Editor’s Note: Bill Parks sits on the CPA board of directors and is the founder of NRS Inc., an Idaho-based sporting goods manufacturer.

Americans are undoubtedly frustrated with the double standard enjoyed by large multinational corporations.

[Bill Parks | July 6, 2020 | InsideSources]

Each year, these massive companies earn billions of dollars in profit from America’s lucrative consumer market. Yet they miraculously manage to avoid paying any U.S. taxes.

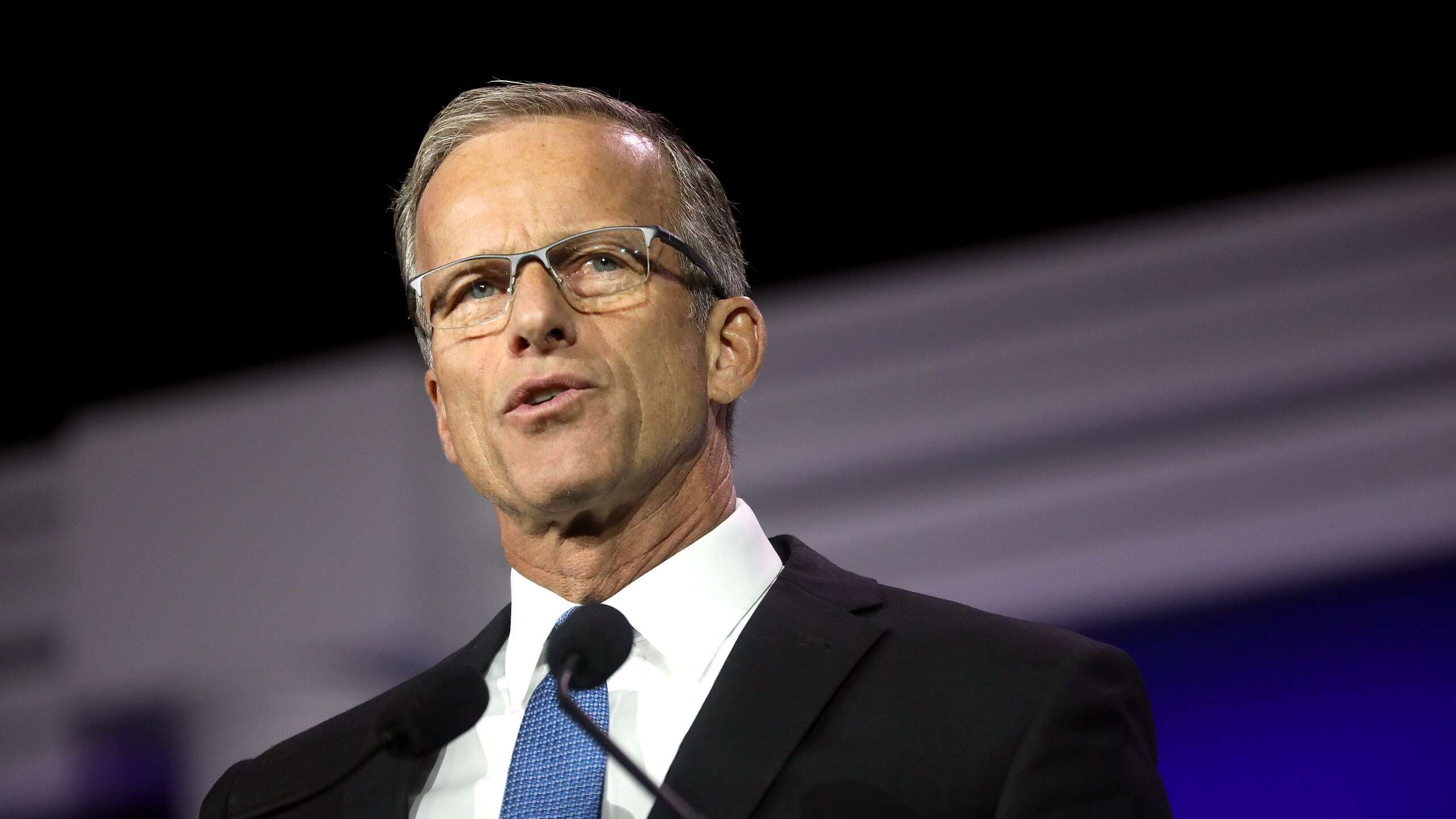

All of that is due to a longstanding system of clever tax loopholes that have continued unchecked since the last U.S. tax package in 2017. Regrettably, U.S. Treasury Secretary Steven Mnuchin is failing to hold these multinational corporations accountable.

During recent tax negotiations at the Organization for Economic Cooperation and Development (OECD), Mnuchin declared the talks to be at an impasse. That leaves the status quo in place — which means it’s time for Congress to take action.

There were some valid concerns at the OECD. The U.S. recognizes that multinationals are getting away with massive tax avoidance. And European leaders have a similar problem, since tech companies like Facebook and Google are continually shifting their considerable profits to tax-haven nations.

Massive tax revenues are at stake for all concerned. It’s estimated that corporate profit shifting costs the U.S. Treasury $80 billion each year. Essentially, large companies that can afford to move operations out of the United States enjoy a significant tax break.

But smaller, domestic businesses continue to pay their share of taxes. In a tightening economy, this makes little sense, particularly when a broad swath of the U.S. workforce has suddenly become unemployed due to the COVID-19 pandemic.

Since the OECD hasn’t solved the overall problem of tax avoidance, and Mnuchin has chosen to pause any talks, Congress must now step in. It’s time to transform America’s approach to corporate taxation — and finally aim for an equitable solution.

Congress should implement a system of “Sales Factor Apportionment.” Doing so would establish a very bedrock fundamental of tax law: Whatever profits a company earns in the United States should be taxed in the United States.

This would eliminate the very glaring problem of tax havens in Bermuda and the Cayman Islands, among other places.

Obviously the system needs to change, and Americans are continually reminded of the unfairness of the current process. Amazon, for example, paid zero state or federal taxes in 2018 despite earning more than $11 billion in profits. And dozens of other Top 500 firms also paid no federal taxes in 2018.

Multinational corporations are simply enjoying very profitable access to U.S. consumers — without contributing a dime to the U.S. economy.

At the same time, domestic companies are expected to pay a full load of taxes in order to participate in the U.S. market. Unfortunately, the impasse at the OECD squanders an opportunity to support these smaller companies.

Complicating matters is that, if the OECD negotiations ultimately fail, many European nations are prepared to implement digital taxes on America’s large tech corporations.

That’s logical on their part, since they want to claim tax revenues from these very successful behemoths.

But the United States is threatening tariffs in response — which would spur a wider conflict without ever solving the larger problem of corporate tax avoidance. And that means losing a breakthrough opportunity to implement a Sales Factor Apportionment tax system.

Multinationals will always opportunistically shift their trademarks, patents, payroll, and property to tax-haven countries. But their sales largely happen in affluent nations like the United States.

Under a Sales Factor Apportionment system, if 20 percent of a company’s sales occur in the United States, then 20 percent of their worldwide profits would be taxed in the United States. That would finally eliminate the tax shenanigans of shifting profit to low-tax countries.

Since the OECD negotiations are foundering under Mnuchin, Congress should hold hearings and start drafting legislation. Otherwise, the United States will squander a critical moment to finally address the glaring inequity of corporate tax avoidance.

And that will leave America’s domestic companies trailing further behind at a particularly tough time.

Read the original article here.