“Reprinted from Tax Notes, November 27, 2017”

By Jeff Ferry, CPA Research Director

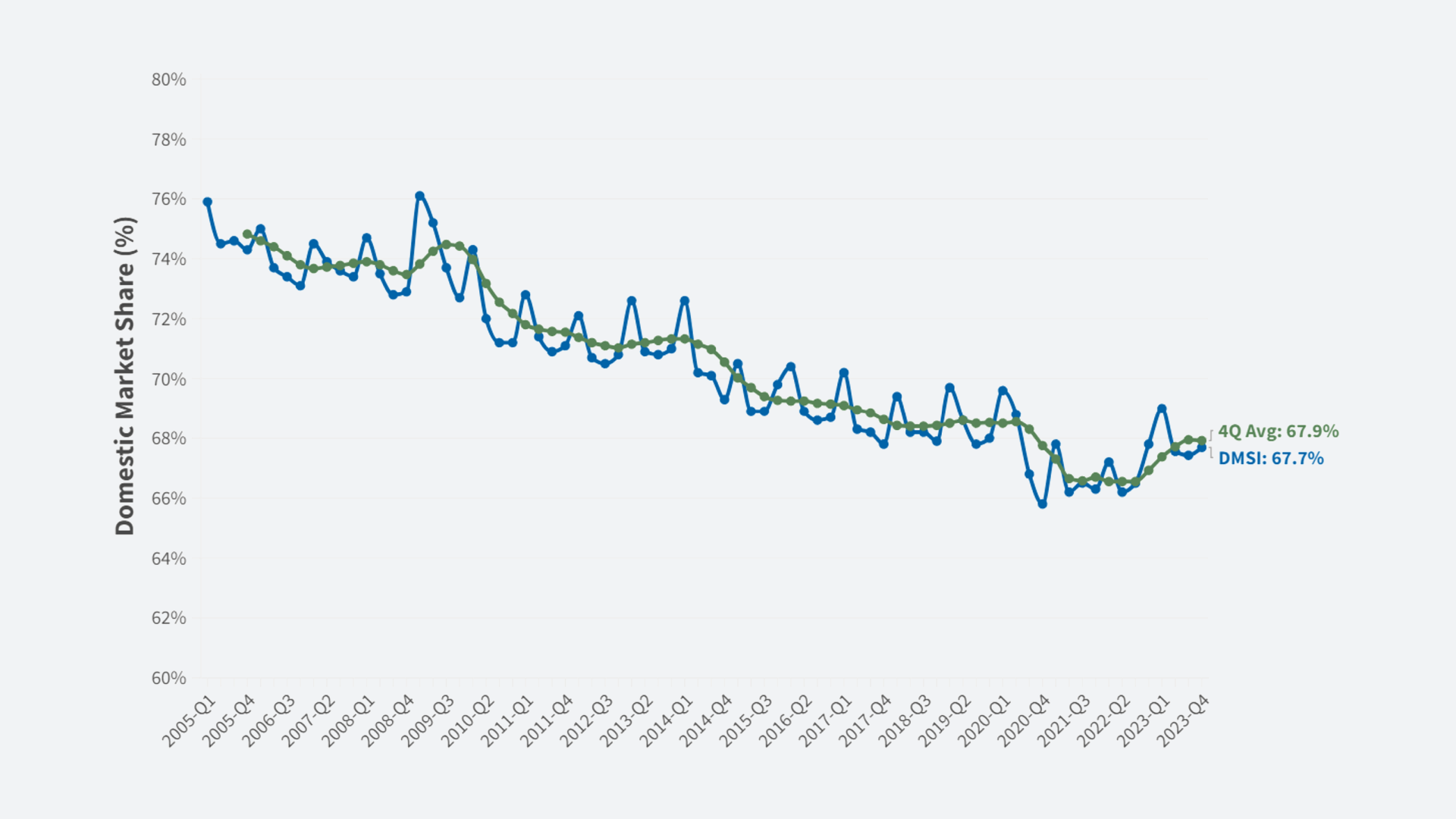

The U.S. corporate income tax system is failing to deliver for the government and taxpayers. Receipts are falling steadily as a share of corporate profits as corporations exploit loopholes to shift profit out of the reach of the IRS. Sales factor apportionment (SFA) income tax has been proposed as an alternative. I look at the merits of the SFA system and then estimate the potential receipts of an SFA system by individual analysis of 87 large, public U.S. corporations. I find that under an SFA system at the current top rate of 35 percent, tax receipts would have increased by 34 percent to $460 billion in 2016. Alternatively, the top rate could be cut by 9 percentage points to 26 percent, and the SFA system would deliver total receipts similar to those gained by Treasury last year while creating a fairer system and closing many loopholes.