Key Points:

- This article reviews the last five years of federal government manufacturing policy, including tariffs and tax credits, finding positive effects on rebuilding U.S. manufacturing.

- Single-country tariffs on imports from China have reduced U.S. dependence on China, with modest impact on reshoring U.S. manufacturing.

- Global tariffs such as those on steel and washing machines have successfully reduced imports, rebuilt U.S. production, created jobs, and advanced technological progress.

- Tax credits have triggered an investment boom in autos, EV batteries, semiconductors, and renewable energy equipment manufacturing.

- Tariffs stimulate domestic production and reduce import penetration at no cost to the taxpayer. Contrary to media campaigns, the alleged inflationary effects of tariffs were short-lived or nonexistent.

- Tax credits have the advantage of stimulating immediate investment plans by U.S. companies in the targeted industries, but at significant cost to the taxpayer.

- All these sets of policies suffer from the lack of publicly-agreed objectives, which makes it difficult to judge their success or take a view on how long they should continue.

In early 2018, the first so-called “Trump tariffs” came into effect, on solar panels and steel. These were followed by tariffs on other products and a wide-ranging set of tariffs on imports from China. In January 2021, Joe Biden took office as President. The Biden administration has enacted a wide-ranging set of pro-American manufacturing measures, using tax credits instead of tariffs.

Five years on, it is a good time for a preliminary assessment of the results. They are much better than media coverage might lead one to believe. The tariffs and the tax credits have boosted industrial investment, reshored production in some industries, and promise to reshore billions of dollars more in production in electric vehicles and renewable energy. They have created thousands of good manufacturing jobs, and they have broken the cycle of U.S. spending enriching China. They have supporters on both sides of the political aisle. U.S. construction spending on manufacturing facilities reached an all-time high last year, at $107 billion. While it is too early to call this a manufacturing boom, the early signs are highly positive.

Let’s take a closer look at the policy measures involved. We can group them into three buckets: single-country tariffs, global tariffs, and industrial tax credits. We will examine each in turn.

In 2018 and 2019, President Trump implemented Section 301 tariffs ranging from 10% to 25% in four separate lists on imports from China. About half of China’s $500 billion of annual shipments to the U.S. were impacted. The immediate result was to depress U.S. imports from China. The effect is somewhat covered up by the surge in global imports that began in late 2021, at the end of the COVID shutdowns. Between the pre-tariff year of 2017 and 2022, U.S. goods imports from the world grew 39%, from $2.34 trillion to $3.25 trillion. Imports from China grew by only 6%, reaching $537 billion last year. To put it another way, the Section 301 tariffs reduced China’s role in U.S. trade from 21.6% of U.S. imports to only 16.5% last year. Roughly $164 billion worth of imports was diverted from China to other source nations.

Table 1 below shows some examples from U.S. Census import data. In most categories we looked at, the China share of U.S. imports fell over these five years. In luggage, the China share fell by more than half, from 58.2% to 24.5%. In computers, one of the largest categories of imports from China, the China share fell by 15 points, to 44.8%. In cellphones, the China share fell by only 2.6 points, to 77.1%, but this share should fall further if Apple implements its expected shift of production to India.

The exception to the trend was in vehicles, where the China share rose slightly to reach 5.5% of world imports. That is in spite of a 25% tariff on vehicles and parts from China. The rising trend represents the determination of Chinese automakers, and some U.S. automakers such as GM, to capitalize on the shift to EVs by moving more production to China. GM and others remain determined to win large market share in the two largest auto markets, China (25 million vehicles a year) and the U.S. (14 million). The Chinese communist government has made it clear to foreign carmakers they won’t succeed in China without production there. The U.S. government has no such requirement (although the Inflation Reduction Act takes steps in that direction, see below).

