The U.S. government was well aware of China’s aggressive strategy of leveraging private investors to buy up the latest American technology when, early last year, a company called Avatar Integrated Systems showed up at a bankruptcy court in Delaware hoping to buy the California chip-designer ATop Tech.

[Cory Bennet & Bryan Bender | May 22, 2018 | Politico]

ATop’s product was potentially groundbreaking — an automated designer capable of making microchips that could power anything from smartphones to high-tech weapons systems. It’s the type of product that a U.S. government report had recently cited as “critical to defense systems and U.S. military strength.” And the source of the money behind the buyer, Avatar, was an eye-opener: Its board chairman and sole officer was a Chinese steel magnate whose Hong Kong-based company was a major shareholder.

Despite those factors, the transaction went through without an assessment by the U.S. government committee that is charged with reviewing acquisitions of sensitive technology by foreign interests.

In fact, a six-month POLITICO investigation found that the Committee on Foreign Investment in the United States, the main vehicle for protecting American technology from foreign governments, rarely polices the various new avenues Chinese nationals use to secure access to American technology, such as bankruptcy courts or the foreign venture capital firms that bankroll U.S. tech startups.

The committee, known by its acronym CFIUS, isn’t required to review any deals, relying instead on outsiders or other government agencies to raise questions about the appropriateness of a proposed merger, acquisition or investment. And even if it had a more formal mandate, the committee lacks the resources to deal with increasingly complex cases, which revolve around lines of code and reams of personal data more than physical infrastructure.

“I knew what was critical in 1958 — tanks, airplanes, avionics. Now, truthfully, everything is information. The world is about information, not about things,” said Paul Rosenzweig, who worked with CFIUS while at the Department of Homeland Security during President George W. Bush’s second term. “And that means everything is critical infrastructure. That, in some sense, means CFIUS really should be managing all global trade.”

As a senior official at the Treasury Department, which oversees CFIUS, put it: “Any time we see a company that has lots of data on Americans — health care, personal financial data — that’s a vulnerability.”

When CFIUS was formed, in the 1970s, the companies safeguarding important technology were so large that any takeover attempt by foreigners would be certain to attract attention. Now, much of the cutting-edge technology in the United States is in the hands of much smaller firms, including Silicon Valley startups that are hungry for cash from investors.

The gap in oversight became a more urgent problem in 2015, when China unveiled its “Made in China 2025” strategy of working with private investors to buy overseas tech firms. A year earlier, Chinese investments in U.S. tech startups had totaled $2.3 billion, according to the economic research firm CB Insights. Such investments immediately skyrocketed to $9.9 billion in 2015. These amounts dipped the following year, as the Obama administration voided a high-profile deal, but analysts say China’s appetite to buy U.S. firms and technology is still strong. In 2017, there were 165 Chinese-backed deals closed with American startups, only 12 percent less than the 2015 peak.

On the Senate floor Monday, Minority Leader Chuck Schumer (D-N.Y.) lashed out at Trump’s approach.

“China’s trade negotiators must be laughing themselves all the way back to Beijing,” he said. “They’re playing us for fools — temporary purchase of some goods, while China continues to steal our family jewels, the things that have made America great: the intellectual property, the know-how in the highest end industries. It makes no sense.”

National security specialists insist that such a stealth transfer of technology through China’s investment practices in the United States is a far more serious problem than the tariff dispute — and a problem hiding in plain sight. A recent Pentagon report bluntly declared: “The U.S. does not have a comprehensive policy or the tools to address this massive technology transfer to China.” It went on to warn that Beijing’s acquisition of top-notch American technology is enabling a “strategic competitor to access the crown jewels of U.S. innovation.”

