By Jeff Ferry, CPA Research Director

CPA Economic Model Refutes Alarmist Trade Partnership Study A Coalition for a Prosperous America (CPA) modeling study of the impact of the Section 232 tariffs on the U.S. economy shows minimal national macroeconomic impact of the tariffs. The study shows that U.S. GDP would fall by 8/1000s of 1 percent of GDP, or $1.4 billion. Economy-wide net job gains or losses would be negligible as the 19,000 jobs gained in the steel and aluminum sectors would largely offset any job losses in metal–consuming industries.

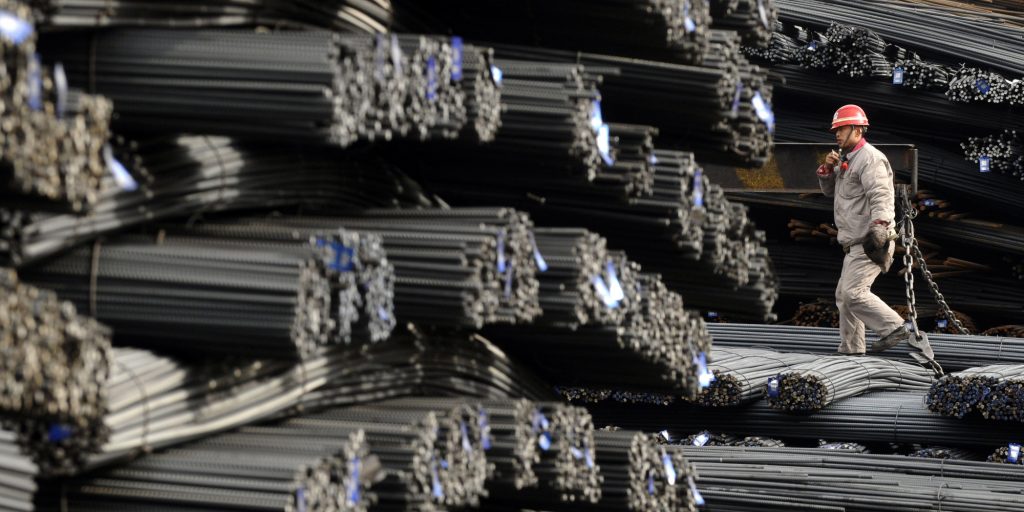

On March 1, President Trump announced his intention to adjust the level of steel and aluminum imports by imposing a 25 percent tariff on imports of steel and a 10 percent tariff on imports of aluminum. The tariff was recommended by the Department of Commerce and approved by the President due to the threat to national security arising from the weakened state of the steel and aluminum industries caused by excessive imports. The CPA study finds that the domestic prices of steel and aluminum would rise far less than the tariff rate, due to spare capacity in the U.S. industry and competition Specifically, steel prices are forecast to rise 6.29 percent and aluminum prices just 2.5 percent. These small price increases limit the effect of the tariffs on other sectors of the U.S. economy. The CPA study was carried out using the publicly available GTAP general equilibrium model and 2016 data.