Table 1. U.S Imports From World and From China, 2017 and 2022, Show Reduced Dependence on China

| Total Import Value ($B) | China share of World Total | ||||||

| Commodity | HTS Code | Source | 2017 | 2022 | % Change | 2017 | 2022 |

| All imports | na | World | $2,339.6B | $3,246.4B | 38.8% | ||

| na | China | $505.2B | $536.8B | 6.2% | 21.6% | 16.5% | |

| Luggage, handbags, wallets, etc. | 4202 | World | $10.8B | $13.6B | 25.9% | ||

| 4202 | China | $6.3B | $3.3B | -47.1% | 58.2% | 24.5% | |

| Apparel, knit or crochet | 61 | World | $44.2B | $57.8B | 30.8% | ||

| 61 | China | $14.3B | $12.7B | -11.5% | 32.3% | 21.9% | |

| Apparel, not knit, etc. | 62 | World | $36.6B | $42.5B | 16.2% | ||

| 62 | China | $13.B | $9.4B | -27.4% | 35.5% | 22.2% | |

| Tools, cutlery, etc. | 82 | World | $9.8B | $12.1B | 23.2% | ||

| 82 | China | $3.7B | $3.9B | 5.7% | 37.5% | 32.2% | |

| Computers, etc. | 8471 | World | $83.9B | $122.3B | 45.8% | ||

| 8471 | China | $50.4B | $54.9B | 8.9% | 60.0% | 44.8% | |

| Cellphones | 8517-12, -13 | World | $56.0B | $65.1B | 16.4% | ||

| 8517-12, -13 | China | $44.6B | $50.2B | 12.7% | 79.7% | 77.1% | |

| Vehicles | 87 | World | $289.6B | $322.3B | 11.3% | ||

| 87 | China | $14.6B | $17.7B | 20.8% | 5.1% | 5.5% | |

| Furniture, bedding, etc. | 94 | World | $62.4B | $77.0B | 23.3% | ||

| 94 | China | $31.9B | $25.3B | -20.7% | 51.1% | 32.9% | |

| Source: U.S. Census, CPA calculations | |||||||

The Section 301 tariffs have materially reduced U.S. dependence on China in many product categories. They are also weakening the Chinese economy. The process of all the world’s manufacturing moving to China has been interrupted.

In many cases, China is still involved in the production coming to the U.S. Apparel imports from China have fallen, but imports from Southeast Asia are still likely to use fabrics, either cotton or synthetics, made in China. In an unknown number of cases, straight transshipment, i.e. repackaging of Chinese goods in a third country for shipment to the U.S. (illegal under U.S. law) may be involved. But in any case, the tariffs are adding to China’s costs. They are also laying the groundwork for the economic development of other nations, some of which are not especially friendly to China. Vietnam’s GDP surged 8% last year, to $409 billion. Shipments to the U.S., at $127 billion or over a quarter of the Vietnamese economy, are a major driver of that growth. Vietnam is a historic enemy of China. We are building up an adversary to China as regards control of the South China Sea, but we are doing so at the expense of U.S. manufacturing jobs.

In terms of manufacturing in the U.S., the boost to U.S. manufacturing revenue and jobs from the China tariffs has been less than many had hoped for. Apple is moving large parts of its supply chain not to the U.S., but to India, with the rumored goal of assembling a quarter of its output of cellphones, computers, and accessories in India. Dell, the third largest computer maker in the world, is rumored to be reorienting its supply chain so that all computers and components going into the U.S. market will not be made in China. Malaysia, Vietnam, India, and Mexico will all likely benefit with manufacturing investment and jobs from the 301 tariffs.

Reshoring Production to the U.S.

However there have also been examples of U.S. manufacturers moving from China back to the U.S. Generac, a maker of power generators, moved some production out of China and to a new factory in Trenton, South Carolina. That factory opened in 2021 and is set to employ up to 750 employees. Furniture-makers like Williams Sonoma (owner of retailers Pottery Barn and West Elm) reacted to the tariffs by moving some production back to the U.S. According to a survey last year carried out by investment bank UBS and reported by Bloomberg, 90% of U.S. executives surveyed were planning to move production out of China and 80% of them were considering moving some production to the U.S.

Global Tariffs Drive U.S. Investment

The global tariffs enacted by the Trump administration in 2018 and 2019 delivered a much stronger boost to U.S. production than the 301 China-specific tariffs. Two cases illustrate the positive effects of global tariffs: washing machines and steel.

