By Jeff Ferry, CPA Research Director

Turkey’s currency crisis is threatening the Turkish economy and there is a genuine risk that this could spill over into other emerging market economies with excessive foreign indebtedness.

There’s even a risk this could lead to a worldwide recession as the aftereffects boomerang back on to the advanced nations whose banks have lent money to those struggling nations.

But make no mistake, Turkey’s problems are not the result of President Trump’s trade policies, nor any American policies.

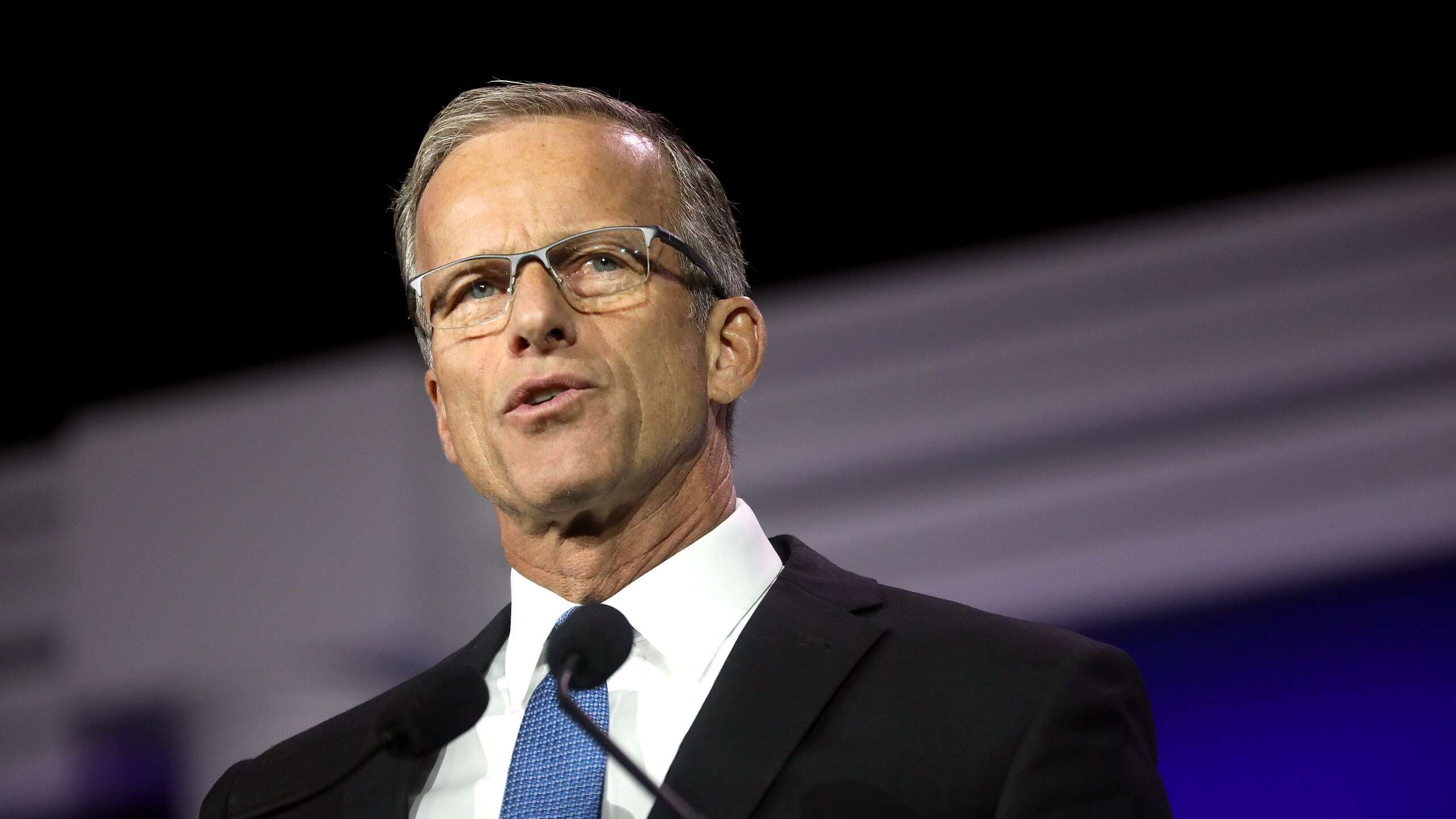

Turkey’s problems are the product of an eccentric president, Recep Erdogan (above, left), who is leading his country down an economic rathole. After an outstanding record of economic growth under prime minister Erdogan, (2003-2014), President Erdogan’s behavior reached new lows of authoritarianism after his election as president in 2014 and reelection in June of this year. Controversial constitutional reform in 2017 gave Erdogan both presidential and prime ministerial powers. On top of that, he has appointed his son-in-law Berat Albayrak (above, right) Finance Minister. On the economic side, inflation has skyrocketed. While Turkey’s official rate of inflation is 15%, according to economist Steve Hanke, the daily rate of inflation is now at 101%. (see graph).