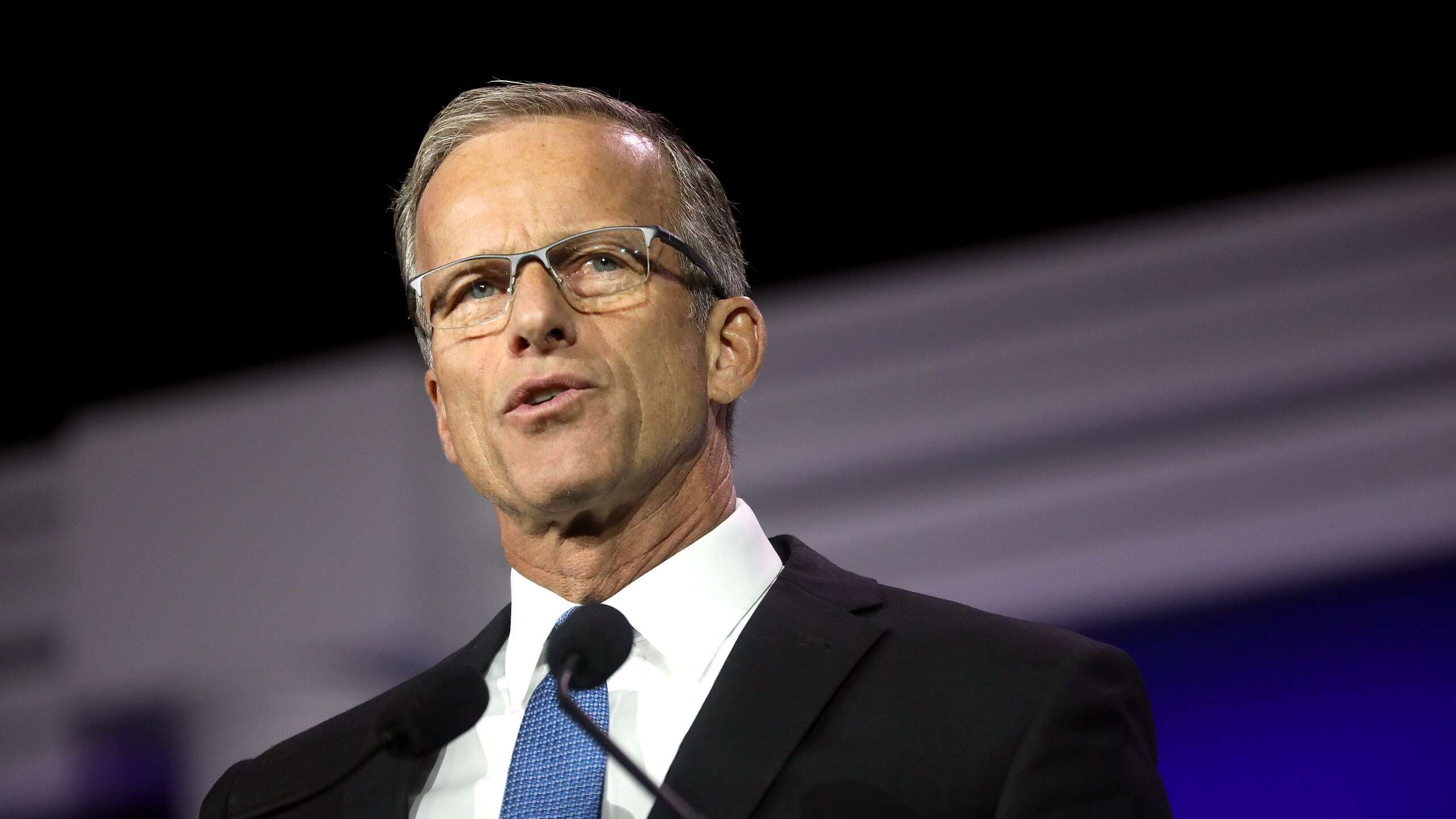

Some congressional leaders concur. Senate Majority Whip John Cornyn (R-Texas) regularly warns his colleagues that China is using private-sector investments to pilfer American technology. China has “weaponized” its investments in America “in order to vacuum up U.S. industrial capabilities from American companies,” Cornyn said at a January hearing. The goal, he added, is “to turn our own technology and know-how against us in an effort to erase our national security advantage.”

Legislation to expand the CFIUS budget and staff has been moving slowly through the halls of Congress amid pushback from Silicon Valley entrepreneurs and business groups. The legislation would give CFIUS new resources to scrutinize bankruptcy purchases and establish stricter scrutiny of start-up investments.

As months passed without any action, and the issue of Chinese investments got overshadowed by tariff fights and feuds between Beijing and the Trump administration, national security experts grew more concerned, fearing that Congress lacked a sense of urgency to police transfers of sensitive technology.

The White House began exploring what more it could do on its own, asking the Treasury Department in late March to offer a list of potential Chinese investment restrictions within 60 days.

Finally, earlier this month, Senate and House leaders announced plans to mark up the bill, starting a process that could lead to passage later this year.

