Editor’s Note: “Martin Wolf, in this article, reviews Pettis/Klein’s new book “Trade Wars are Class Wars”. It is an important book and even Wolf manages to get most of it right.

The “trade wars” are not Trump tariffs but pre-existing trade imbalances. The imbalances are caused by engineered overproduction in relation to consumption in persistent surplus countries. The excess savings from surplus countries flows to deficit countries causing their currencies to rise and their consumption to increase relative to production. The US is, of course, the key deficit country largely due to our idiotic acceptance of providing central bank services to the world for free.

The real economy result is that financial elites benefit from excess savings (but don’t spend much) and working class declines in relation to the elites in purchasing power. (Thus the title which should be “trade imbalances are class wars”). Overall demand stagnates.

Core point: Causation runs from oversaving/overproducing surplus countries (China/Germany/Japan) to open economies that absorb the financial excess/glut and give rise to current account deficits. The transmission mechanism is capital flows.

If we in the US moderate capital inflows, then the transmission mechanism is broken. The way to do that is (a) take away tax-free benefits of foreigners buying US financial assets and (b) put a charge on those inflows to slow them. The goal would be to gently move the dollar down to a current account balancing price, which is probably 30% lower than it is now.

The US cannot balance trade without dealing with capital flows and exchange rates. Tariffs, subsidies and industrial strategy are fantastic, but for composition of production and trade rather than balance.”

-Michael Stumo

[comments to the article below]

[Martin Wolf | June 18, 2020 | Financial Times]

A new book looks at why global conflicts owe more to divisions within countries than between them.

“Trade war is often presented as a war between countries. It is not: it is a conflict mainly between bankers and owners of financial assets on one side and ordinary households on the other — between the very rich and everyone else.”

This encapsulates the argument of Trade Wars Are Class Wars. Its authors Matthew Klein and Michael Pettis argue that what has been happening to trade and finance can only be understood in the context of domestic pathologies in leading economies. The result has been severe global imbalances, unsustainable debt and monstrous financial crises. This story matters for everybody.

The foundation of this excellent book is the theory of “underconsumption”, proposed by the British analyst John Hobson in 1902. It returned in the 1930s in the work of John Maynard Keynes. It is, yet again, relevant.

“For decades,” note the authors, “real borrowing costs have been below long-term forecasts of real economic growth and remain around zero.” This combination of extraordinarily low real interest rates with weak global demand and low inflation is a prime symptom of underconsumption or, in modern parlance, “a savings glut”. The explanation given by Klein, economics commentator at Barron’s, and Pettis, professor of finance at Peking University’s Guanghua School of Management, is that income has been shifted to wealthy people who do not spend what they earn.

That is the overall perspective. But the relationship among national economies produces this overall picture. The crucial point is that one cannot analyse what is happening in a single economy, in isolation. Furthermore, the overall balance in goods and services is explained by savings, investment and capital flows, not by bilateral trade balances, as Donald Trump imagines.

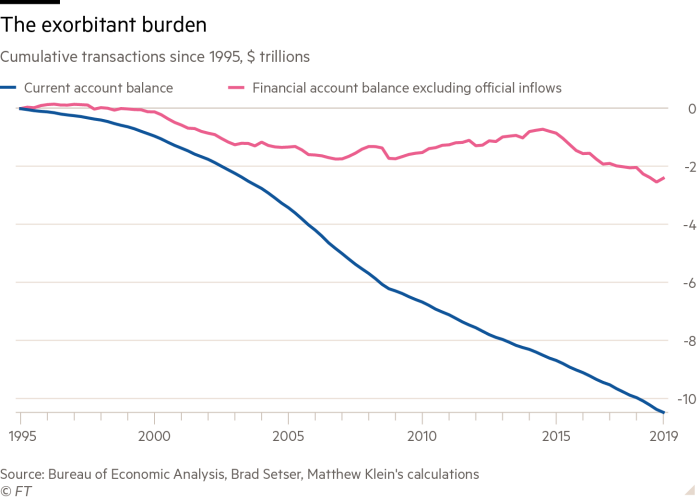

Moreover, as Klein and Pettis argue, “Financial imbalances now determine trade imbalances.” In adjusting to the resulting structural deficits, domestic supply of tradeable goods and services has to be squeezed in deficit countries like the US, with the cruel effects on the industrial working class illuminated in another important recent book, Deaths of Despair and the Future of Capitalism by Anne Case and Angus Deaton.

