more competition. While tariffs are not the solution for every industry, they can be helpful to some and critical to many.

Policy makers should learn from the experience of real-time crises. To build a strong workforce and supply chain, we cannot adopt policies that prioritize the cheapest prices for short-term gain. We are paying higher prices now due to these types of myopic policies that favored lower prices above all other consequences.

Conclusions

The current inflation problem can be explained by our heavy reliance on foreign production that has been exposed with recent global crises. The solution is not to attack our domestic firms and increase our foreign dependence by dropping tariffs. Doing more of the same thing and hoping for different results is the definition of insanity. We need to address the systemic ambivalence to a strong domestic supply chain and instead adopt policies that put domestic U.S. firms and workers ahead of our foreign counterparts. Industrial policies such as tariffs are tools to help provide economic incentives for firms to grow domestically. The lesson of the current global crisis is that we should not continue to adopt policies that position us to disproportionately rely on foreign production.

References

[1] For a detailed explanation see Amanda Mayoral, “Tariff Incidence in the Real World: Why Consumers (Mostly) Didn’t Pay the Steel Tariffs”, Coalition for A Prosperous America, October 20, 2021, https://prosperousamerica.org/tariff-incidence-in-the-real-world-why-consumers-mostly-didnt-pay-the-steel-tariffs/

[2] U.S. International Trade Commission, “The Impact of the COVID-19 Pandemic on Freight Transportation Services and U.S. Merchandise Imports”, 2021 https://www.usitc.gov/research_and_analysis/tradeshifts/2020/special_topic.html

[3] Alicia Parlapiano and Deborah B. Solomon, Madeleine Ngo and Stacy Cowley, “Where $5 Trillion in Pandemic Stimulus Money Went”, The New York Times, March 11, 2022 https://www.nytimes.com/interactive/2022/03/11/us/how-covid-stimulus-money-was-spent.html

[4] James Witts, “Pandemic vs Brexit – why have bikes got more expensive and harder to find?”, Bike Radar, January 22, 2021, https://www.bikeradar.com/features/long-reads/pandemic-brexit-bike-prices/

[5] Grace Brombach, “1 Year Later: Comparing Pre-Pandemic Prices To Today’s On Amazon”, U.S. PIRG Education Fund, January 2021

[6] Kim Parker andnd Juliana Menasce Horowitz, Majority of workers who quit a job in 2021 cite low pay, no opportunities for advancement, feeling disrespected”, Pew Research Center, March 9, 2022, https://www.pewresearch.org/fact-tank/2022/03/09/majority-of-workers-who-quit-a-job-in-2021-cite-low-pay-no-opportunities-for-advancement-feeling-disrespected/

[7] Renato Faccini , Leonardo Melosi , Russell Miles, “The Effects of the “Great Resignation” on Labor Market Slack and Inflation”, Federal Reserve Bank of Chicago, Chicago Fed Letter, No. 465, February 2022, https://www.chicagofed.org/publications/chicago-fed-letter/2022/465

[8] Jeff Sommer, “Russia’s War Is Raising Gas Prices and Roiling Financial Markets”, The New York Times, March 10, 2022, https://www.nytimes.com/2022/03/10/business/russia-ukraine-war-gas-prices.html

[9] Emily Pickrell, “Russia-Ukraine War Helps Drive Nickel Prices, EV Headaches”, Forbes, March 31, 2022, https://www.forbes.com/sites/uhenergy/2022/03/31/russia-ukraine-war-helps-drive-nickel-prices-ev-headaches/?sh=24c3caf557cd

[10] Robert E. Scott, “We can reshore manufacturing jobs, but Trump hasn’t done it”, Economic Policy Institute, August 10, 2020, https://www.epi.org/publication/reshoring-manufacturing-jobs/

[11] Reshoring Index, Coalition for a Prosperous America, https://prosperousamerica.org/reshoring-index/

[12] U.S. International Trade Commission, “Economic Impact of Trade Agreements Implemented Under Trade Authorities Procedures”, June 29, 2021, https://www.usitc.gov/press_room/news_release/2021/er0629ll1788.htm