The Section 201 washing machine tariffs were implemented in 2018, starting at 20%, and rising to 50% above a total of 1.2 million units per year. The two major South Korean washing machine manufacturers, Samsung and LG Electronics, reacted by announcing plans to build factories in the U.S. to produce tariff-free for the U.S. market. Samsung chose Newbury, South Carolina for its location, while LG chose Clarksville, Tennessee. Today, each factory employs about one thousand people producing, washers, as well as dryers, and related products. Last year, a South Carolina economist published a study estimating that the Samsung plant created over 1,300 indirect jobs in the state, in addition to the 1,074 employees at the Samsung plant.

The tariffs gave a boost to the U.S. appliance industry in terms of output, employment, and investment. In addition, it accelerated competition, with the two Korean makers on the ground here. U.S. appliance makers including Whirlpool and Chinese-owned GE Appliances have been forced to focus more aggressively on competitiveness thanks to the Korean competition.

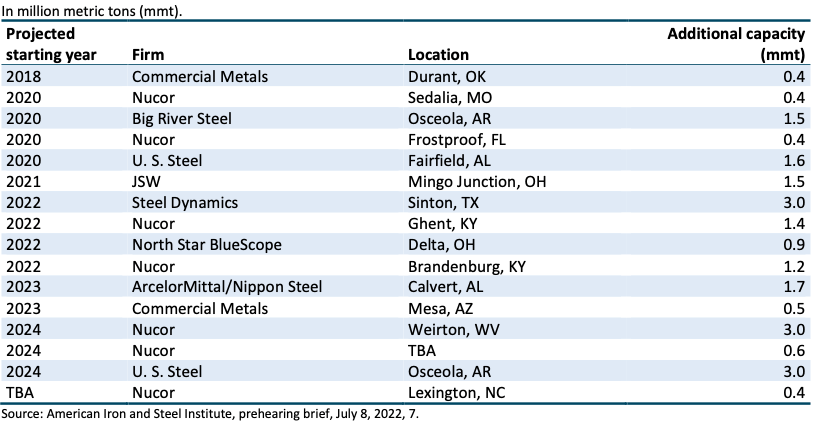

The results in steel have been even more impressive. A study[1] recently published in March by the U.S. International Trade Commission used economic modeling to evaluate the impact of the Section 232 steel tariffs. The USITC study found that the steel tariffs cut import levels by 24% and raised steel capacity utilization to 80%. Both were primary goals of the tariffs. Capacity utilization at 80% or better is needed to make the industry sufficiently profitable to continue investing in new facilities and product improvement.