Trade Wars Are Class Wars lays out these general ideas in its first three chapters, which discuss the history of world trade, the role of liberalised finance in creating unsustainable capital flows and, above all, how savings, investment and external “imbalances” interact. Yet the book’s core is the analysis of the history of China, Germany and the US over the past three decades.

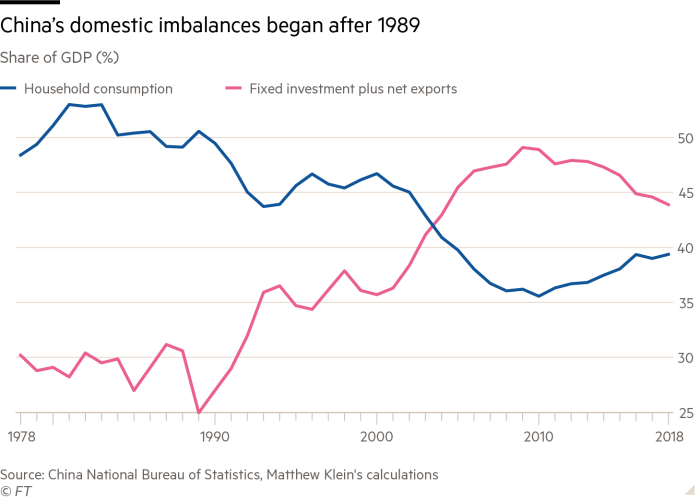

The economic success of China was the result of an extreme version of what the authors call the “high savings” model of development, together with exploitation of trade opportunities, which Japan pioneered. Thus, from the early 1990s and particularly after 2000, there was a sharp decline in the share of household consumption in China’s gross domestic product.

“As of 2018, Chinese households still consume less than 40 per cent of Chinese output — a lower ratio than in every other major economy in the world, by far,” the authors write. This is due to a host of mechanisms — high household savings, low interest rates, lack of rights of rural migrants in cities, regressive taxation, weak social safety nets and the failure of state-owned companies to pay dividends — all designed to shift income from workers and retirees to companies and the state.

Gross national savings reached a peak of close to 50 per cent of GDP. Until the global financial crisis, these savings went into domestic investment and the current account surplus. After the crisis, the decline in the surplus on the current account — the balance on trade in goods and all services — was offset by a further huge increase in credit-fuelled investment, which reached nearly half of GDP.

This surge in investment was funded by a huge credit boom. Today, the share of household consumption is a little higher, but it is still remarkably low by international standards. China is caught between three options: wasteful credit-fuelled investment, massive external surpluses or huge shifts of income from the hands of the elite and into those of ordinary people.

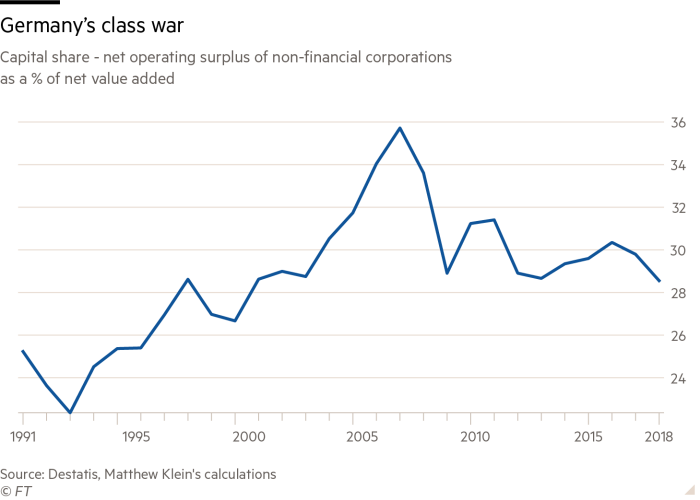

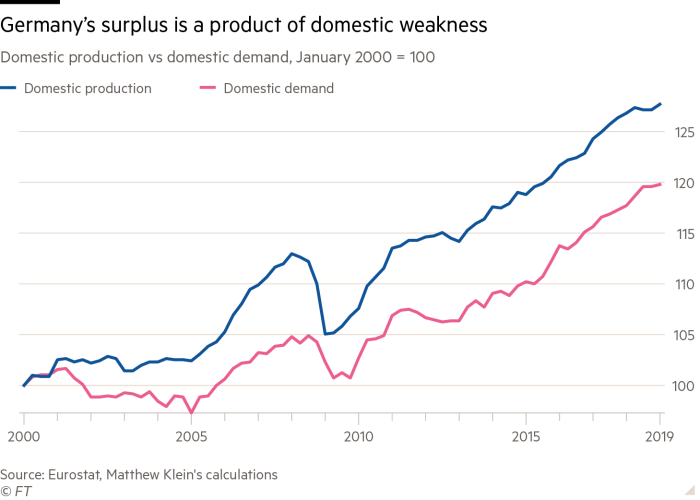

Now consider Germany. Since the end of the post-reunification boom of the 1990s and the labour market liberalisation of the 2000s, corporate profits have been high and domestic corporate investment weak. Remarkably, “[German] consumption did not grow at all between 2001 and 2005.” Domestic spending fell far behind trade-fuelled income. The German government has, until Covid-19, also run a very tight budget. As a result, a gigantic and persistent current account surplus — excess savings, in other words — emerged.

