In Indiana, Missouri and Pennsylvania, President Trump used the same promise to sell the tax bill: It would bring jobs streaming back to struggling cities and towns.

[NATALIE KITROEFF | January 8, 2018 | New York Times]

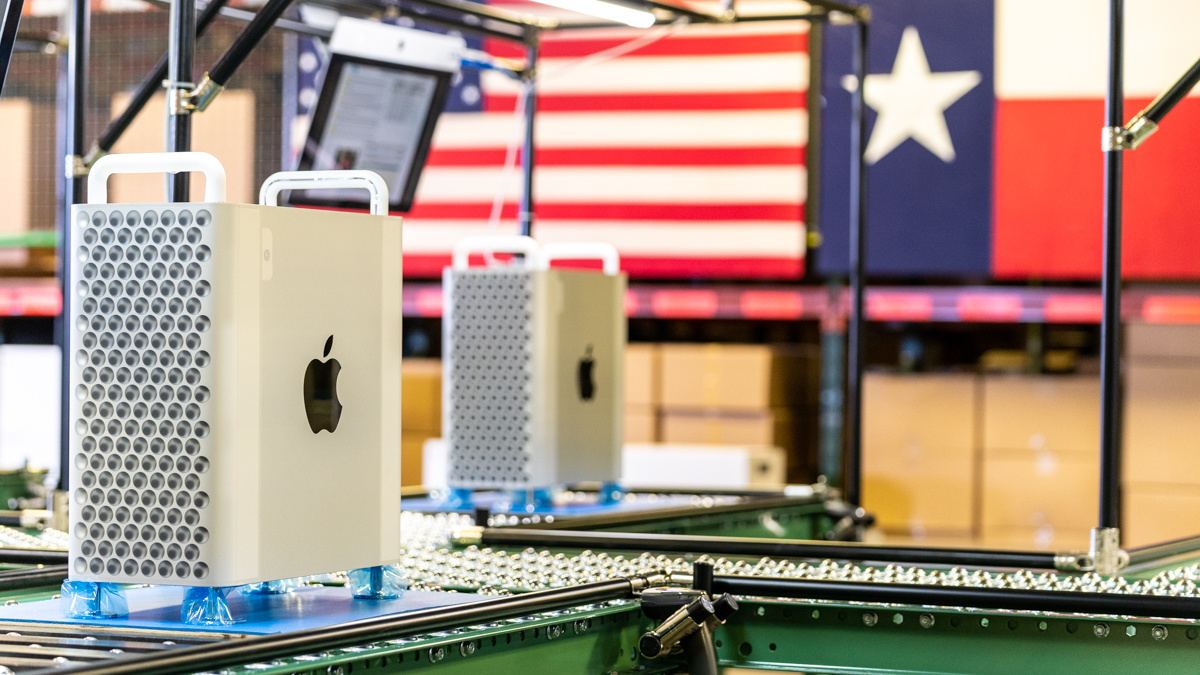

“Factories will be pouring into this country,” Mr. Trump told a crowd in St. Charles, Mo., in November. “The tax cut will mean more companies moving to America, staying in America and hiring American workers right here.”

The bill that Mr. Trump signed, however, could actually make it attractive for companies to put more assembly lines on foreign soil.

Under the new law, income made by American companies’ overseas subsidiaries will face United States taxes that are half the rate applied to their domestic income, 10.5 percent compared with the new top corporate rate of 21 percent.

“It’s sort of an America-last tax policy,” said Kimberly Clausing, an economist at Reed College in Portland, Ore., who studies tax policy. “We are basically saying that if you earn in the U.S., you pay X, and if you earn abroad, you pay X divided by two.”

What could be more dangerous for American workers, economists said, is that the bill ends up creating a tax break for manufacturers with foreign operations. Under the new rules, beyond the lower rate, companies will not have to pay United States taxes on the money they earn from plants or equipment located abroad, if those earnings amount to 10 percent or less of the total investment.

The Republican vision for the tax plan was to make the United States a more competitive place to do business. Supporters contend that the new rules do not encourage companies to locate overseas. Rather, they say, slashing the corporate rate will make it more attractive to set up shop at home, since many other advanced economies now have higher taxes.

And manufacturers do not simply follow their accountants’ advice. They consider taxes, but they also look at an array of other factors, including the local talent pool and transportation network, when deciding where to build a new plant.

Before the tax overhaul, companies had to pay the standard corporate tax on the money they earned abroad, with a top rate of 35 percent, but only when they brought that income back into the United States.

Many corporations responded by keeping their profits abroad indefinitely. A record $2.6 trillion was in offshore accounts as of 2015, according to the Joint Committee on Taxation, a congressional panel. Republicans argued that the system deprived the American economy of investments that could have financed new ventures and hiring at home.

It also meant that many multinationals effectively paid no American tax on their overseas earnings. The new bill, supporters point out, will prevent that from happening on such a large scale in the future.

“It’s a vast improvement from what was on the books,” said Ray Beeman, a tax lawyer at Ernst & Young who worked on a tax reform proposal that was a precursor to the current law when he was counsel to the House Ways and Means Committee, under Republican leadership, from 2011 to 2014.

To prevent an exodus of businesses from the United States, the law establishes a minimum tax rate of 10.5 percent every year.

Companies will get credit for up to 80 percent of the taxes they pay to foreign governments. But if the total still comes to less than 10.5 percent of the income they earn abroad, they have to make up the difference with a check to the American government.

So while companies will now have to pay some tax in most cases, wherever they operate, they will pay much less on what they make abroad than at home.

“Having such a low rate on foreign income is outrageous,” said Stephen E. Shay, a senior lecturer at Harvard Law School and a Treasury Department official during the Reagan and Obama administrations. “It creates terrible incentives.”

Mr. Shay said the new rule could make a big difference for small and medium-size companies, which make up a vast majority of American businesses. When those companies used to ask him whether to open offices abroad, he advised against it if they needed to bring their cash home.

Such companies, Mr. Shay said, now have no reason to resist the temptation to shift some of their operations abroad, since they would end up paying half the rate they would pay in the United States.

Some companies may not want to leave the comforts of home for a cut in their tax bill. Plants are expensive — they can cost more than $1 billion to buy and to outfit with the necessary industrial machinery. Manufacturers also gravitate toward stable, affordable locales where they can reach their customers easily and hire skilled workers.

“You may prefer to stay in the U.S., with the protections of our legal system, our infrastructure and our labor force,” said Steven M. Rosenthal, an expert at the nonpartisan Tax Policy Center.

On the other hand, for the biggest makers of cars and machines — the kinds of companies that Mr. Trump promised to lure back to the United States — a few percentage points in tax savings can be valuable.

“There are lots of great retail markets out there,” Mr. Rosenthal said. “The new rules might yet encourage jobs and factories to be shipped offshore.”