With workers locked out at a Allegheny Technologies (NYSE:ATI) plant less than a mile from my home in western Pennsylvania, I’m sensitive to what is happening in the steel industry.

[Reposted from ETF Daily News | Tony Daltorio | September 1, 2015]

And right now, things don’t look good. For example, the U.S. benchmark hot rolled coil index is down 22% so far in 2015, to $467 a ton.

Conditions for the steel industry are poor globally. Demand for steel is weakening in emerging markets like China. And supply from China, the world’s largest steel-producing country, has not declined.

The result?

More steel exports from China to a world with already too much steel.

Demand Falling

The world’s biggest steel maker by market share, ArcelorMittal (NYSE:MT), recently cut its forecast for steel demand growth in 2015 to zero. Arcelor said that demand actually picked up a bit in Europe and the U.S. But it said demand in emerging markets “remains weak.”

In particular, it said the Chinese market “had deteriorated significantly.” The company’s chairman, Lakshmi Mittal, told the Financial Times that “China has been kind of a surprise, that it is so down.”

This slack demand in China feeds through directly into problems for other steel makers around the world.

You see, nearly half of China’s steel makers are losing money. But they keep producing and selling steel at what Mittal calls “not market prices.” Even the Xinhua News Agency is talking about a “deep supply glut.”

Chinese Steel Supply Unending

Estimates for expected steel exports from China this year are about 100 million metric tons. That is up from just 53 million tons in 2013.

At its current pace, China’s steel exports would overtake Japan’s total steel production sometime next year. Japan is the world’s No. 2 steel maker.

The devaluation of the yuan, although small, only added to steel’s woes. Producers immediately used the cheaper currency to lower the export price for steel once again.

The U.S. is a prime destination for steel because prices for steel here, although down, are still $100 higher than in Europe and $200 higher than in Asia.

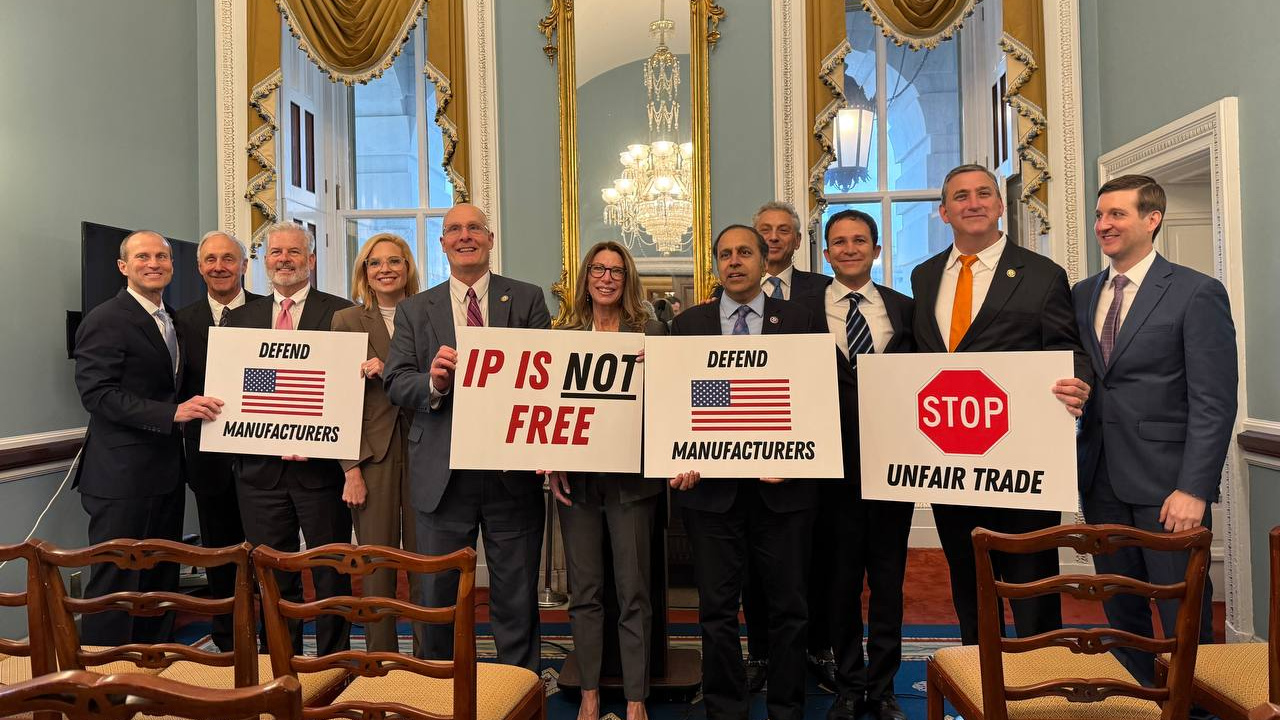

Nucor (NYSE:NUE) is among a number of steel companies filing anti-dumping suits with the government against China and others. Other steel companies have joined in the suits, including Arcelor Mittal, U.S. Steel (NYSE:X), AK Steel Holding Corp. (NYSE:AKS) and Steel Dynamics (NASDAQ:STLD).

A lawyer for Nucor, Alan Price, hit the nail on the head when he told Reuters, “China has built massive excess capacity in steel.” And he got the solution right too when he said China needs to shut some of those loss-making plants down.

But that’s where politics comes in. The Communist Party wants to stay in power. Having massive unemployment in a major industry is not a way to remain popular.

Is there any hope for the steel makers?

Longer term, yes.

Steel production in China has peaked. In January, the Chinese made this very clear. The new chairman of the China Iron and Steel Association, Zhang Guangning, said, “China’s steel sector has already entered a period of peaking and flattening out.”

That’s bad news for iron ore producers, but good news for the other steel makers.

Demand for steel in China will rebound too. Near year-end, some infrastructure projects kick off. Environmental and urbanization projects in China should alleviate some of that supply glut.

More importantly, China has been busy signing major agreements around the globe with regard to very large infrastructure projects.

These include the “belt and road” initiative, which is better known as the New Silk Road. Neighboring countries will benefit from this infrastructure build-out. In Pakistan, for example, China will spend $46 billion on infrastructure build.

There are other major projects in the works too in Africa, South America and Latin America (the Nicaragua Canal).

China is not doling all these billions just to make friends. It wants to keep its construction and industrial companies vibrant – with lots of its citizens employed, no doubt.

Major infrastructure projects equals lots of steel being used. This should keep the Chinese steel makers working to feed those projects, which should alleviate the need to export so much steel to the U.S.

So as long as the domestic steel makers can stay afloat, better times are coming for the steel industry in the years ahead.