Still, the failure to act more quickly may itself be jeopardizing national security. At a hearing in January, Heath Tarbert, the Treasury Department assistant secretary overseeing CFIUS, testified that allowing foreign countries to invest in U.S. technology without making sufficient background checks “will have a real cost in American lives in any conflict.”

“That is simply unacceptable,” he said.

‘Made in China 2025’

Last October, Chinese President Xi Jinping took the podium before 2,300 Communist Party delegates to deliver his expansive vision for China’s future.

Xi was speaking at the party’s 19th Congress, a summit held every five years to choose the nation’s leaders in the Great Hall of the People in Beijing, the expansive theater right off Tiananmen Square. Speaking in front of a giant gold hammer and sickle framed by bright red drapes, Xi held forth for 3½ hours, declaring that China would look outward to solve its problems.

China will not close its door to the world — we will only become more and more open,” Xi declared to his rapt audience of party leaders, many of them having close ties to the billionaire investors who represent China in the global market. “We will deepen reform of the investment and financing systems, and enable investment to play a crucial role in improving the supply structure.”

China watchers said Xi was alluding to the government’s relatively new economic plan, dubbed “Made in China 2025,” which leaders had unveiled in 2015. The detailed vision shifted the focus on domestic research investments to the need to pump money into — and better understand — foreign markets.

“We will,” the document proclaimed, “guide enterprises to integrate into local culture.”

“We will,” the document continued, “support enterprises to perform mergers, equity investment and venture capital investment overseas.”

At the top of the investment wish list were high-tech industries like artificial intelligence, robotics and space travel.

For the increasingly powerful Chinese leader, it was the culmination of years of efforts to guide how China spends its blossoming wealth. In addition to luring foreign companies to China, Xi wanted the country — which is sitting on several trillion dollars in foreign exchange reserves — to start investing abroad.

The plan had “much more money behind it” and “much more coordination” between Beijing and Chinese industrialists than previous economic strategies, according to Scott Kennedy, an expert on Chinese economic policy at the Center for Strategic and International Studies, a Washington think tank that specializes in defense matters.

“And a big component of that is acquiring technology abroad,” he said.

From 2015 to 2017, Chinese venture capitalists pumped money into hot companies like Uber and Airbnb, but also dozens of burgeoning firms with little or no name recognition. The country didn’t just want “trophy assets,” Kennedy explained. China’s leaders wanted to “fill in some of the gaps they have” in China’s tech economy.

While the Asian power has piled up profits from its large manufacturing plants that churn out low-cost products, the Beijing government realized it would face declining productivity unless its economy, from agriculture to manufacturing, adopted high-tech methods. Essentially, China wanted to automate entire industries — including car manufacturing, food production and electronics — and bring the whole process in-house.

So Beijing’s leaders encouraged the country’s cash-rich investors to search for “emerging companies that have technologies that may be extremely important … but aren’t proven,” Kennedy said. The initiative has spawned investments in American startups that work on robotics, energy equipment and next-generation IT. Of particular concern to U.S. national security officials is the semiconductor industry, which makes the microchips that provide the “guts” of many advance technologies that China is seeking to leverage.

“A concerted push by China to reshape the market in its favor, using industrial policies backed by over one hundred billion dollars in government-directed funds, threatens the competitiveness of U.S. industry and the national and global benefits it brings,” declared a January 2017 report from the President’s Council of Advisors on Science and Technology, warning of the urgent threat to U.S. superiority in semiconductor technology.

Notably, many of China’s investments didn’t register on the CFIUS radar. They involved the early-seed funding of tech firms in Silicon Valley and low-profile purchases such as the one in Delaware bankruptcy court. They included joint ventures with microchip manufacturers, and the research and development centers created with international partners.

“They have diversified to look for smaller targets,” Kennedy said. “Those things typically do not generate a CFIUS reaction. That is part of it.”

An obscure research body

CFIUS was set up by Congress in 1975 amid growing concerns about oil-rich countries in the Middle East buying up American companies, from energy firms to armsmakers. Chaired by the Treasury Department, the committee brought together representatives from all the major Cabinet agencies to assess the financial, technological and national security threats posed by such investments. For its first decade, however, CFIUS existed mostly as an obscure research body. From 1975 to 1980, the committee met only 10 times, according to congressional reports.

