WASHINGTON — The Coalition for a Prosperous America (CPA) today released a statement after 130 countries and jurisdictions, representing more than 90% of global GDP, joined a statement establishing a new framework for international tax reform. According to the announcement, the “framework updates key elements of the century-old international tax system, which is no longer fit for purpose in a globalised and digitalised 21st century economy.” This represents a positive step towards eliminating the ability of multinational companies to avoid paying U.S. corporate tax by shifting profits offshore to tax havens.

In June, CPA released a statement after the Finance Ministers and Central Bank Governors of the G7 economies announced that they support the Organization for Economic Cooperation and Development’s (OECD) efforts to more fairly tax multinational profits.

“With this new announcement, it is clear that there is a strong, growing consensus towards eliminating the ability of multinational companies to avoid paying corporate taxes,” CPA Chair Zach Mottl said. “For family companies like mine that pay a higher corporate tax rate than foreign and multinational competitors, this represents a positive, productive step forward. Congress and the Biden administration should embrace this consensus and urge the OECD to implement Sales Factor Apportionment to truly end the game of multinational profit shifting.”

CPA has long called for ending tax avoidance by implementing Sales Factor Apportionment (SFA), which would tax profits based on the location where the product was sold. Earlier this year, CPA praised the Biden administration’s Pillar 1 offer to the OECD that would implement a limited SFA for the top 100 multinational corporations. On April 23, CPA urged Senators Ron Wyden (D-OR), Sherrod Brown (D-OH), and Mark Warner (D-VA) to include SFA in their tax framework proposal released earlier this year.

“While not perfect, this announcement is a much-needed move away from the old ‘origin of income’ system that large multinational corporations abuse in order to shift profits to tax havens,” said Michael Stumo, CEO of CPA. “If adopted, this simpler, SFA-like system will place the interests of domestic producers in every country on a closer tax footing to their multinational competitors. As momentum continues to grow towards more fairly taxing multinational profits, Congress must recognize that SFA is the best way to finally end the corporate tax avoidance practiced by the world’s largest corporations.”

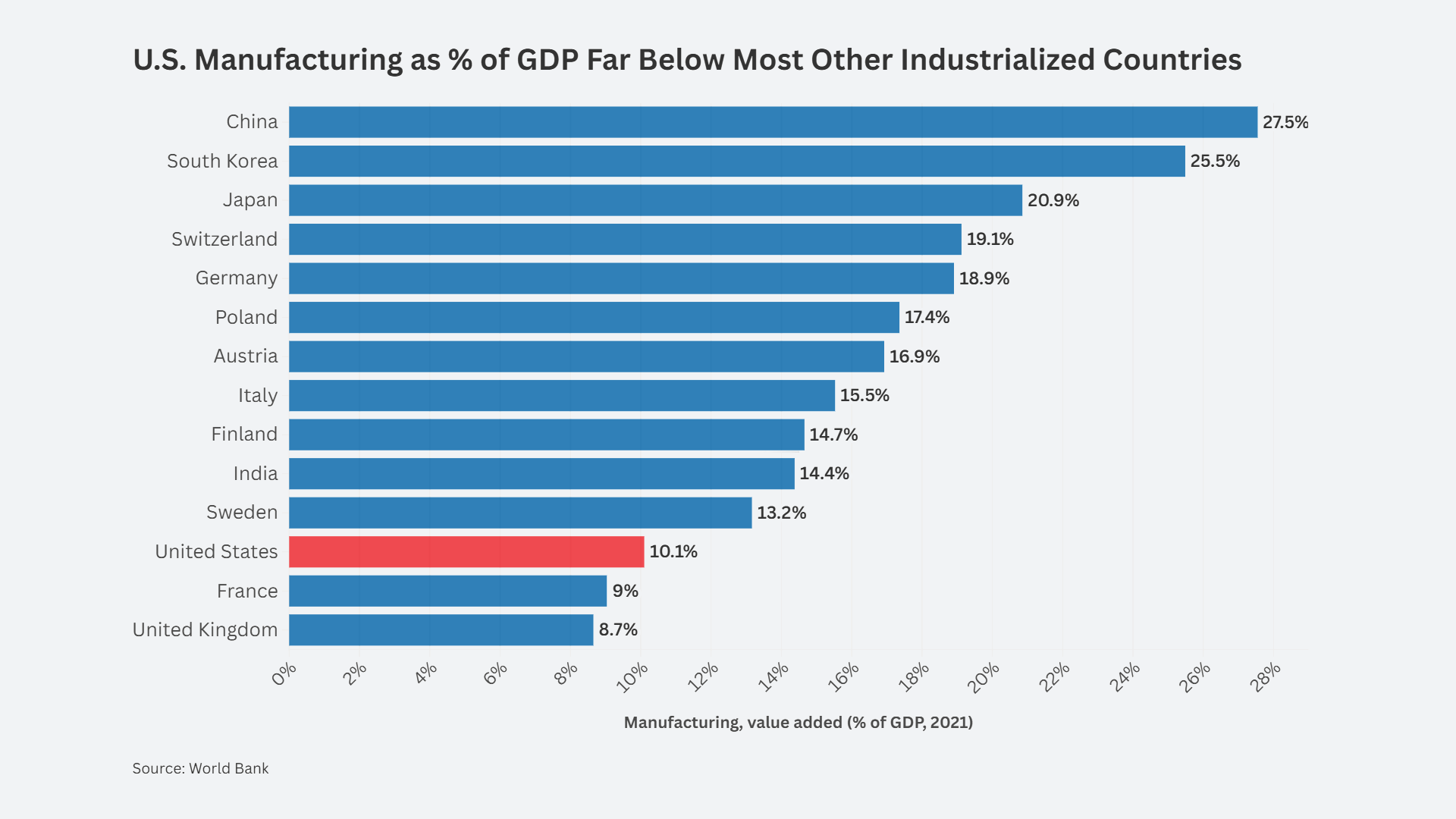

In September 2020, CPA published an analysis of the federal corporate tax paid by the S&P 500 companies in 2019 and found they paid on average less than 9% in cash federal tax last year. The analysis also found that by replacing the current corporate tax system with an SFA system at 21 percent, the United States could have expected to earn an additional $97.8 billion in federal corporate tax receipts for 2019.

On April 6, CPA Tax Policy Director David Morse published an op-ed calling on Congress to “no longer allow multinationals to employ convoluted profit calculations—or claim residence in an obscure, offshore location—as a means to skirt U.S. tax obligations.” In November 2019, CPA urged the OECD to support a move to sales factor apportionment (SFA) as part of its comprehensive review of international corporate tax systems.