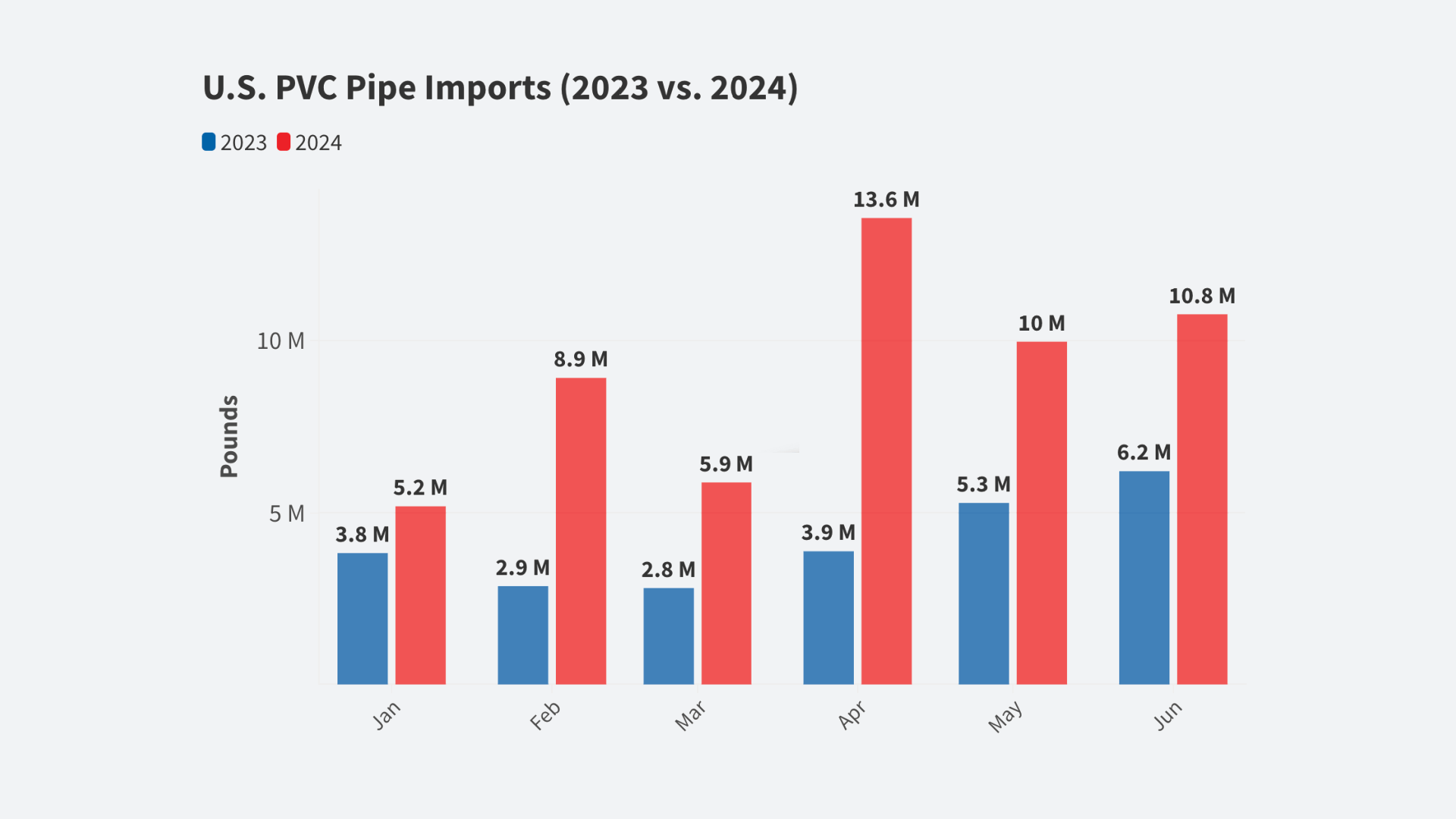

The steel industry responded to the tariffs with a wave of announcement of new facilities, some of which are already producing steel and others are under construction. Table 1 shows the 16 new facilities announced since 2018, per the USITC report.

Table 2. Steel facilities announced since 2018. Source: USITC, March 2023

The new facilities incorporate the latest technologies to make lighter, stronger steels. These improvements are valuable for both the military and the civilian economy. Further, they increase the share of steel made via the cleaner electric arc furnace technology. The U.S. steel industry is already one of the cleanest and least polluting in the world. The new investments make the industry even cleaner, as well as more efficient.

Few people outside the steel industry appreciate how well-paid the steel industry is. SEC filings show that the average pay of a U.S. steelworker at a major steel company in 2021 was just over $126,000 a year. Table 3 shows the details by company. College degrees are not required for most jobs in a steel company. Manufacturing industries, and especially manufacturers of durable goods like steel, pay far better wages to non-college degree holders, who make up a majority of the U.S. labor force.

The national security reasons for enacting the steel tariffs were obviously very important. But equally important is the economic logic: the prime way to drive economic growth is to drive the growth of high-wage industries. The leading technological innovators in the steel industry, Nucor and Steel Dynamics, pay high wages because the companies achieve high productivity per employee. They also follow more egalitarian management techniques, such as profit-linked bonuses paid to all staff. The steel tariffs created stability in the industry, enabling the other steel companies to move towards the techniques practiced at the two industry leaders.