Japan’s economic ascendance in the 1980s changed that. The Defense Department asked CFIUS to step in and investigate potential Japanese purchases of a U.S. steel producer and a company that made ball bearings for the military. In 1988, Congress gave the committee the authority to recommend that the president nix a deal altogether. Still, the committee remained mostly an ad hoc operation into the 1990s.

“Bureaucratically it was not a very smooth, functioning operation,” recalled Steve Grundman, who worked as part of the committee during the Clinton administration. “We had to pick up some intelligence here, some technology assessment there, some industrial analysis hither.”

After the Sept. 11, 2001, terrorist attacks, Congress renewed its interest in CFIUS, passing legislation that instructed the committee to consider a deal’s effect on “homeland security” and “critical industries,” a notable change, according to Rosenzweig, the DHS official who worked with CFIUS during the George W. Bush administration. The directive gave the committee a mandate to keep an eye on a wider array of industries, such as hospitals and banks, that DHS considered “critical” to keeping American society operating.

Rosenzweig called it a “singular shift.” Over time, he said, the committee went from reviewing acquisitions of steel companies — involving just two parties and a tangible product — to investigating technically complex purchases of microchip companies and other software or data-rich firms.

“When I first came to CFIUS, the filings from the other side would be a few-page letter about why this was a good deal,” Rosenzweig said. “Now it’s a stack of books that’s up to my knee.”

The committee’s staffing and resources have not kept pace with the growing workload, multiple people who work with CFIUS told POLITICO. While the Treasury Department has been hiring staffers and contractors to help handle the record workload, the committee’s overall resources are subject to the whims of the individual agencies involved in the process, said Stephen Heifetz, who oversaw the CFIUS work at DHS during the second Bush administration.

There is no single budget or staffing figure for CFIUS. Instead, each agency decides the level of personnel and funding it’s willing to commit to the committee. The Treasury Department and DHS have two of the larger CFIUS teams, Heifetz said. During his tenure, Heifetz’s DHS squad included roughly 10 people, split equally between government workers and outside contractors.

“Each agency decides more or less on their own how they’re going to staff it,” Heifetz said.

At Treasury, there are now between 20 and 30 people working for CFIUS, according to a senior department official. But even with the expanded team, the committee is stretched precariously thin. The official described 80-hour workweeks, regular weekend work and no ability to take time off.

“It’s enough to handle the current mandate, but not comfortably,” the official said.

Amid this uncertainty over resources, CFIUS investigations into foreign acquisitions nearly tripled from 2009 to 2015. The most common foreign investor that hits the CFIUS radar is now China. Nearly 20 percent of the committee’s reviews from 2013 to 2015, the most recent data available, involved the Asian power, easily ahead of second-place Canada at just under 13 percent.

Since 2015, the Treasury official said, those trends have only continued: Chinese deals now represent a large plurality of the committee’s work.

The attention appears to be well-founded. In recent years, China has been repeatedly accused of industrial espionage — using indirect means to obtain American software and military secrets, everything from the code that powerswind turbines to the designs that produce the Pentagon’s modern F-35 fighter jets. And several Chinese businessmen have pleaded guilty to participating in complex conspiracies to get their hands on sensitive technical data from U.S. firms and shuttle it back to Beijing. Again and again, high-tech products and military equipment have popped up in China that bear a too-striking resemblance to their American counterparts.

Spurred by these incidents, CFIUS has successfully advised the president to nix Chinese deals at a record clip. In December 2016, President Barack Obama stopped a Chinese investment fund from acquiring the U.S. subsidiary of a German semiconductor manufacturer — only the third time a president had taken such a step at that point. In September 2017, Trump halted a China-backed investor from buying the American semiconductor maker Lattice, citing national security concerns.

Three months later, a Chinese company’s plan to acquire the American money transfer company MoneyGram fell apart when the two sides realized they would likely not get CFIUS approval because of concerns that the personal data of millions of Americans — including military personnel — could fall into the hands of the Chinese military.

Weeks after that, the committee essentially jettisoned a Chinese state-backed group’s attempt to buy Xcerra, a Massachusetts-based tech company that makes equipment to test computer chips and circuit boards. Then, in March, Trump blocked the purchase of the chipmaker Qualcomm by Singapore-based Broadcom Ltd. CFIUS said such a move could weaken Qualcomm, and thereby the United States, as it vies with foreign rivals such as China’s Huawei Technologies to develop the next generation of wireless technology known as 5G.

Read more at Politico