In another bit of progress, Sen. Orrin Hatch expressed reserved “interest” in a consumption tax as a part of tax reform.

Why is CPA, a trade focused organization, interested in consumption taxes? Because foreign consumption taxes are charged at the foreign border, have replaced tariffs, and thus our exports are double taxed (US tax and the foreign tax). Further, foreign governments send substantial 17% (on average) consumption tax rebate checks to their exporters amounting to what would otherwise be an outlawed export subsidy. See a full explanation here.

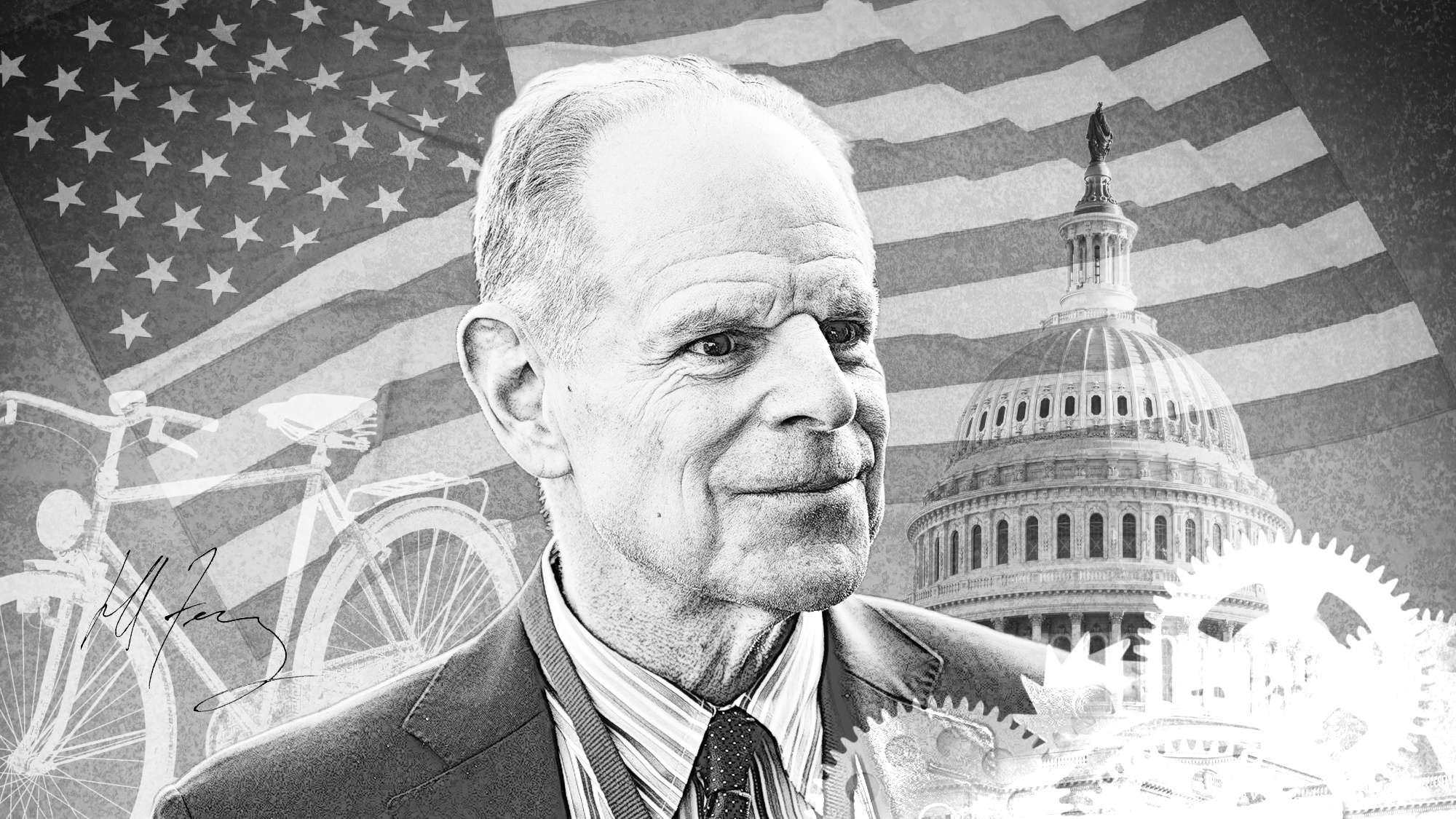

Here is the Q&A involving Hatch on tax reform.

Q: Dave Camp, the former chairman of House Ways and Means, last year laid out a tax reform proposal. Does that look to you like a decent road map?

HATCH: There were some very good concepts in that bill — a revenue neutral bill that would’ve put us on a path towards balancing the budget. The consumption tax does appeal to me, because you determine how much you pay by what you buy. If you’re going to buy a Cadillac, you’re going to pay more in taxes. The problem with the consumption tax is that it leads to value-added taxes that can be easily added on by a profligate Congress.

It’s probably going to take longer than two years. The president said he’s interested in a business tax bill. That’s easy to say. I’ve suggested to them, “send us up a bill that you believe will solve that problem.” So far, nothing.

Hatch’s interest is promising because it is not the past dismissal that you hear from many. Indeed, he brought it up right away in this single tax reform question. However, the point that future Congresses can increase the tax, while a common refrain, seems hollow. Why would a consumption tax be more attractive to increase than income taxes? No reason, really. Either a future Congress wants to raise taxes or it doesn’t. Because a consumption tax is so transparent, the public would feel an increase much sooner and much more definitively than an increase in income taxes which are complex, obscure and delayed in impact.

Indeed, Senator Ben Cardin’s Progressive Consumption Tax Act would, if passed, implement a 10% consumption tax with a mathematical, statutory “circuit breaker” to prevent it from raising more revenue than the Congressional target set. It would also exempt tens of millions of low to middle income families from income tax because they would not pay tax on their first $100,000 of income.

CPA has been promoting interest in consumption taxes to neutralize the border adjustable (it’s a tariff and a subsidy) trade impact because we can’t address this WTO-legal distortion through a trade remedy process. The best shot we have is to neutralize it with our own consumption tax, while offsetting the new tax revenue with very large income tax cuts. This can be done in a revenue neutral way that is also progressivity/distribution neutral.

Shifting our tax mix to more border adjustable taxes while decreasing non-border adjustable taxes is a good trade competitiveness strategy.