Table 3. Median Pay at Major U.S. Steel Companies Are All in Six Figures

| Company | No. employees | Median pay 2021 |

| Nucor | 26,120 | $ 142,635 |

| Steel Dynamics | 10,729 | $ 126,721 |

| US Steel | 23,141 | $ 109,369 |

| Cleveland-Cliffs | 25,535 | $ 125,396 |

| Industry | 85,525 | $ 126,491 |

| Source: SEC company filings | ||

Tax Credits Focus on Renewable Energy and EVs

The Biden administration opted for tax credits as a less controversial policy tool than tariffs, but with the same objective of stimulating U.S. manufacturing. Nevertheless, the new administration has maintained nearly all the Trump-era tariffs. It has kept to an anti-China position, reinforcing a growing consensus within the U.S. that right across the political spectrum, that the belief that China would become more democratic with economic prosperity has failed. Today China is increasingly seen as an adversary, not a partner.

The tax credits enacted by the Biden administration in last year’s CHIPS Act and Inflation Reduction Act (IRA) have kicked off a huge amount of investment in manufacturing production. The CHIPS Act allocated $39 billion worth of tax credits spread over ten years to microchip manufacturers to credit against the cost of building U.S.-based chip fabrication facilities. The credits are conditional on state or local governments also providing support, but that has been immediately forthcoming. They also require companies to put a brake on their investment in chipmaking in China.

As a first approximation, the combination of all federal, state and local credits, grants, loans, and tax abatements means that chipmaking companies can expect to pay roughly half the cost of the facilities they are now beginning to build. They get to keep 100% of the profits (if any) from these new facilities.

Chipmakers find that deal highly attractive. A rough estimate is that this has kicked off some $150 billion in investment, which could create 20,000 direct jobs. Both numbers could get larger, if companies like Micron and Samsung implement some of the bigger, 2030s-era plans they have talked about. Even in the near-term, the jobs number will likely be larger because each manufacturing job will likely spur the creation of between two to seven indirect jobs. This will be a boon for Ohio, where Intel is building a large fab complex, upstate New York (Micron), and Arizona (TSMC).

Equally important, this will stimulate interesting new technologies, such as the silicon carbide chips used in EV batteries that are being pioneered by Wolfspeed.

The IRA tax credits passed by Congress last summer have initiated a boom in investment in solar energy equipment manufacturing. The two largest U.S. producers of solar modules, First Solar and Hanwha Q Cells, have each committed to billion-dollar investment programs to create new solar module production facilities in Ohio, Georgia, and Alabama. Other producers are also investing and boosting production. Thousands of jobs will be created, with indirect jobs as a multiple of the direct jobs at the solar companies. Industry analysts forecast that by 2030, the U.S. could be producing the majority of solar modules it consumes, and half of the solar cells that go into those modules.

The solar and chips programs are both dwarfed by the potential impact of the IRA’s provisions for autos and batteries. The tax credits, both consumer-directed and producer-directed for EVs, the mining of critical minerals, and the production of EV batteries have spurred ambitious plans by automakers and others for new facilities. Late last year, we estimated the promised investment at $22 billion, but that now appears too conservative. Census data shows that annual construction for manufacturing grew 36% last year to $107 billion, an all-time high for this data series. New projects include a Hyundai facility in Georgia to produce batteries and EVs that will employ 8,000, and a Panasonic battery production facility that will employ 4,000. GM, Ford, Chrysler (now Stellantis), and Tesla also have ambitious plans to expand U.S.-based EV and battery production.

Conclusion: Comparing Policy Tools

The U.S. now seems to have begun a journey towards a new priority on manufacturing production within our borders. The Democrats favor the use of tax credits, while the Republicans, or at least a growing number within the congressional Republican Party, prefer the use of tariffs. Nevertheless both parties are coming around to the view that U.S. manufacturing is important for geostrategic and economic reasons. Robert Lighthizer, who was Trump’s U.S. Trade Representative, and Katherine Tai, now Biden’s Trade Representative, explain their reasoning differently, but both have pushed forcefully for the reshoring of U.S. manufacturing.

The economic indexes do not yet show a significant increase in U.S. manufacturing output. Our own Domestic Market Share Index, which removes the effect of the business cycle, shows only a slight uptick in domestic manufacturing share in 2022. Offshoring continues in some high-volume sectors such as pharmaceuticals and electronics. There are unfortunately efforts, notably by Janet Yellen’s Treasury, to water down the pro-American provisions of the IRA. But if current investment plans are fulfilled, and followed by further action on strategic sectors (a term that lends itself to very broad definition in a nation with a $1 trillion trade deficit), then there is reason to expect a historic upturn in manufacturing output.

