Susan Houseman is a senior economist at the Upjohn Institute in Michigan. I’ve followed her work on employment trends, especially in manufacturing, for years, and wanted to share some of her recent findings that struck me as particularly germane at this point in time.

JB: This election has clearly elevated the view that our manufacturing sector, and the families and communities that have historically depended on it, has been hurt by trade. A countervailing view says it’s not trade, it’s automation that’s responsible for large-scale job losses. You’ve recently updated your very important work on this question. Does productivity in the manufacturing sector support the automation story?

SH: No, it doesn’t. To see why, consider where that story comes from. The simple automation story says that U.S. manufacturing is doing well and automation is behind the large job losses. At first blush, government data seem to support that story. Manufacturing output growth, adjusted for inflation, has been strong, rising almost as quickly as GDP. At the same time, employment in manufacturing, which previously had been pretty stable, has dropped by nearly 30 percent since 2000. Strong output growth combined with declining employment means labor productivity (output per worker) is growing quickly—much more quickly than in the economy as a whole.

Looking at these numbers, many conclude that the rapid productivity growth must reflect automation and that automation, in turn, must be responsible for manufacturing’s job losses. On the surface, that story seems sensible. After all, everyone has heard about robots replacing workers in factories. But, if you take a deeper look at what is going on in the sector, the narrative doesn’t hold up.

It turns out that one relatively small sub-sector, the computer industry, drives the strong output and productivity growth in manufacturing. The computer industry, which includes semiconductors and related electronics, accounts for only about 13 percent of manufacturing output. Output has been weak or declining in the industries that make up the other 87 percent of manufacturing. If one excludes the computer industry from the numbers, manufacturing output is only about 8 percent higher now than in 1997. It is about 5 percent lower than before the Great Recession. And, without the computer industry, productivity growth is no higher in manufacturing than in the economy overall.

JB: OK, so one sub-sector, computers, is the main driver of the sector’s output and productivity growth. But why does that undermine an automation story?

SH: Remember, the basis for the automation story is that output growth has been about as high in manufacturing as in the rest of the economy and productivity growth has been much higher. Neither is true in most — 87 percent — of manufacturing.

Many processes in manufacturing have been automated. But automation and other types of labor-saving technology have been introduced throughout the economy, not just in manufacturing. The critical difference is that, unlike in other sectors, output in most manufacturing industries has barely risen or declined since the late 1990s. It’s the very weak performance in U.S. manufacturing, when combined with automation, that has led to massive job losses since 2000.

JB: Well what about the computer industry? Couldn’t one tell a story about automation for that industry?

SH: No. The computer industry has been automated for years. Productivity growth in that industry — and by extension the above average productivity growth in the manufacturing sector — has little to do with automation.

Computers, semiconductors and other electronics are much more powerful today than in the past. The extraordinary productivity growth in the computer industry has to do with the way government statisticians account for the rapid technological advances in the products made in this industry. Consider this simple example. Say buyers are willing to pay 15 percent more for a new computer that boasts greater speed and more memory than last year’s model. Then, in a statistical sense, 100 of the new computers would be the equivalent of 115 of last year’s model.

As a result, the rapid output growth in this industry does not mean that American factories are producing many more computers, semiconductors, and related products — they may be producing fewer. Instead, it reflects the fact that the quality of the products produced is better than in the past. And because assembling a higher-powered computer or semiconductor doesn’t necessarily require more workers, the extraordinary output growth in the computer industry translates into extraordinary labor productivity growth.

Perhaps ironically, the locus of production of semiconductors and computers has been shifting to Asia. Offshoring, not automation, is responsible for recent job losses in the U.S. computer industry. The loss of production to Asia is likely already contributing to a slowdown in measured output and productivity growth in manufacturing.

JB: Outside of computers, you note that manufacturing output has been “anemic” and that globalization is a major factor accounting for this result. What do you mean by that?

SH: As I mentioned, besides computers, output in manufacturing is barely higher today than in the 1990s and is actually lower than in 2007, before the Great Recession. Since the U.S. population has grown about 18 percent since then does that mean that the average person is buying fewer things? Of course not.

