40 Chinese Companies with Strategic Ties to Iran Present in U.S. Capital Markets

WASHINGTON — An alarming new report released by the Prague Security Studies Institute (PSSI) has identified 40 Chinese publicly traded companies in the U.S. capital markets which have strategic links to Iran. These companies have attracted at least $6.2 billion from U.S. investors to date. According to PSSI, “[t]hese 40 Chinese enterprises are materially advancing Iran’s strategic interests, yet they are all included in the investment products of U.S. asset management firms (e.g. Exchange-Traded Funds, etc.).”

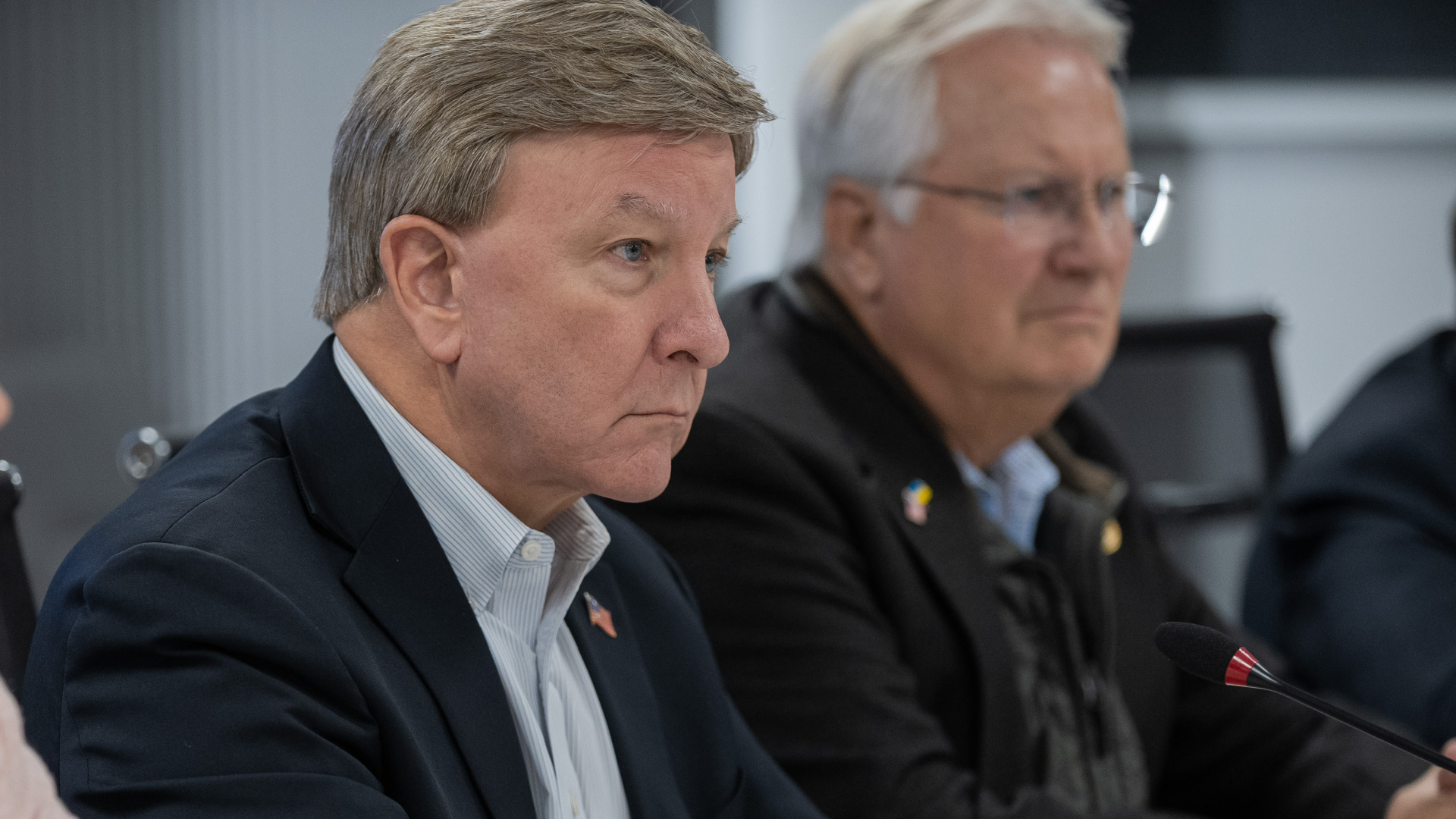

Roger Robinson Jr., Chairman and Co-Founder of PSSI and former Senior Director of International Economic Affairs for President Ronald Reagan’s National Security Council, discussed the report’s findings in an interview with Maria Bartiromo on Fox Business on January 31. PSSI released these research findings “in response to the Iranian regime’s long-standing involvement in the funding and arming of Hamas, its responsibility for the devastating attacks against Israel on October 7, and its support for the continued activities of Hezbollah, Islamic Jihad, the Houthis and other terrorist proxies.”

In the midst of an escalating Middle East conflict, the fact that this Administration and the Congress are permitting this U.S. investor underwriting of these Chinese public companies, which are largely responsible for keeping the world’s leading sponsor of terrorism a going concern economically and militarily, is unconscionable. Ronald Reagan would be appalled by this extremely dangerous, morally repugnant U.S. government and Wall Street default on their obligations to the American people.

ROGER ROBINSON, JR.

According to the report, “[o]f the 40 Chinese companies identified, 8 have ties to the Iranian military sector, 9 are involved in Iranian communications and surveillance, 21 in its oil and gas industries (including associated activity such as the shipment of Iranian oil), and 2 are engaged in Iranian infrastructure projects.”

The report finds that major U.S. asset managers are actively helping to fund these 40 Chinese companies that are facilitating Iran’s aggression in the region, including Vanguard, State Street, Dimensional, Fidelity, and BlackRock.