Source: Prof. Steve Hanke (@steve_hanke)

Turkey’s economic problems are due to a loose monetary policy that has encouraged bank lending, coupled with excessive foreign borrowing, particularly in dollars, now amounting to $250 billion in dollars owed by Turkish banks and corporations, according to an E21 economist at Berenberg. The obvious solution is to raise interest rates to tighten up the monetary tap and bring down borrowing and inflation. When the Turkish central bank refused to do that in June and July, the financial markets basically gave up and began selling the lira. It’s down 40% this year, making that foreign debt even harder for Turkish debtors to repay.

President Trump doubled tariffs on steel and aluminum from Turkey to counteract the effect of the falling lira. Turkey has been an active steel exporter in recent years. Trump was also trying to send the message that devaluing a currency to make your exports more competitive is not an acceptable way to sidestep US tariffs. This is especially relevant at the moment, with the Chinese renminbi down some 6% from April levels.

The Turkish crisis, along with financial market nerves about other emerging market economies has contributed to a rising dollar since early this year. The dollar has risen more than 7% from its April lows, undermining the competitiveness of US manufacturers and farmers. The US government must pay attention to this issue. Currency chaos in Venezuela, endemic Brexit-related weakness in the pound sterling, all these trends contribute to international investors clamoring for dollars, and that hurts Main Street USA. The solution is either short-term Treasury intervention to get the dollar down, cutting US interest rates, or a long-term solution like the Market Access Charge, as proposed by the CPA.

Turkish Solution Hangs on One Imprisoned American

Back to the Turkish situation: the real sticking point between Trump and Erdogan is the Turkish president’s imprisonment of American pastor Andrew Brunson on charges of involvement in a bungled revolt against Erdogan in 2016. According to Brunson’s lawyer, there is no evidence to support these charges. Brunson has lived in Izmir, Turkey for 20 years with his wife and three children and ran a Christian ministry there. In October 2016, Brunson and his wife were arrested and imprisoned. After two weeks Turkish police let his wife go, but Brunson was kept in prison and charged with “threatening national security.” The evidence, such as it is, relies on reports by anonymous witnesses that Brunson agitated among Kurds to convert them to Christianity and persuade them to rebel against Erdogan’s (moderate Muslim) rule.

Trump has championed the cause of other imprisoned evangelical Christians elsewhere in the world, and he is demanding that Erdogan release Brunson. Erdogan is refusing to do so, and calling for tariffs and import controls on American goods.

Erdogan is playing the patriotic card, calling on Turks to use foreign currency to buy lira to push up the currency. The Turkish people are not so gullible. One British reporter, writing in the Financial Times after a recent vacation in Turkey, reports that Turkish boat captains are asking to be paid in sterling or dollars—anything but lira. The boat captain told her that they hold the sterling or dollars in cash until the end of each month, expecting them to be worth more lira by then.

Such is the nature of currency crises. They feed on themselves and become self-reinforcing. The solution is clear—Turkey needs to get its finances under control. There are two obvious routes to do that. One is to work with the IMF. The other is to embrace Professor Hanke’s proposal of a currency board, a way of tying the lira to a strong currency or gold.

The US government can and likely will support a solution to the Turkish crisis, once Turkey recognizes its own responsibilities. Erdogan should release Pastor Brunson. Erdogan then needs to show himself ready to consider serious economic policy measures regarding Turkish monetary policy, foreign debt, and the balance sheets of Turkish banks. These measures will be imposed on him by a debt crisis anyway, so he should take preemptive action now, before things get any worse.

From a geopolitical point of view, Turkey is an ally, a member of NATO, and in fact was a strong and growing economy before Erdogan’s latest unfortunate delusional phase. Turkey is unlikely to find a solution elsewhere: Vladimir Putin can talk all he wants, but Russia is in no position to lend Turkey the sort of funds it would need to overcome this crisis. China has the funds, but has too many domestic problems of its own right now and won’t get involved. The Turks know from observing poor Greece just over the strait, that asking the European Union for a “solution” would be opening the door to a version of economic water torture. In fact, Turkey has secured a $15 billion credit line from the Middle Eastern state of Qatar but that is not nearly enough. As finance veteran Mohamed El-Erian explains in this Bloomberg TV interview, Turkey needs three things: a big loan to back up the lira, a “seal of approval” that its financial policies are on the right track from a respected financial authority like the IMF or the US, and, most of all, internal reforms to show the international financial community that it is serious about getting inflation under control and solving its debt problems.

In the final analysis, the Turkish government is the master of its own fate.