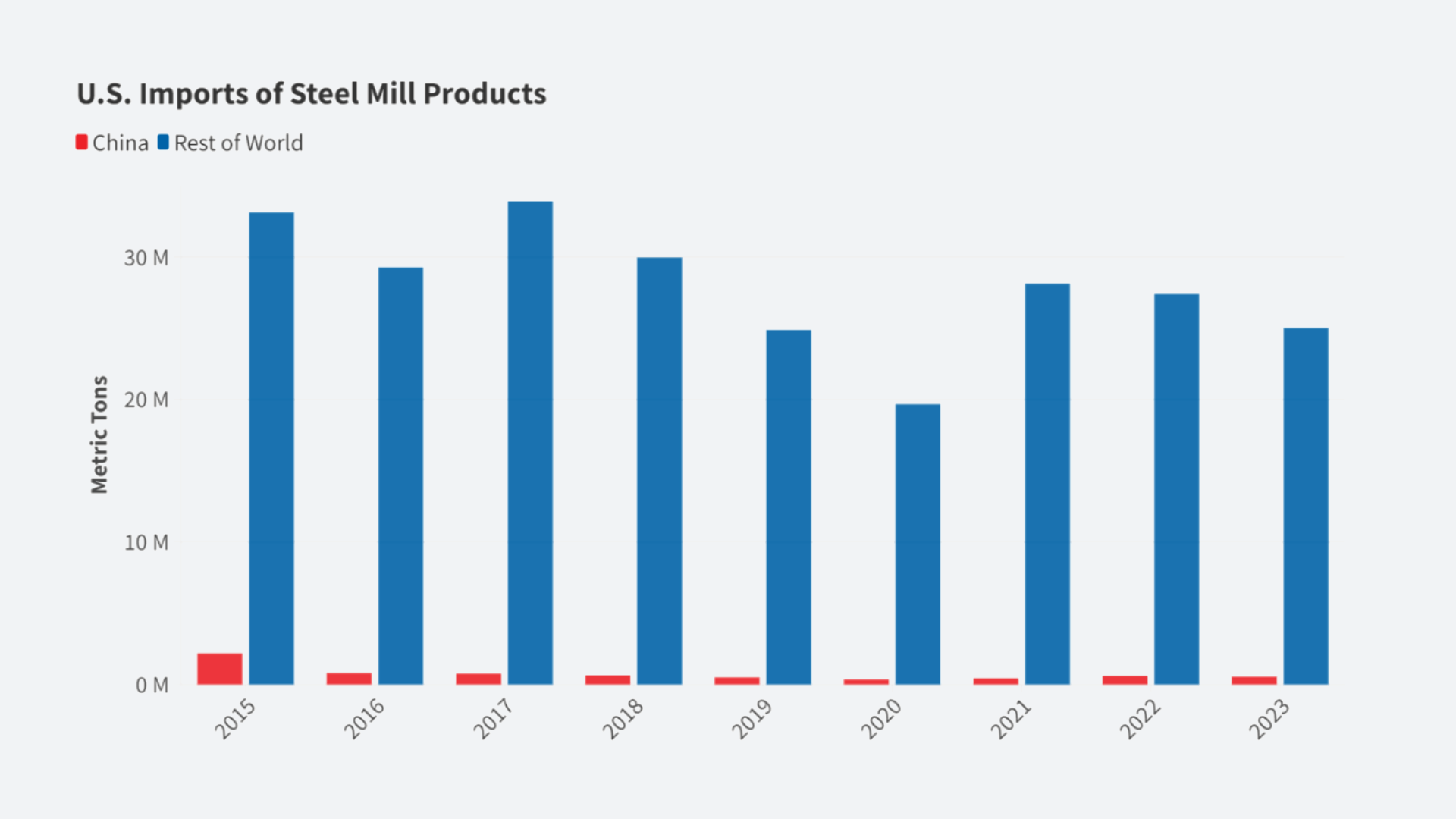

The reason for manufacturing’s anemic performance is that U.S. consumers and businesses are buying more imported products, and American exports have not risen commensurately. Instead of manufacturing their products in the United States and exporting them to foreign markets, U.S. multinational companies now often locate production overseas to take advantage of lower labor costs and taxes, among other factors.

So, manufacturing’s anemic output growth is largely the result of globalization. That fact, coupled with automation, is responsible for the large reductions in manufacturing employment since 2000.

JB: Hasn’t manufacturing employment declined as a share of total employment in every advanced economy? Is it somehow worse here?

SH: That’s right, manufacturing employment has declined as a share of employment in other advanced countries, too.

In the United States, manufacturing’s employment share has been falling since the 1950s. But the number of manufacturing workers trended up until the 1980s, and then was fairly stable or declining very slowly. That situation abruptly changed in the United States after 2000. Between 2000 and 2007, which were business cycle peaks, manufacturing employment plummeted by 20 percent. Manufacturing employment has not recovered from the Great Recession, and now is 29 percent lower than in 2000. That decline is historically unprecedented. And those large-scale job losses are the reason for the focus on manufacturing in the presidential campaign.

But U.S. job losses are not unique. Other advanced countries have been exposed to the same forces of globalization. Many have experienced substantial job losses in their manufacturing sectors in recent years and in Britain, they have been on par with losses in the United States.

JB: When you hear the candidates talk/fight about this, is anyone saying anything that resonates with you?

SH: First, I want to say that the spotlight the presidential campaign has shined on problems in American manufacturing is a good thing. The weakness of the American manufacturing sector often is not recognized — in part, as I’ve explained, because the data can be confusing. And too often the consequences of manufacturing job losses for workers and communities are ignored, or minimized, or taken as inevitable.

That said, Trump’s blunt policy proposals — like tearing up our past trade deals and slapping higher tariffs on imported goods — are bad ideas. They would likely invoke retaliatory actions by our trading partners. Moreover, production is more globally integrated than in the past. Factories and other businesses have come to rely on imported materials and parts, and raising tariffs would unintentionally harm them and their workers.

We can’t turn back the clock, and besides, trade broadly benefits many Americans. But when working out the specifics of trade deals, our negotiators need to better take into account workers’ interests and avoid terms that will lead to large-scale layoffs. That, essentially, reflects Hillary Clinton’s position on trade deals.

JB: What do you think we should do, policy-wise, to revitalize our factory sector?

SH: Revitalizing American manufacturing will necessarily involve a number of different policies. For example, the international competitiveness of domestic manufacturing depends to a large degree on exchange rates. When the dollar strengthens against foreign currencies, Americans benefit from lower import prices, but domestically-produced goods become less competitive at home and abroad. We need to make sure that our trading partners do not keep their currencies artificially low against the dollar in order to “export unemployment” to the United States.

In order to take advantage of tax policies that favor multinationals, some American companies have relocated overseas or expanded their foreign operations at the expense of their domestic ones. The Obama administration has taken steps to address this problem — specifically steps that discourage so-called inversions — but more comprehensive tax reform is needed. Government subsidies for research and development, technical assistance for small manufacturers, and subsidies for worker training at businesses and at community colleges will also improve the competitiveness of domestic manufacturers and help revitalize the sector.

At the same time, we need to be realistic. With globalization and technological change, there will be on-going restructuring in the American economy. Factories will close. So, income and retraining assistance for dislocated workers and economic development assistance for their communities should be an integral part of the policy mix.