Consumption taxes are “border adjustable taxes” allowed under WTO rules. They average 17% globally. This means that virtually all foreign countries tax our exports at 17% on top of tariffs. They subsidize domestic shipments abroad with a 17% tax rebate. US.S. does not have a consumption tax to offset this advantage.

MADE IN AMERICA.

CPA is the leading national, bipartisan organization exclusively representing domestic producers and workers across many industries and sectors of the U.S. economy.

TRENDING

For Universal Tariff, Treasury Has Responsibility

November 22, 2024

CPA Urges Senate to Reject Anti-Tariff USITC Nominees

November 22, 2024

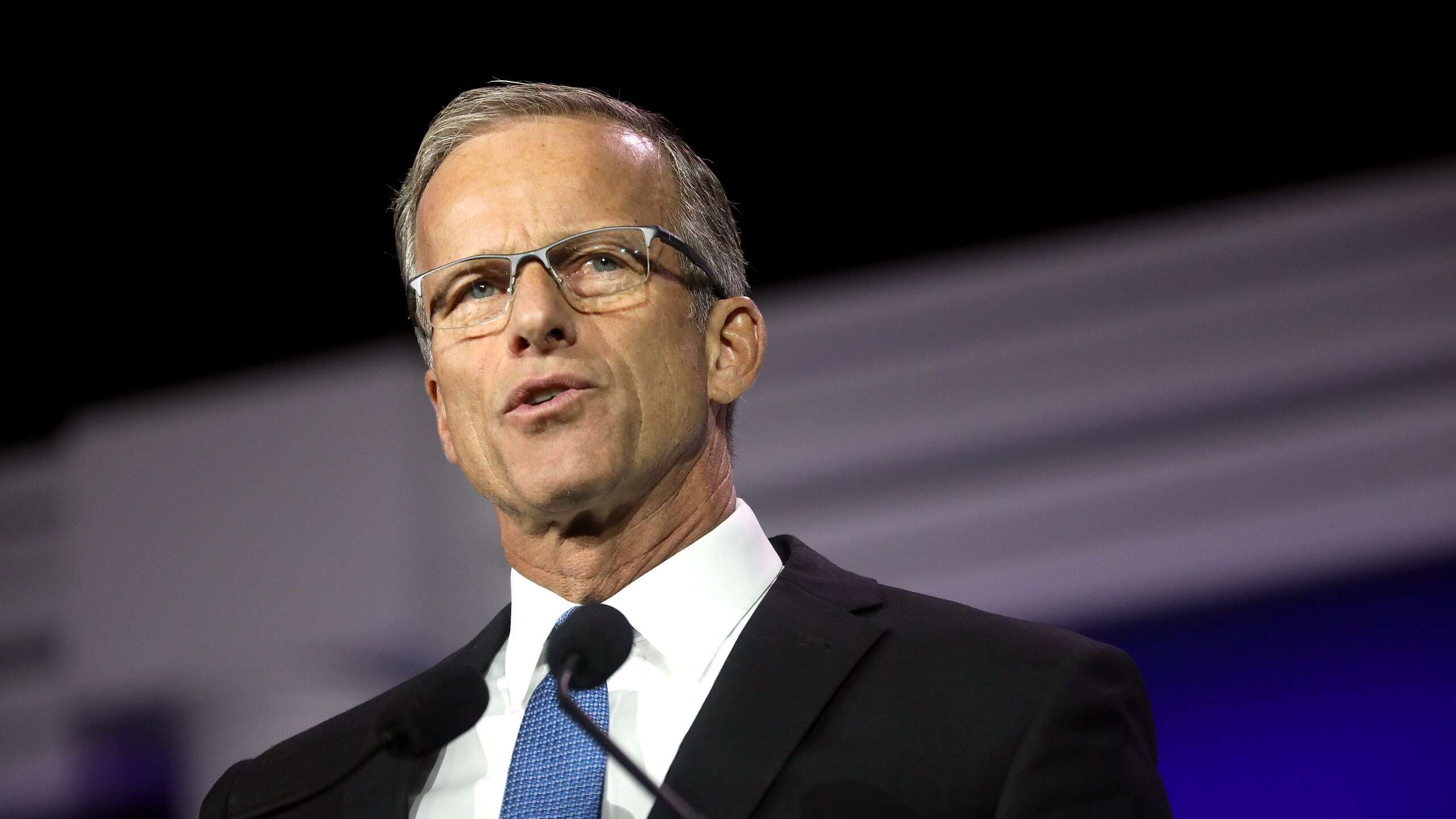

CPA Supports Senator Rick Scott for Senate Majority Leader

November 8, 2024

The latest CPA news and updates, delivered every Friday.

WATCH: WE ARE CPA