KEY POINTS

- China only accounts for 2% of total U.S. steel imports

- The scope of steel tariffs must be much wider than China if it will actually protect U.S. manufacturing

- China has a much larger share of articles of steel/iron imports (21%)

- Additional tariffs on Chinese articles of steel/iron would have more of an impact, but would likely only move production out of China (not help domestic manufacturing)

The Biden administration’s recently announced proposal to increase the steel and aluminum tariffs on Chinese products from 7.5% to 25% could be a mixed bag. It is not yet clear how wide of a steel tariff increase USTR would implement and exactly which products would be included. The 7.5% Section 301 tariff implemented under the Trump administration covers both Chapter 72 steel/iron and Chapter 73 articles of steel/iron from China. However, by limiting the tariffs to China, the tariff increase is already on track to fall short of the mark.

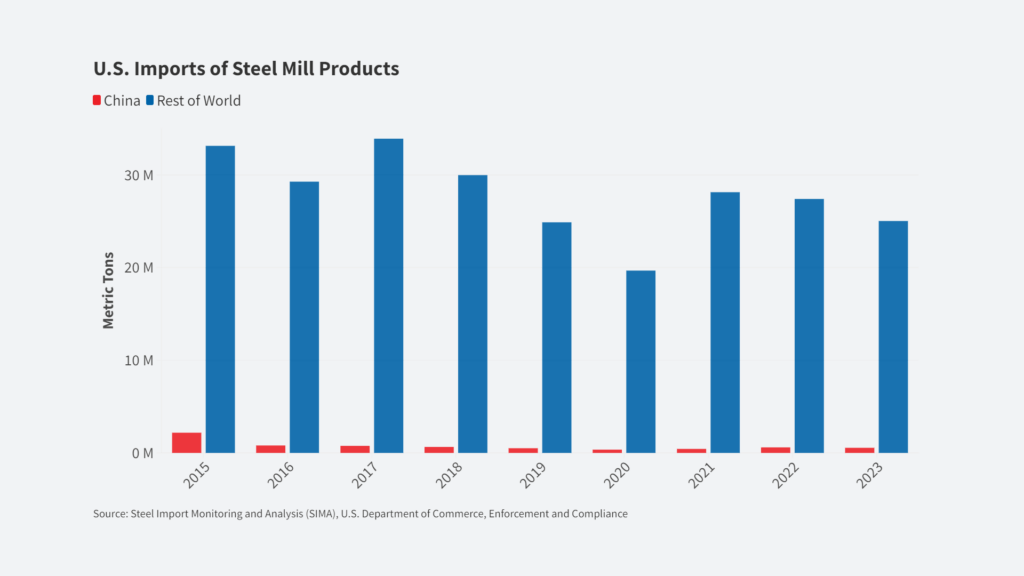

China holds only a small percentage of steel and iron mill product imports into the United States. By total volume, only 2.2% of 2023 U.S. imports of steel mill product imports came from China. As shown in Figure 1, China has only had a small share in U.S. steel imports for many years. The story is the same when looking at import value. By total value, China only held 1.8% of 2023 imports of steel and iron (HTS Chapter 72) into the United States. The countries with the largest share of U.S. steel imports are Mexico, Canada, and Brazil. China does not even come close to the top of the list. If the U.S. is going to truly address surging steel imports harming U.S. manufacturers, the scope has to be much broader than only China.

Figure 1:

The area where the tariff increase could have some bite is for Chapter 73 products. As shown in Figure 2, China has a much larger share of U.S. imports of articles of steel and iron (HTS Chapter 73), holding 21% of total U.S. imports in 2023. This is really where Chinese steel imports are having the most negative impact on U.S. steel product manufacturers. However, it still is not the whole story. China has a large piece of these imports, but many countries such as Mexico, Taiwan, South Korea, and India also have large shares of U.S. imports of articles of steel and iron. As seen many times before, tariffs that target one specific country’s imports tend to only move production to other importers, rather than truly protecting domestic manufacturing.

Figure 2:

Furthermore, there is a significant amount of China steel products and articles going through various third countries such as Mexico and many others to avoid duties on steel products from China. The proposed tariff increase on China does not clearly address this issue. The scale of this transshipment is underreported but still shows up in the trade data of these third countries. For example, Mexico’s import data shows that Chinese steel/iron product imports have doubled from 2015 to 2023, far outpacing any increase in domestic demand in Mexico. President Biden’s proposal announcement even recognizes this third-country transshipment and duty evasion issue but does not take any concrete steps to address it.