Until 2008, the excess savings of Germany and several other smaller European countries (such as the Netherlands) were offset by unsustainable credit and spending booms in countries such as Greece, Ireland and, above all, Spain. The global financial crisis ended that. Since then the entire eurozone has moved into a globally destabilising current account surplus, in a damaging attempt to turn the second-largest economy in the world into a bigger Germany in the midst of a global savings glut.

What benefit have Germans obtained from their huge excess savings? Remarkably little. “Germans, who have been such avid exporters of financial capital over the past two decades, are almost uniquely bad at investing abroad,” write the authors. “Since the start of 1999, the German private sector collectively spent a little over €5.1tn acquiring assets in other countries. Yet over the same period, the amount of these foreign assets grew by only €4.8tn.” Over almost two decades, unwise purchases of US subprime mortgages and Greek sovereign debt have resulted in a valuation loss of 7 per cent. This is a fruitless form of frugality.

If some countries have excess savings, others must be in the opposite position. Occasionally, capital flows have generated large deficits in emerging or weaker high-income countries, such as Spain. But the biggest and most persistent deficit country has been the US. Global supply and demand are balanced there, mainly by the Federal Reserve, in effect the world’s central bank.

This has not been so easy to do, particularly since the US, too, has had a big shift in income towards the high savers. With the current account deficit largely driven by external demand for safe US assets, the offsetting excess domestic demand has come from two sources: financial bubbles and the federal deficit. The former emerged in the stock market bubble of the 1990s and again in the housing bubble of the 2000s; the latter emerged after both bubbles burst and, more recently, with Trump.

The housing bubble was particularly fascinating not only because of its disastrous end, but because of the way in which Wall Street generated the safe dollar-denominated assets the world wanted by alchemy: the conversion of bad mortgages into triple-A securities.

As Klein and Pettis note, “The rest of the world’s unwillingness to spend — which in turn was attributable to the class wars in the major surplus economies and desire for self-insurance after the Asian crisis — was the underlying cause of both America’s debt bubble and America’s deindustrialisation.”

Notably, “Foreign central banks and other reserve managers spent about $4.1tn buying dollar-denominated assets between the start of 1998 and the middle of 2008.” Effectively, the surplus savings of a number of countries drove a huge net capital inflow into the US, which resulted in a massive trade deficit and so ultimately, the loss of manufacturing jobs in the US heartland. It was the capital account that mattered. The trade balance was just the byproduct.

The role of the US as supplier of the world’s safest and most liquid assets is vital. We are trying to run a global economy with a national money. It has long been known that this is problematic. It has not become any less so, despite the move to floating exchange rates. If foreigners want to hold American liquid assets in vast amounts, the US must run a huge external deficit, unless its private sector wishes to load itself up with riskier foreign assets on a comparable scale.

The beginning of any sensible policy is clear analysis. The imbalances that caused the eurozone crisis, the debt explosions in the US and peripheral Europe, and again in post-financial-crisis China go back to two fundamental failures: the distribution of income away from the bulk of the population towards wealthy elites and the unique global role of the dollar.

The obvious solution to the first failure is to distribute income to people who will spend it without having to go ever deeper into debt. In the eurozone, this will probably require the creation of a central fiscal authority with capacity to redistribute resources. In Germany, it will require higher government spending on investment and welfare. In China, it will require the reform of property rights, improved rights for migrants to urban areas, a better social safety net, the ability of workers to organise and a shift of taxes on to the rich.

As for the role of the dollar, we should recall that Keynes himself recommended the creation of a global currency at Bretton Woods in 1944. This may never happen. But it is clear that running a globally integrated economy with a national money creates insoluble problems. We should not be surprised if these emerge and re-emerge. Indeed, we should not be surprised if they end up destroying the open world economy.

If we do not recognise and respond to these challenges, we may find ourselves persistently mired in the world of imbalances and trade wars. This is not a good place to be. We should escape.

Martin Wolf is the FT’s chief economics commentator

Read the original article here.