Single-country tariffs, specifically the Section 301 tariffs on China imports, have delivered reduced U.S. dependence on China and are weakening the Chinese economy, since much of its growth in the last two decades was based on selling goods into the U.S. However the benefits in reshoring U.S. production have been limited. Most U.S. multinationals, not to mention Chinese or other multinationals, prefer to move production to low-wage nations elsewhere in the world and bypass the Section 301 tariffs. Nevertheless there have been some significant wins with U.S. companies moving production back home, and also some wins in U.S. carmakers planning to escalate production in China before 2018 who put those plans on hold. Of course, the widespread supply chain snafus during and after the COVID pandemic, and China’s ruthless closures of cities under its Zero-COVID policy also contributed to a rising wave of companies leaving China, or at least dividing production between China and one or more additional locations. Security of supply is today as important, or more important, than low cost.

Global tariffs have delivered clear success in reshoring production to the U.S. They have created good-paying jobs and investment, especially in poorer regions of the country. Less advantaged groups have job opportunities that were not available before the tariffs. The benefits of the new facilities extend beyond the new facilities and their employees, to regional increases in pay levels, investment in new roads, more local tax revenue, and other benefits.

It is still early days, but the Biden tax credits (CHIPS and IRA) promise to deliver a large boost to U.S. manufacturing investment, production, and jobs. However, this comes at a significant cost to the U.S. taxpayer.

In comparing the different policy tools, tariffs and tax credits, our first observation is that both tools lack a clear statement of end-objectives. Congress is very reluctant to identify objectives because members of Congress, like all elected officials, do not like to be held to deliver measurable results. On the other hand, the Department of Commerce document on Section 232 steel tariffs, published in 2018, was a model in identifying clear results, which have been achieved. For the Biden tax credits, multiple objectives have been proclaimed, notably addressing climate change, but no specific, measurable results were announced.

Tariffs have an advantage of intellectual consistency: to rebuild the U.S. manufacturing base, be it for geostrategic or economic reasons, tariffs provide a straightforward insulation against low-priced foreign goods. They are also consistent with U.S. history. Our economic growth from 1816 to 1945 took place under the protection of high tariffs. Moreover, it is clear that, when faced with a high U.S. tariff, foreign companies are ready to invest in U.S. production to avoid those tariffs and reach our trillion-dollar market. The presence of multiple companies producing within the U.S. guarantees vigorous competition and prevents excessive price increases. In addition, tariffs bring revenue to the federal government. Despite conventional economists’ yelps about tariffs and price increases during the Trump years, prices were actually restrained immediately after those tariffs. Inflation only took off in 2021 and that was due to supply chain constraints (too much import reliance) and mismanaged fiscal/monetary policy.

Tax credits have the advantage of stimulating an immediate response in investment. The Biden tax credits are mostly guaranteed for a ten-year period, and this gives companies the assurance that the credit will have a sustained effect on their financial results. Rough calculations suggest that the IRA solar tax credit doubles the operating profit margin on a solar module, a powerful inducement to companies to invest.

However, the idea of many years of subsidy to industry remains unacceptable to the majority of American voters. The CHIPS Act is perhaps the best illustration of the dilemma. Assuming Intel and Micron successfully complete the new fabs they are now building, what will their future business models look like? The two biggest markets for those chips are servers and cellphones, and both products are primarily assembled in Asia. Those chips will need to be shipped from Ohio and New York to Asia. Given that it is more expensive to make chips in the U.S. than in Taiwan or Korea, what will happen to those fabs when the CHIPS Act subsidies run out? There is no long-term plan to establish the U.S. as more competitive than those countries, nor to reshore the production of the end-products using those chips.

Nevertheless, the policy efforts of the last five years are to be celebrated as steps towards restoring U.S. manufacturing capability, with great potential to rebuild the U.S. economy, high-wage jobs, and greater equality.

[1] U.S. International Trade Commission, Economic Impact of Section 232 and Section 301 Tariffs on U.S. Industries, Publication no. 5405, March 2023