The report notes that “Vanguard stands out for its especially egregious involvement, as it is responsible for channeling the investments of tens of millions of American retail investors into 38 of the 40 identified companies. For example, any investor in Vanguard’s VGTSX fund (a major fund with over $350 billion in assets under management) would see their money invested in 95% of those companies identified by PSSI as having strategic ties to Iran.”

Last year, the Coalition for a Prosperous America (CPA) released a report showing that Vanguard, which has roughly $8 trillion in global assets under management, is investing the retirement and investment dollars of the American people in bad actor Chinese “A-Share” companies at a level unmatched in the U.S., including 60 Chinese companies linked to China’s military and its defense sector, as well as eight companies currently sanctioned by the U.S. government for human rights abuses in Xinjiang

As first reported by the Financial Times, “Vanguard, the world’s second-largest asset manager, is acting as a pipeline through which US investment dollars are being funneled into Chinese military companies and corporations sanctioned over human rights abuses.”

In light of these findings, CPA is calling on Congress to take immediate action to remove these 40 Chinese publicly traded companies from the U.S. capital markets (i.e., delist and deregister them) and to make it illegal for any U.S. citizen worldwide to hold their stocks and bonds (i.e., securities). The same legislative action should be applied to any other such Chinese public companies unearthed by the U.S. government. Failing to act only validates the already obvious lack of U.S. seriousness vis a vis sanctions on display toward both Iran and China, and Wall Street’s fiduciary malfeasance.

“CPA has already published research documenting the alarming extent to which Wall Street asset managers like Vanguard are investing the retirement and investment dollars of the American people in Chinese firms that have been sanctioned by the U.S. government for human rights abuses and that are helping to modernize China’s People’s Liberation Army,” said Michael Stumo, CEO of CPA. “PSSI’s report is more alarming evidence of the extent that Wall Street is funding Chinese companies that are supporting authoritarian regimes like Iran that present a direct threat to the national security of the U.S. and our allies. Congress must take immediate action to address this by making it illegal for the Chinese Communist Party to fund its malign activity via U.S. capital markets.”